Bank of Canada - Proceeding carefully, but risks still lean towards further easing

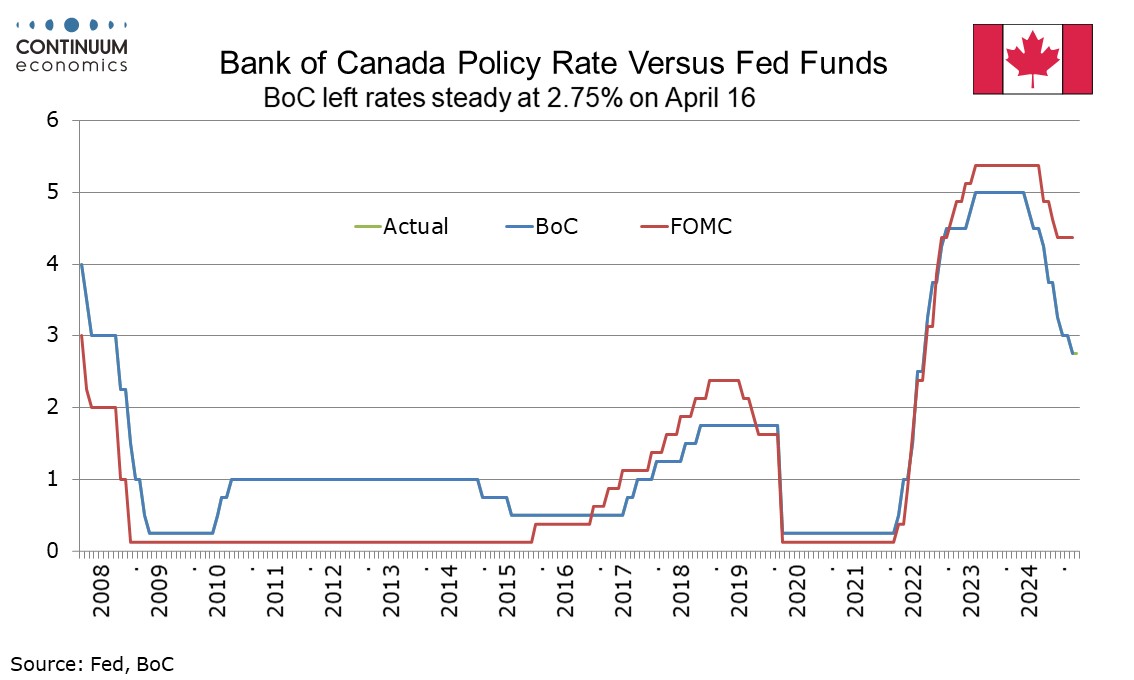

The Bank of Canada left rates unchanged at 2.75% as expected. The statement concluded that the BoC will proceed carefully, noting that monetary policy cannot resolve trade uncertainty or offset the impacts of a trade war, but it can and must maintain price stability in Canada. While this shows caution, a balance of two alternative economic scenarios still implies a leaning to ease. A June easing is now a close call, but we will stick with forecasting such a move while awaiting incoming data.

Governor Tiff Macklem stated that while a lot has happened since the March meeting the future is no clearer, and policy was left unchanged awaiting more information. The focus on inflation does not mean only upside risks are in focus, as they will be assessing the downside pressure on inflation from a weaker economy and upside pressure from higher costs. While promising to proceed carefully they are also prepared to act decisively if incoming information points clearly in one direction.

