Canada December CPI - Stronger due to year ago tax holiday, BoC core rates softer

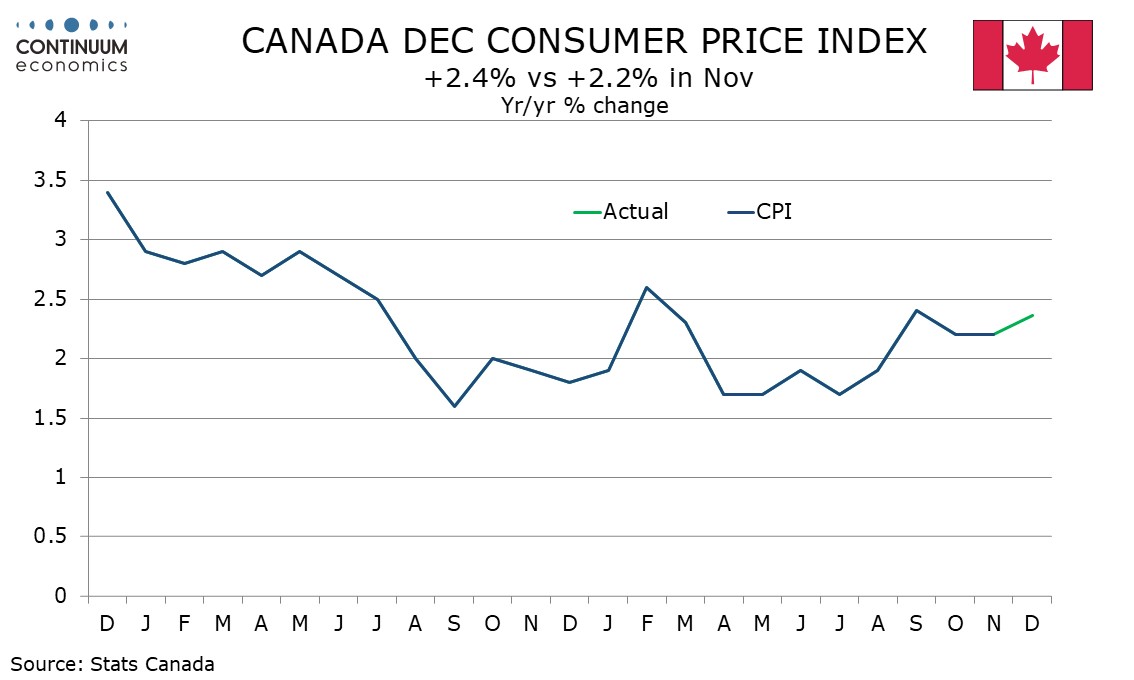

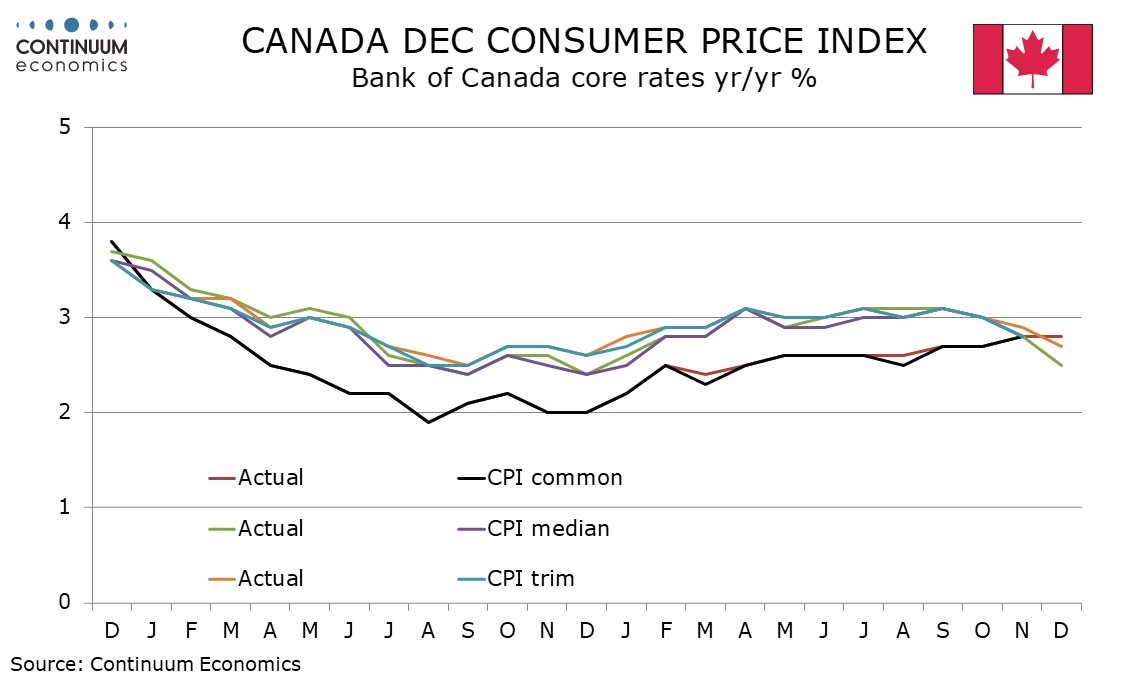

December Canadian CPI at 2.4% yr/yr has accelerated from 2.2% in November but the BoC’s core rates are softer. The contrast is explained by a year ago tax holiday inflating the overall figure but not the core rates, which will matter more to the BoC. Still, easing at next week’s BoC meeting remains unlikely.

A sales tax holiday started in mid-December of 2024 and persisted through mid-February. The Bank of Canada has already warned that this was likely to inflate yr/yr CPI, and the boost will peak in January as the holiday persisted through the whole of January 2025.

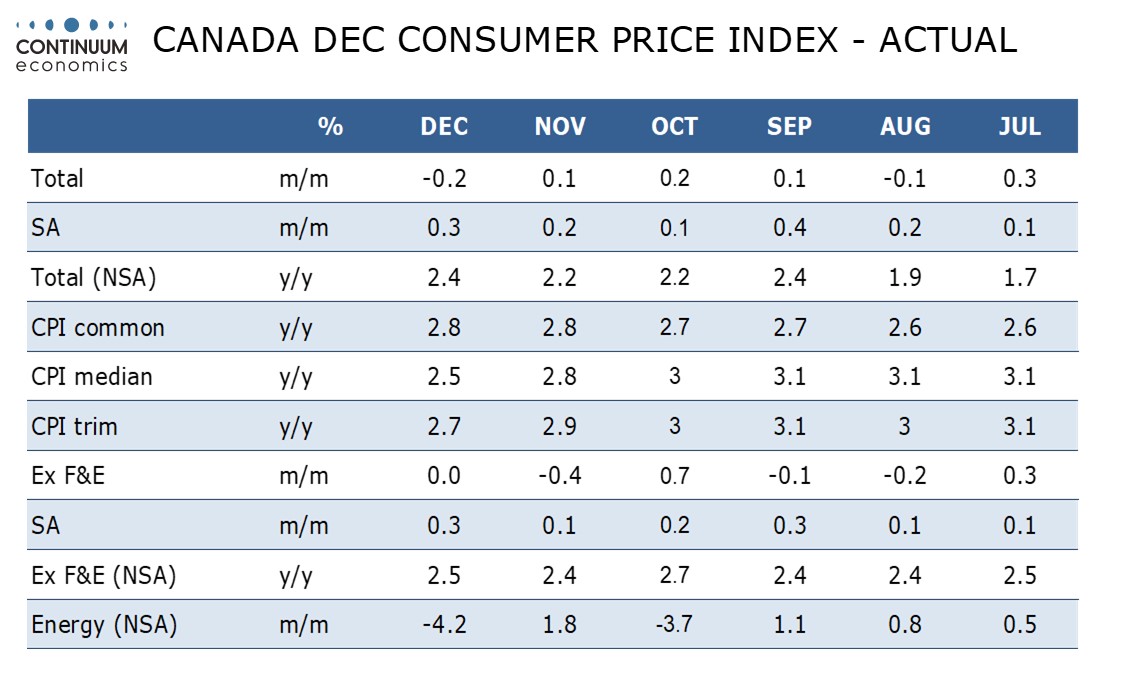

On the month overall CPI fell by 0.2% with ex food and energy CPI unchanged though this weakness is seasonal with the seasonally adjusted gains being on the firm side of trend at 0.3% both overall and ex food and energy. The ex food and energy seasonally adjusted gain follows a subdued 0.1% increase in November.

CPI ex food and energy picked up to 2.5% yr/yr from 2.4% but this is not one of the BoC’s three core rates. Here CPI-Common was stable at 2.8% but CPI-Trim fell to 2.7% from 2.9% and CPI-Median fell to 2.5% from 2.8%.

CPI is up 2.3% yr/yr in Q4, above a BoC October forecast of 2.0%. However the average of CPI-Median and CPI-Trim, at 2.8% in Q4, is slightly below an October BoC projection of 2.9%, if still above the 2.0% target. The BoC will see this as evidence that core inflation is moving towards target, but with employment growth having held up in Q4 there does not appear to be any urgency to ease further.