Bank of Canada - Consensus to hold in June, but we now expect easings in July and October

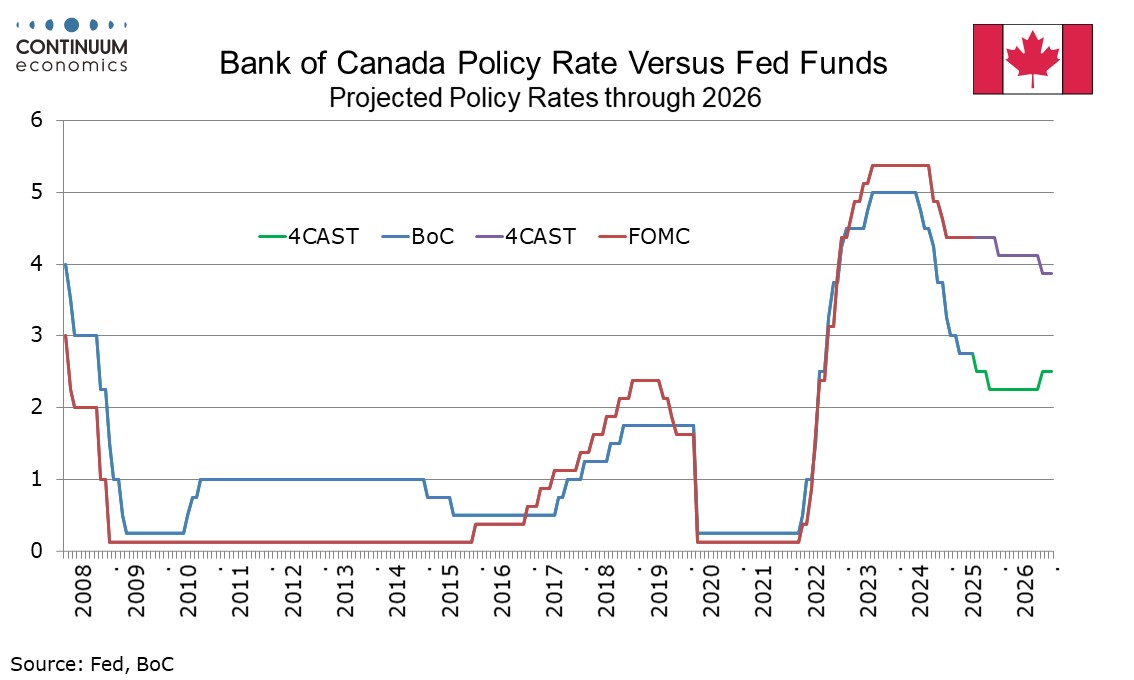

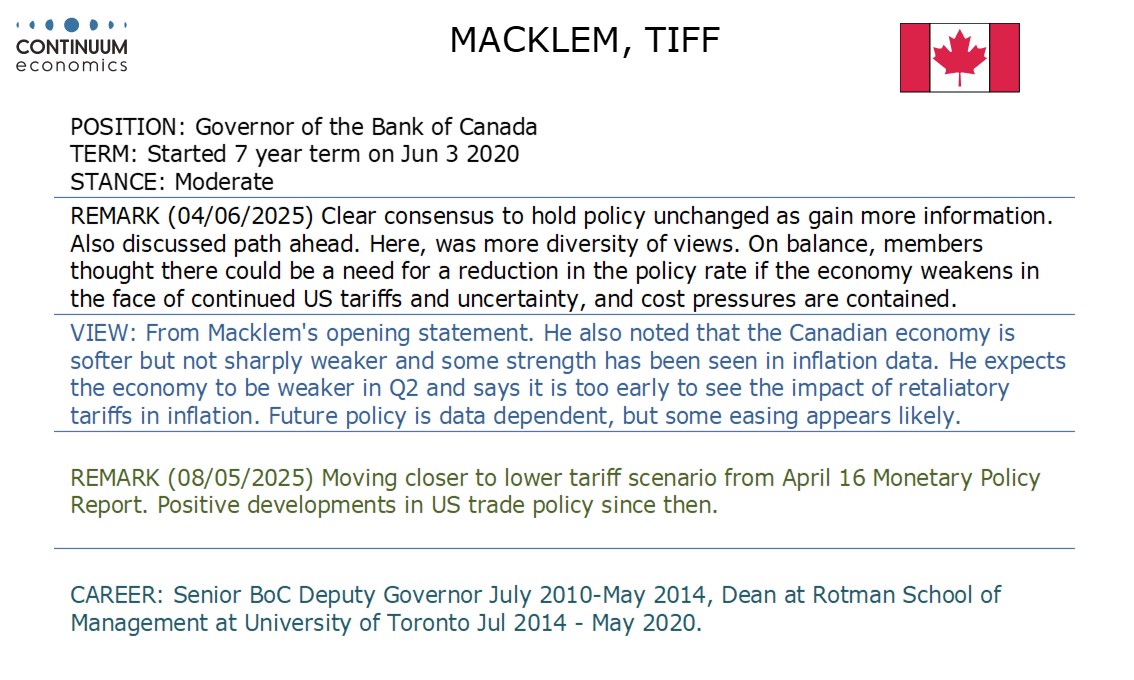

Governor Tiff Macklem stated that the Bank of Canada’s decision to leave rates unchanged at 2.75% was a clear consensus. There was more diversity of views on the path forward, though members thought there could be a need for easing, depending on data. We now expect two further easings in 2025, in July and October, which would take the rate to 2.25% at year end.

