United Kingdom

View:

January 06, 2026

Markets 2026

January 6, 2026 9:58 AM UTC

• For financial markets, the muddle through for global economics and policy provides support for risk assets, combined with solid earnings prospects from some of the magnificent 7. However, U.S. equities are once again significantly overvalued and we look for a 5-10% correction in 2026, b

January 02, 2026

December 22, 2025

December 19, 2025

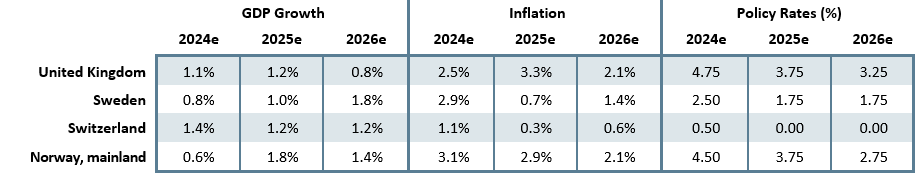

Western Europe Outlook: Underlying Price Pressures Ebbing

December 19, 2025 9:34 AM UTC

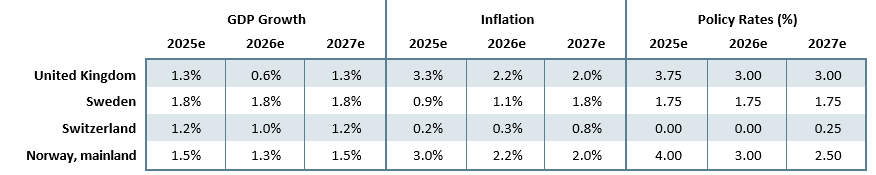

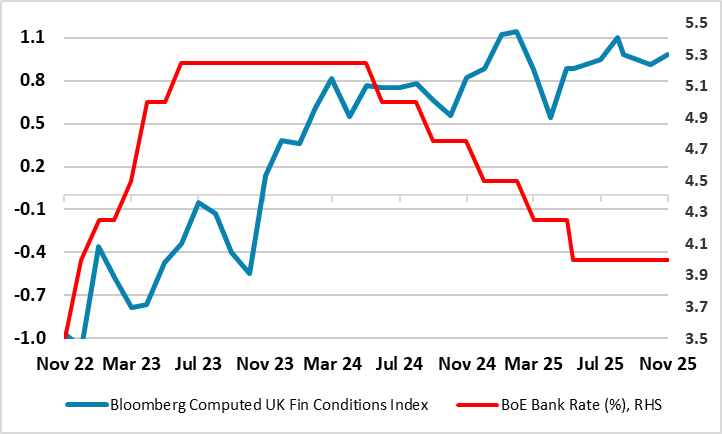

· In the UK, we have upgraded 2025 GDP growth by 0.1 ppt to 1.3%, but pared back that for next year by a two notches to a very sub-par 0.6%. We think the weak(er) labor market will accentuate somewhat refreshed disinflation allowing the BoE to ease further in 2026 by around 75 bp to 3.0

December 18, 2025

DM FX Outlook: Scope for USD decline against JPY, AUD and NOK

December 18, 2025 2:31 PM UTC

· Bottom Line: We expect some modest USD losses across the board over the next couple of years, but there is much more scope for losses against the JPY, AUD and NOK than the other G10 currencies, as yield spreads have moved dramatically in favour of these currencies, and the currencies

BoE Review (Dec 18): Splits More Entrenched?

December 18, 2025 12:41 PM UTC

That the BoE delivered a sixth 25 bp rate cut (to an almost three-year low of 3.75%) was hardly in doubt. But we were surprised that amid the recent run of weak data, that there were (again) four dissents with Governor Bailey switching sides. Notably, in a clear combative overtone, at least some

December 17, 2025

DM Rates Outlook: 2026 Yield Curve Steepening Before 2027 Flattening

December 17, 2025 9:21 AM UTC

· Multi quarter, we still look for 50bps of further Fed easing by end 2026, which will likely initially bring 2yr yields down to 3.35%. However, once the Fed Funds rate get closer to 3.0-3.25% and the assumed slowdown turns into a soft landing, the 2yr will likely move to a premium ve

Outlook Overview: Turbulent Times

December 17, 2025 7:44 AM UTC

· The U.S. slowdown remains in focus as the lagged effects of President Trump’s tariff increases continues to feedthrough, though our baseline is for a 2026 soft-landing. The Supreme court will likely rule against part of Trump’s reciprocal tariffs, which will create short-term

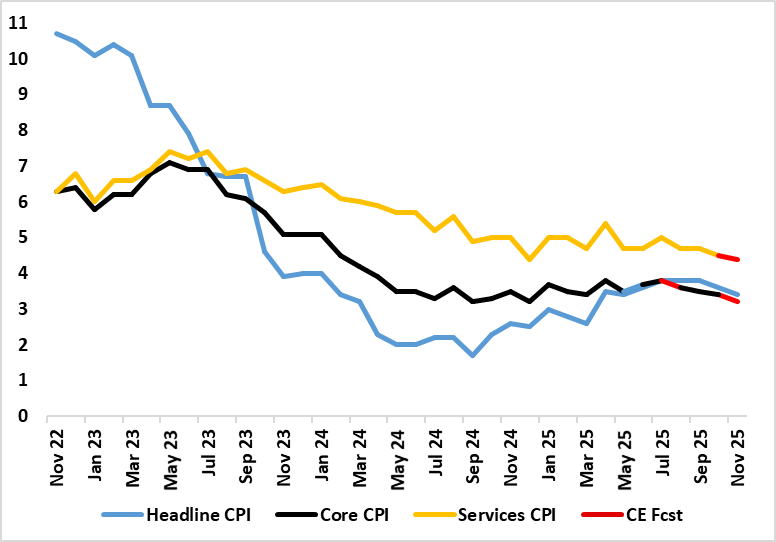

UK CPI Review: Down More Than Expected from Likely Peak?

