Canada October Employment - Second straight strong rise reinforces expectations for steady BoC policy

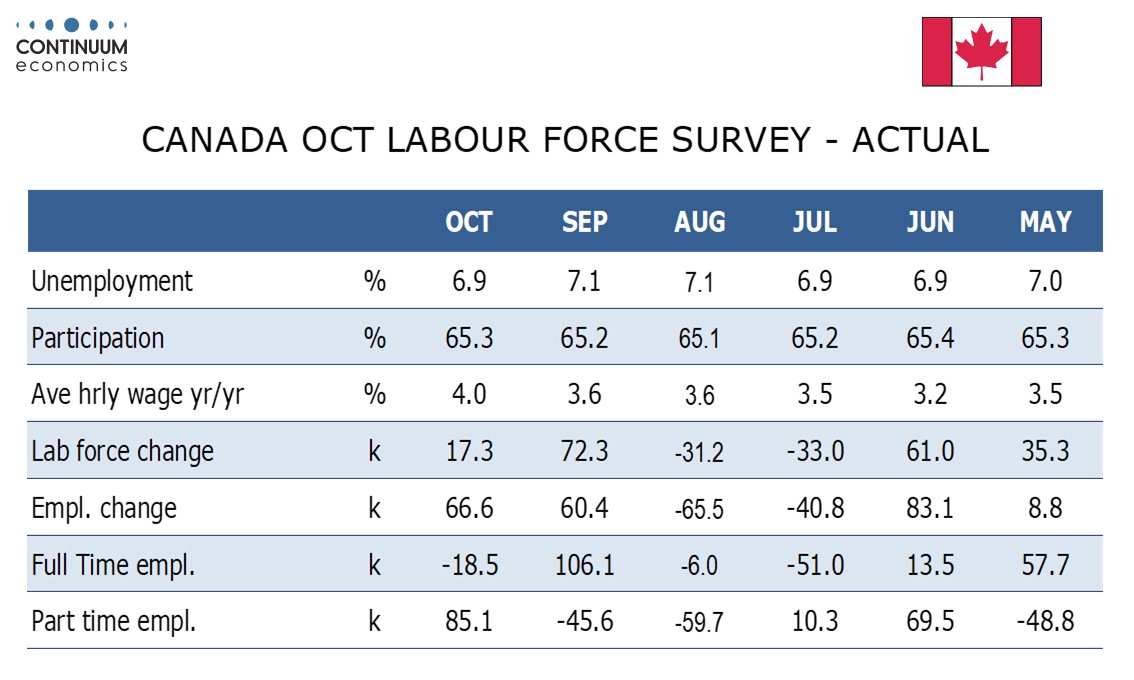

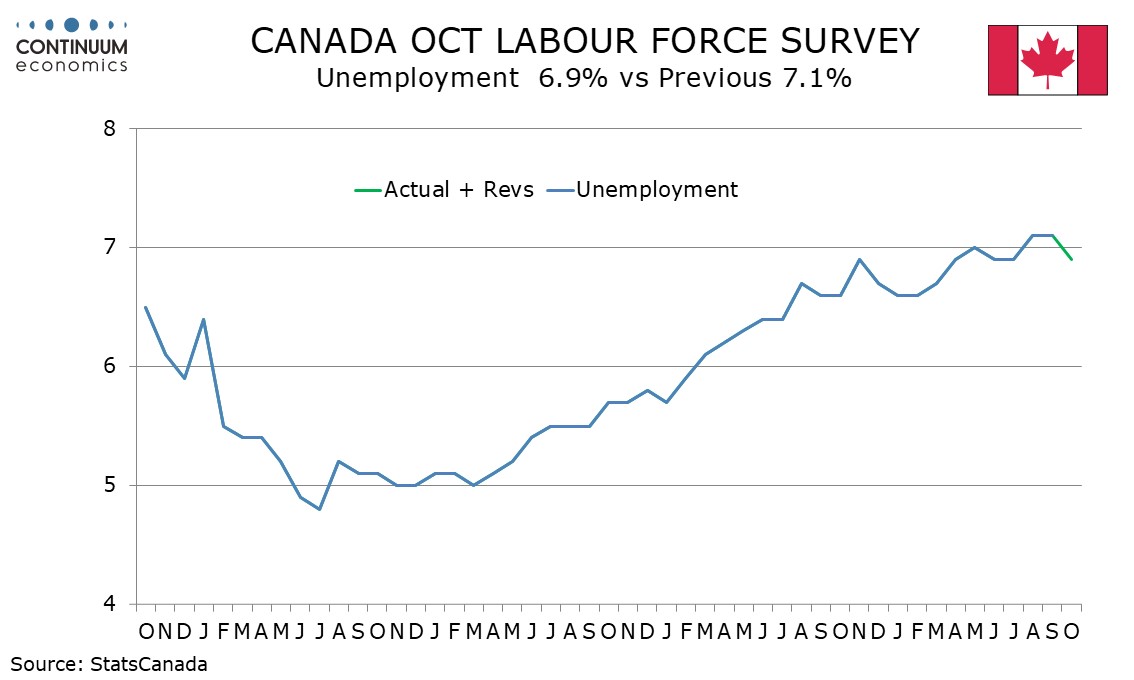

Canada’s October employment report provides a second straight strong increase, by 66.6k, and while the series is volatile and the two strong months follow two weak months, the data suggests underlying trend has not turned negative and that the Canadian economy may be regaining momentum. Unemployment unexpectedly fell to 6.9% after two months at 7.1%. This will reinforce expectations for steady Bank of Canada policy near term.

