Canada April CPI - Core rates highest for over a year

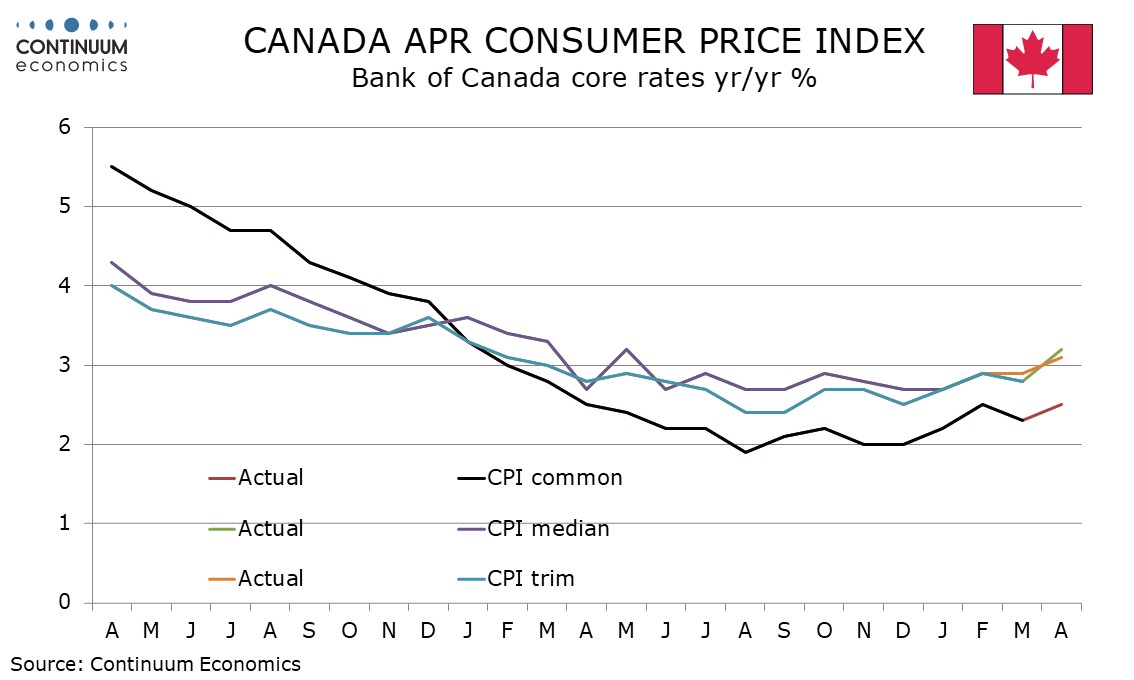

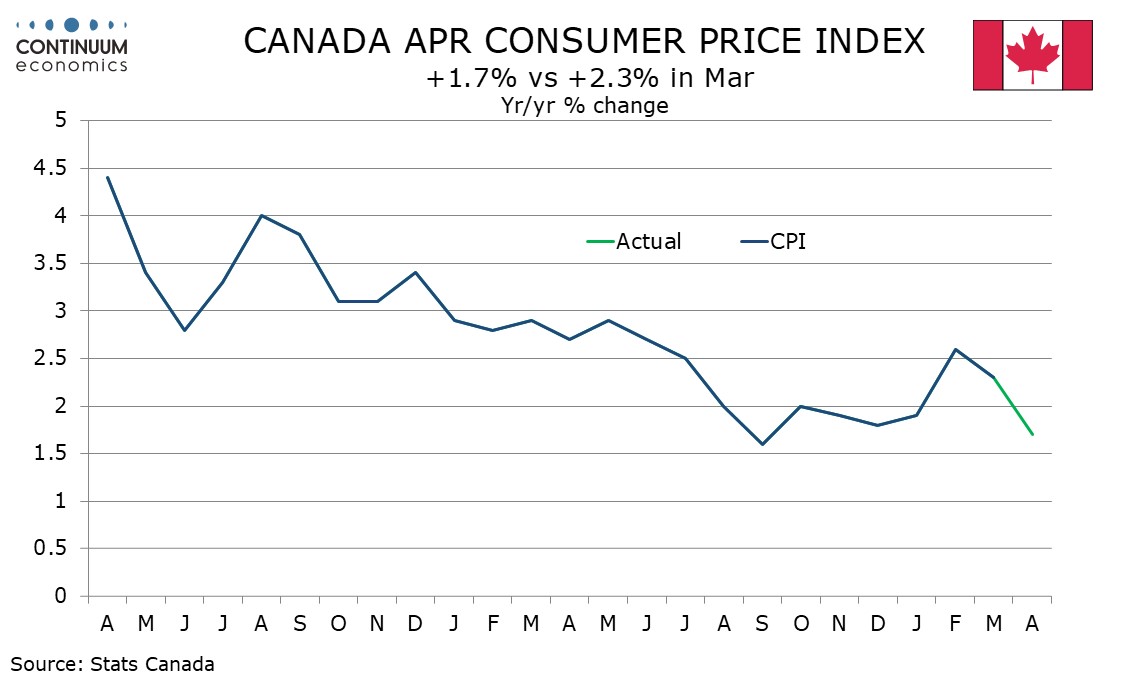

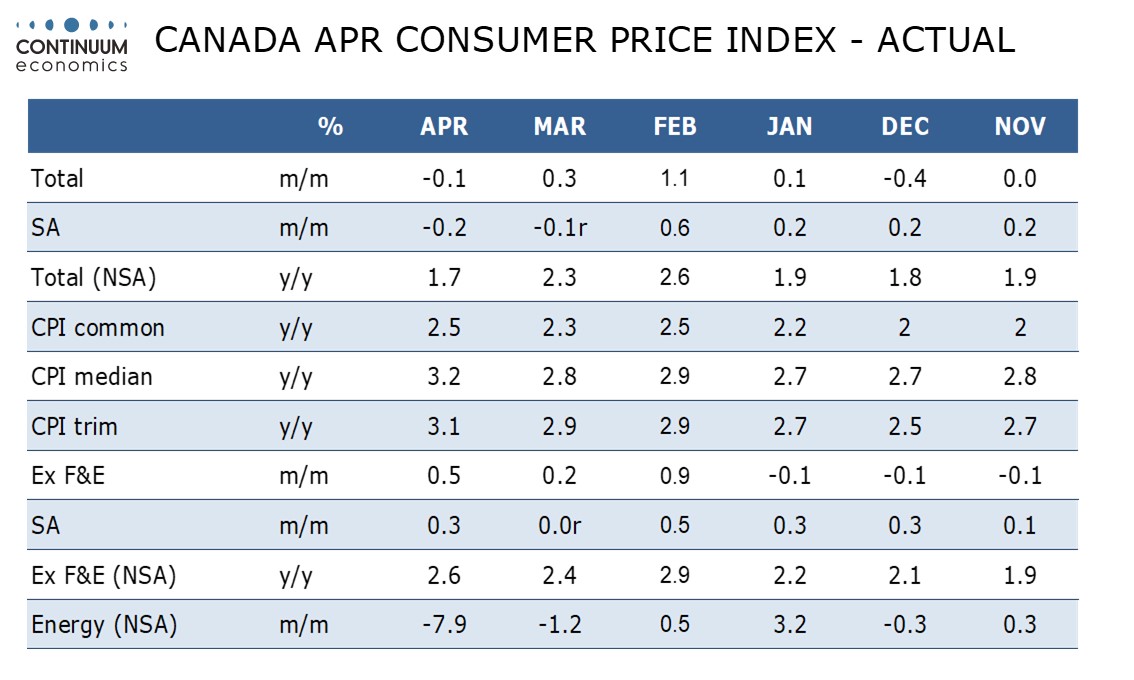

April Canadian CPI in falling to 1.7% yr/yr from 2.3% is slightly stronger than expected with the fall fully due to the ending of a carbon tax. The BoC’s core rates are stronger than expected, CPI-Median at 3.2% from 2.9%, CPI-Trim at 3.1% from 2.8% and CPI-Common at 2.5% from 2.3%.

This puts the average of the core rates at 2.9% from 2.7%, reaching the highest since March 2024 and further above the BoC’s 2.0% target.

Energy prices fell by 7.9% on the month largely due to the abolition of the tax though lower oil prices played an additional part. Excluding energy CPI accelerated to 2.9% yr/yr from 2.5% while ex food and energy CPI accelerated to 2.6% yr/yr from 2.4%. Neither of these rates are considered core rates by the BoC.

Unadjusted the CPI fell by 0.1% on the month with a 0.5% increase ex food and energy. Seasonally adjusted overall CPI fell by 0.2% with a 0.3% incase ex food and energy. The latter should not be considered overly alarming coming after an unchanged March. The data is not strong enough to exclude a BoC easing in June, though on the margins may make the BoC a little more cautious.

Areas of strength included food and surprisingly travel tours, rebounding from a weak March. March’s weakness was seen as related to Canadians boycotting the US for vacations due to the trade conflict. It appears that if the boycott of the US is continuing, Canadians have found other places to travel to.