Bank of Canada

View:

February 11, 2026

Bank of Canada Minutes from January 28 - Steady policy dependent on economy evolving as expected

February 11, 2026 7:06 PM UTC

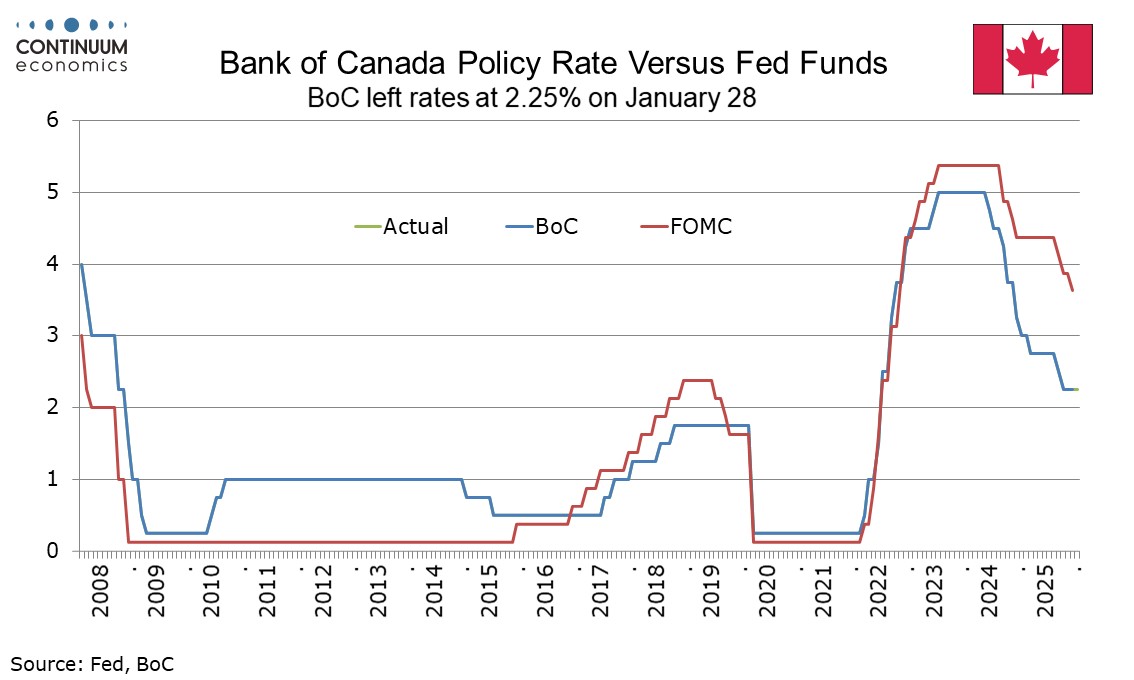

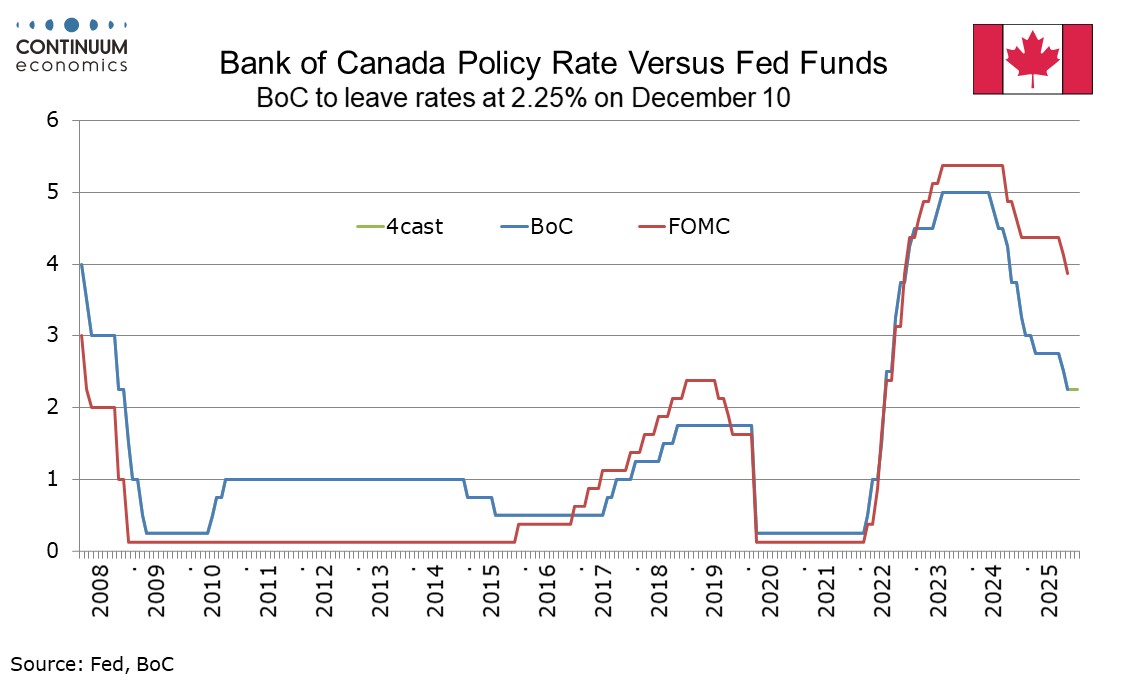

The Bank of Canada has released minutes from its January 28 meeting which provide no major surprises. The meeting saw rates left unchanged at 2.25% but noted heightened uncertainty, which the minutes also emphasize, with steady policy conditional on the economy evolving as expected.

February 06, 2026

Canada January Employment - Ontario explains employment and labor force slippage

February 6, 2026 2:02 PM UTC

Canada has delivered a mixed employment report for January, with a 24.8k decline in employment led by manufacturing and the province of Ontario, but a decline in the unemployment rate to 6.5% from 6.8%. Weather may have played a part in the weakness in Ontario, though details are mixed leaving the d

February 05, 2026

January 28, 2026

Bank of Canada - Rate Level Still Appropriate But Uncertainty Heightened

January 28, 2026 4:42 PM UTC

The Bank of Canada left rates unchanged at 2.25% as expected and continues to see the current policy rate as appropriate, Governor Macklem stating updated economic forecasts have not changed significantly since October. However in highlighting heightened uncertainty the statement appears to leave ri

January 20, 2026

Bank of Canada Preview for January 28: Rate level still appropriate but uncertainty high

