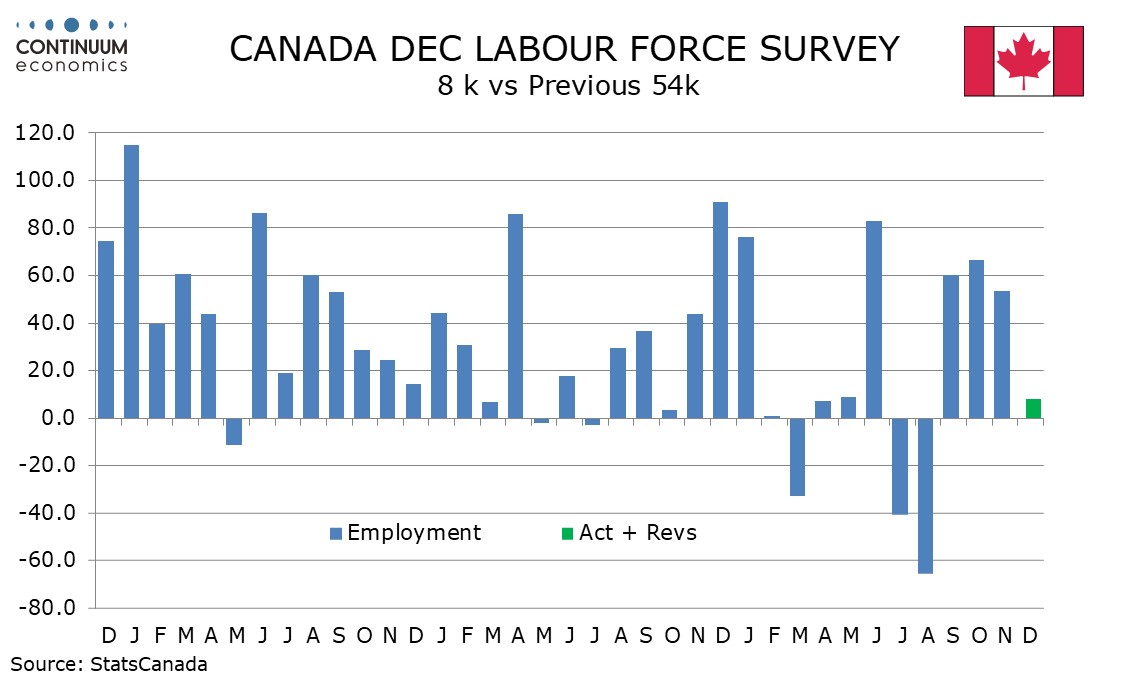

Canada December Employment - A fairly stable underlying picture

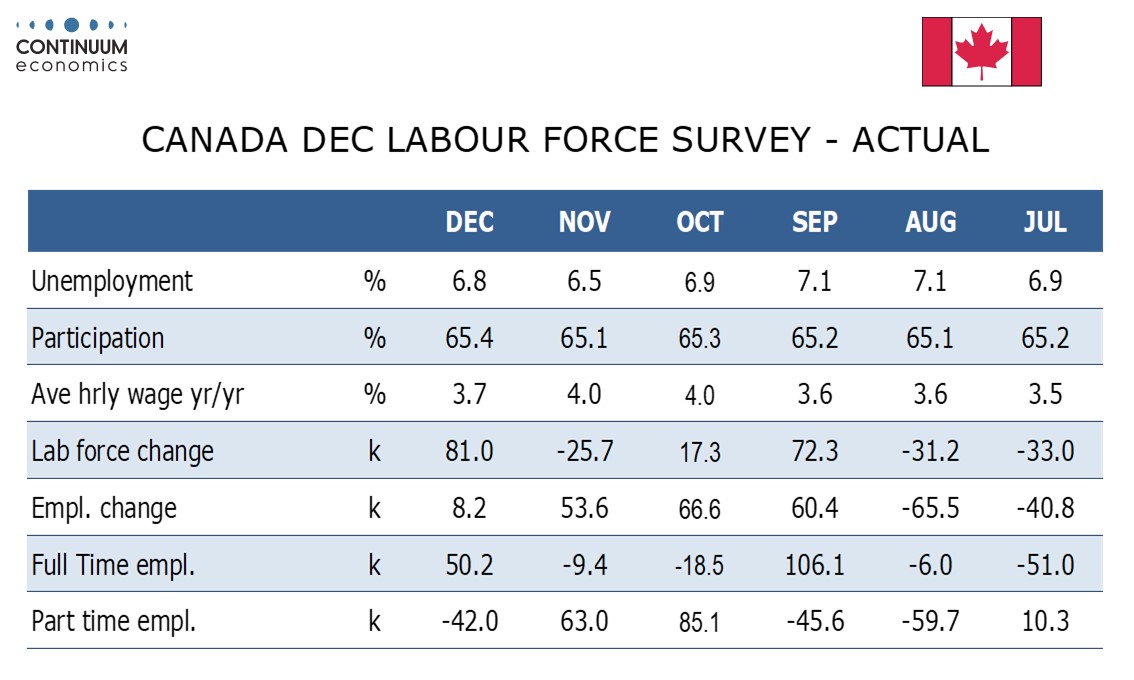

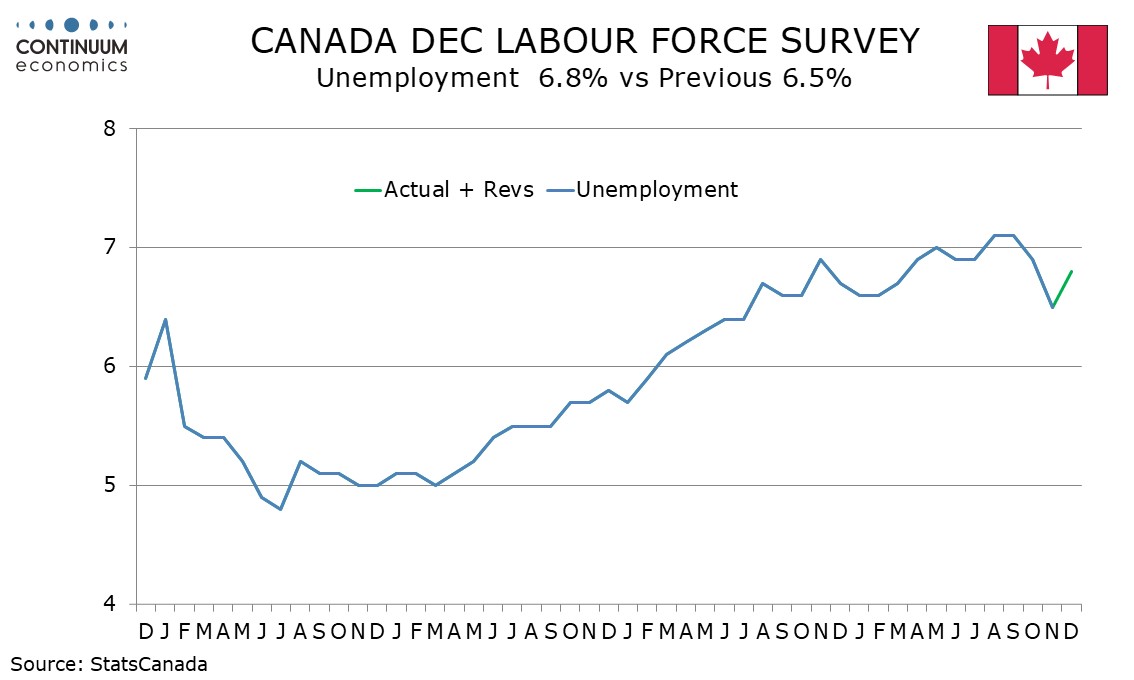

After three surprisingly strong months, which followed two surprisingly weak months, Canada’s December employment report has delivered a normal outcome, with employment modestly positive at 8.2k, and unemployment bouncing to 6.8% from 6.5%, through in remaining below October’s 6.9% and the highs of 7.1% in August and September is still consistent with unemployment having peaked.

The employment detail is positive in that it shows a 50.2k rise in full time employment outweighing a 42.0k loss in part time work. Most of the employment gain came from a 7.3k rise in self- employment, with public and private sector employment both virtually unchanged.

Most components showed modest changes in employment, the strongest being a 20.8k rise in health care and social assistance, and the weakest a fall of 18.1k in professional, scientific and technical services. Both manufacturing, by 4.3k, and construction, by 11.2k, saw increases.

The volatility in unemployment over the last two months came from the labor force seeing an unusual 25.7k decline in November followed by surprisingly strong rebound of 81k in December. This puts the 3-month average labor force increase at 24.2k, above the 6-month average of 13.5k which is almost identical to the 6-month avenge employment gain of 13.8k. The unemployment rate has probably peaked, but any further labor force strength could lift the rate.

The yr/yr growth in the hourly wage of permanent employees slipped in December, to 3.7% after two months at 4.0%, but remains above the pace seen from March through September. Despite plenty of volatility, the underlying picture in the Canadian labor market looks fairly stable. There is no urgency for the Bank of Canada to ease rates again, but they will want to see unemployment trending lower in 2026, with the rate still significantly above levels consistent with full employment.

I,Dave Sloan, the Senior Economist declare that the views expressed herein are mine and are clear, fair and not misleading at the time of publication. They have not been influenced by any relationship, either a personal relationship of mine or a relationship of the firm, to any entity described or referred to herein nor to any client of Continuum Economics nor has any inducement been received in relation to those views. I further declare that in the preparation and publication of this report I have at all times followed all relevant Continuum Economics compliance protocols including those reasonably seeking to prevent the receipt or misuse of material non-public information.