December 17, 2025 7:38 AM UTC

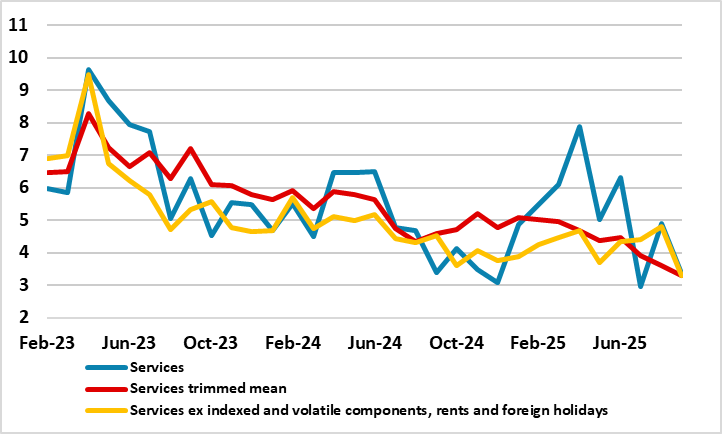

A clear downside surprise adds to the wealth of data suggesting a reining of price and cost pressures. This November result makes it more likely that the September CPI outcome will prove to be the CPI inflation peak. Indeed, although October figure fell a little less than the consensus by 0.2 pp