January 20, 2026 3:24 PM UTC

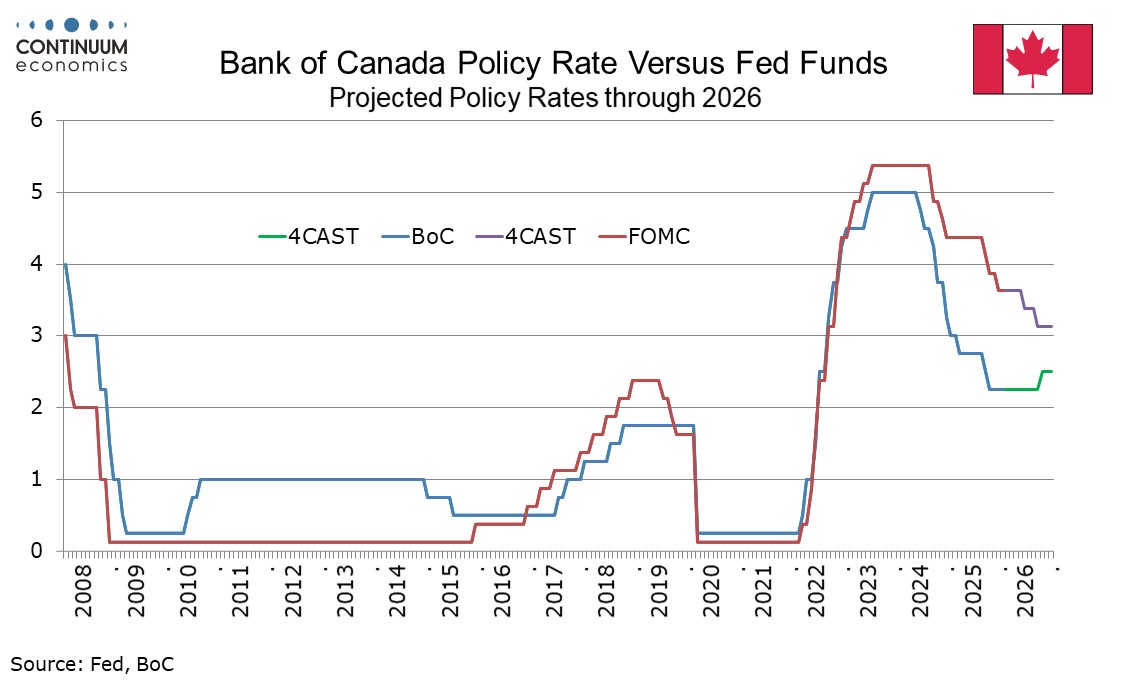

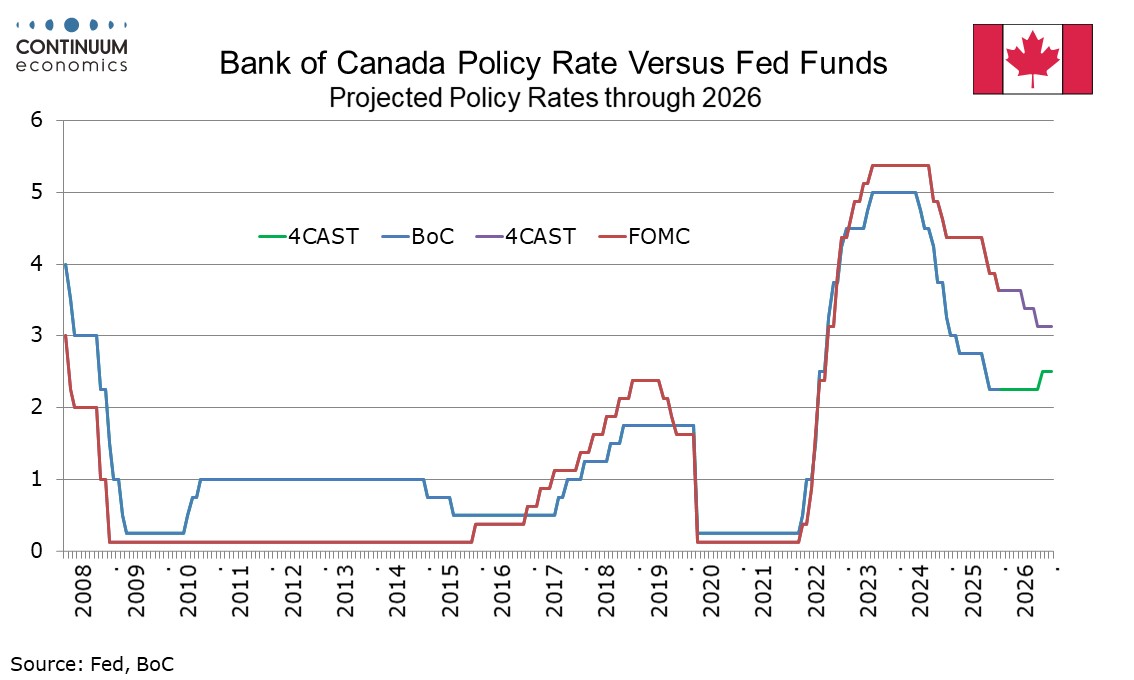

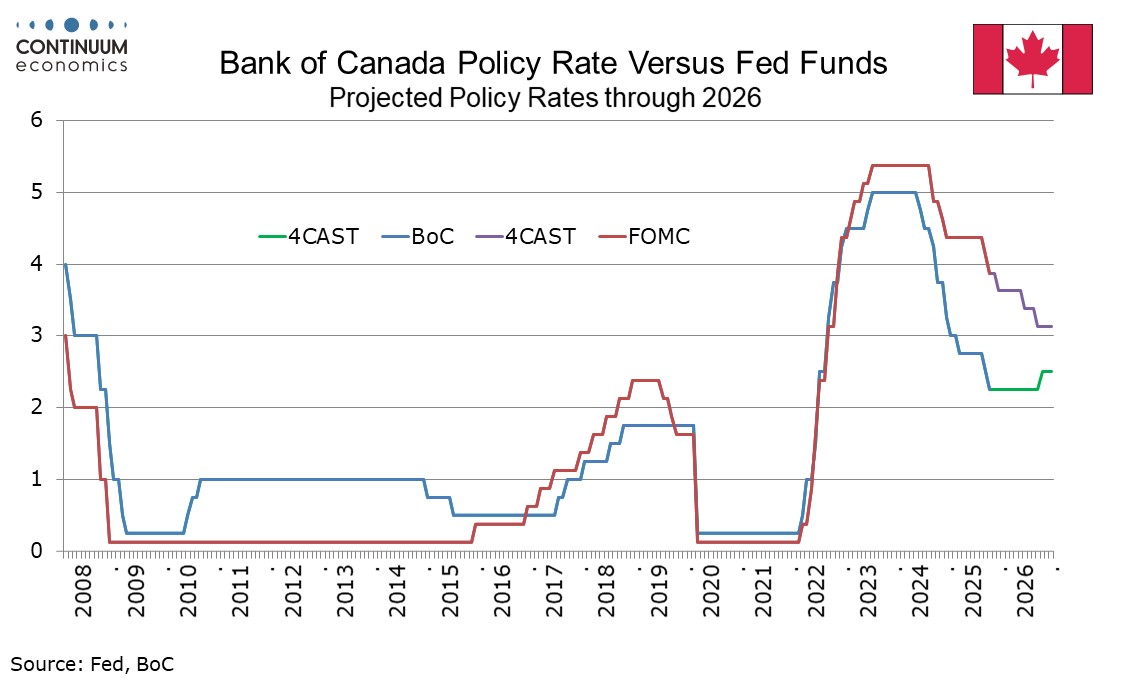

The Bank of Canada looks highly likely to leave rates unchanged at 2.25% on January 28 and reiterate that rates are at about the right level if the economy evolves as expected, while adding that uncertainty remains elevated. We expect that the next BoC move will be a modest tightening, but this will

January 19, 2026

Canada - BoC Q4 Business Outlook Survey - Mostly stronger

January 19, 2026 4:03 PM UTC

The Bank of Canada’s Q4 business outlook survey is mostly improved with the business outlook indicator of -1.78 from -2.27 the strongest since Q4 2024 while the index on future sales bounced to a positive 13 from -2, returning to the pre-tariff level seen in Q1 2025. The data, while improved, is n

Canada December CPI - Stronger due to year ago tax holiday, BoC core rates softer

January 19, 2026 2:06 PM UTC

December Canadian CPI at 2.4% yr/yr has accelerated from 2.2% in November but the BoC’s core rates are softer. The contrast is explained by a year ago tax holiday inflating the overall figure but not the core rates, which will matter more to the BoC. Still, easing at next week’s BoC meeting rema

January 09, 2026

Canada December Employment - A fairly stable underlying picture

January 9, 2026 2:55 PM UTC

After three surprisingly strong months, which followed two surprisingly weak months, Canada’s December employment report has delivered a normal outcome, with employment modestly positive at 8.2k, and unemployment bouncing to 6.8% from 6.5%, through in remaining below October’s 6.9% and the highs

December 15, 2025

Canada November CPI - Underlying trend has slowed

December 15, 2025 1:48 PM UTC

November Canadian CPI at 2.2% has held steady at October’s pace, and is slightly weaker than expected. The Bank of Canada’s core are are on balance weaker, with CPI-Median and CPI-Trim falling to 2.8% from 3.0%, though CPI-Common (less important to the BoC) edged up to 2.8% from 2.7%.

