Bank of Canada Preview for April 16: Easing to pause, but unlikely to be done

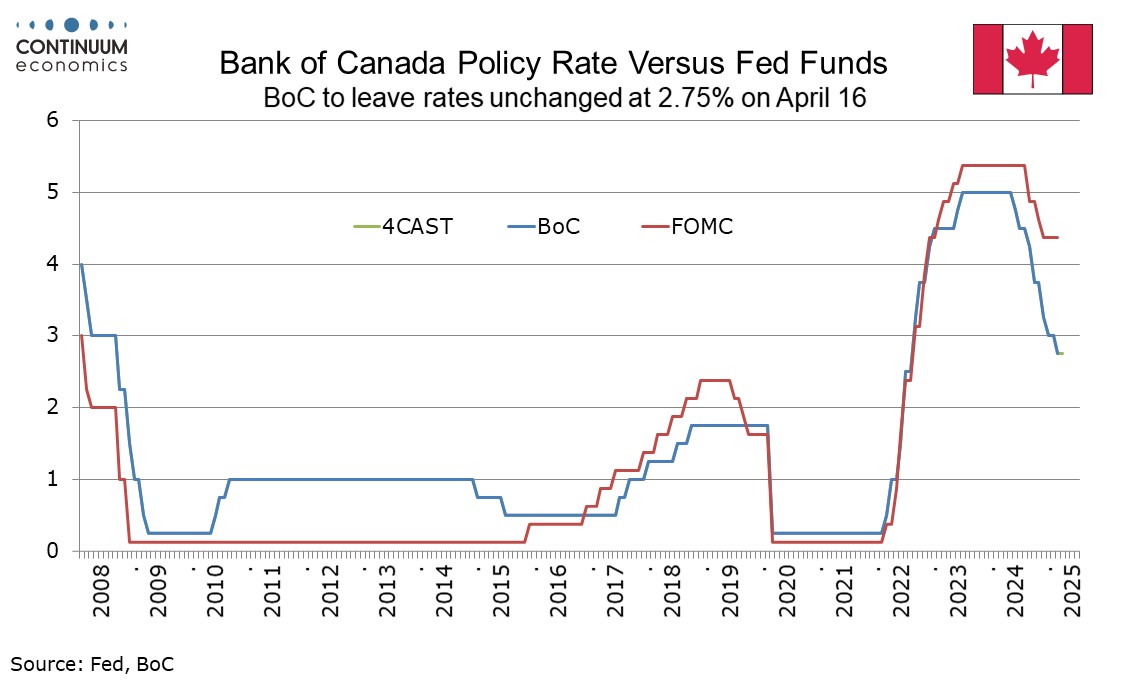

The Bank of Canada meets on April 16 and we expect that strength in some recent data and high uncertainty will see rates left unchanged at 2.75%. There will be little forward guidance and the accompanying Monetary Policy Report may avoid providing its usual economic forecasts. We do not expect that a pause at this meeting will mark the end of the easing cycle.

The Bank of Canada eased by 25bps to 2.75% on March 12, though the minutes showed some debate over the decision, with some preferring to hold at 3.0% until greater clarity was achieved. The minutes noted a stronger than expected Q4 GDP gain of 2.6% annualized, and a firmer than expected January CPI, at 1.9% yr/yr despite a sales tax holiday. Since then February CPI bounced to 2.6%, and the unwind of the sales tax holiday will not be fully reflected until March CPI data due on April 15.