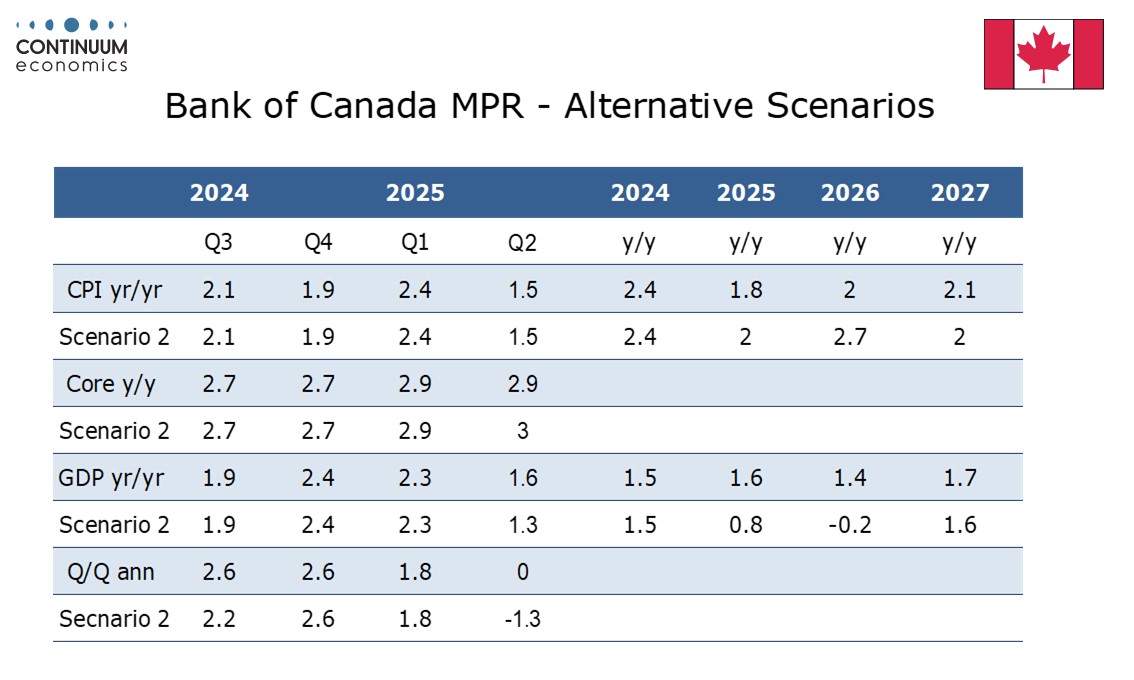

GDP is seen rising by 1.8% annualized in Q1 but with domestic demand flat and exports lifted by a pull-forward ahead of tariffs. Q2 is expected to be much weaker. Near term inflation is expected to fall from 2.3% in March to around 1.5% in April given lower oil prices and elimination of a consumer carbon tax taking off 0.7% from the CPI for one year.

Looking beyond that, the BoC considered two scenarios. In the first it is assumed most of the new tariffs get negotiated away but uncertainty persists. GDP then stalls in Q2 and then expands only moderately while inflation drops below 2.0% for the rest of the year and into 2026. Under this scenario some moderate easing would be likely before returning rates to neutral once trend growth and target inflation returns, probably in 2027.

The second scenario assumes a long lasting global trade war. GDP falls in Q2 and Canada remains in recession for a year. Growth gradually returns in 2026 but remains soft through 2027, while inflation rises above 3% in mid-2026, before falling as weak demand limits ongoing inflationary pressures. Here the policy path is uncertain. We however feel that some easing to support growth would be more likely than tightening to fight inflation if the rise in inflation was concentrated in tariff-sensitive goods while services softened.

Macklem stated that Trump’s April 2 announcement suggested a situation similar to scenario 2 but Trump’s partial climb down on April 9 meant a situation in the middle of the two scenarios. In predicting future BoC policy, we will assume the situation remains similar to where it is now though Trump will remain unpredictable. This would imply a modest recession with higher inflation, but with a peak probably short of 3.0%.

Ahead of this meeting, we had expected the BoC to ease three more times this year, in Q2, Q3 and Q4. With only one meeting left in Q2, on June 4, the June call is now a close one, but with Macklem stating that the BoC did consider an ease at this meeting, we will wait and see more data before changing the call. Risks to our forecast are for less easing this year rather than more, but we would continue to expect rates to see a floor of 2.0%, though the final move could come in 2026. The economy is then still likely to look subdued while inflation could be showing signs of peaking, particularly in monthly data if not yet the yr/yr pace.