Preview: Due May 30 - Canada Q1/March GDP - A slower quarter, with risk for further slowing in Q2

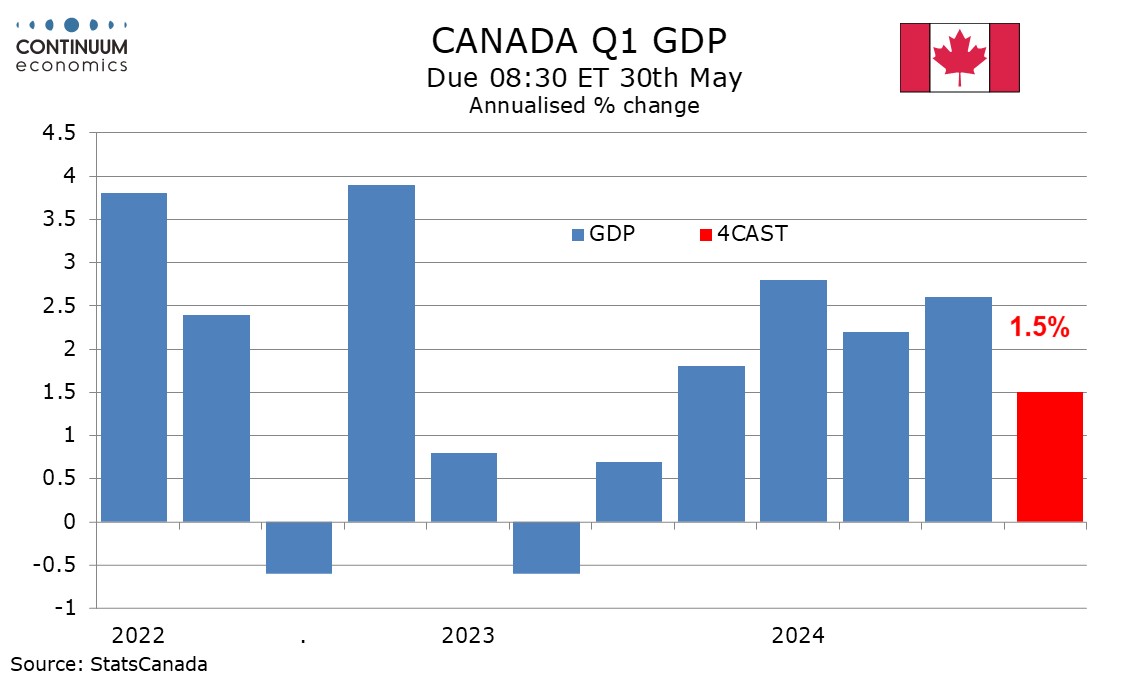

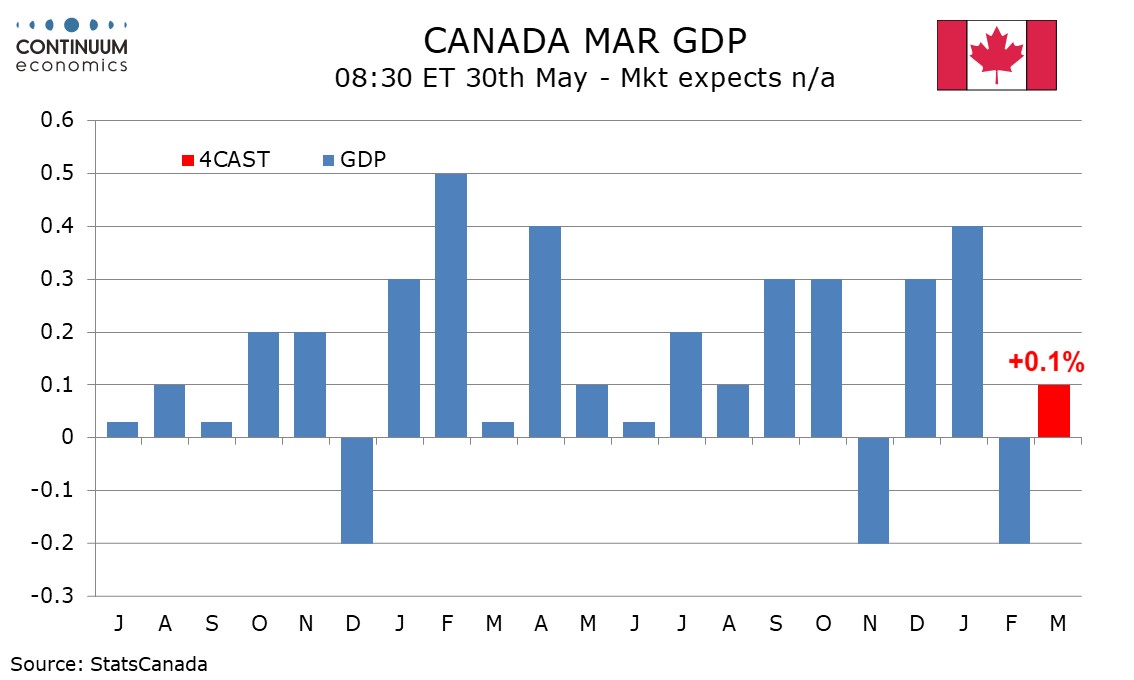

We expect Q1 Canadian GDP to rise by a five-quarter low of 1.5% annualized, below a 1.8% estimate made with the Bank of Canada’s April Monetary Policy Report. We expect a 0.1% increase in March GDP, matching an estimate made with February’s data. We expect a slight decline in the preliminary estimate for April.