December 16, 2025

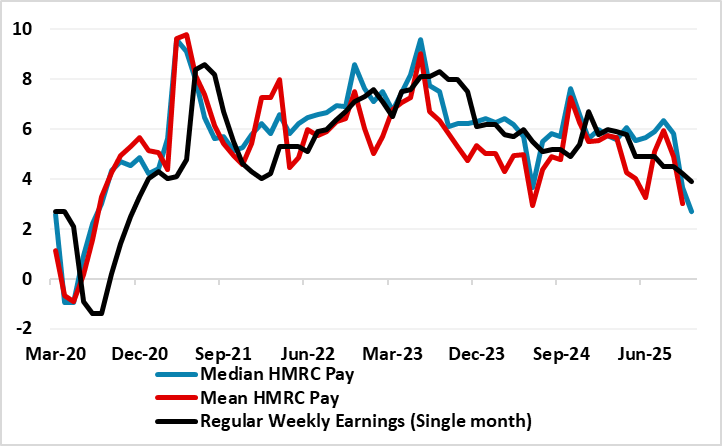

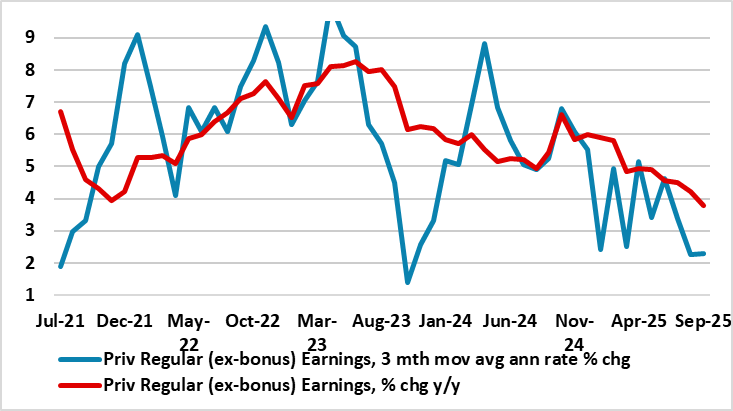

UK Labor Market: Job Losses Weighing Even More Clearly on Wages

December 16, 2025 8:06 AM UTC

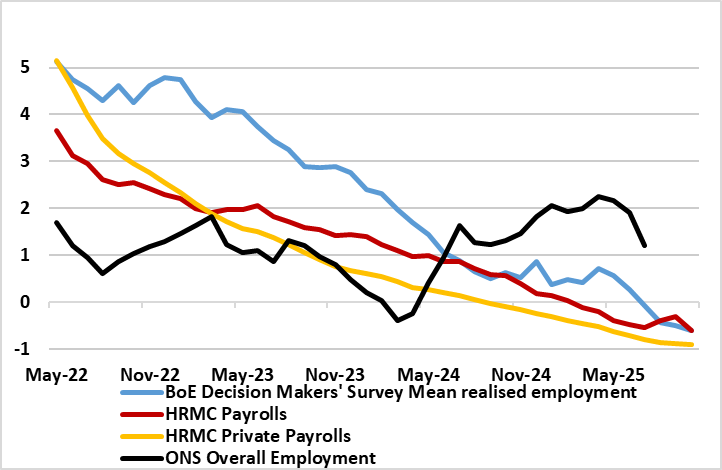

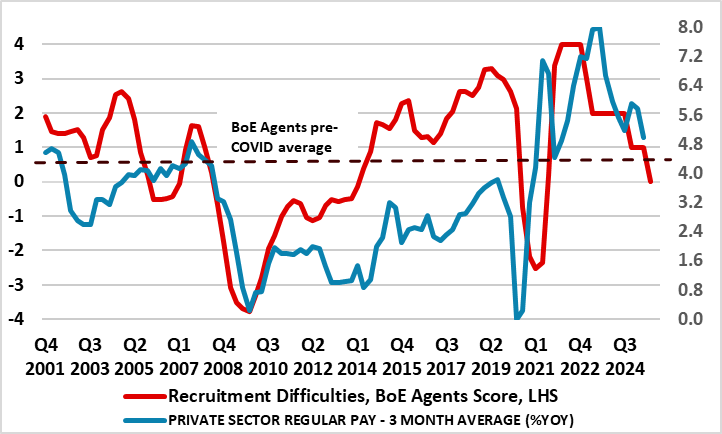

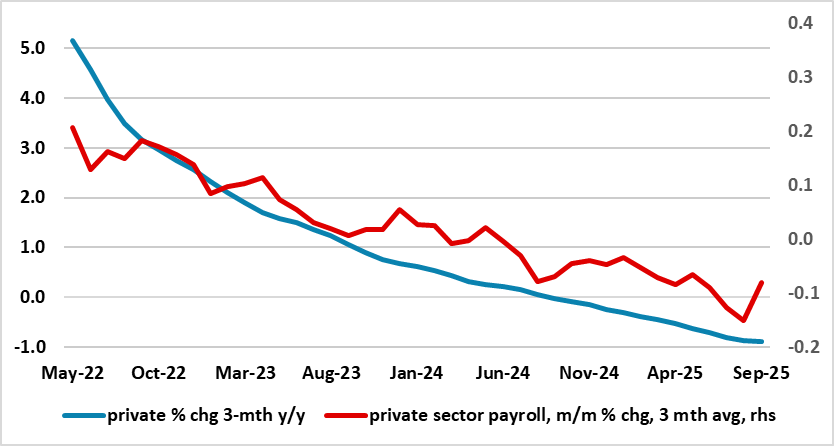

Adding to the array if weak activity updates of late, there are increasing signs that the labor market is haemorrhaging jobs more clearly and broadly with fresh and deeper falls in the more authoritative measure of jobs covering payrolls. Indeed, private sector payrolls are still falling, down alm

December 12, 2025

Equities Outlook: Choppy Up For 2026 and Down for 2027?

December 12, 2025 8:05 AM UTC

· The U.S. equity market is underpinned by the bullish AI/tech story and a soft economic landing into 2026. However, overvaluation is clear and this leaves the market vulnerable to a 5-10% correction on moderate bad news e.g. economic data. We see the S&P500 having a choppy year a