December 10, 2025

Bank of Canada - Rate Level Still Appropriate Despite Stronger Data

December 10, 2025 4:21 PM UTC

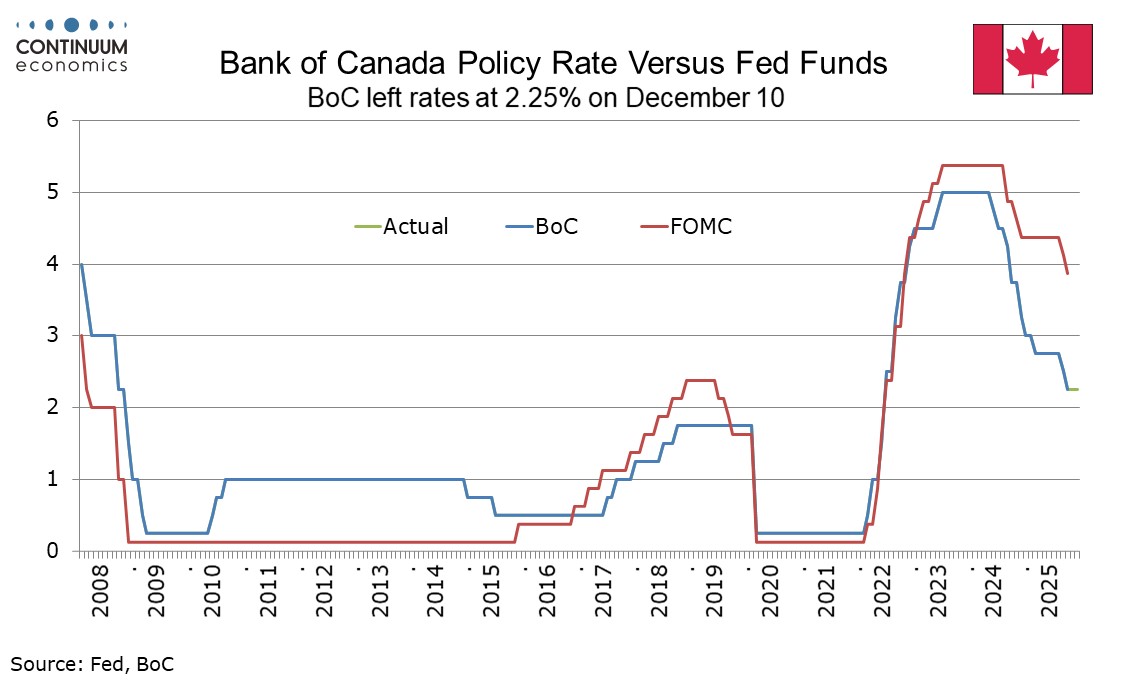

Since the Bank of Canada eased rates to 2.25% in October and stated that policy was now at an appropriate level, Canada has delivered stronger than expected data on GDP and employment. The data has not been dismissed, but the BoC view that policy is at an appropriate level persists after today’s m

December 05, 2025

Bank of Canada Preview for December 10: Stronger data reinforces case for a pause

December 5, 2025 2:31 PM UTC

The Bank of Canada looks highly likely to leave rates at 2.25% when it meets on December 10. After easing in both September and October, the BoC after its October move stated rates were now at about the right level if the economy evolved in line with its expectations. With Q3 GDP and November employ

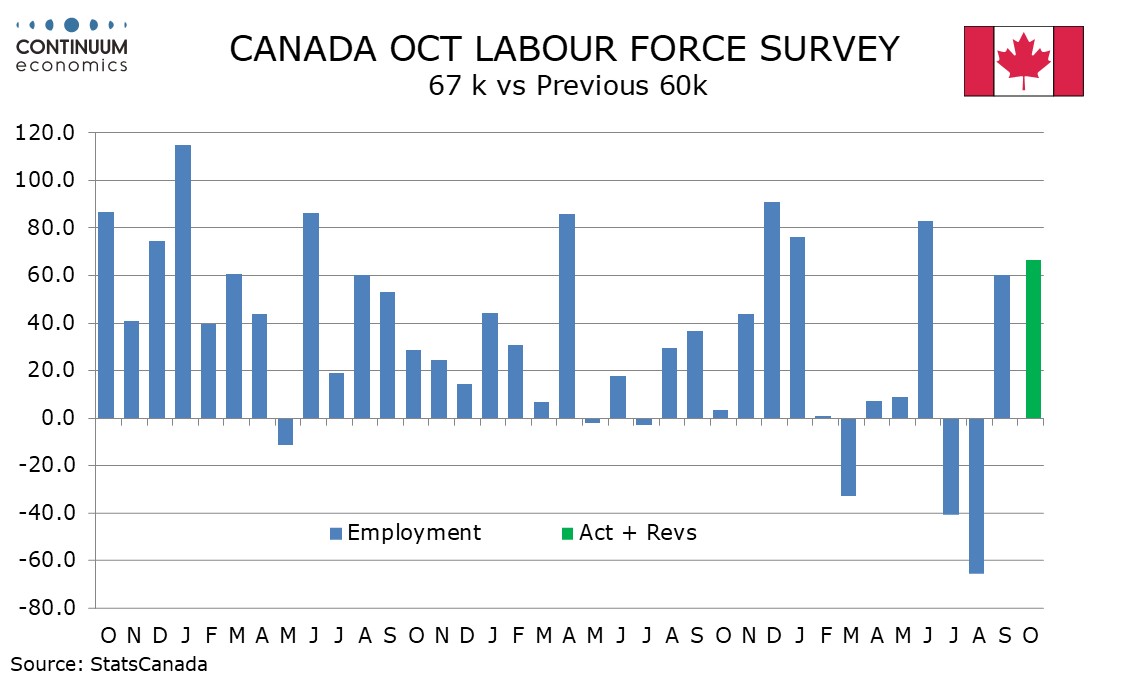

Canada November Employment - Third straight strong rise, unemployment lowest since July 2024

December 5, 2025 2:00 PM UTC

Canada’s November employment report has surprised on the upside for a third straight month, rising by 53.6k, and this time with a sharp fall in unemployment to 6.5% from 6.9%. While the Bank of Canada is unlikely to be thinking about tightening yet, the data adds to hopes generated by a 2.6% annua

November 28, 2025

Canada Q3 GDP rebounds as imports plunge but domestic demand marginally negative

November 28, 2025 2:14 PM UTC

Canada’s 2.6% annualized increase in Q3 GDP is sharply higher than expected though the surprise comes largely from a sharp fall in imports. Domestic demand was almost unchanged with a 0.1% annualized decline. September GDP grew by 0.2% on the month, but the preliminary estimate for October is weak

November 27, 2025

USMCA Renegotiation: Hostage To Trump

November 27, 2025 2:55 PM UTC

• Trump could decide to go on an early offensive over the July 2026 USMCA review or could wait until after the November congressional elections to act tough given it could cause new cost of living fears for U.S. voters. This could mean that at times the USMCA negotiations are upsetting fo

November 17, 2025

Canada October CPI - BoC core rates mostly slower, but still running above target

November 17, 2025 2:06 PM UTC

October Canadian CPI has slowed to 2.2% yr/yr from 2.4% in September, though excluding gasoline the yr/yr increase was 2.6% in each month. The BoC’s core rates were however mostly slower, CPI-Median at 2.9% from 3.1%, CPI-Trim at 3.0% from 3.1%, though CPI-Common was unchanged at 2.7%. Year ago st

November 12, 2025

Bank of Canada Minutes from October 29 reinforce steady policy message after a 25bps easing

November 12, 2025 7:18 PM UTC

The Bank of Canada has released minutes from its October 29 meeting, and after a 25bps easing members agreed that monetary policy was now close to the limits of what it could do to support the economy under current circumstances. They agreed to be as clear as possible to communicate that policy was

November 07, 2025

Canada October Employment - Second straight strong rise reinforces expectations for steady BoC policy

November 7, 2025 2:11 PM UTC

Canada’s October employment report provides a second straight strong increase, by 66.6k, and while the series is volatile and the two strong months follow two weak months, the data suggests underlying trend has not turned negative and that the Canadian economy may be regaining momentum. Unemployme

