Canada January Employment - Ontario explains employment and labor force slippage

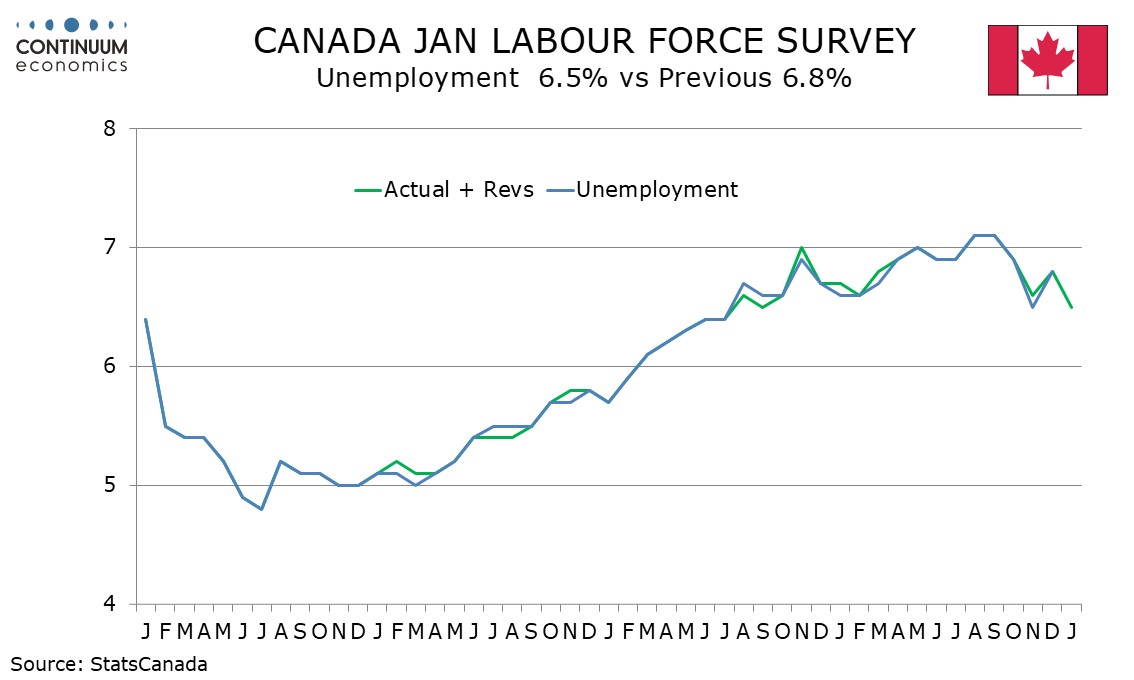

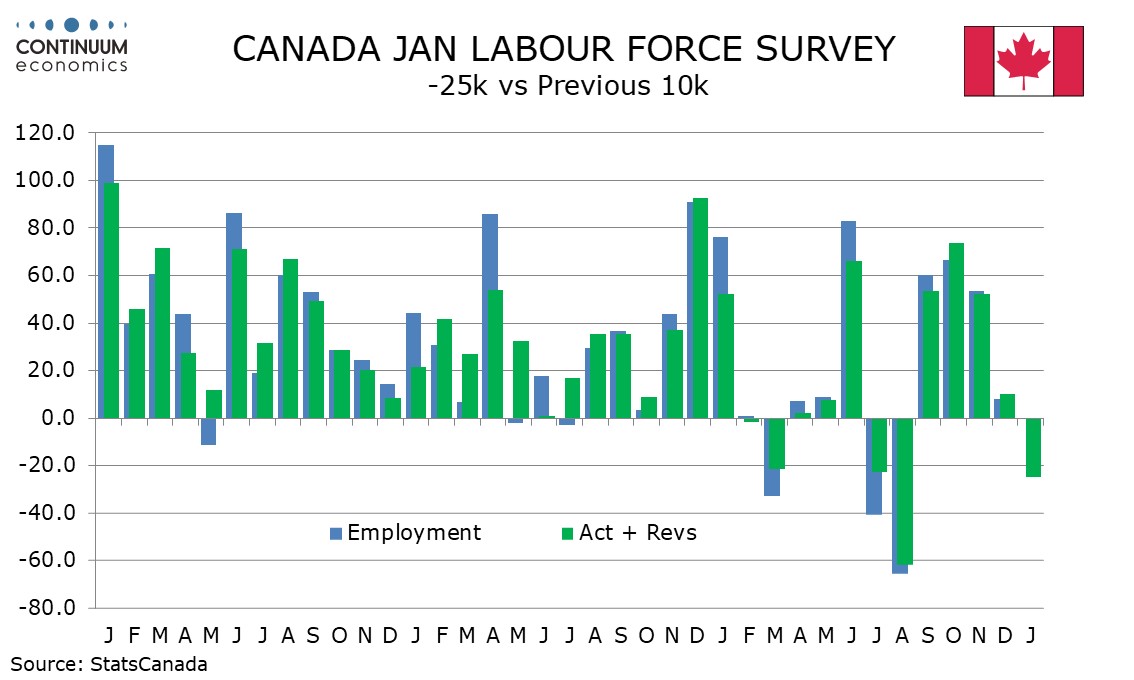

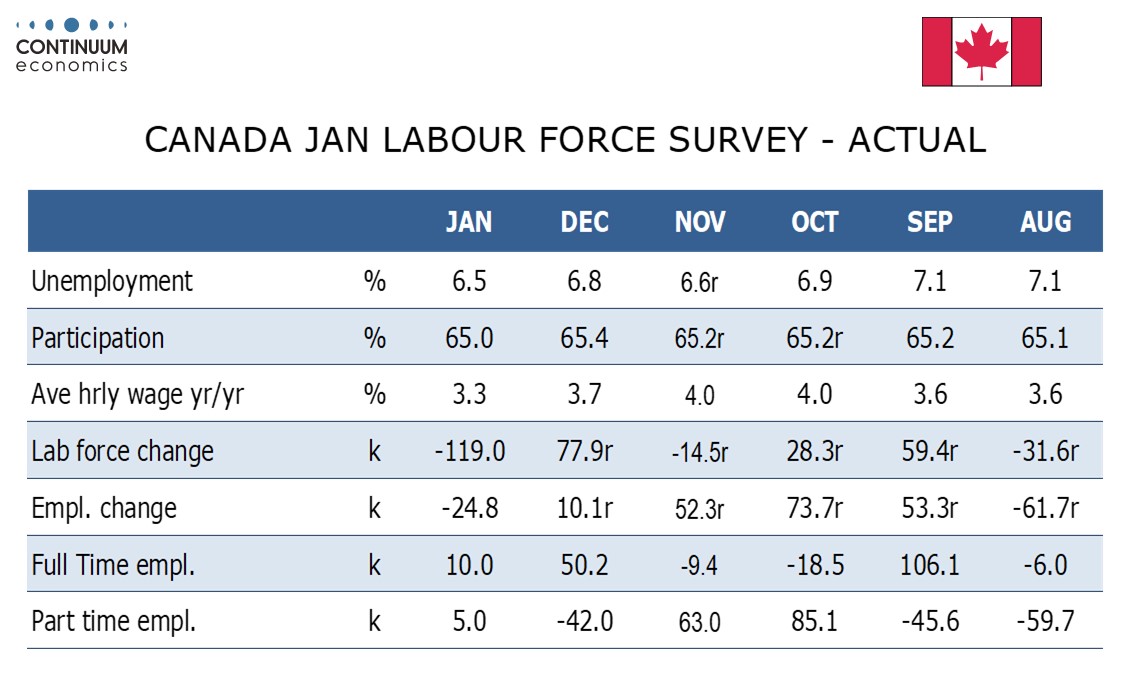

Canada has delivered a mixed employment report for January, with a 24.8k decline in employment led by manufacturing and the province of Ontario, but a decline in the unemployment rate to 6.5% from 6.8%. Weather may have played a part in the weakness in Ontario, though details are mixed leaving the data inconclusive. Bank of Canada views are unlikely to shift on the data.

Full time employment rose by a solid 44.9k but this was outweighed by a 69.7k decline in part time work. The employment decline was more than fully explained by a 66.5k decline in Ontario, that may be connected to bad weather. Ontario saw its unemployment rate fell by 0.6% to 7.3%, steeper than the 0.3% fall in the national rate, as fewer people in Ontario looked for work. Nationally the labor force fell by 119k, more than fully explained by a fall of 136k in Ontario.

While the data by province hints at a weather impact, the breakdown by industry does not, with the largest negative being a 27.5k decline in manufacturing, and that suggests tariffs. Construction, seen as weather-sensitive, actually increased by 8.9k. Other sources of weakness were declines of 21.0k in wholesale and retail and 24.2k in education. Private sector employment fell by 52.0k, partly offset by gains of 13.3 in the public sector and 14.0k in self-employment.

Average hourly wages of permanent employees lost some momentum, up by 3.3% yr/yr versus 3.7% in December. This suggests that the labor market is still quite subdued. Given that slippage in employment and the labor force was concentrated in Ontario, which experienced some bad weather (though largely late in the month that we did not expect to impact this survey) conclusions on the data should be cautious. Unemployment may have peaked, but the latest rate of 6.5% probably flatters the true picture.