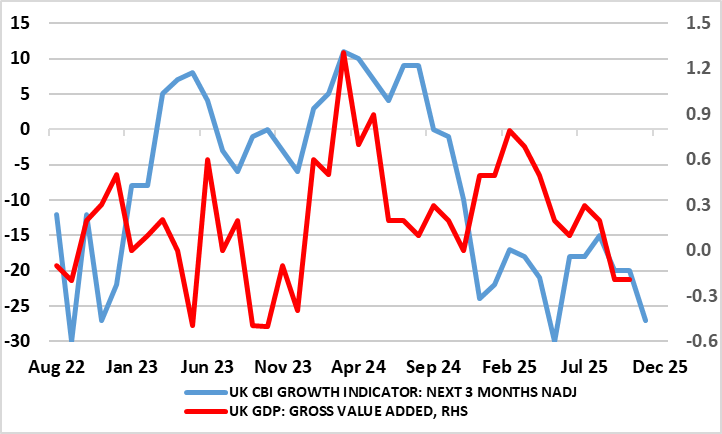

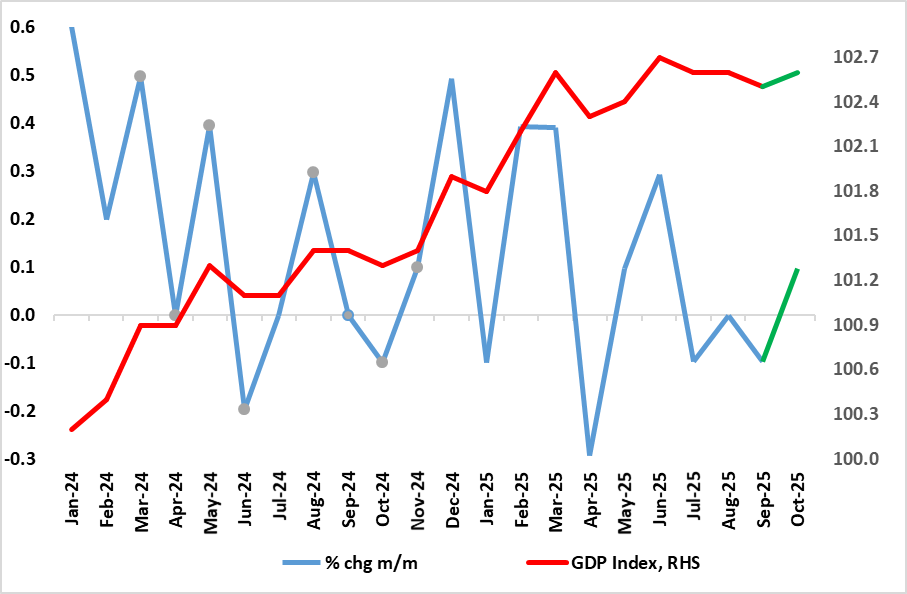

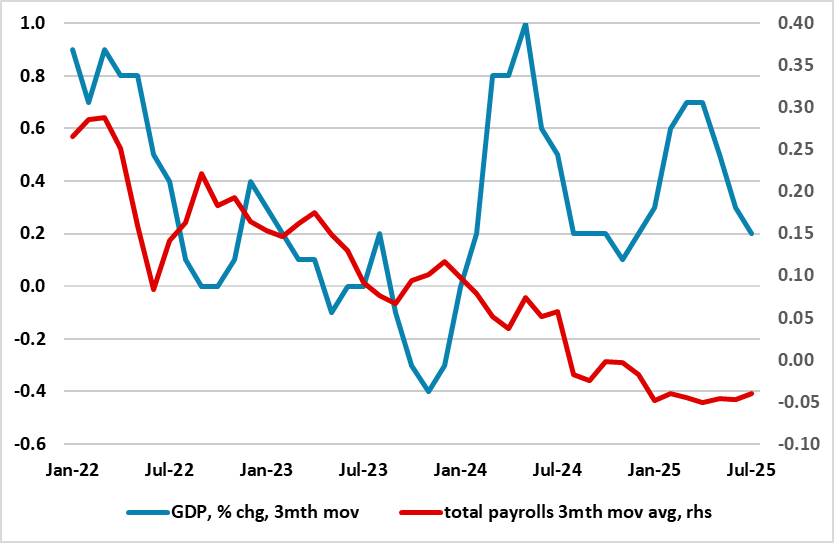

UK GDP Review: Underlying and Headline Economy Negative, Fragile and Listless

December 12, 2025 7:47 AM UTC

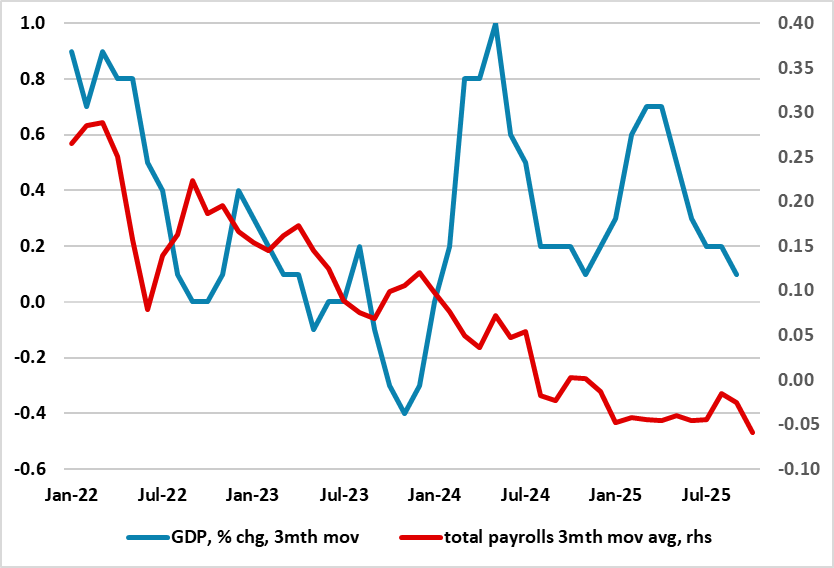

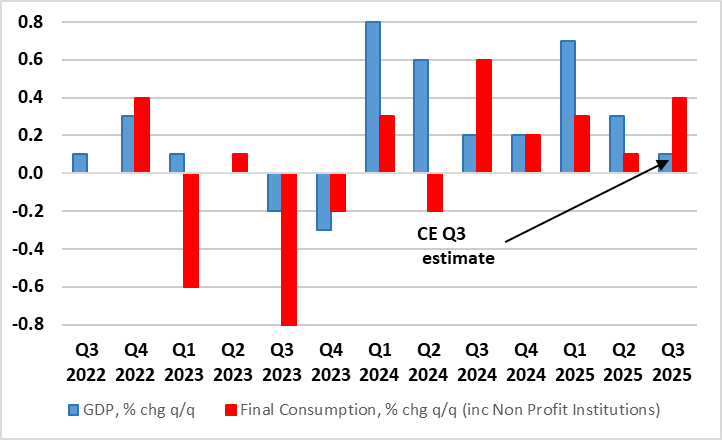

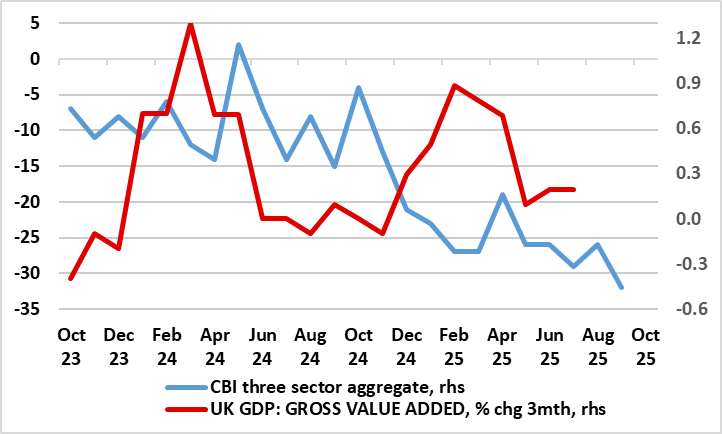

As we have underlined, GDP has hardly moved since March and this became even clearer with the October GDP release, the question being whether weakness is getting more discernible and significant. Indeed, it has fallen in three of the last four months (Figure 1), and where the unexpected further 0.

