Bank of Canada - Rate Level Still Appropriate But Uncertainty Heightened

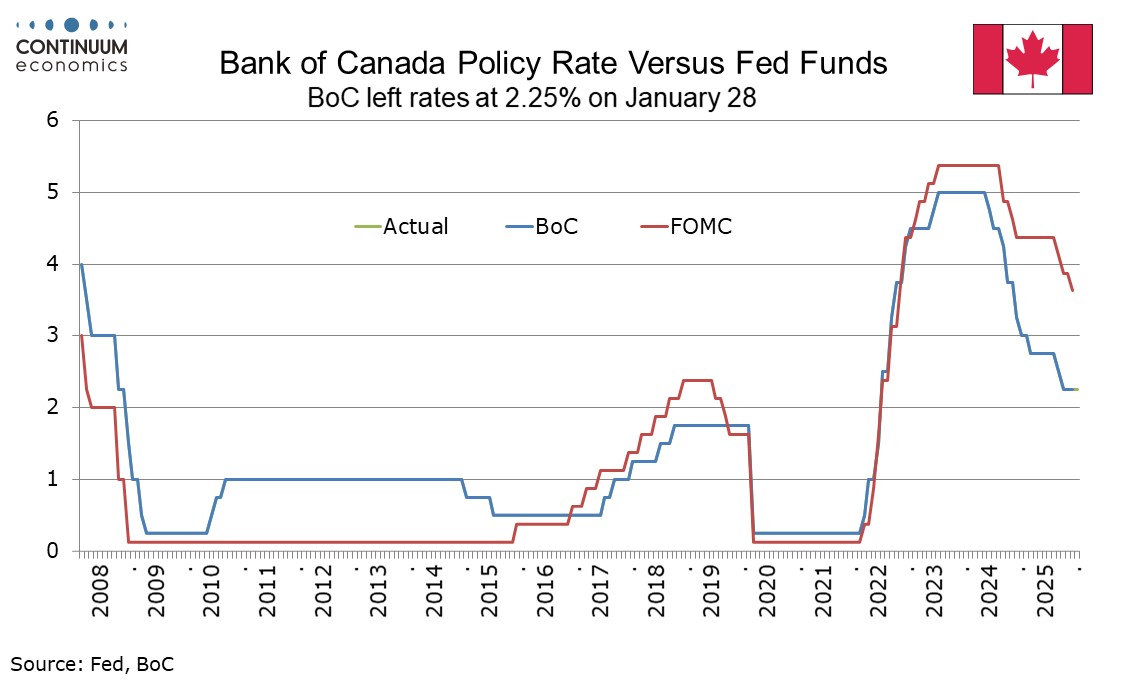

The Bank of Canada left rates unchanged at 2.25% as expected and continues to see the current policy rate as appropriate, Governor Macklem stating updated economic forecasts have not changed significantly since October. However in highlighting heightened uncertainty the statement appears to leave risks that the next move will be lower as somewhat higher, even if we do not expect that to be the case.