November 04, 2025

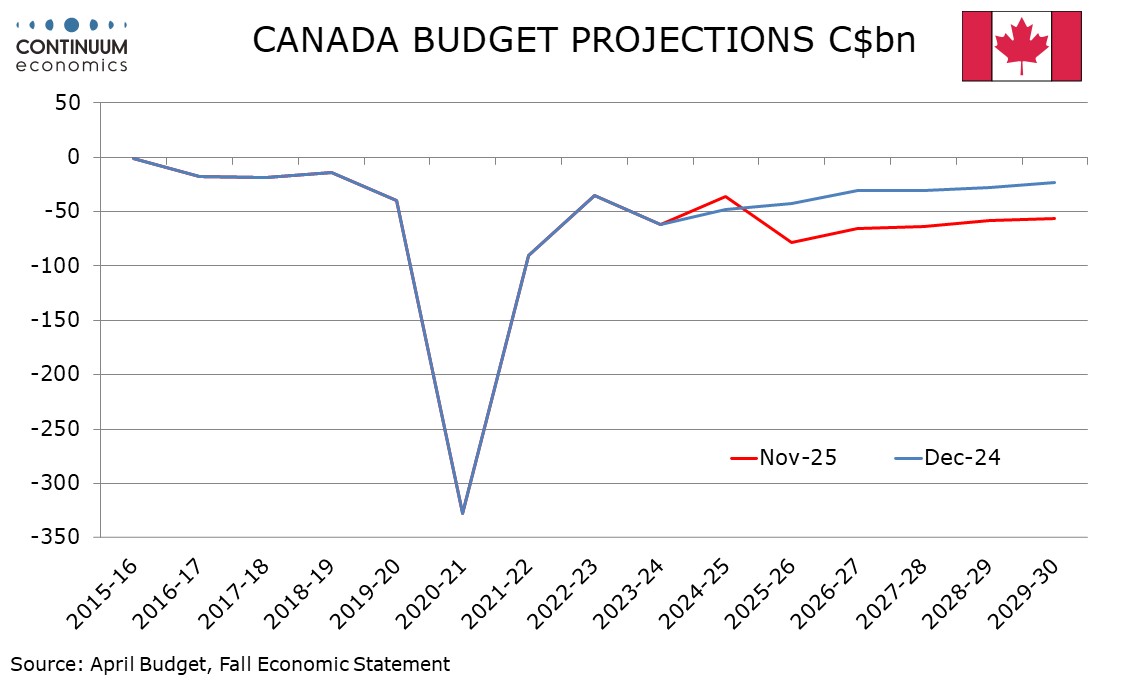

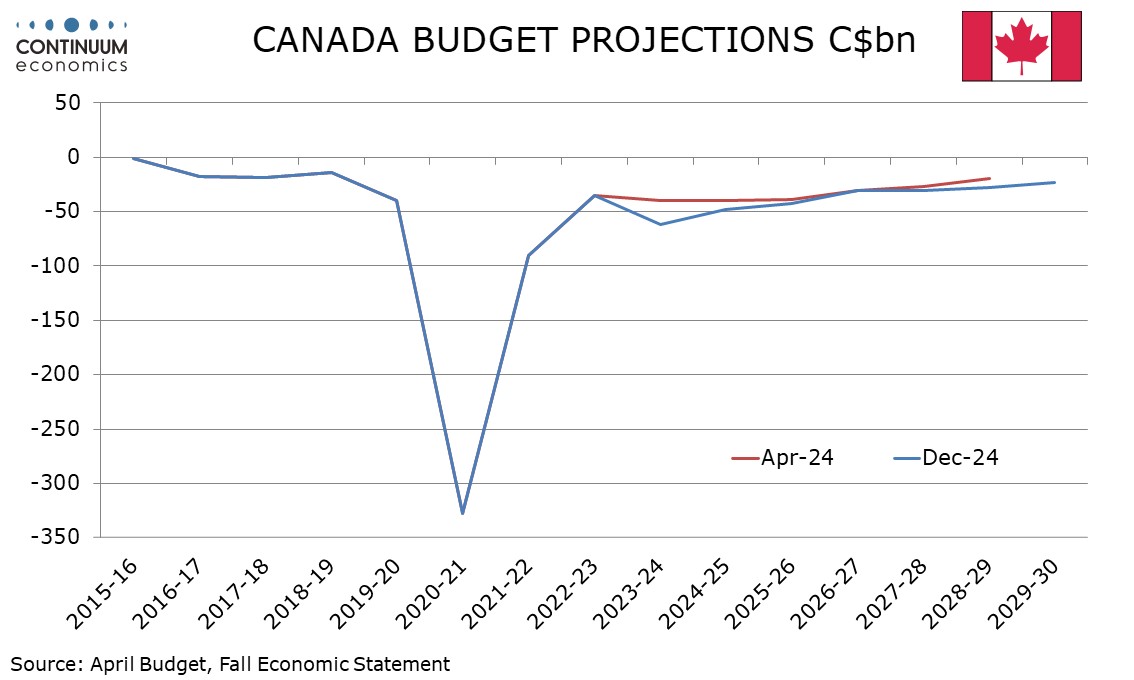

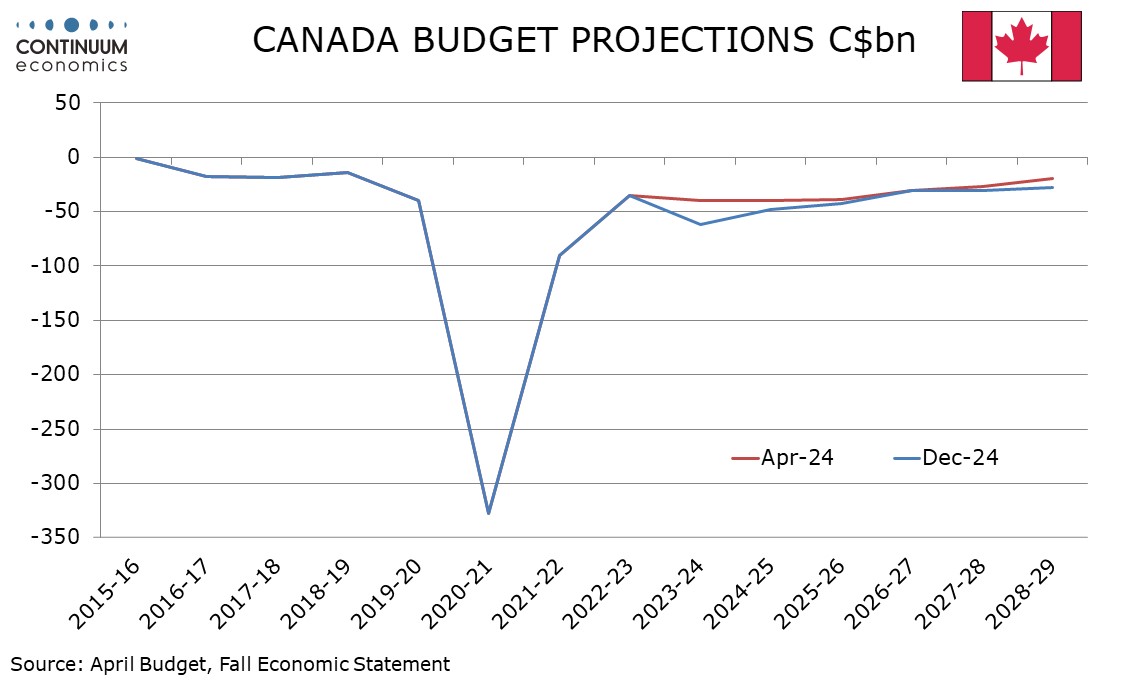

Canada Budget Sees Larger Deficits, Slower Growth

November 4, 2025 9:58 PM UTC

Canada’s budget has seen the deficit for 2025-26 revised up to C$78.3bn from C$42.2bn in the December 2024 statement, which will now be 2.5% of GDP versus 1.3%, still a level that is quite small compared to many other developed countries. The deficit is projected to slip after that, reaching C$56.