December 09, 2025

BoE Preview (Dec 18): How Big a Split?

December 9, 2025 11:29 AM UTC

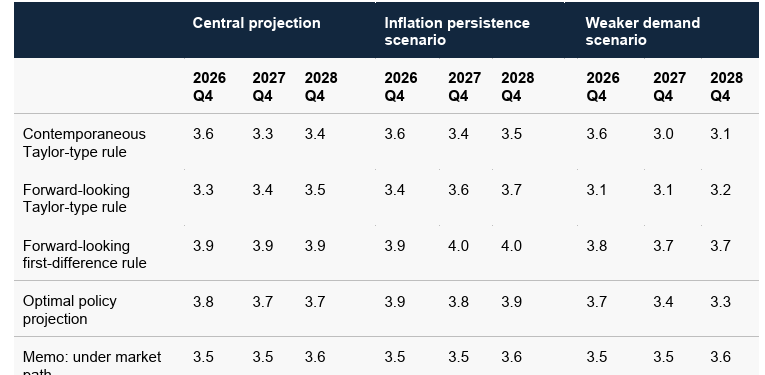

That the BoE will deliver a fifth 25 bp rate cut (to 3.75%) on Dec 18 is almost certain, even after a Budget that did not accentuate current emerging demand weakness. The question is whether the MPC vote will be as close as the 5:4 split seen last month but with Governor Bailey switching sides.

Americas First: New National Security Strategy

December 9, 2025 8:40 AM UTC

· The new NSS at one level reads like a Trump/MAGA current list of topics and desires, that may not translate into policy or a major shift of military assets. Trump has blown hot and cold on Europe and China over the past 12 months and could shift again. Nevertheless, the NSS does r

December 08, 2025

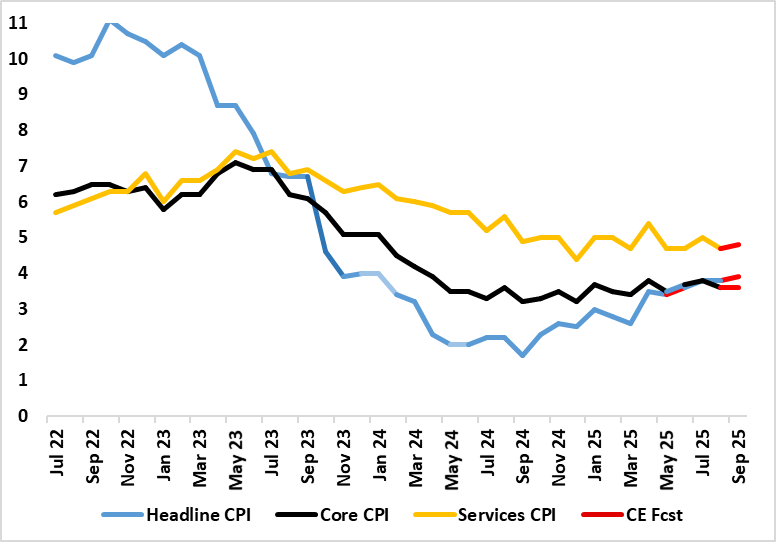

UK CPI Preview (Dec 17): Down Further from Likely Peak?

December 8, 2025 9:43 AM UTC

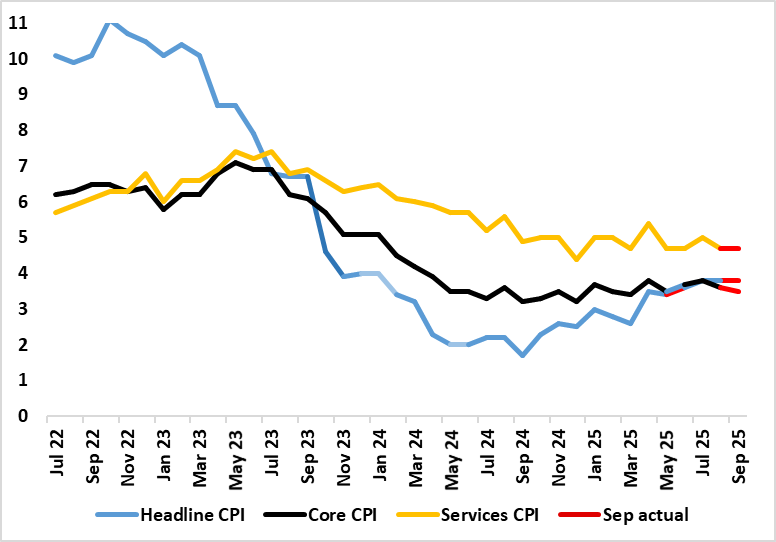

It does seem as if the September CPI outcome will prove to be the CPI inflation peak. Indeed, although October figure fell a little less than the consensus to 3.6%, the looming November numbers may show a same-sized fall to 3.4%, a six-month low. We see the core rate seen also dropping 0.2 ppt b

December 04, 2025

UK GDP Preview (Dec 12): Underlying Economy Fragile and Listless

December 4, 2025 9:55 AM UTC

As we have underlined, GDP has hardly moved since March and this is un likely to change with the October GDP release. Indeed, it has fallen in two of the last three months (Figure 1), albeit where some recovery should be in store for the current quarter as the September numbers were hit (temporari

December 02, 2025

UK: BoE Offers Financial Boost?

