Bank of Canada Minutes from March 12 - Debate over the 25bps easing, agreement to proceed carefully

The Bank of Canada has released minutes from its March 12 meeting, and these show some debate about the meeting’s decision to ease by 25bps to 2.75% and agreement to proceed carefully with further changes to policy. A lot can happen before the BoC next meets on April 16, but these minutes suggest rates are more likely to be kept on hold at that meeting.

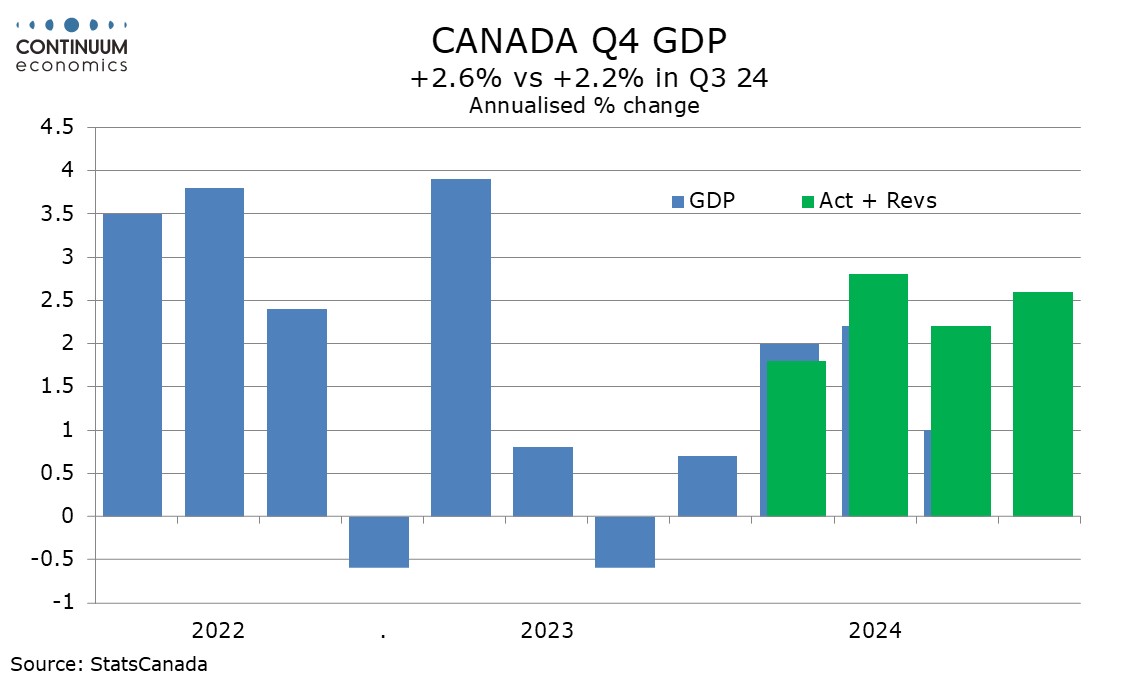

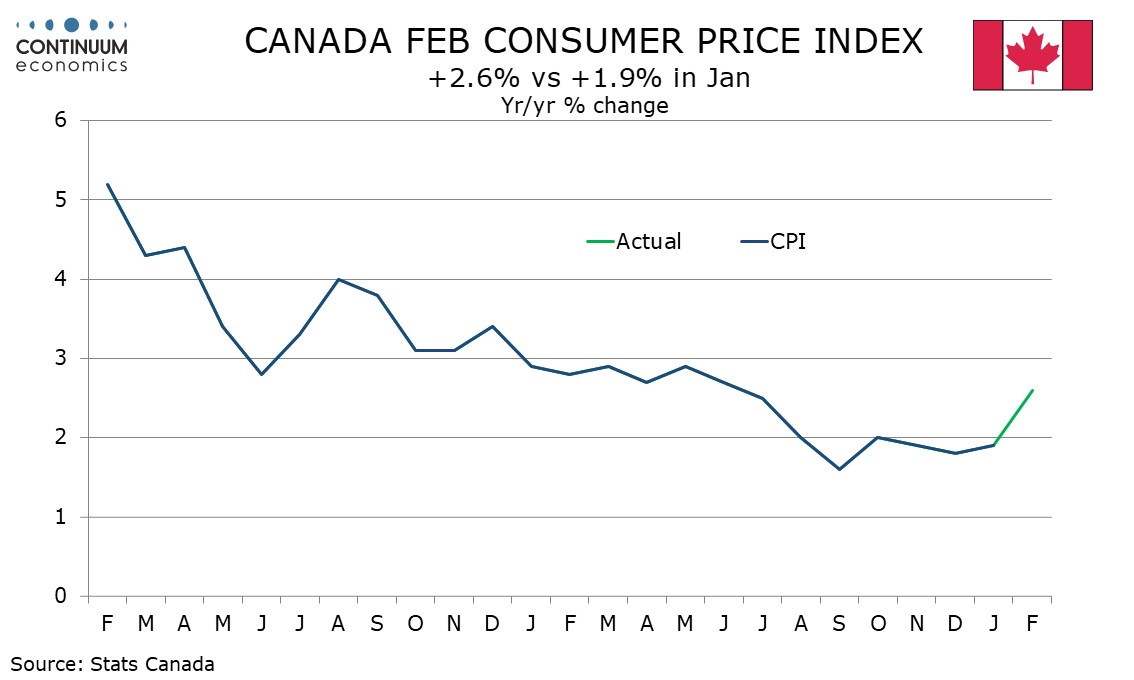

The minutes note a stronger than expected 2.6% annualized increase in Q4 Canadian GDP, with significant upward back revisions, and members were encouraged by labor market developments. A stronger than expected 1.9% increase in January CPI was also noted, though members noted that shelter was the only component above its historical average. Members agreed that the new data had shifted the balance, with less risk of lower inflation outcomes, and agreed that in the absence of tariff-related uncertainty, the rate would have been left at 3.0%. Since the meeting February CPI also came in stronger than expected, accelerating to 2.6%.

The risks associated with the tariff threat were considered in detail, with surveys suggesting a consequent reduction in hiring and increased pessimism from both consumers and businesses. There was a difference opinion into the implications of this, with some cautious about reading too much into survey evidence but others stressing the consistency and size of the survey deteriorations. Some argued for holding rates at 3.0% until there was greater clarity, while others felt that the outlook had changed sufficiently to justify the further easing that was delivered. There was agreement that forward guidance would not be appropriate.

The BoC resolved to assess the balance between upward inflationary pressure from higher costs and downward pressures from weaker demand, and recognized that some prices will rise as a result of tariffs and retaliatory measures. They agreed that policy must ensure that initial price rises do not lead to ongoing inflation, and to proceed carefully with further changes in policy. The next BoC meeting will take place on April 16 before which important tariff announcements from Trump are due, but what will be announced and for how long any imposed tariffs will last is unclear. These minutes suggest that the BoC will probably keep rates on hold on April 16, though we expect sufficient economic weakness to emerge to ensure that the March 12 easing will not be the last.