November 03, 2025

October 29, 2025

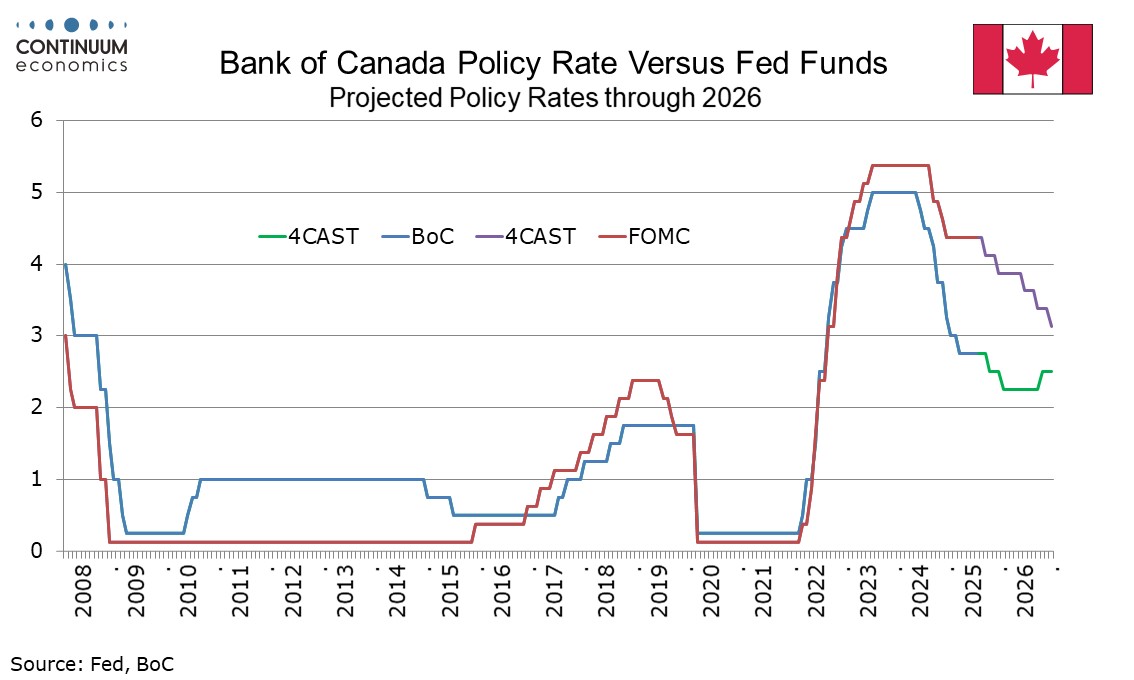

Bank of Canada - Hawkish Ease with Current Rate Level Seen as Appropriate

October 29, 2025 3:40 PM UTC

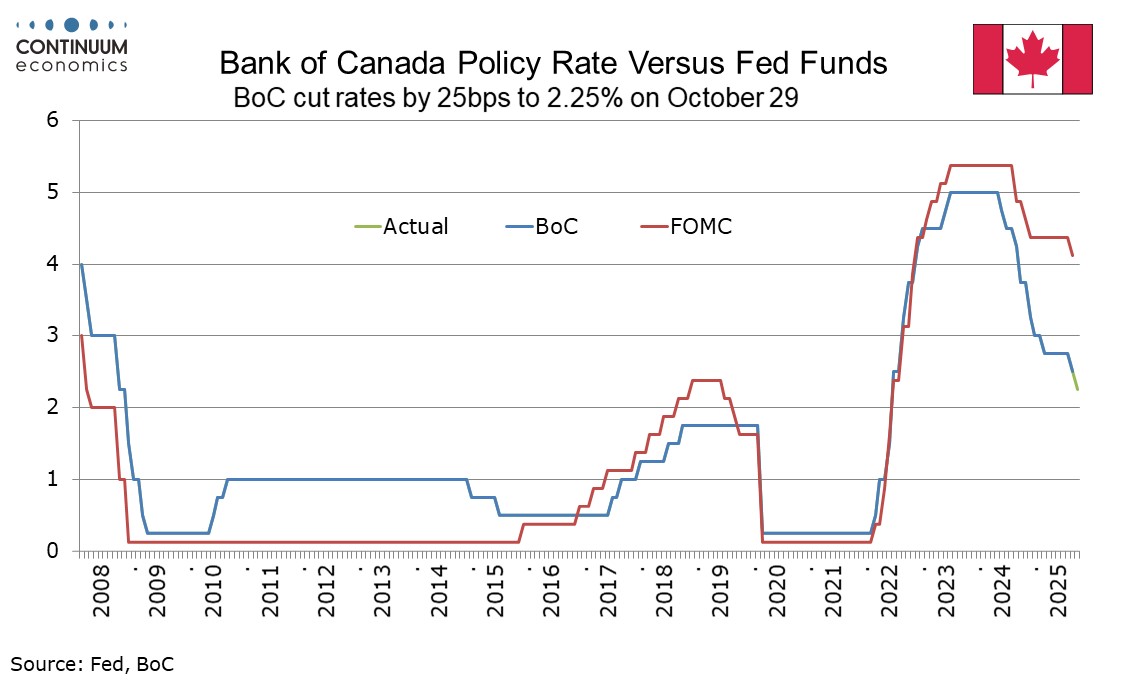

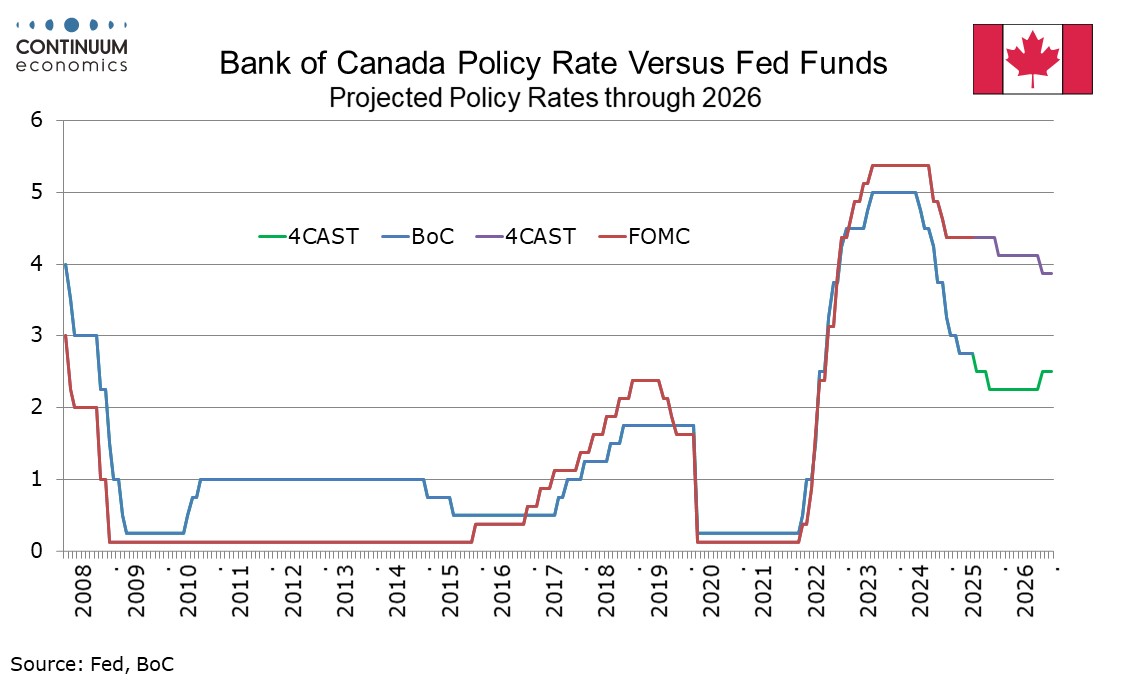

The Bank of Canada delivered a hawkish easing, cutting rates for the second straight meeting by 25bps, to 2.25%, but stating that if inflation and activity evolve in line with its projection, the current rate is seen as about the right level to keep inflation close to 2% while helping the economy th

October 27, 2025

U.S-China Trade Tensions Ease, US-Canada Tensions Escalate

October 27, 2025 3:32 PM UTC

Trade tensions between the US and China appear to be easing, with it looking increasingly unlikely that the US will impose a threatened extra 100% tariff on China on November 1. However trade tensions with Canada have increased, with Canada receiving an extra 10% tariff, adding to downside economic

