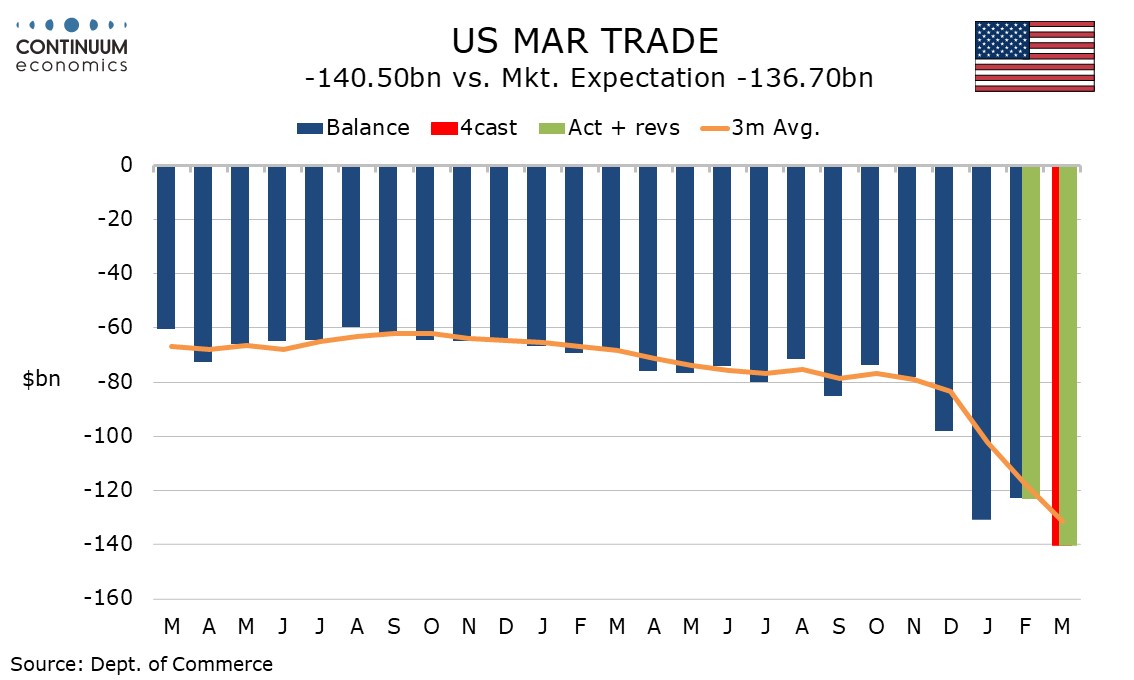

US March trade deficit surges as service export weakness adds to pre-tariff strength in goods imports

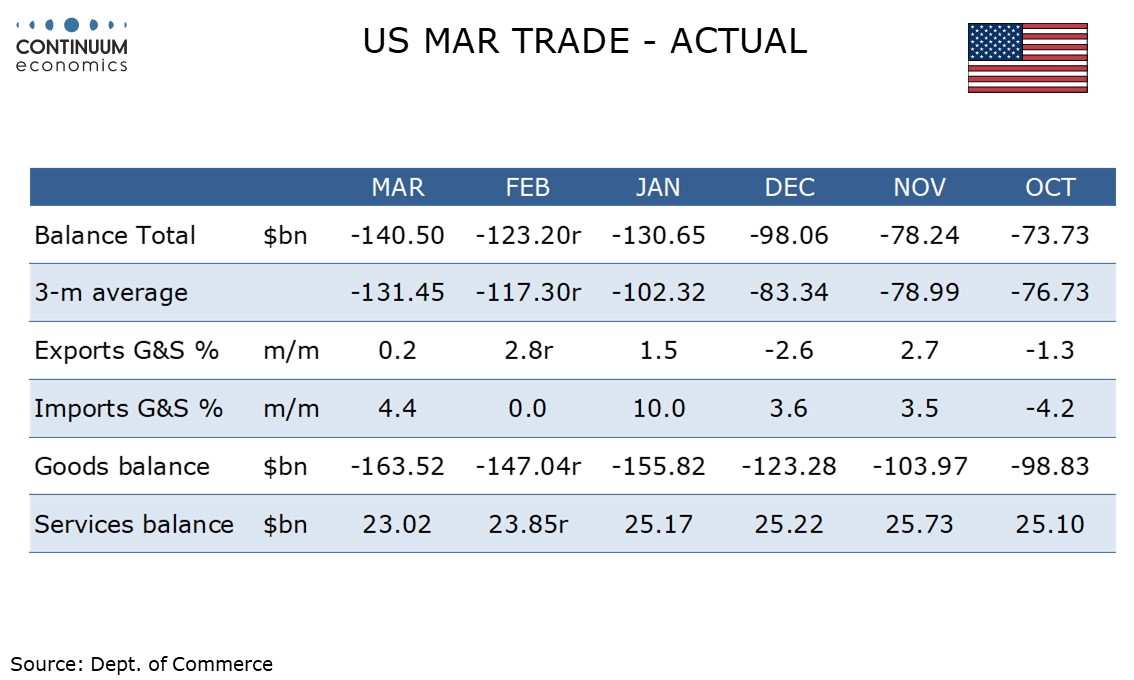

March’s record US trade deficit of $140.5bn is even higher than expected though consistent with the assumptions of the Q1 GDP report. Exports surged by 4.4% ahead of the April 2 tariff announcement while exports rose by a marginal 0.2%.

