Canada - BoC Q1 Business Outlook Survey shows caution, Consumer Survey more pessimistic

The Bank of Canada’s Q1 business outlook survey is weaker, though probably not by enough to shock the Bank of Canada. The survey was conducted in February, when tariffs were a worry but not yet a reality.

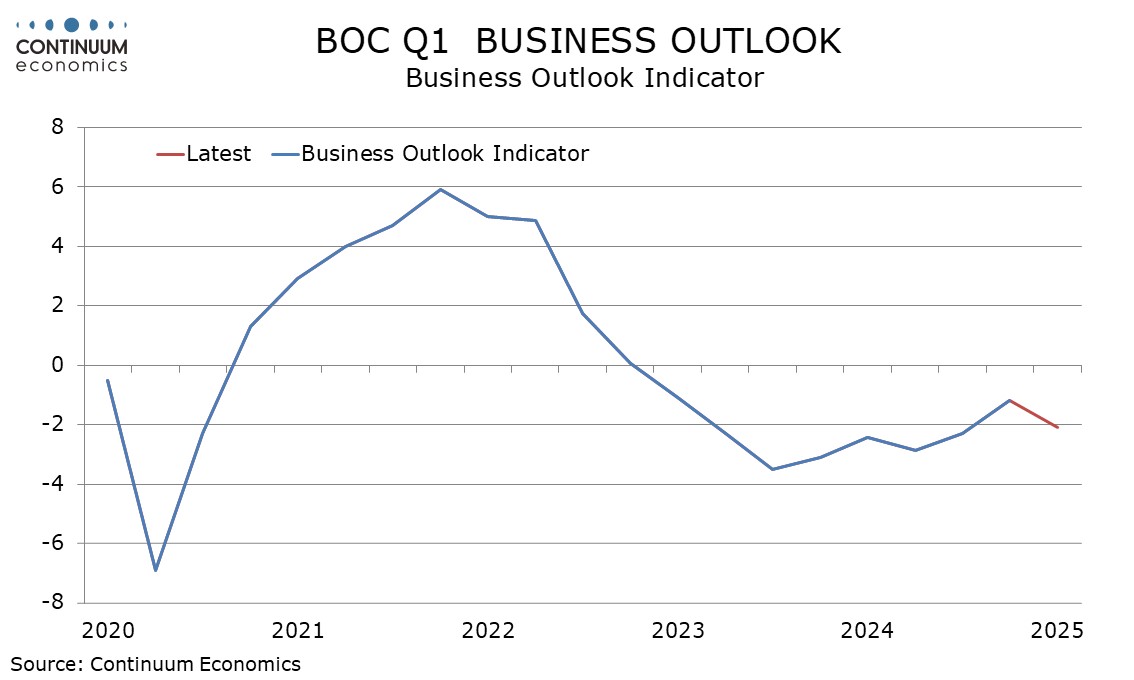

The business outlook index of -2.1 from -1.2 almost reversed a Q4 improvement from -2.3 in Q3. The fear of tariffs appears to have paused what were emerging signs of the Canadian economy responding to BoC easing in late 2024.

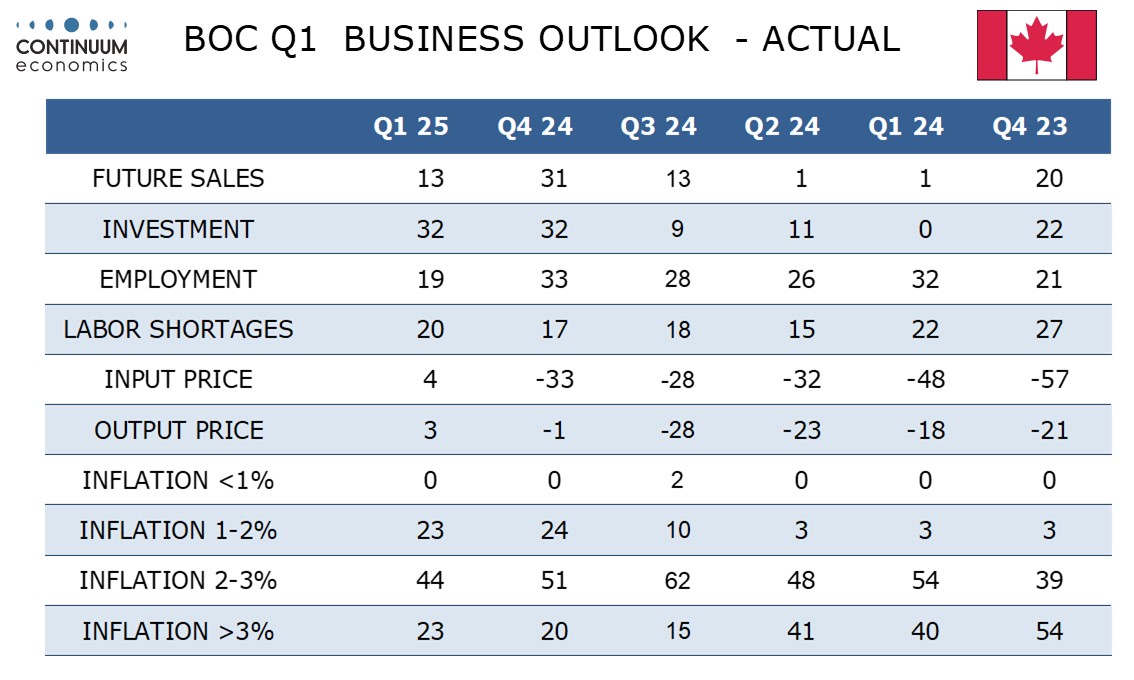

The index of future sales similarly reversed a Q4 improvement but the employment index of 19 from 33 is the weakest since Q4 2015. Employers are reluctant to hire given high uncertainty. Indices of input and output prices turned positive for the first time since Q2 2022 but inflation expectations were only modestly higher.

The separate BoC survey of consumer expectations saw a more significant rise in consumer expectations however, the -1year view to 4.0(% from 3.05%, the 2-year to 3.89% from 2.97%, and the 5-year to 3.39% from 3.03%, Consumers are also more pessimistic on the economy, with 66.5% expectation a recession, up from 46.5% in Q4.