October 21, 2025

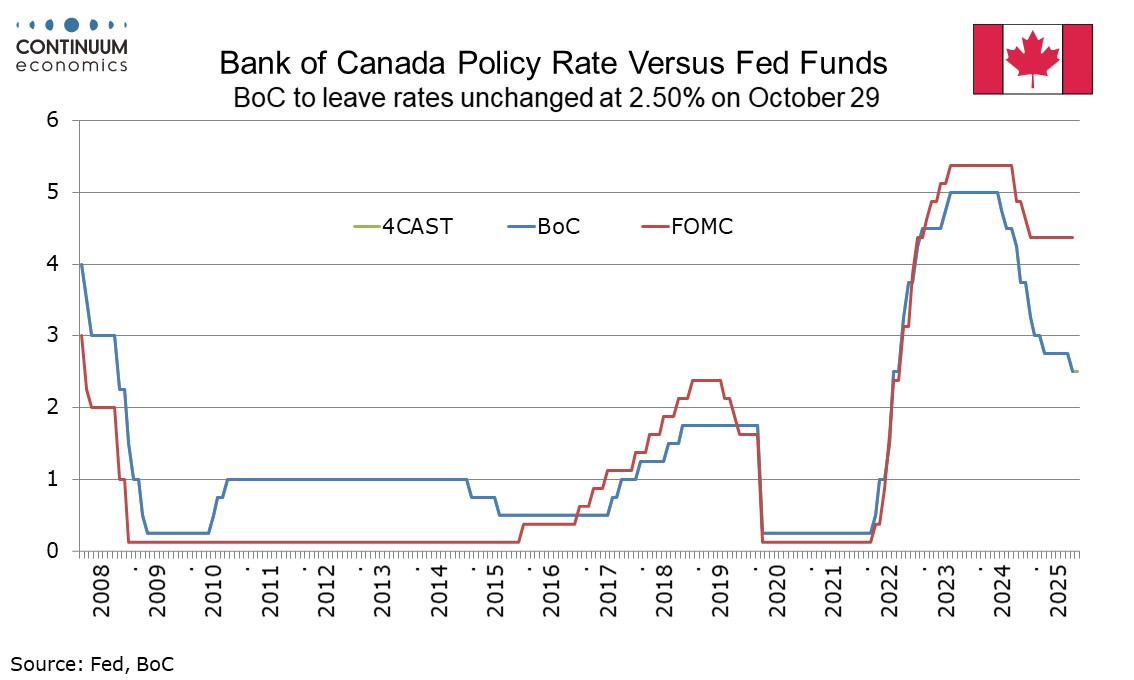

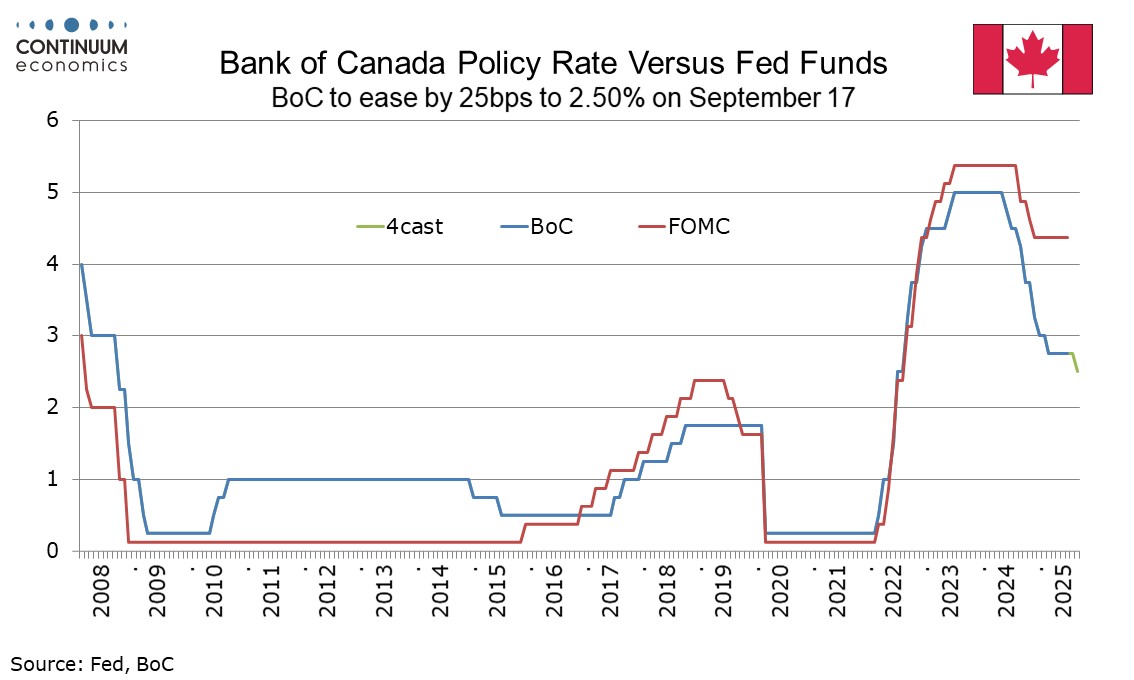

Bank of Canada Preview for October 29: A Pause before easing resumes in December

October 21, 2025 3:52 PM UTC

While we do not believe the Bank of Canada is done with easing, we expect the October 29 meeting to see rates left on hold at 2.50% given that most recent data have been on the firm side of expectations, though not strong enough to rule out a move. A pause in October would follow easing in September

Canada September CPI - Not alarmingly strong but argues against BoC easing next week

October 21, 2025 12:59 PM UTC

September Canadian CPI at 2.4% from 1.9% yr/yr is stronger than expected with the Bank of Canada’s Bank of Canada’s core rates also mostly marginally firmer. The monthly details do not look alarmingly strong but, particularly after a strong employment report, the data argues against a BoC easing

October 20, 2025

Canada - BoC Q3 Business Outlook Survey - Unlikely to shift BoC's views

October 20, 2025 3:52 PM UTC

The Bank of Canada’s Q3 business outlook survey is mixed though overall probably does not change the Bank of Canada’s view very much. The overall business outlook indicator of -2.28 is marginally improved from Q2’s -2.40 but leaves the index is a fairly narrow and marginally negative range. Th

October 10, 2025

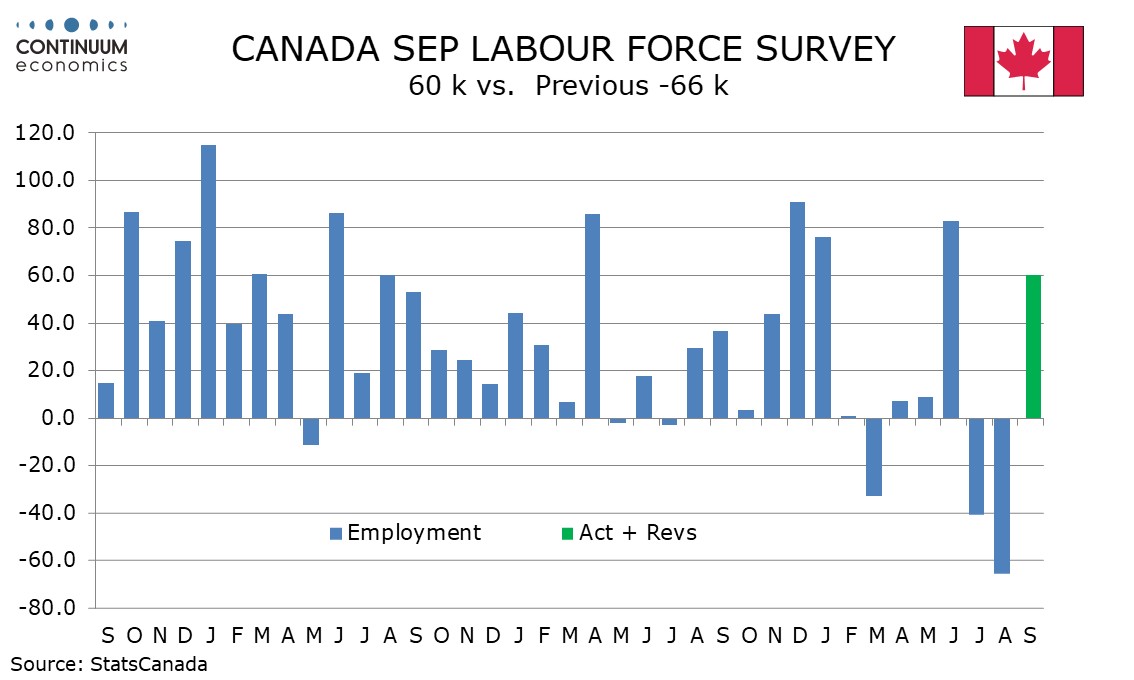

Canada September Employment - Rebound strengthens the case for a BoC pause in October

October 10, 2025 1:10 PM UTC

Canada’s September employment report with a 60.4k increase has reversed nearly all of a 65.5k decline seen in August though unemployment which is unchanged at up to 7.1% remains up from July’s 6.9%. The Bank of Canada decision on October 29 remains a close call, but this data increases our confi

