Bank of Canada Minutes from January 28 - Steady policy dependent on economy evolving as expected

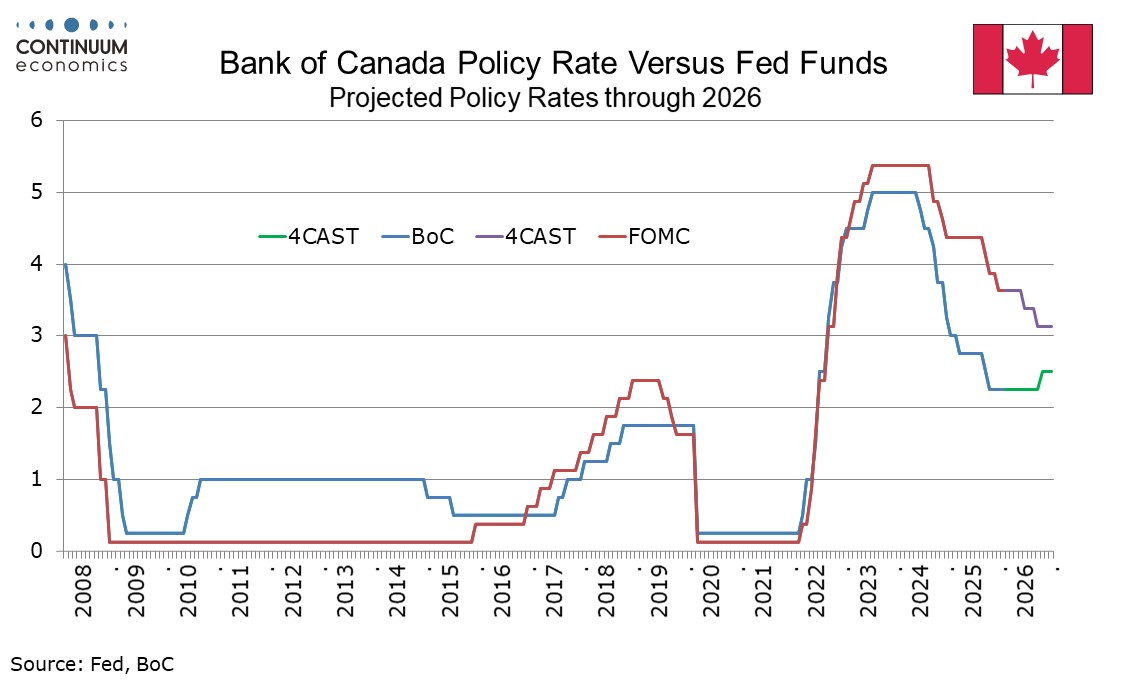

The Bank of Canada has released minutes from its January 28 meeting which provide no major surprises. The meeting saw rates left unchanged at 2.25% but noted heightened uncertainty, which the minutes also emphasize, with steady policy conditional on the economy evolving as expected.

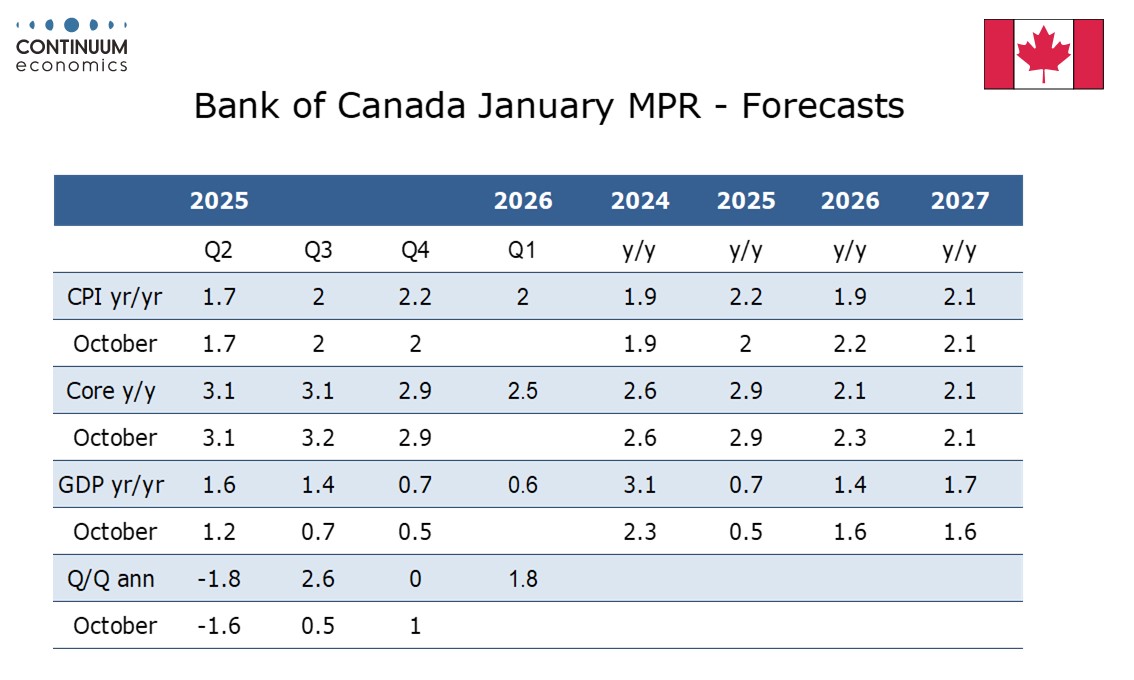

Most major economies were seen as proving resilient to US tariffs but were still seen as vulnerable to unpredictable US policy. The Canadian economy was seen as evolving largely as anticipated in October’s Monetary Policy Report. Domestic demand was expected to remain resilient but with investment soft through 2026. Fiscal policy was seen as supportive while the labor market continued to be soft. CPI was seen as evolving in line with expectations with the BoC’s preferred measure of core inflation falling to 2.5% in December from 3.0% in October.

Three broad areas of risk were discussed. Firstly geopolitical, including in Venezuela, Iran and Greenland, as well as threats to the independence of the US Federal Reserve, which added to uncertainty. The review of the Canada-US-Mexico trade agreement as seen as an important risk, and to the downside on growth, though with potential inflationary risk from any retaliatory tariffs. Finally the BoC discussed risks from ongoing trade disruptions and structural adjustments, concluding that risks around the outlook had moved higher.

Members agreed to hold policy given that it was already on the stimulative side and the projection remained in line with October’s, but agreed that holding policy at the current rate was conditional on the economy evolving in line with their outlook. The range of possible outcomes was seen to have broadened with assigning weighs to their probabilities unusually difficult, as was predicting the direction and timing of the next policy change. We expect the BoC to keep policy steady until a modest tightening in Q4, but if there is to be a move before then, it is more likely to be an easing, in response to downside risks materializing.