December 2, 2025 8:05 AM UTC

In its updated financial policy report which included fresh bank stress tests, the BoE Financial Policy Committee (FPC) is reducing bank capital requirements. This very seems to be designed to encourage bank to lend and may reflect what have been modest, if not flagging, numbers regarding actual p

November 28, 2025

November 26, 2025

UK Budget Review: Deferring the Fiscal Pain?

November 26, 2025 2:01 PM UTC

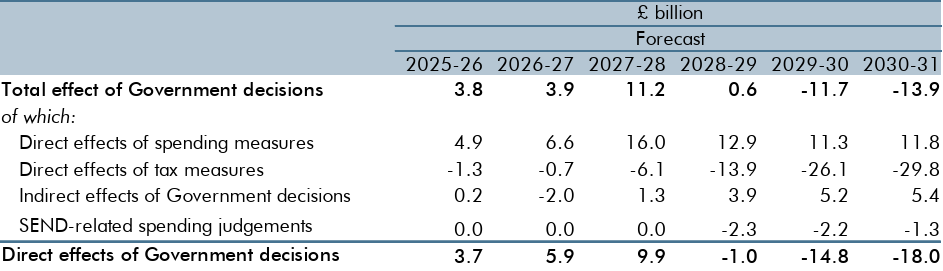

The Budget looks something of a fudge, with no fiscal tightening until 2028 suggesting policy changes very much back-loaded (Figure 1) and puzzlingly timed to take effect in what may be the lead-up to the next general election. The immediate the result is actually a modest boost to GDP growth in t

November 24, 2025

Japan Aging: Consumption Lessons for Eurozone/China?

November 24, 2025 10:55 AM UTC

· China will likely suffer slowing consumption from population aging in the coming years, as consumption per head falls for over 55’s and large scale immigration is not a likelihood. China’s household wealth is also heavily concentrated in falling illiquid residential property. Chin

November 21, 2025

U.S. Asset Inflows After April’s Trump Tariffs

November 21, 2025 8:00 AM UTC

· Net foreign portfolio inflows have not been hurt by Trump’s April tariff drama, with the AI and tech boom attracting new equity inflows. Flows could become more volatile with a U.S. equity bear market or recession, but these are modest risk alternative scenarios rather than high r

November 19, 2025

UK CPI Review: Down from Likely Peak?

November 19, 2025 7:50 AM UTC

It does seem as if the September CPI outcome (a third successive and lower-than-expected outcome of 3.8%) will prove to be the inflation peak. Indeed, the just released October figure fell a little less than the consensus but in line with BoE thinking, to 3.6%, helped by favourable energy base eff

November 18, 2025

UK Budget Outlook (Nov 26): The Fiscal Blame Game – Yet Again!

November 18, 2025 3:09 PM UTC

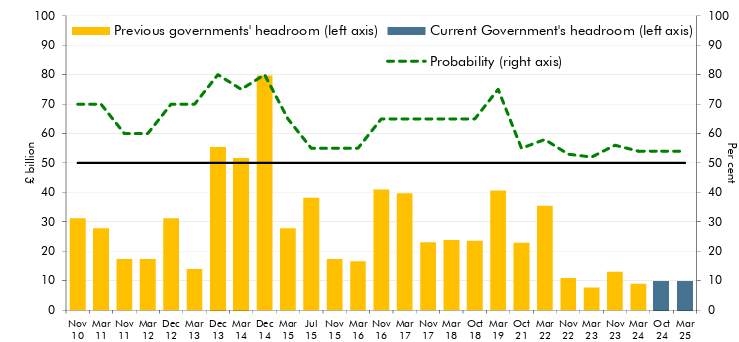

If not the most keenly awaited Budget for some years, Chancellor Reeve’s updates on Nov 26 is certainly the one that has attracted the most speculation and from all sides. What is clear is that amid several factors, a marked fiscal tightening is in store. This though now seems as if it will be

Markets 2026

November 18, 2025 10:30 AM UTC

· The Fed, ECB and BOE will likely drive further 10-2yr government bond yield curve steepening, with 10yr Bund yields rising due to ECB QT and German fiscal expansion. 10yr JGB yields are set to surge through 2%, as BOJ QT remains excessive and underestimated. The BOJ could partiall

November 17, 2025

Financial Stability Risks: Vulnerable To A Recession

November 17, 2025 1:00 PM UTC

The November Fed financial stability review highlights continued concern over hedge funds and insurance company leverage, while the IMF GSFR is concerned about U.S. equity market overvaluation and growing links between banks and non-bank financial intermediaries. However, the main adverse shock wo

November 13, 2025

UK GDP Review: Underlying Economy Listless - At Best

November 13, 2025 8:10 AM UTC

As we have underlined, GDP has hardly moved since March and, again, the latest update undershot consensus thinking. Indeed, GDP has fallen in two of the last three months (Figure 1), albeit where some recovery should be in store for the current quarter as these September numbers were hit (temporar

November 12, 2025

UK Gilts: Fiscal, Politics and BOE

November 12, 2025 9:55 AM UTC

· 2yr Gilt yields have scope to fall through 2026, as we see growth and inflation slowing more than the BOE and this will likely see the MPC changing view and cutting policy rates to 3.25% in H1 2026. Though a pause could then be seen, we see one final BOE cut then being delivered to

