Canada September Employment - Rebound strengthens the case for a BoC pause in October

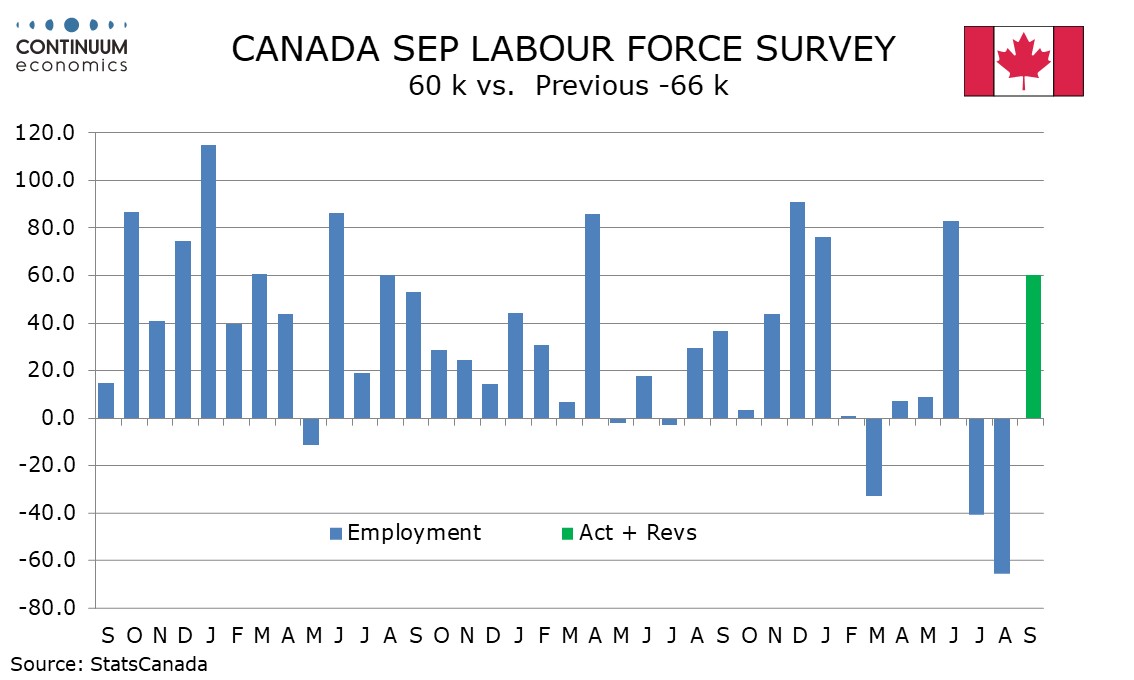

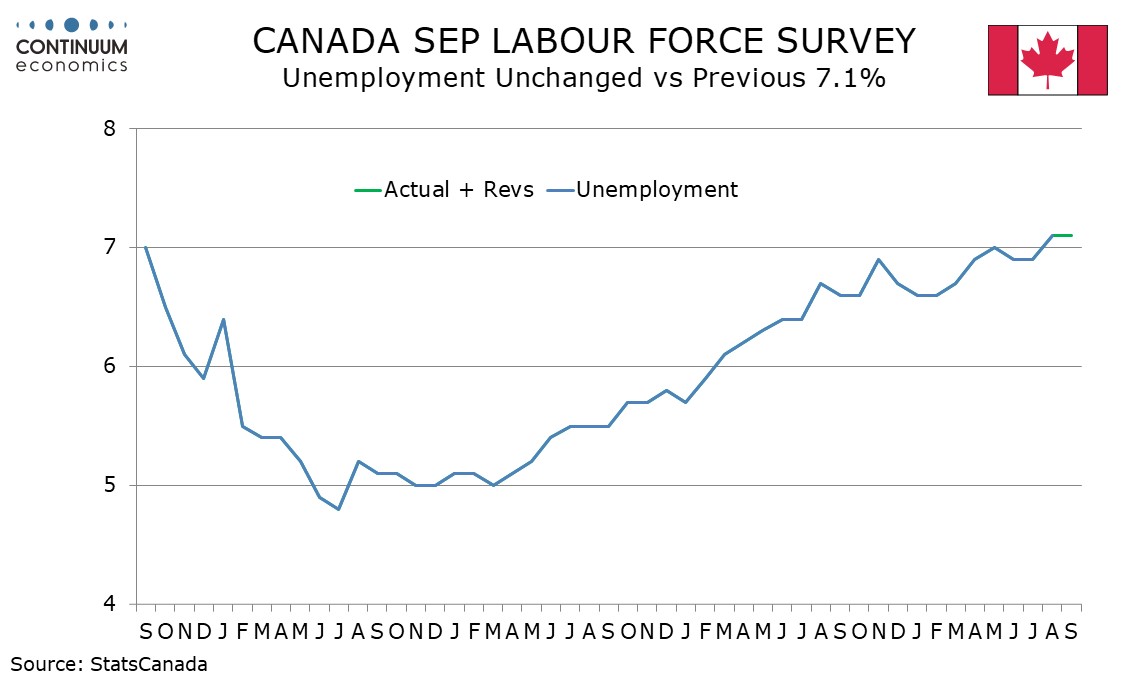

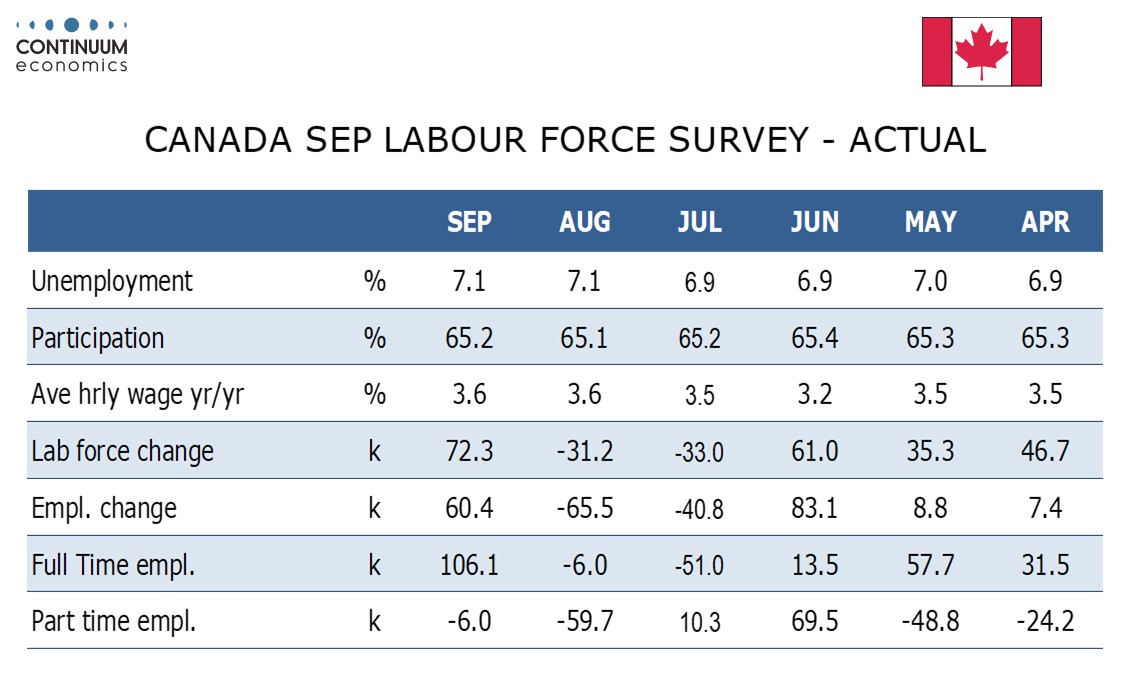

Canada’s September employment report with a 60.4k increase has reversed nearly all of a 65.5k decline seen in August though unemployment which is unchanged at up to 7.1% remains up from July’s 6.9%. The Bank of Canada decision on October 29 remains a close call, but this data increases our confidence that there will be only one more 25bps easing by the BoC this year, with the move more likely to come in December than October.

Full time employment was up by 106.1k after a modest 6.0k decline in August which is a positive detail, though part time employment at -45.6k saw a second straight steep decline after falling by 59.7k in August. Less positive in the detail is that 30.7k of the rise came in the public sector, with the private sector up by 21.9k and self-employment up by 7.9k. Goods producing employment rose by 42.0k led by a very surprising 27.8k increase in manufacturing. Services rose by 18.4k, restrained by a 20.8k fall in wholesale and retail but with health care and social assistance, much of which is public sector, up by 13.9k.

Unemployment was unchanged at 7.1% with the labor force up a strong 72.3k to more than fully reverse two straight declines. Yr/yr hourly wage growth for permanent employees was stable at 3.6% and has shown little change over the last seven months. The employment series is volatile with strong data seen in June and now September but substantial declines in July and August. The 4-month average of 12.4k is not consistent with an economy entering recession but the 3-month average is negative at -15.3k and the 6-month average only modestly positive at 8.9k. Unemployment is trending higher, having started the year at 6.6%.

A case can still be made for easing provided September’s CPI is acceptably subdued, though employment data does appear to have been influential in Bank of Canada decisions, with September’s easing having followed the weak July and August employment reports but July’s pause having followed June’s strong data. The Bank of Canada is unlikely to be done easing, but this data makes it less likely that they will move for a second straight meeting in October. We expect a 25bps easing in December, and a final 25bps move in Q1 of 2026, taking the rate to 2.0%.

I,Dave Sloan, the Senior Economist declare that the views expressed herein are mine and are clear, fair and not misleading at the time of publication. They have not been influenced by any relationship, either a personal relationship of mine or a relationship of the firm, to any entity described or referred to herein nor to any client of Continuum Economics nor has any inducement been received in relation to those views. I further declare that in the preparation and publication of this report I have at all times followed all relevant Continuum Economics compliance protocols including those reasonably seeking to prevent the receipt or misuse of material non-public information.