Canada - BoC Q4 Business Outlook Survey - Mostly stronger

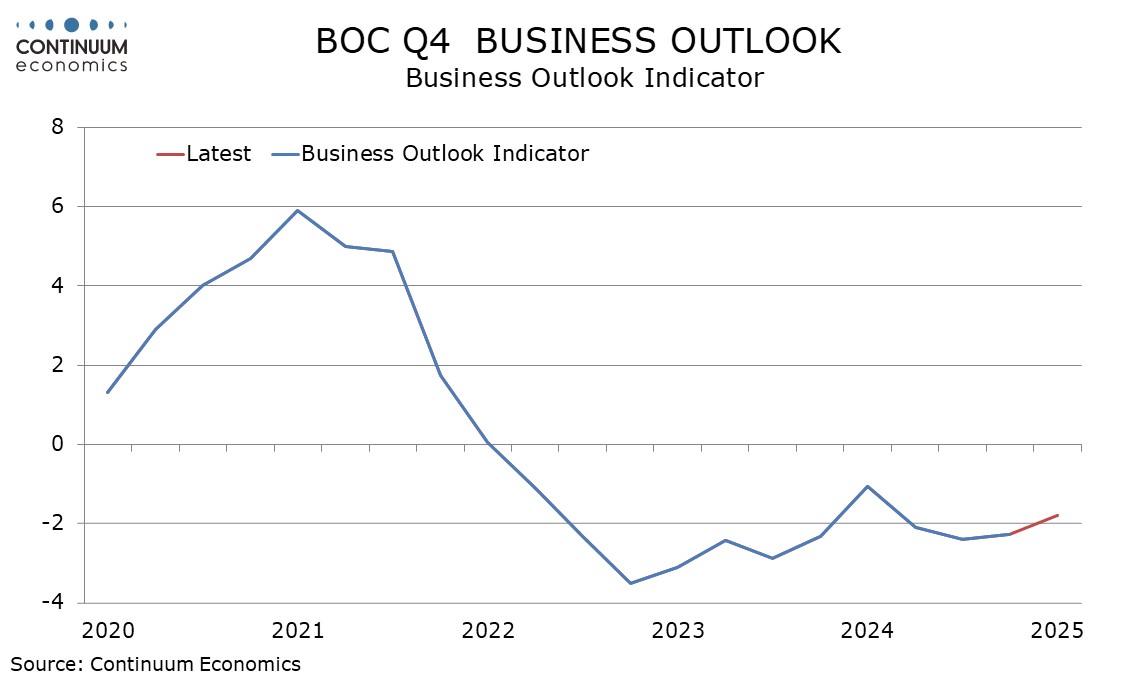

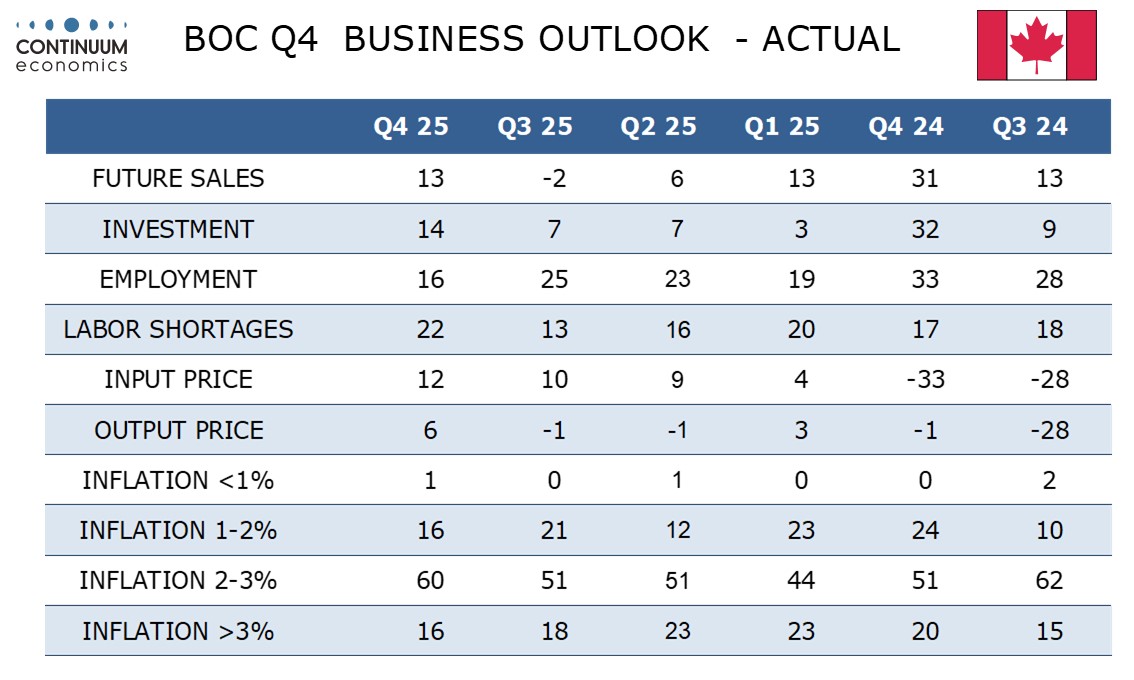

The Bank of Canada’s Q4 business outlook survey is mostly improved with the business outlook indicator of -1.78 from -2.27 the strongest since Q4 2024 while the index on future sales bounced to a positive 13 from -2, returning to the pre-tariff level seen in Q1 2025. The data, while improved, is not sufficient to get the BOC talking about tightening.

The index on investment at 14 was up from 7 in Q3 and the highest since Q4 2024. Employment slipped to 16 from 25, adding to suspicions that recent strong employment gains are unsustainable, but the proportion seeing labor shortages at 22%, up from 13%, is the highest since Q1 2024.

Inflation expectations have picked up too, with 76% seeing inflation above the 2% target, the highest since Q3 2024, though 60% see it in a 2-3% range. The index on input price inflation of 1 is only marginally up from zero in Q3 but the index on output prices as a positive 6 from -1 is the highest since Q2 2022.

The separate survey of Canadian consumers saw marginal gains in short term inflation expectations, to 4.10% from 4.00% for the 1-year view and to 3.98% from 3.94% for the 2-year. However, this is outweighed by a significant dip in the 5-year view, to 3.09% from 3.67%, reaching a 4-quarter low.