November 11, 2025

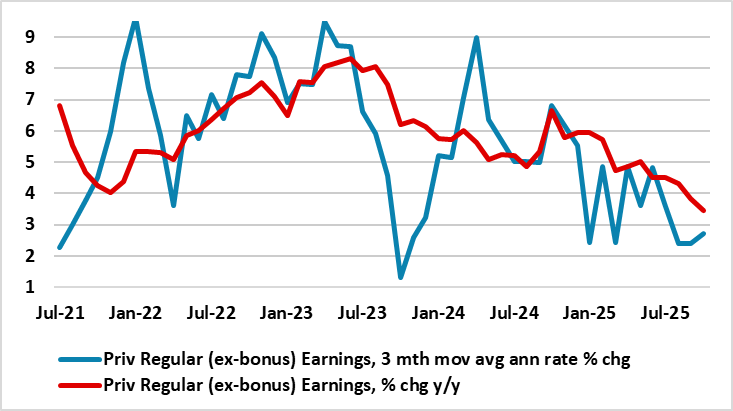

UK Labor Market: Continued Private Sector Job Losses Weighing Even More Clearly on Wages

November 11, 2025 8:01 AM UTC

Previous signs that the labor market is haemorrhaging jobs less clearly have evaporated, with fresh and deeper falls in the more authoritative payrolls. Indeed, private sector payrolls are still falling, down almost a full ppt in y/y terms and more steeply so (Figure 1). Regardless, the latest l

November 10, 2025

UK CPI Preview (Nov 19): Falling Back Broadly From Likely Peak?

November 10, 2025 10:49 AM UTC

After the upside (and broad) June CPI surprise, CPI inflation rose further, up another 0.2 ppt to 3.8% in July and stayed there for the two following months, with the September outcome having been lower-than-expected outcome in what we (and the BoE) think will be the inflation peak. Indeed, we see

November 06, 2025

BoE Review: Fiscal Elephant in the Room Ignored – For Now!

November 6, 2025 1:47 PM UTC

A tight vote was always likely for the November MPC verdict, but the 5:4 split was closer than expected, but almost a repeat of the August decision when rates were cut to the current 4%. What seems clear is that the effective swing voter was Governor Bailey but who coloured his decision with a cle

November 03, 2025

UK GDP Preview (Nov 13): Cyber Crime Shock but Underlying Economy Listless

November 3, 2025 4:01 PM UTC

Notably, the level of UK GDP has hardly moved since March but we think there will be distinct setback in the September numbers where the cyber-attack of JLR vehicle manufacturing may be sizeable – car reduction may have fallen some 25% m/m-plus in the month alone. As a result, we see September G

October 31, 2025

October 29, 2025

BoE Preview (Nov 6): Easing Door Opening Afresh?

October 29, 2025 4:43 PM UTC

That the BoE kept Bank Rate at 4% after last month’s MPC meeting was all but certain, as was the two vote dissent in favor of further easing. But of more note, and amid what have been recent hawkish hints from the MC majority, was that the MPC adhered to its (conventional) policy guidance, still

October 28, 2025

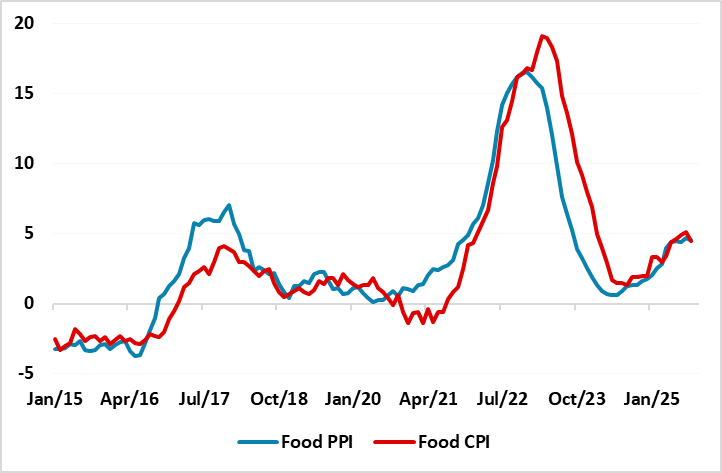

UK Food Inflation; Not Just a Domestic Issue, Despite Industry Claims

October 28, 2025 8:45 AM UTC

Food price inflation is becoming an increasing issue for both policy makers and households as well as companies that are generating and selling the produce. Particularly in the UK, rising food price inflation is helping shore up well-above target CPI inflation and thereby deterring the BoE from what

October 22, 2025

UK CPI Review: A Final and Lower Than Expected Peak?

October 22, 2025 7:05 AM UTC

After the upside (and broad) June CPI surprise, CPI inflation rose further, up another 0.2 ppt to 3.8% in July, higher than the consensus but matching BoE thinking. Despite adverse rounding and fuel costs, the headline stayed there in the August figure, and did so again in September in what was a lo

October 16, 2025

UK GDP Review: Moving Sideways – At Best

October 16, 2025 6:39 AM UTC

Although the revisions up to July GDP data now confirm a small m/m fall for that month), this was unwound in the August numbers with a 0.1% rise (Figure 1). This put the less volatile three-month rate at 0.3% but we think this overstates what is very feeble momentum, which may actually be nearer zer

October 14, 2025

UK CPI Preview (Oct 22): A Final Peak?