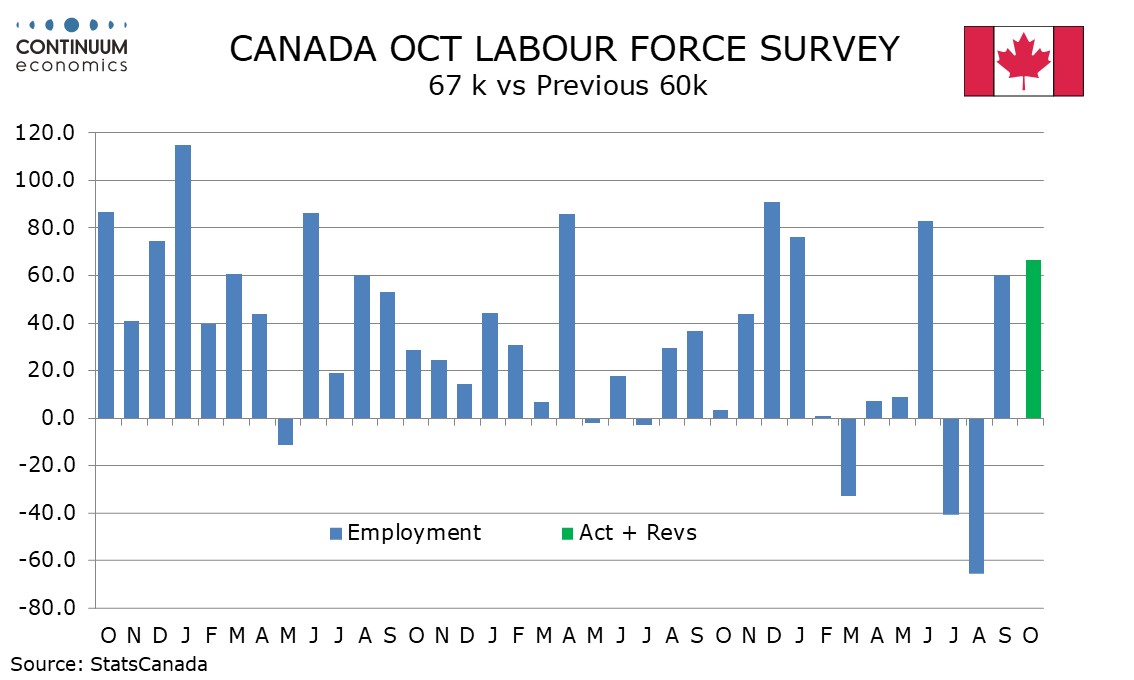

Canadian employment was fairly flat between February and May as tariff concerns started to build, then showed a surprising 83.1k increase in June. The 5-month average is now 20.8k, up from 12.1 in May. The 3-month average was negative in August and September and the 6-month average dipped below zero in August but both are now positive again at 20.5k and 18.8k respectively. Canadian GDP dipped in Q2 after a firm Q1 but looks set to record modest growth in Q3. This data hints at a stronger Q4.

October’s detail shows a loss of 18.5k in full time employment but this needs to be seen alongside a surge of 106.1k in September. Part time employment rebounded by 85.1k after a 45.1k loss in September. August saw full time down a modest 6k and part time down by 59.7k. More positive in the detail was private sector employment rising by 73.2k, while the public sector fell by 4.2k and self-employment fell by 2.5k.

Goods producing employment fell by 1.1k with manufacturing surprisingly extending a strong September by 8.7k, but construction was weak with a 14.7k decline. Service producing employment surged by 67.6k led by a 40.7k rise in retail and wholesale, hinting at consumer resilience. Also firm were transport and warehousing at 29.5k and information, culture and recreation at 25.2k

September’s strong rise in employment was matched by strength in the labor force but in October the labor force managed only a modest rise of 17.3k allowing unemployment to slip to 6.9% after two months at 7.1%. If the economy is picking up it may be that the 7.1% will prove a peak, but such a conclusion is tentative at this point. Further evidence of strength came in a 4.0% yr/yr rise in the hourly wages of permanent employees, up from two straight months at 3.6% and the highest since February. Again, any conclusions that trend has found a base are tentative but the strength of the data is notable.

While the strong June employment report was probably instrumental in a Bank of Canada pause in July, and the weak July and August data encouraged easing in September, September’s bounce did not prevent the BoC from easing in October. However the October statement BoC suggested rates would now be left on hold unless data fell short of expectations. This data will reinforce expectations of steady near term BoC policy.

I,Dave Sloan, the Senior Economist declare that the views expressed herein are mine and are clear, fair and not misleading at the time of publication. They have not been influenced by any relationship, either a personal relationship of mine or a relationship of the firm, to any entity described or referred to herein nor to any client of Continuum Economics nor has any inducement been received in relation to those views. I further declare that in the preparation and publication of this report I have at all times followed all relevant Continuum Economics compliance protocols including those reasonably seeking to prevent the receipt or misuse of material non-public information.