Canada June Employment - Strong gain broad based but hard to sustain if tariff escalation persists

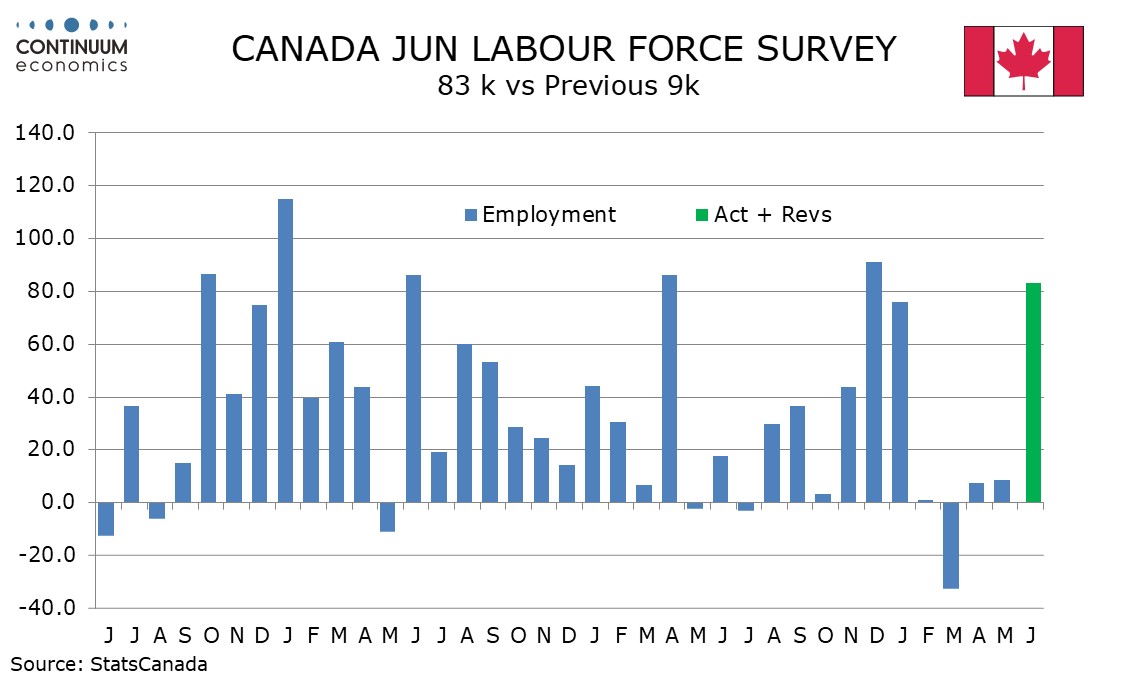

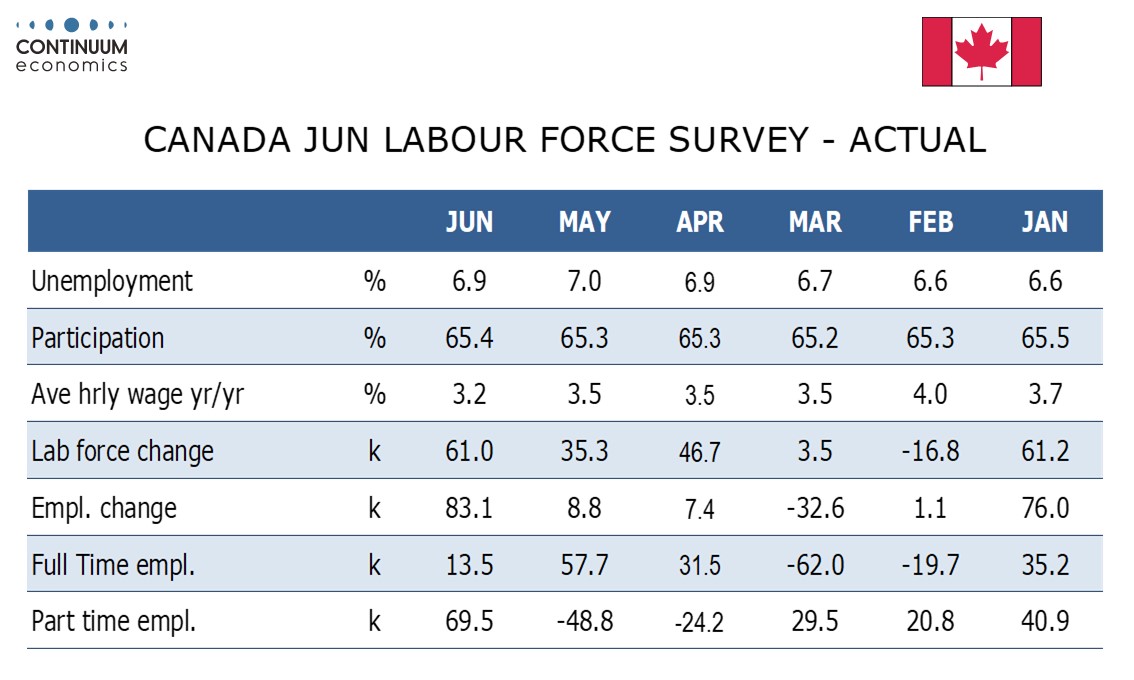

Canada’s June employment report with a rise of 83.1k is sharply ahead of expectations, even when noting that most of the gains came in a 69.5k rise in part time employment. The data may have been supported by a temporary easing of trade tensions that have subsequently escalated with yesterday’s announcement from Trump that Canada will face a 35% tariff from August 1.

The Bank of Canada will have plenty to consider when it next meets on July 30, with signs of economic weakness in early Q2 as tariffs took effect, but now resilience in employment at the end of the quarter. April and to some extent May core CPI disappointed on the upside and June data is due on Tuesday. Fresh tariff developments may override economic data, but uncertainty is likely to remain high ahead of August 1, when the latest tariffs are due to take effect.

