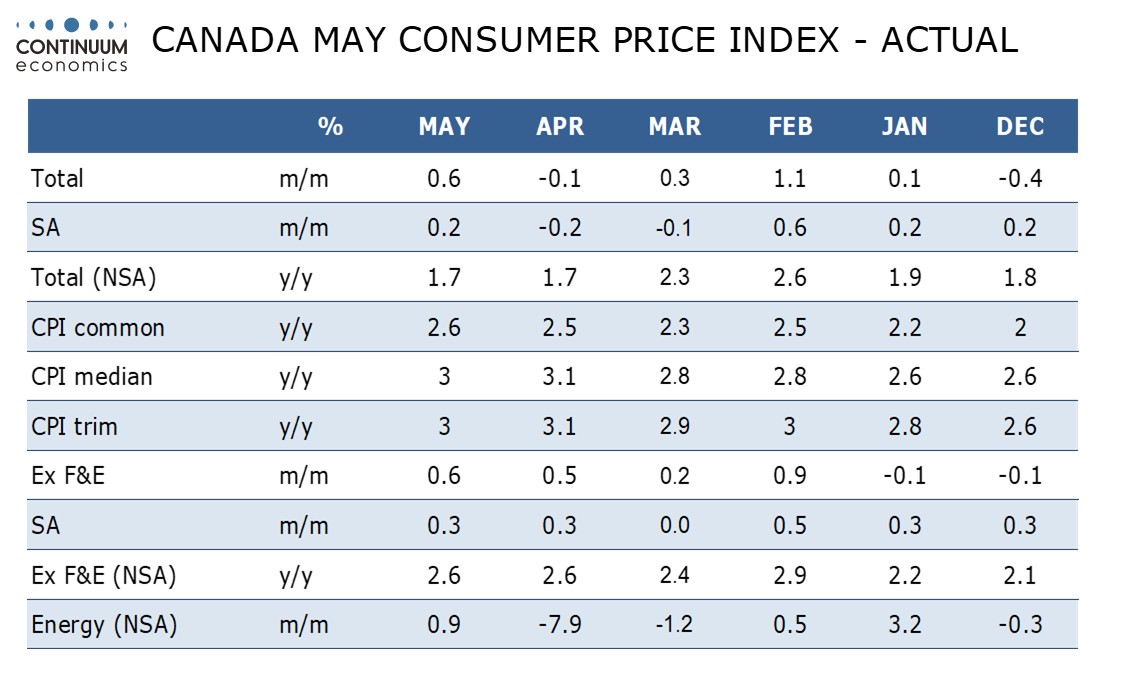

Canada May CPI - Mixed data leaves July BoC decision a close call

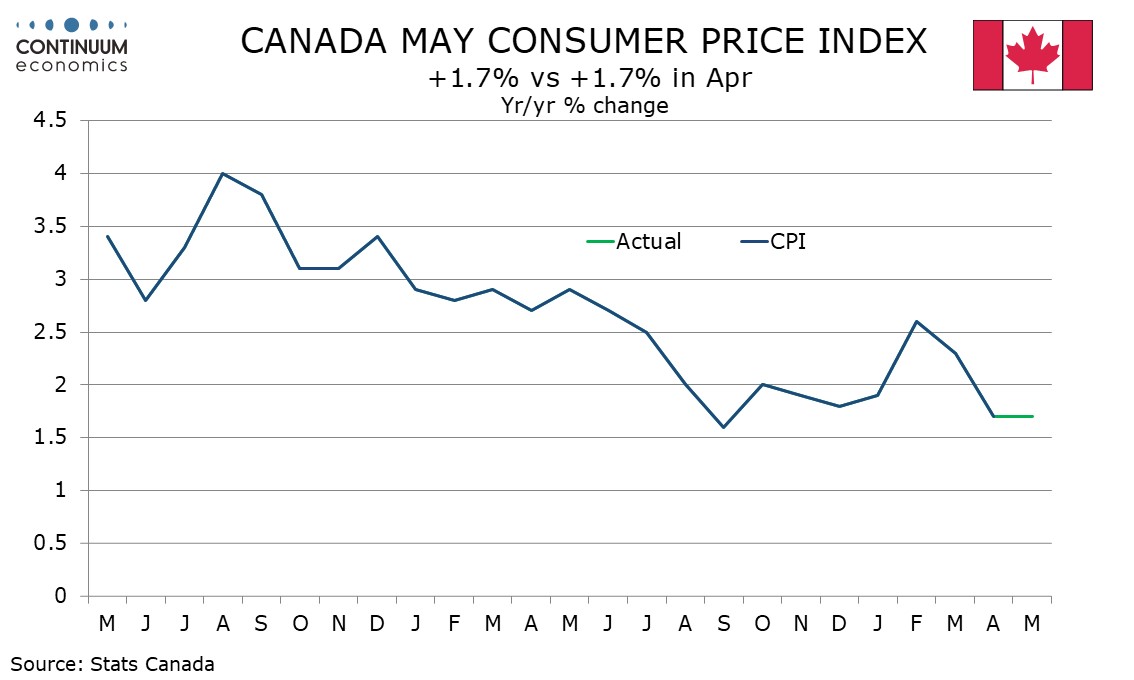

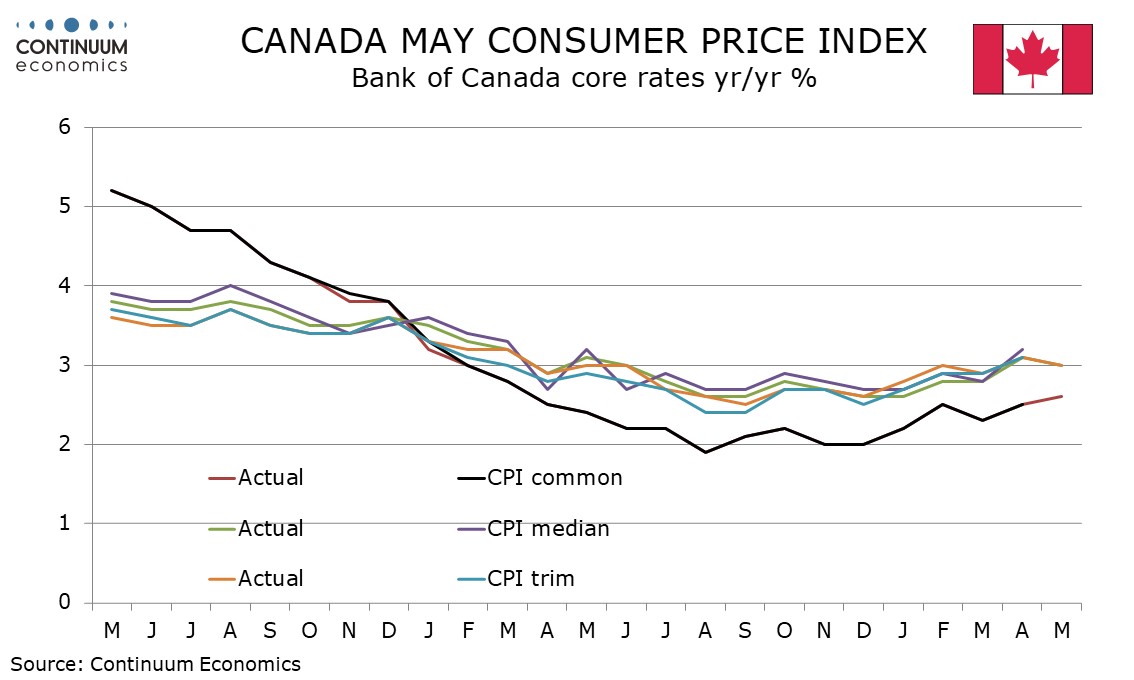

May Canadian CPI has come in as expected, unchanged at 1.7% with this yr/yr rate still restrained by the abolition of the consumer carbon tax which took 0.7% off the rate in April. The BoC’s core rates are on balance slightly softer, but do not fully reverse acceleration seen in May, leaving the July BoC decision a close call. June CPI data will be seen before that meeting.

Looking at the BoC’s three core rates, CPI-Median and CPI-Trim both slipped to 3.0% from, 3.1%, but the less closely watched CPI-Common edged up to 2.6% from 2.5%. All three rates are stronger than in April, when CPI-Common was 2.3%, CPI-Median 2.8% and CPI-Trim 2.9%. Underlying inflation is well above the 2.0% target but the BoC will have to see how big a hit the economy takes from tariffs as well as June CPI before making its rates decision on July 30.

On the month CPI rose 0.6% both overall and ex food and energy. Seasonally adjusted the increase was 0.2% overall, but a second straight 0.3% increase ex food and energy is stronger than the BoC would like. Yr/yr growth ex food and energy was unchanged at 2.6%, though this is not one of the BoC’s core rates.

The monthly seasonally adjusted data is mixed, with strength in health and personal care, up by 0.7%, household operations, furnishings and equipment, up by 0.6% and clothing, up by 0.5%. Elsewhere the data is subdued, with shelter, until recently an area of strength, unchanged after a 0.1% decline in April. On a yr/yr basis shelter is still relatively firm at 3.0%.