September 17, 2025

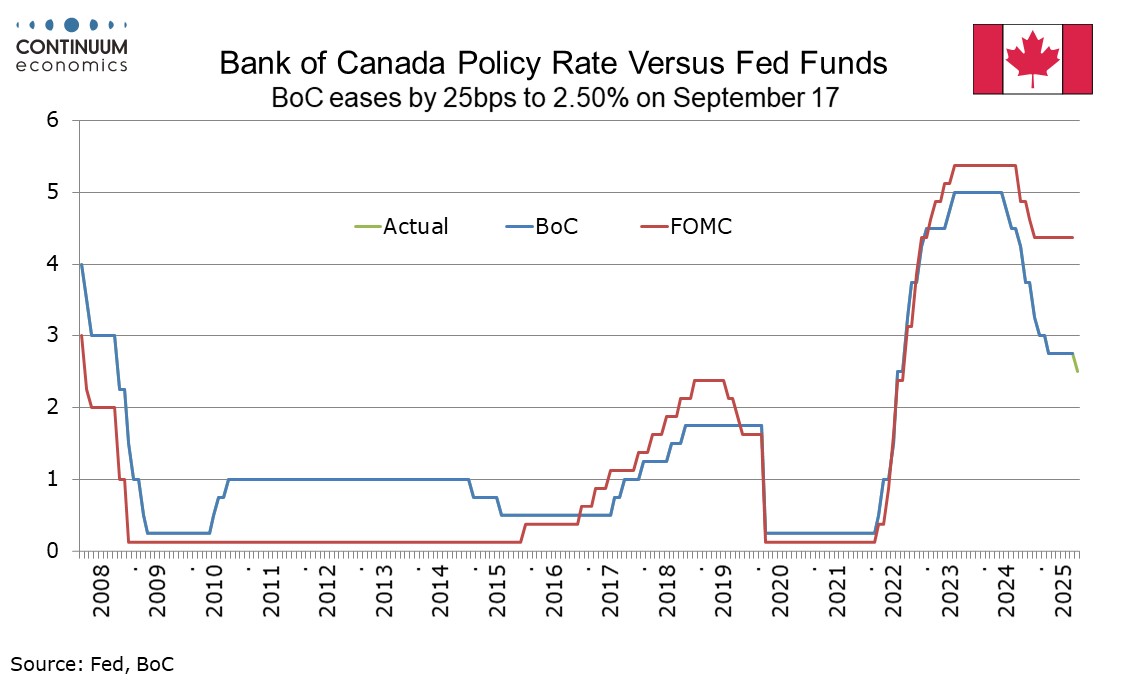

Bank of Canada - Clear consensus to ease, we expect two further 25bps moves

September 17, 2025 3:46 PM UTC

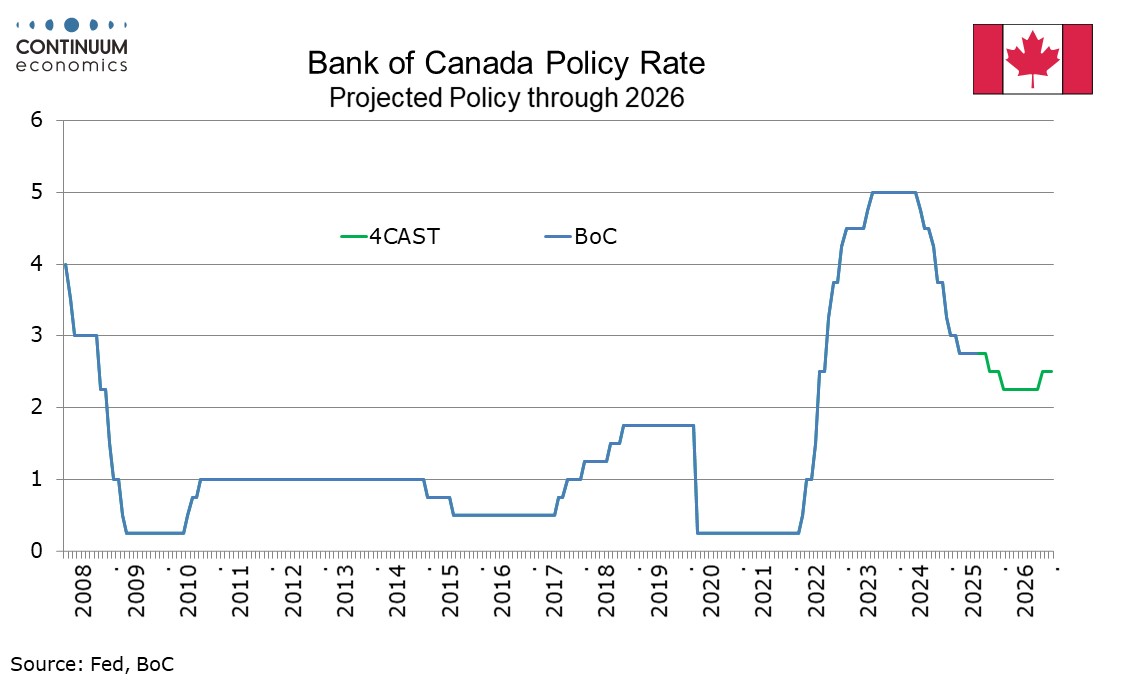

The Bank of Canada’s decision to ease today for the first time since March, by 25bps to 2.50% was as the market expected. We expect two further easings from the BoC, in Q4 of this year and Q1 of 2025, which would take the rate to 2.0%, which is likely to prove the floor.

September 16, 2025

Canada August CPI - Subdued enough for a BoC easing

September 16, 2025 1:04 PM UTC

August Canadian CPI at 1.9% yr/yr reversed a July dip to 1.7% yr/yr and remains restrained by around 0.7% by the abolition of the carbon tax. Core rates remain above target but are on balance marginally softer while monthly details also look acceptably subdued. The data is not an obstacle to an expe

September 09, 2025

Bank of Canada Preview for September 17: Weak data justifies resumption of easing

September 9, 2025 6:26 PM UTC

After the Bank of Canada’s last meeting on July 30 we expected rates to be left on hold in September before easing resumed in October. However with data since that meeting having been mostly weak, a 25bps easing, the first move since March, now looks likely at the September 17 meeting, to 2.5%. We

September 05, 2025

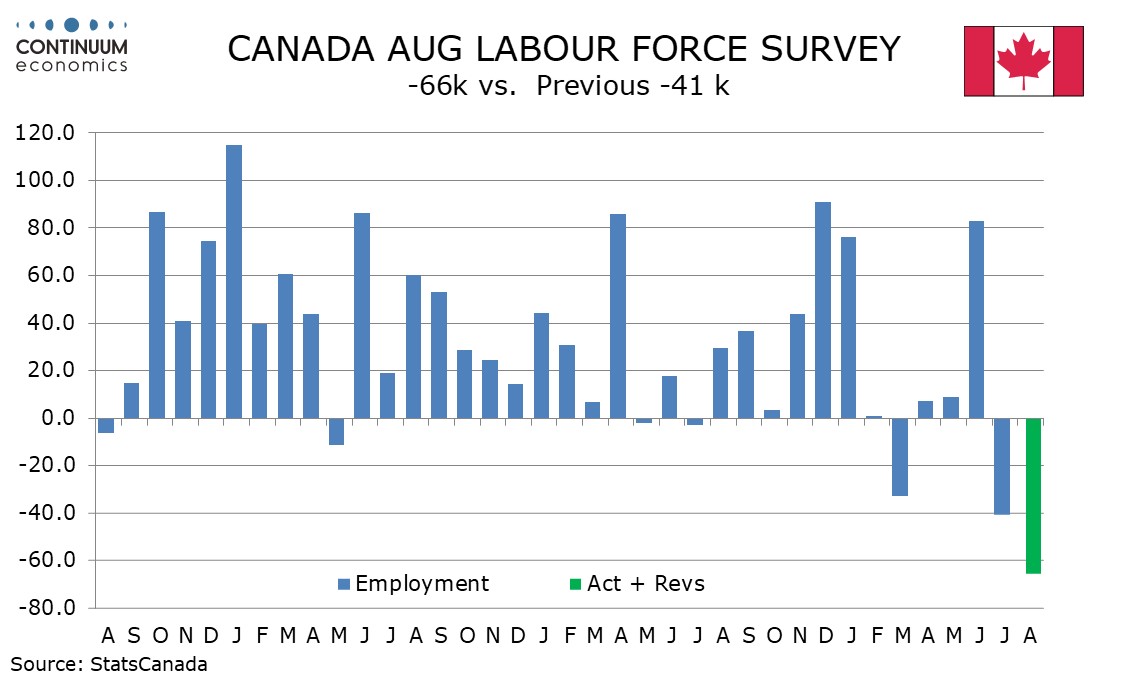

Canada August Employment - With Q3 looking weak, we now expect the BoC to ease in September

September 5, 2025 1:41 PM UTC

Canada’s August employment report with a 65.5k decline with unemployment up to 7.1% from 6.9% is much weaker than expected. While the detail is a little less weak than the headlines suggest, and the data has been volatile recently, we are revising our Bank of Canada call, and now expect a 25bps ea

August 13, 2025

Bank of Canada Minutes from July 30 - Differences of opinion on whether further easing would be needed

August 13, 2025 7:32 PM UTC

The Bank of Canada has released minutes from its July 30 meeting, which saw rates left unchanged at 2.75% with Governor Macklem stating after the meeting that there was a clear consensus to do so. However the minutes show that some felt the rate had been reduced sufficiently, while others felt that

August 08, 2025

Canada July Employment - A weak month after a strong month

August 8, 2025 12:54 PM UTC

Canada’s surprisingly strong June employment report has been followed by a significant correction lower in July, with a fall of 40.8k to follow a rise of 83.1k, Full time work is negative over the two months, a 51.0k fall after a 13.5k increase, while part time work with a rise of 10.3k extended a

