Canada July Employment - A weak month after a strong month

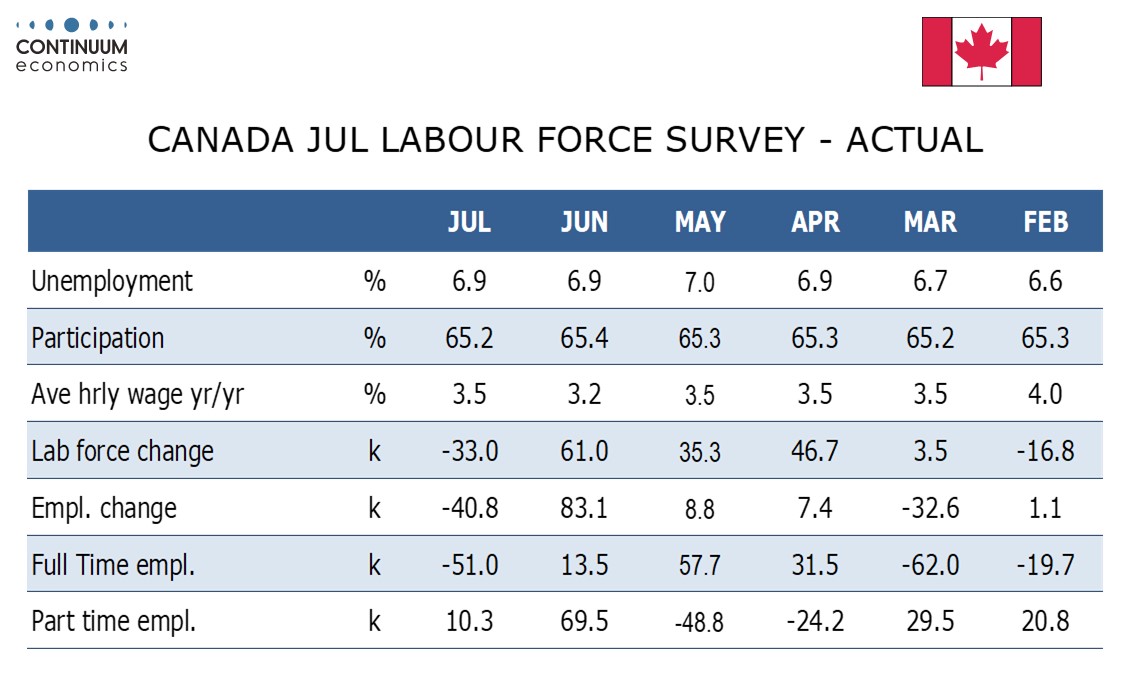

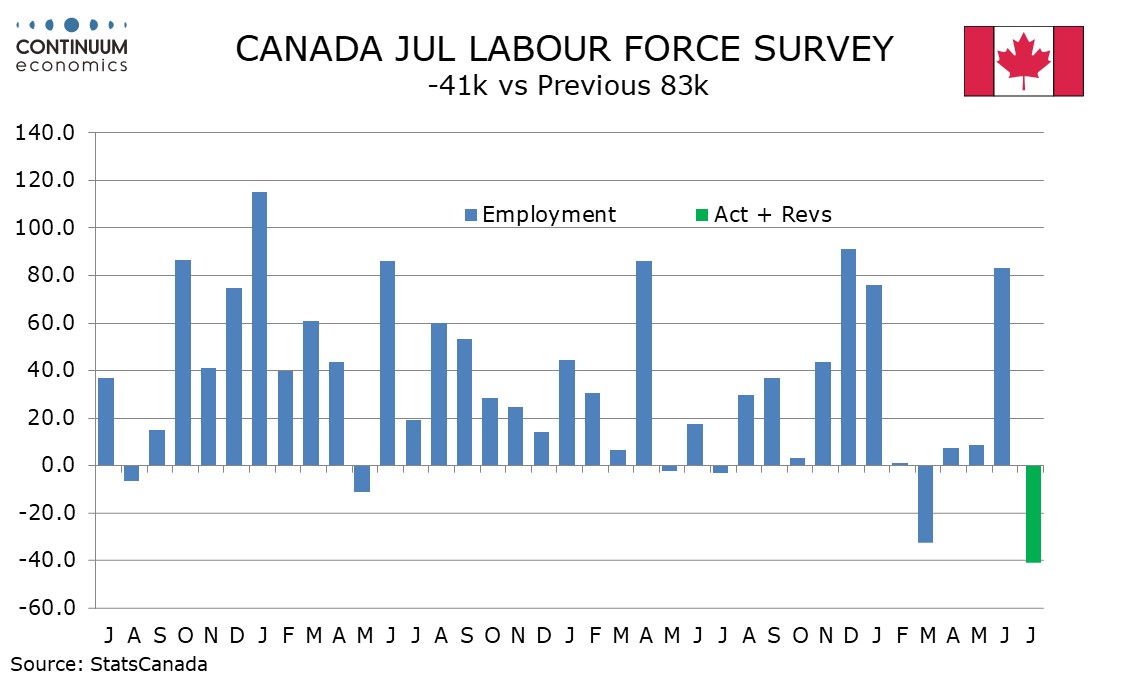

Canada’s surprisingly strong June employment report has been followed by a significant correction lower in July, with a fall of 40.8k to follow a rise of 83.1k, Full time work is negative over the two months, a 51.0k fall after a 13.5k increase, while part time work with a rise of 10.3k extended a 69.5k increase in June.

Weakness in July was broad based, with private sector employees down by 39.0k, self-employment down by 5.8% but the public sector managing a 4.0k increase. Goods employment fell by 29.0 led by a 21.6k fall in construction, not a sector seen as sensitive to tariffs. Manufacturing was surprisingly one of the few positives, rising by 5.3k. Services fell by 11.9k, information culture and recreation the largest negative at -29.2k, transport and warehousing the strongest positive at 26.1k.