Goods exports rose by 0.7% compared with 1.2% in the advance report while goods imports surged by 5.5% compared with 5.0% in the advance report. There was underperformance of exports in the balance of payments data relative to the census based data following outperformance in February.

The census based goods deficit was revised up to $163.2bn from $162.0bn in the advance data, with goods exports revised up to 1.4% from 1.2% and goods imports revised up to 5.5% from 5.0%. On a balance of payments basis, the goods deficit was $163.5bn, up from $147.0bn in February.

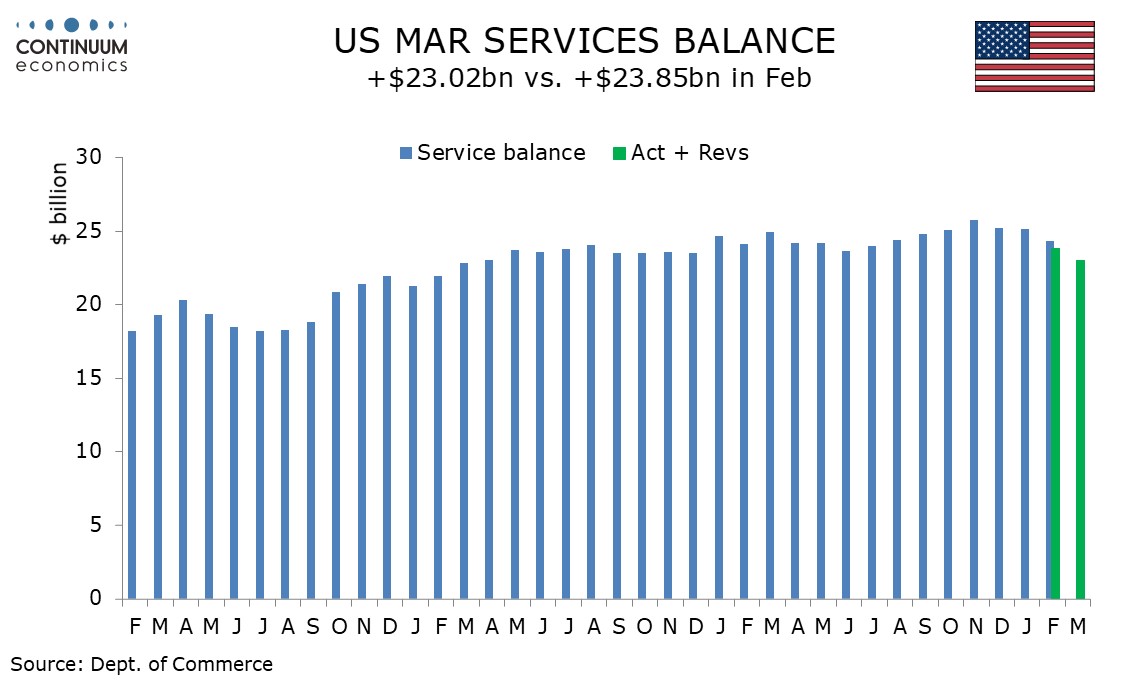

The services surplus slipped to $23.0bn from $23.8bn, and is significantly below January’s $25.2bn and a peak of $25.7bn in November 2024. Service exports fell by 0.9% after a 0.8% decline in February with reduced travel to the US, particularly from Canada, contributing, while service imports fell by only 0.1% after a 0.8% increase in February.

March data showed a particularly sharp surge in imports from the EU. Imports from Japan were also strong but imports from China, which saw tariffs imposed earlier, have slipped back after peaking in January. Imports from Mexico accelerated but those from Canada remained well below a January high.