October 14, 2025 2:07 PM UTC

After the upside (and broad) June CPI surprise, CPI inflation rose further, up another 0.2 ppt to 3.8% in July, higher than the consensus but matching BoE thinking. Despite adverse rounding and fuel (and food) costs, the headline stayed there in the August figure, this foreshadowing a likely rise th

UK Labor Market: Continued Private Sector Job Losses Weighing More Clearly on Wages

October 14, 2025 9:22 AM UTC

There may be signs that the labor market is haemorrhaging jobs less clearly, if not actually indications that the more authoritative payrolls have stopped falling, albeit this largely due to increasing jobs within the health sector. Indeed, private sector payrolls are still falling, down almost a

October 08, 2025

UK: BoE Financial Arm Warns of (Increasing) Risks But Ignores Tighter Financial Conditions

October 8, 2025 1:58 PM UTC

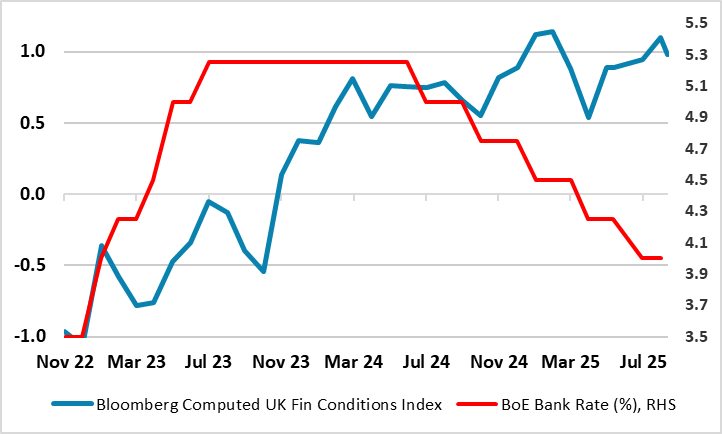

According to the BoE Financial Policy Committee (FPC) meeting this month, risks associated with geopolitical tensions, global fragmentation of trade and financial markets, and pressures on sovereign debt markets remain elevated. In fact, the FPC was very clear of the increasing risk of a sharp ma

October 07, 2025

UK GDP Preview (Oct 16): Conflicting Signs To Veer Toward Weakness

October 7, 2025 1:37 PM UTC

Although we are pointed to a flat m/m GDP outcome for the July data, thereby matching the official outcome, the actual outcome was a small m/m fall (before rounding). We see this being repeated in the August numbers with a 0.1% drop (Figure 1). This would leave the less volatile three-month rate a

October 03, 2025

UK: BoE Inflation Expectations Worries Overdone

October 3, 2025 10:22 AM UTC

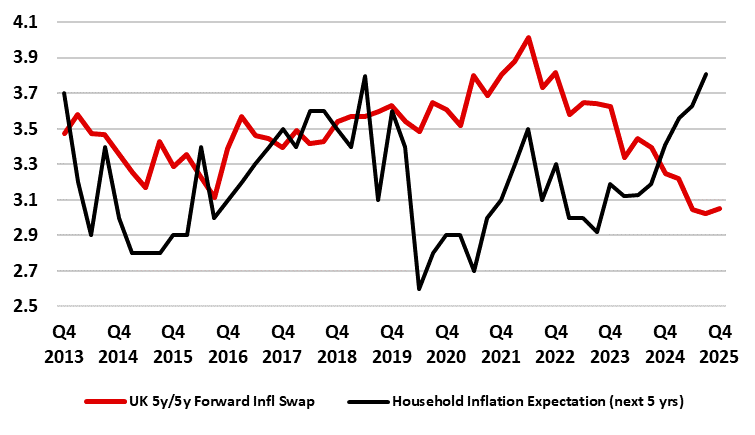

UK monetary policy is relatively loose, according to BoE MPC member Mann. But if the policy stance is so loose (something we refute), why is the real economy at best labouring, if not stalling. In this regard, the BoE have had conflicting data in terms of whether the labor market is loosening wh

October 02, 2025

DM Central Banks: Wider-Ranging Conditions More Than Neutral Rates

October 2, 2025 6:55 AM UTC

· Neutral policy rate estimates and forward guidance provide some help at the start of easing cycles, but less so at mid to mature stages. For the Fed, ECB and BOE we look at a wider array of economic and financial conditions, alongside our own projections over the next 2 years to m

October 01, 2025

AI/Humanoid Robots and Disinflation?

October 1, 2025 9:40 AM UTC

· Overall, a number of forces from the AI wave will impact inflation. Power demand could push up power prices, but productivity enhancements and product innovation could be disinflationary like Information and Communications technology (ICT). One other key uncertainty on a 1-5 year

September 29, 2025

DM Government Bond Saints v U.S.

September 29, 2025 7:35 AM UTC

· Overall, although the fiscal saints (Australia/Canada/Germany/Sweden) have merits over the U.S. in the scenario where Fed independence is undermined and more Fed rate cuts occur than warranted by the economics, the 10yr area of other government bond markets may not outperform. 10yr go

September 26, 2025

September 25, 2025

September 23, 2025

DM FX Outlook: USD steadies but vulnerable to equity correction

September 23, 2025 2:48 PM UTC

· Bottom Line: The USD has continued to edge lower against the EUR in the last quarter as market expectations of Fed easing have increased following clear weakening in U.S. employment growth. But at this stage the data doesn’t indicate we are heading for recession, and this suggests w

Western Europe Outlook: Policy Divergences

September 23, 2025 9:54 AM UTC

· In the UK, we have upgraded 2025 growth by 0.2 ppt back to 1.0%, but pared back that for next year by a notch to a sub-par 0.8%. We think this will refresh somewhat stalled disinflation allowing the BoE to ease further into H1 by around 75 bp.

· Sweden has seen a clear e