Expectations had moved away from a June easing towards a June hold after stronger than expected April CPI and Q1 GDP data. Macklem noted those releases in the decision to keep policy on hold as more information on US trade policy and its impacts is awaited.

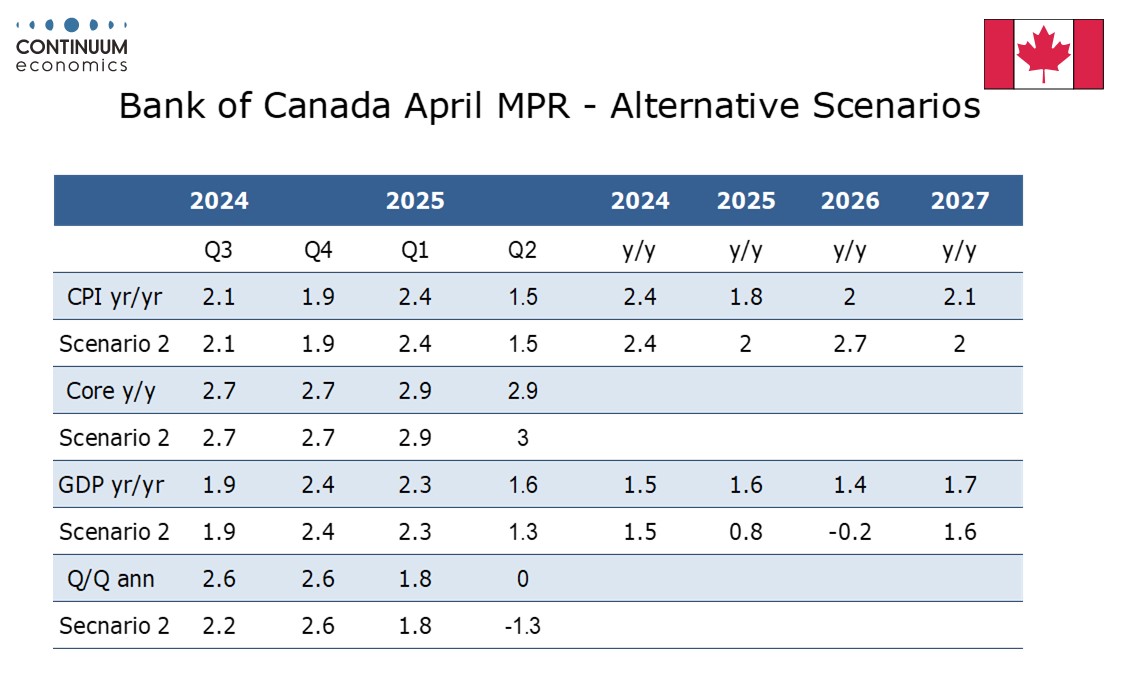

Of the two releases, the CPI appears more significant. While the overall CPI fell to 1.7% in April as the consumer carbon tax was estimated inflation excluding taxes of 2.3% was stronger than expected and up from 2.1% in March. The BoC’s measures of core inflation moved higher too. This suggests that underlying inflation could be firmer than thought, while Macklem said it is too soon to see the direct effects of retaliatory tariffs in the inflation data. CPI data for May, on June 24, and June, on July 17, will both be available before the BoC next meets on July 30. If the data provides relief, the BoC would be likely to ease. Deputy Governor Carolyn Rogers suggested a firmer CAD could be helpful.

The BoC will of course also look at data on economic activity and developments in US trade policy, though we would be surprised if US trade policy risks are seen as dramatically reduced by then, while the BoC does not expect resilience in Q1 GDP to persist in Q2, which is seen as likely to be much weaker. Macklem stated that Q1's 2.2% annualized GDP increase was supported by a surge in exports that was the flip side of a pre-tariff surge in US imports and inventories were also strong, both of which were seen as borrowing growth from the future. Domestic demand was roughly flat in Q1 though Macklem did say that strong spending on machinery and equipment saw business investment holding up better than expected. He also however said that the labor market had weakened.

Easing in July and October would see the BoC moving in the two meetings that will see Monetary Policy Reports released. Rogers said that the BoC hoped to get back to its usual price of giving economic forecasts in July. April saw the BoC deliver two separate scenarios, depending on the extent of tariffs, but Macklem reiterated at the latest press conference that the more severe scenario looks less likely than was the case in April. This encourages us to see only two more easings in 2025 rather than three, as we projected in April, though policy will clearly be dependent on data and policy developments. On the latter, it is US policy that matters most. Macklem sated that a delay in the Canadian budget is not the biggest source of uncertainty.