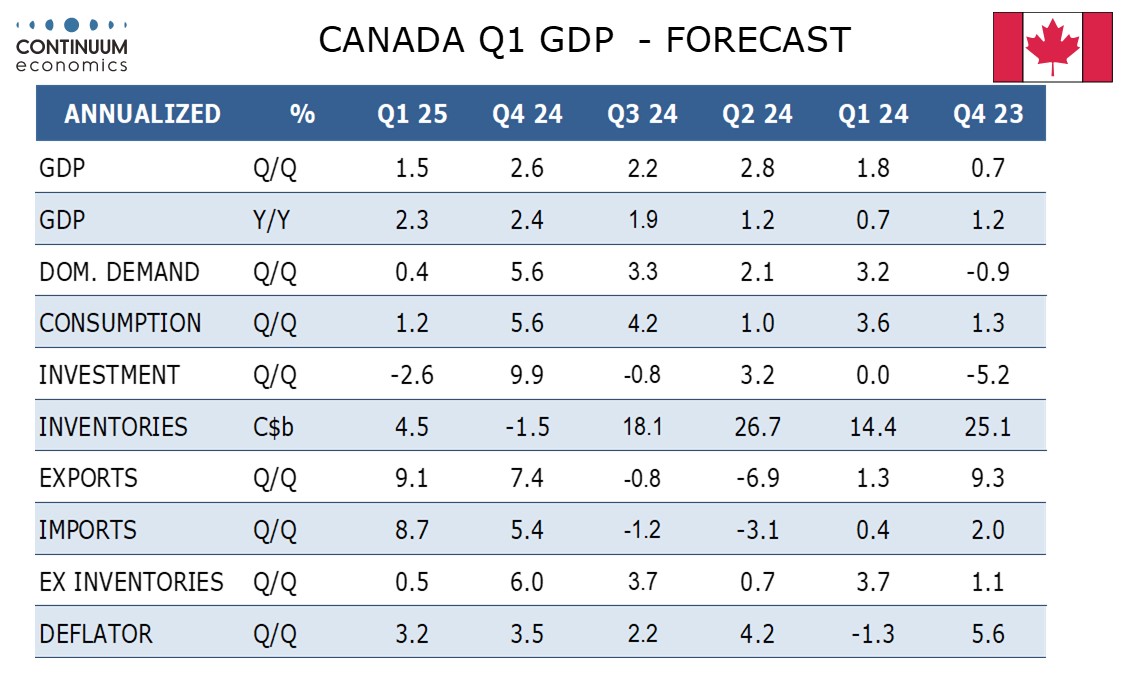

We expect the Q1 data to show a significant slowing from a strong Q4 in consumer spending and a correction lower from Q4 strength in fixed investment. Even with government remaining firm this would leave domestic demand up by only 0.4% annualized after a 5.6% surge in Q4. Exports and imports both look set to see strong gains but the net impact on GDP will be only marginally positive. Inventories are likely to correct higher from a weak Q4, adding 1.0% to GDP.

We expect a 0.8% quarterly rise in the GDP deflator (3.2% annualized), consistent with the CPI. Export and import prices both saw strong gains but the net impact on the deflator is again likely to be marginal.