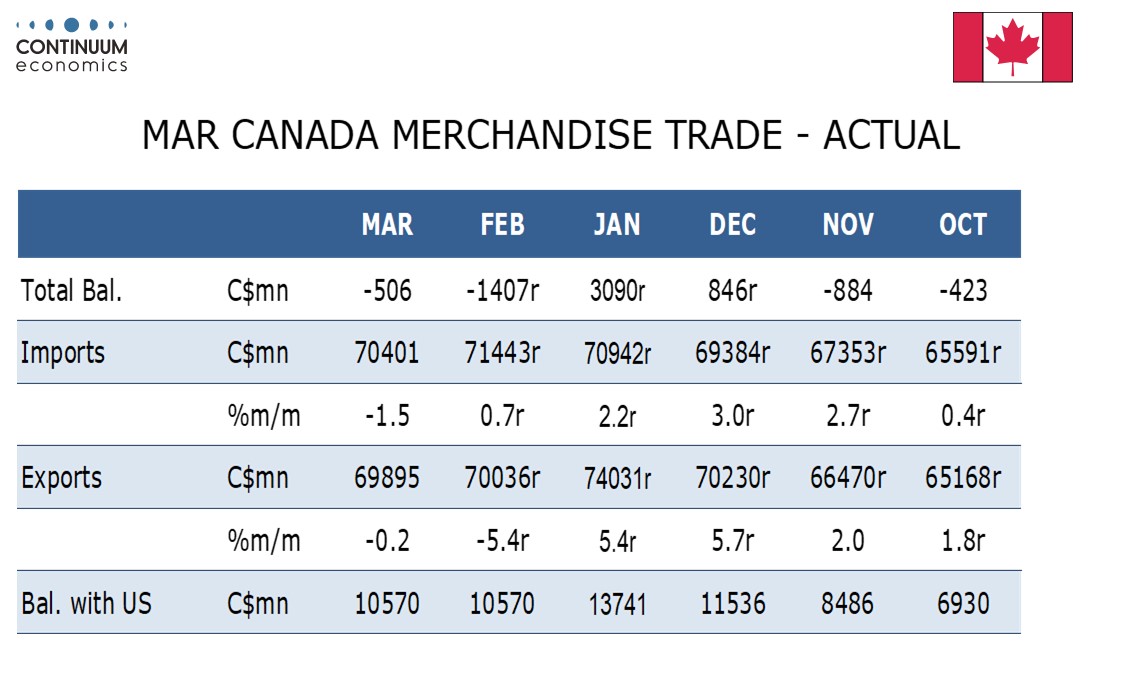

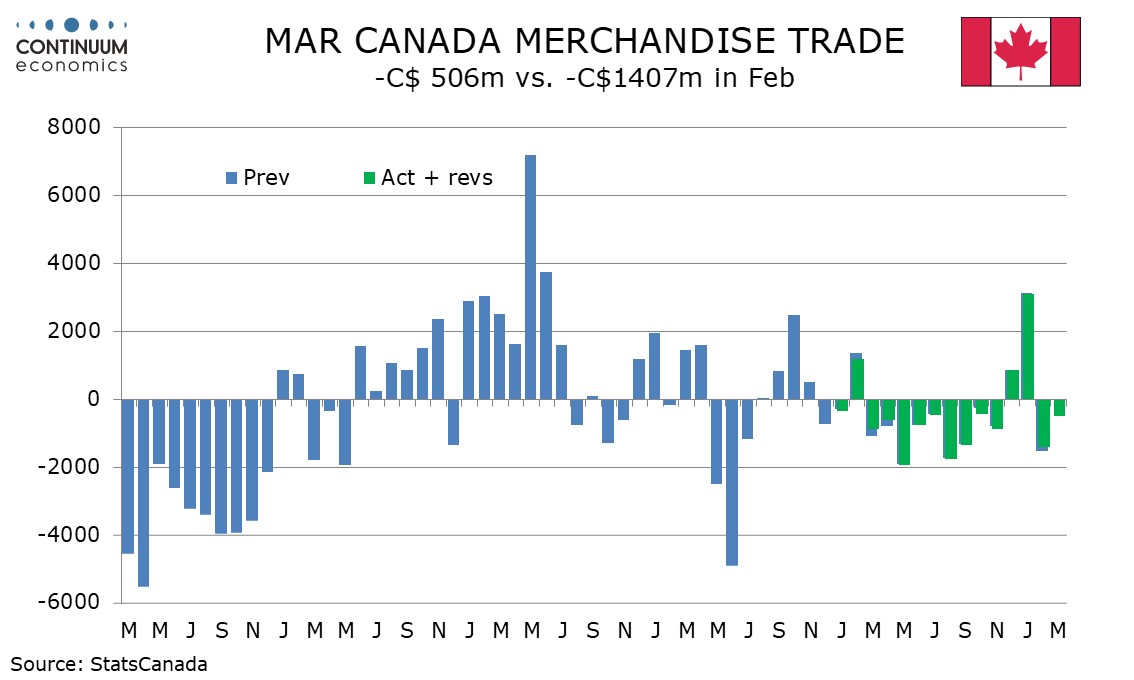

Canada’s trade data showed a deficit of C$0.5bn, narrower than February’s C$1.4bn but much weaker than a C$3.1bn surplus seen in January. Canadian imports fell by 1.5% in March while exports fell by 0.2%. In real terms however exports rose by 1.8% while imports fell by 0.1%. In Q1 real exports rose by 2.5% while real imports rose by 2.3%, implying little net impact on Q1 GDP.