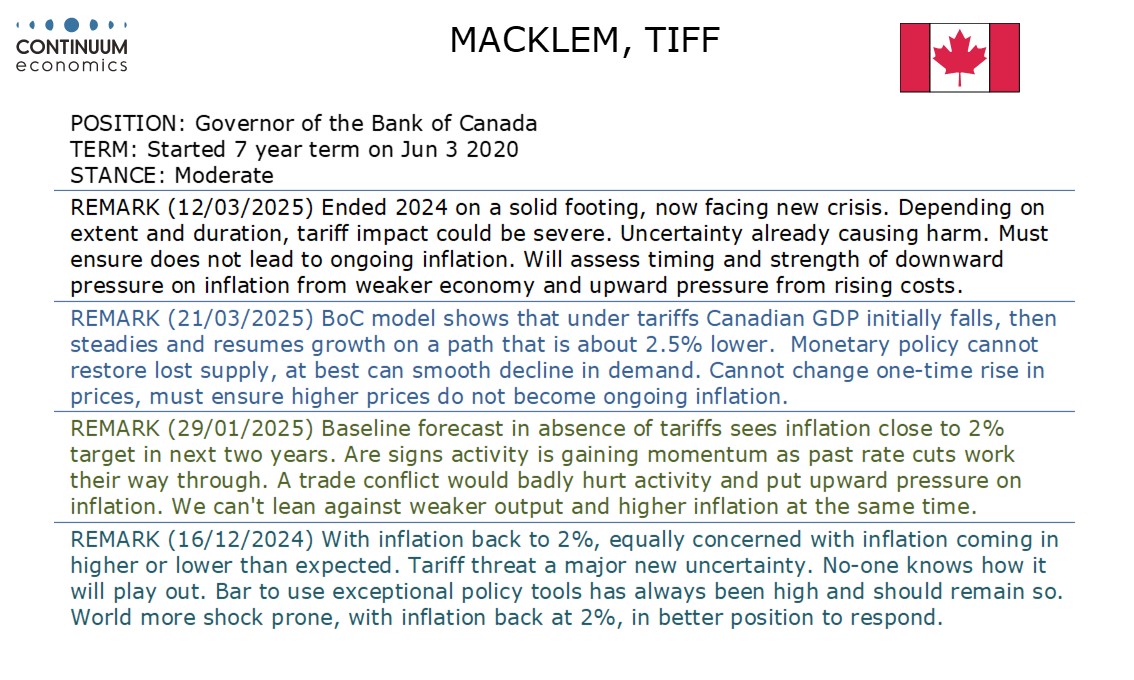

The strength in Q4 GDP, assisted by BoC easing, will be difficult to sustain, and a 32.6k decline in March employment, the weakest since a lockdown- impacted January 2022, is a warning signal going forward. There may be some relief that Trump’s April 2 tariff announcement left the exception for USMCA-compliant goods from Canada (and Mexico) intact, but the likely damage done to the US and global economies adds to the downside risks to growth. The likely BoC pause will be more due to caution on inflation. The March 12 minutes agreed that policy must ensure initial tariff-led price rises do not lead to ongoing inflation, and agreed to proceed carefully with further changes to policy.

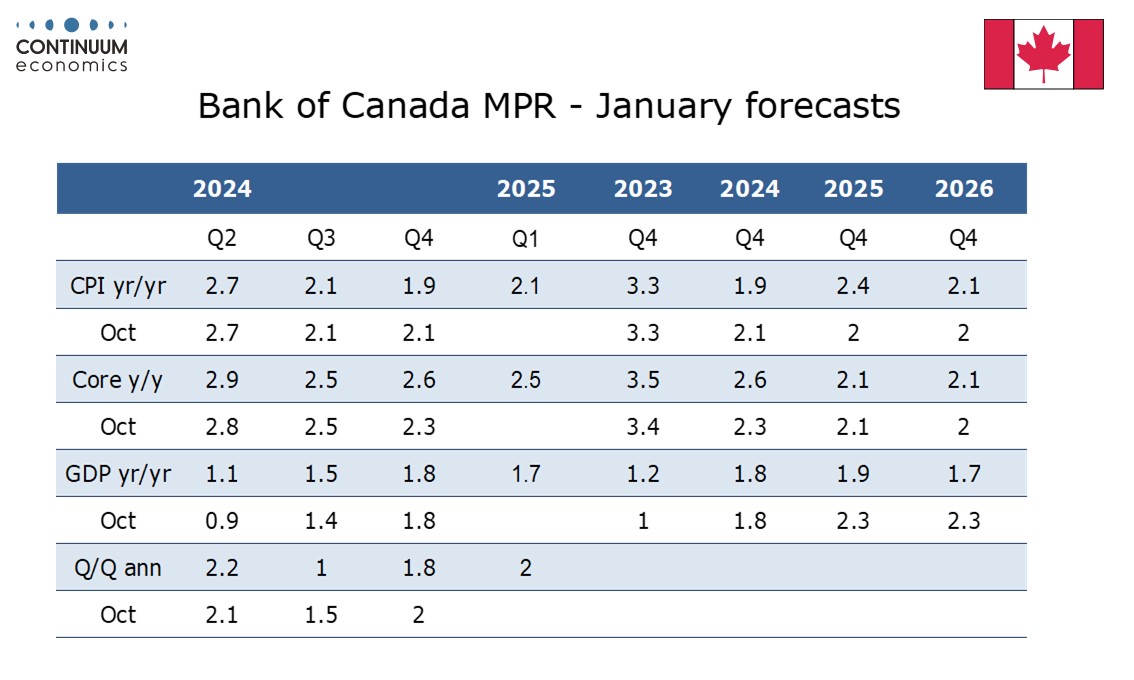

This meeting will see a quarterly monetary policy report. The last report in January gave forecasts, but these assumed the absence of tariffs. Q4 GDP exceeded the BoC’s expectations, but Q1 is likely to fall a little short of the BoC’s 2.0% January estimate, and forthcoming quarters are likely to flirt with recession. Based on our 2.7% March CPI forecast, we expect a Q1 pace of 2.4%, above the BoC’s 2.1% January estimate. In January the BoC saw CPI ending 2025 at 2.4% and 2026 ending at 2.1%. Providing forecasts for future inflation looks even more challenging than providing them for GDP, and we doubt the BoC will try. The Monetary Policy report will discuss the situation and various scenarios in detail, though the BoC has already provided significant material on this, limiting the scope for fresh insights.