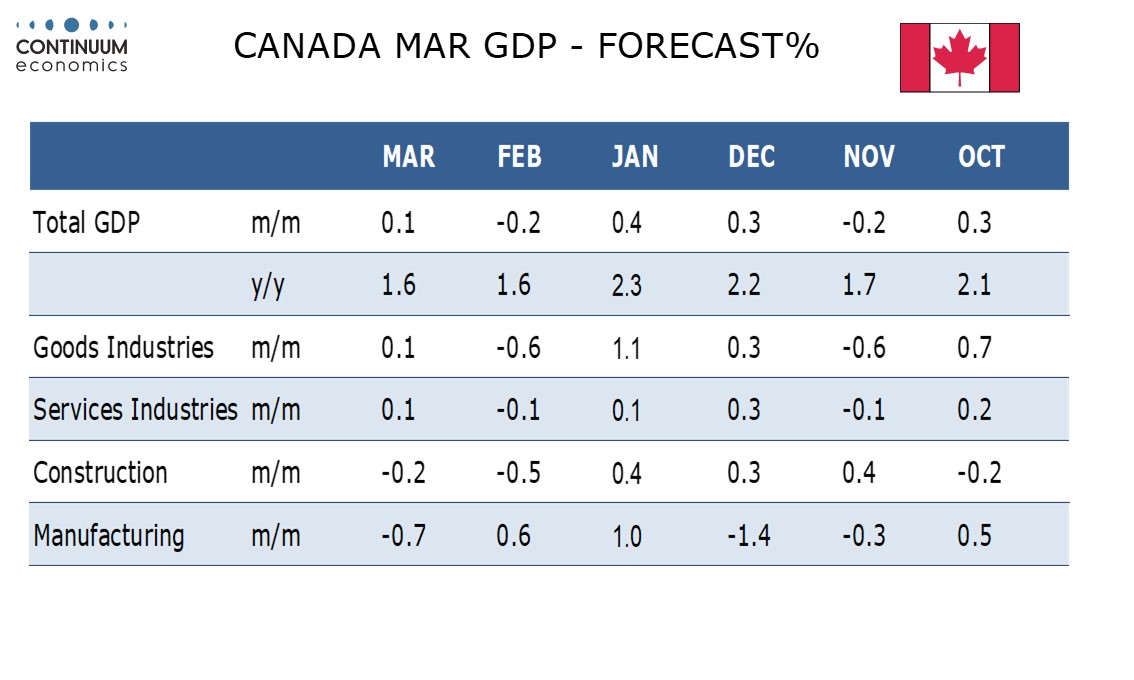

On the month we expect both goods and services to rise by 0.1% in March, with goods led by mining, with manufacturing likely to slip. Services are likely to get support from retail and transport/warehousing, partly offset by slippage in wholesale.

The preliminary estimate for April will give us insight on Q2, which is likely to get off to a soft start. In April the BoC gave two alternative scenarios for Q2, either unchanged of a decline of 1.3%, depending on the tariff scenario. Governor Macklem has said we are now nearer the less negative scenario, but a weak start to the quarter is still likely.