Canada did manage marginal gains in employment in April and May, if without fully reversing a March decline, and while June gains were led by part time work April and May saw strong gains in full time work outweigh slippage in part time. Full time work has seen three straight months of increases. June job gains were broad based, with private sector employment up by 46.6k, the public sector up by 23.4k and self-employment up by 13.1k. Goods producing work rose by 10.1k on a 10.5k rise in manufacturing which is seen as particularly sensitive to tariffs. Services rose by 73.1k, led by a 33.6k rise in wholesale and retail.

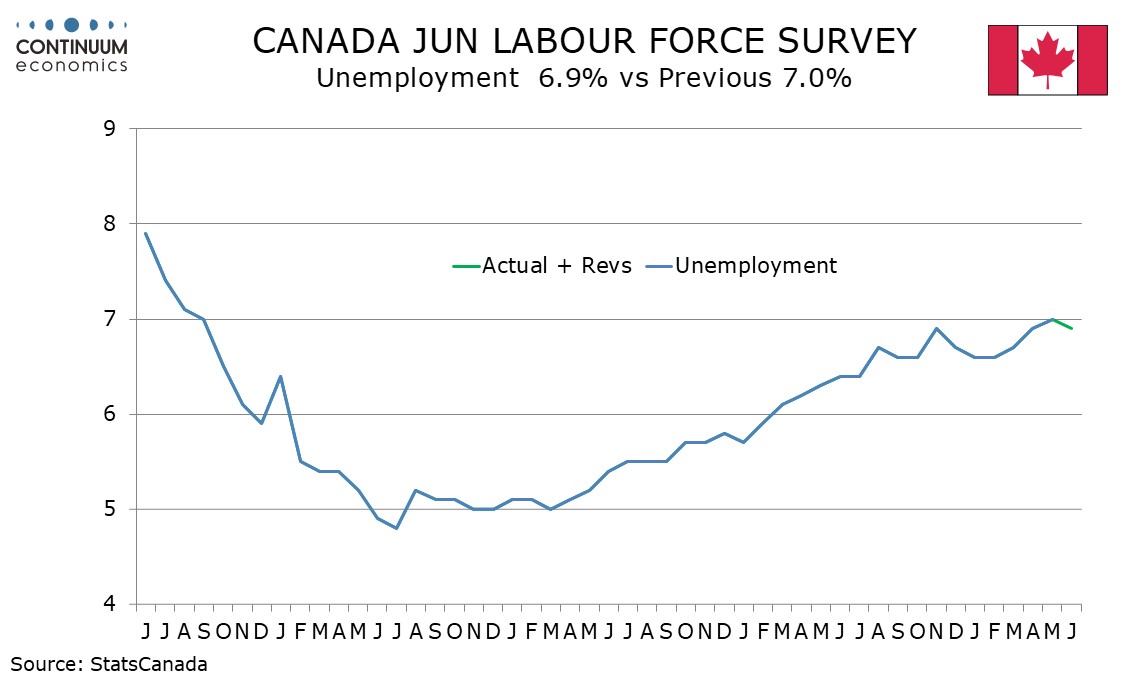

Even with a strong 61k rise in the labor force, unemployment slipped to 6.9% from 7.0% reversing a May rise but is still up from 6.7% in both March and December 2024. Wage pressure is easing, with the hourly wage of permanent employees down to 3.2% yr/yr after three straight months at 3.5%. The pace has slowed significantly from 5.6% in June 2024 and suggests there is now little inflationary risk coming from the labor market. Despite the strong rise in employment, the July BoC decision remains a close call.