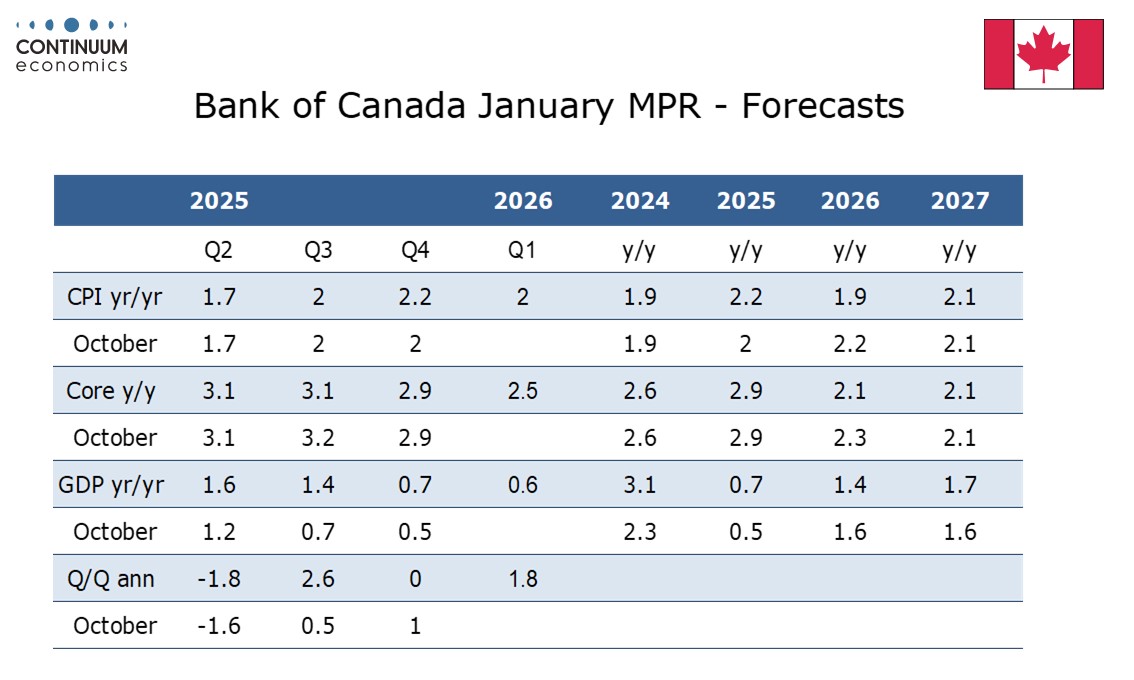

This meeting contained the first quarterly Monetary Policy Report since October. A surprisingly strong Q3 GDP has not changed the projected GDP profile much though in forecasting a flat Q4 the BoC seems to be implying a positive December, while the 1.8% annualized forecast for Q1 is higher than we expected, and surprisingly stronger than the view for 2026 as a whole. The BoC does not seem concerned about a slightly firmer Q4 CPI, which came in part because of a year ago sales tax holiday. The statement was optimistic on its preferred measures of core inflation, stating they had eased to around 2.5% from 3.0% in October. The 2026 core CPI view has been revised down to 2.1% Q4/Q4 from 2.3%, only marginally above the 2.0% target.

The limited changes to the forecast allow the BoC to continue seeing the policy rate as appropriate though the main news in the statement was that uncertainty is now seen as heightened rather than elevated. This is presumably in response to Trump’s threat of a 100% tariff on Canada as well as the recent tension over Greenland, which like the US is a Canadian neighbor. We feel the risk of Trump imposing a 100% tariff on Canada is low, but the risk of him taking actions that while less extreme could do significant damage to Canada’s economic outlook is significant.

The current policy rate is on the lower end of a 2.25-3.25% neutral range and if the economy evolves in line with the BoC’s expectation, the next move in rates will probably be upwards. We currently expect it to come in October, though timing will not only depend on the economy, but also US politics. If tensions with the US escalate, the BoC may consider a further easing, with the statement highlighting the upcoming review of the US-Canada-Mexico trade agreement. This is not the only uncertainty, with the Supreme Court verdict on Trump’s tariffs also set to be important. If the US Supreme Court rules against the reciprocal tariffs and Trump seeks alternative sources of tariff revenue, it could harden his stance on the USMCA talks and prove negative for Canada. Macklem in the press conference stated threats to Fed independence added to Canadian uncertainty. Our central view remains no change in rates until a tightening in October, but the BoC looks more likely to ease in the first half of the year than to tighten.

I,Dave Sloan, the Senior Economist declare that the views expressed herein are mine and are clear, fair and not misleading at the time of publication. They have not been influenced by any relationship, either a personal relationship of mine or a relationship of the firm, to any entity described or referred to herein nor to any client of Continuum Economics nor has any inducement been received in relation to those views. I further declare that in the preparation and publication of this report I have at all times followed all relevant Continuum Economics compliance protocols including those reasonably seeking to prevent the receipt or misuse of material non-public information.