July 30, 2025

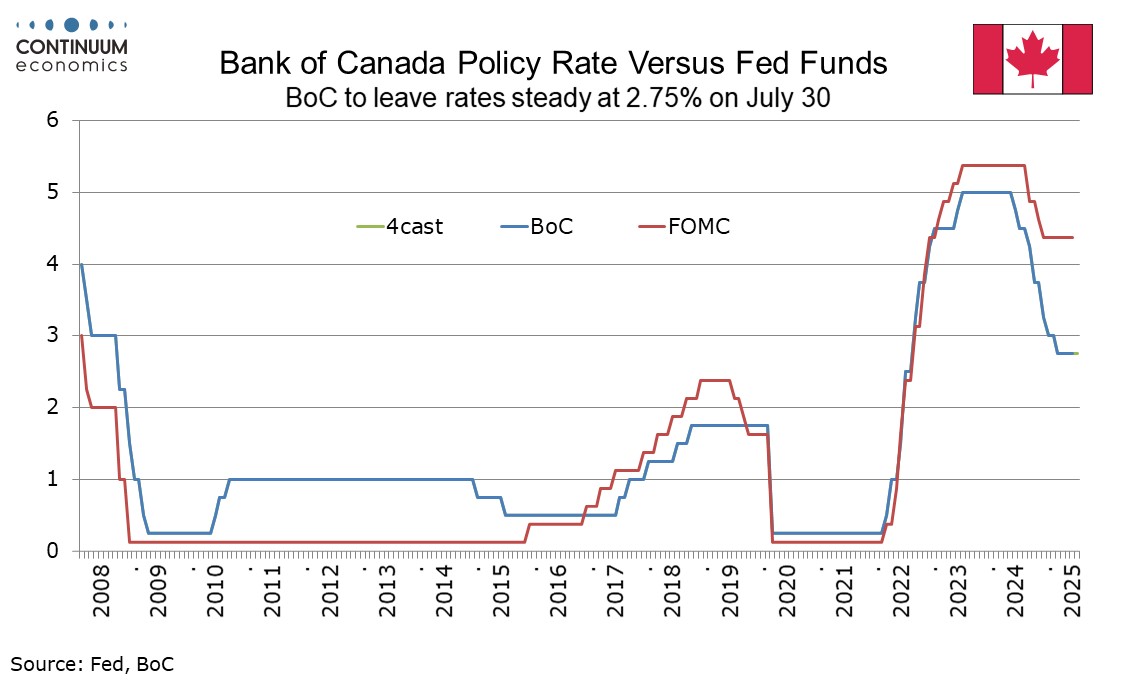

Bank of Canada - Consensus to hold, but cautious bias towards easing

July 30, 2025 3:34 PM UTC

Bank of Canada Governor Tiff Macklem stated that there was a clear consensus to leave rates steady at 2.75% at the latest meeting, as was also the case in June. There does however appear to be scope for further easing ahead. We still expect rates to bottom at 2.25% and end 2026 at 2.5%, but we now

July 15, 2025

Bank of Canada Preview for July 30: Hold after firm data with uncertainty high

July 15, 2025 3:30 PM UTC

The Bank of Canada meets on July 30 and what had been seen as a close call between a 25bps easing and unchanged now looks likely to leave rates unchanged at 2.75%. Continued above target core CPI data and a strong employment report for June argue against easing, though uncertainty remains high with

Canada June CPI - Argues against a July BoC easing

July 15, 2025 1:18 PM UTC

June CPI was as expected with yr/yr growth at 1.9% after two straight months at 1.7%, though without April’s abolition of the Consumer Carbon Tax would be standing around 2.5%. The Bank of Canada’s core rates showed no progress lower, and coupled with Friday’s strong employment report for June

July 11, 2025

Canada June Employment - Strong gain broad based but hard to sustain if tariff escalation persists

July 11, 2025 1:02 PM UTC

Canada’s June employment report with a rise of 83.1k is sharply ahead of expectations, even when noting that most of the gains came in a 69.5k rise in part time employment. The data may have been supported by a temporary easing of trade tensions that have subsequently escalated with yesterday’s

June 24, 2025

Canada May CPI - Mixed data leaves July BoC decision a close call

June 24, 2025 12:49 PM UTC

May Canadian CPI has come in as expected, unchanged at 1.7% with this yr/yr rate still restrained by the abolition of the consumer carbon tax which took 0.7% off the rate in April. The BoC’s core rates are on balance slightly softer, but do not fully reverse acceleration seen in May, leaving the J

June 18, 2025

June 06, 2025

Canada May Employment - Strong gains in full time and private sector work

June 6, 2025 1:32 PM UTC

Canada’s May employment report saw unemployment at 7.0% from 6.9% rising to the highest since September 2021. However a rise of 8.8k in employment is stronger than expected with the detail showing strong gains in full time and private sector employment. Yesterday Bank of Canada’s Kozicki said th

June 04, 2025

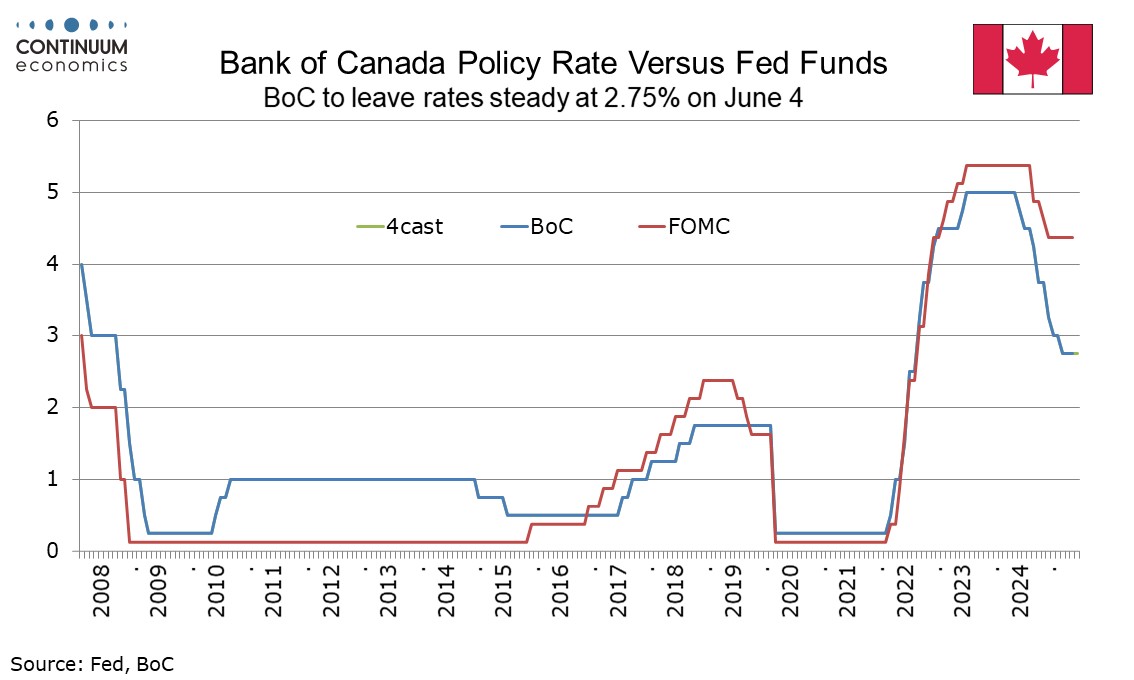

Bank of Canada - Consensus to hold in June, but we now expect easings in July and October

June 4, 2025 3:54 PM UTC

Governor Tiff Macklem stated that the Bank of Canada’s decision to leave rates unchanged at 2.75% was a clear consensus. There was more diversity of views on the path forward, though members thought there could be a need for easing, depending on data. We now expect two further easings in 2025, in

Canada: BoC's Macklem - Consensus to hold at this meeting but scope for future easing seen

June 4, 2025 2:04 PM UTC

The opening statement from BoC's Macklem suggests the decision to hold at this meeting was not the close call seen by many, but scope for future easing is seen, depending on how data evolves.

May 30, 2025

Bank of Canada Preview for June 4: A close call for another policy pause

May 30, 2025 3:43 PM UTC

The Bank of Canada meets on June 4 and it is a close call between leaving rates unchanged at 2.75% and a 25bps easing to 2.5%, though we now lean to the former. The statement is unlikely to give any forward guidance and we still expect further easing this year as the economy weakens in response to U

May 20, 2025

Canada April CPI - Core rates highest for over a year

May 20, 2025 12:56 PM UTC

April Canadian CPI in falling to 1.7% yr/yr from 2.3% is slightly stronger than expected with the fall fully due to the ending of a carbon tax. The BoC’s core rates are stronger than expected, CPI-Median at 3.2% from 2.9%, CPI-Trim at 3.1% from 2.8% and CPI-Common at 2.5% from 2.3%.

May 09, 2025

Canada April Employment - Private sector detail weak

May 9, 2025 12:48 PM UTC

Canada’s April employment gain is modest at 7.4k, and whole full time employment was up by 31.5k there was also a 37.1k increase in public administration. This makes the report on balance weak, particularly with unemployment rising to 6.9% from 6.7%.

May 08, 2025

Canada: BoC's Macklem - Getting closer to lower-tariff scenario from April MPR

May 8, 2025 6:11 PM UTC

The BoC is getting less pessimistic about the tariff scenario, though we are not yet in the better of two scenarios outlined in April's MPR, just closer. Earlier today the BoC's Financial Stability Report saw resilience in the financial system with reduced consumer debt relative for income, while no

April 25, 2025

Canada Election: Liberal Victory Likely, Stable Policy Expected

April 25, 2025 4:21 PM UTC

Canada’s election takes place on Monday. A victory for the ruling Liberals looks likely, but polls are close enough to mean that a hung parliament or even a majority for the opposition Conservatives, while unlikely, is not to be ruled out. Should the Conservatives spring a surprise, a more concili