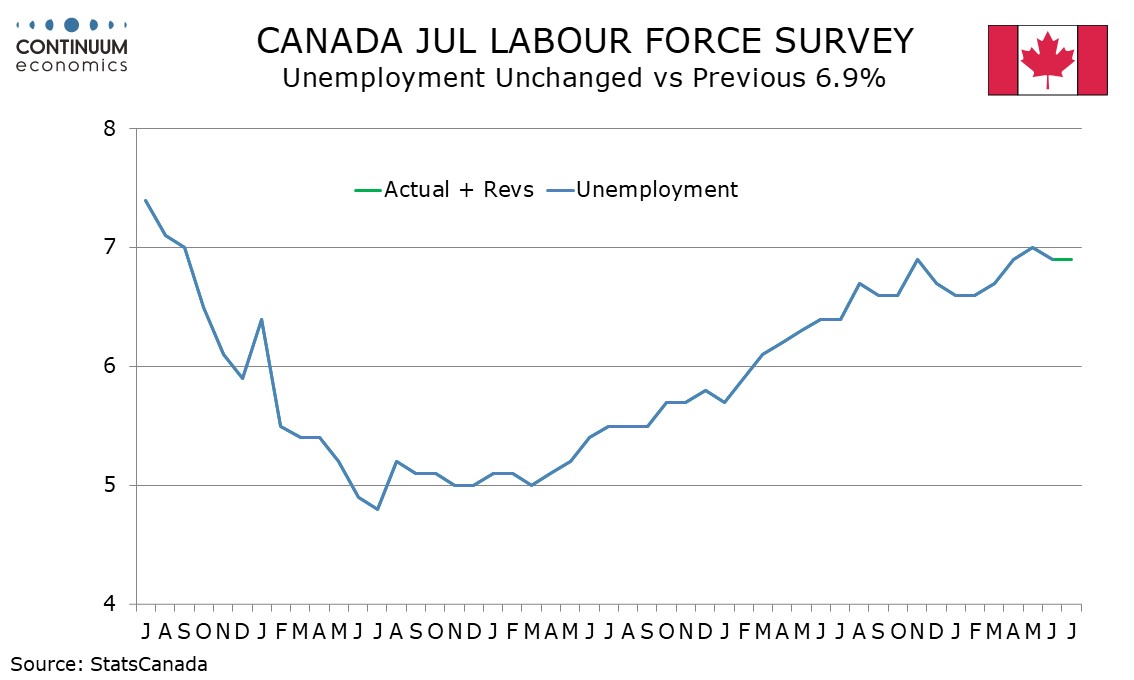

With the labor force down by 33.0k, its sharpest fall since June 2022, the unemployment rate was stable at 6.9% after June saw slippage from 7.0% in May. Hourly wage growth for permanent employees at 3.5% saw a reversal from June’s slower 3.2%, returning to the pace seen in March, April and May. This is not an inflationary worry.

The Bank of Canada left policy unchanged on July 30 and noted resilience in the economy. This data makes the economy look less resilient, though the unemployment rate is looking fairly stable after trending higher through 2024. Trend in employment is still positive, though the 6-month average is now only marginally so. The labor market is not an obstacle to renewed easing but is not suggesting an economy falling into recession. This will leave inflation data as key for BoC decisions.