Bank of Canada Preview for January 28: Rate level still appropriate but uncertainty high

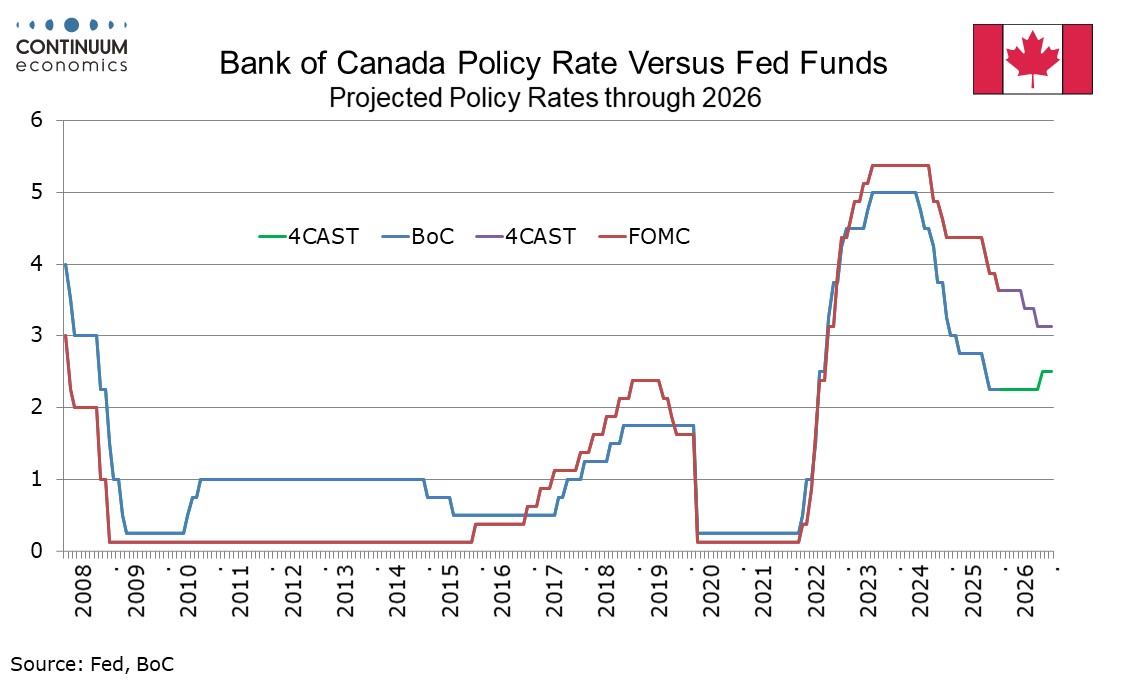

The Bank of Canada looks highly likely to leave rates unchanged at 2.25% on January 28 and reiterate that rates are at about the right level if the economy evolves as expected, while adding that uncertainty remains elevated. We expect that the next BoC move will be a modest tightening, but this will not be seen until Q4. Easing before then is possible if geopolitics gives the economy a fresh hit.

After easing to 2.25% in October, putting rates at the bottom of the BoC’s neutral range of 2.25-3.25%, the BoC stated that if the economy evolved in line with its October projection, it saw policy at about the right level to keep inflation close to 2% while guiding the economy though this period of structural adjustment. This was repeated at the December meeting, when rates were left unchanged.

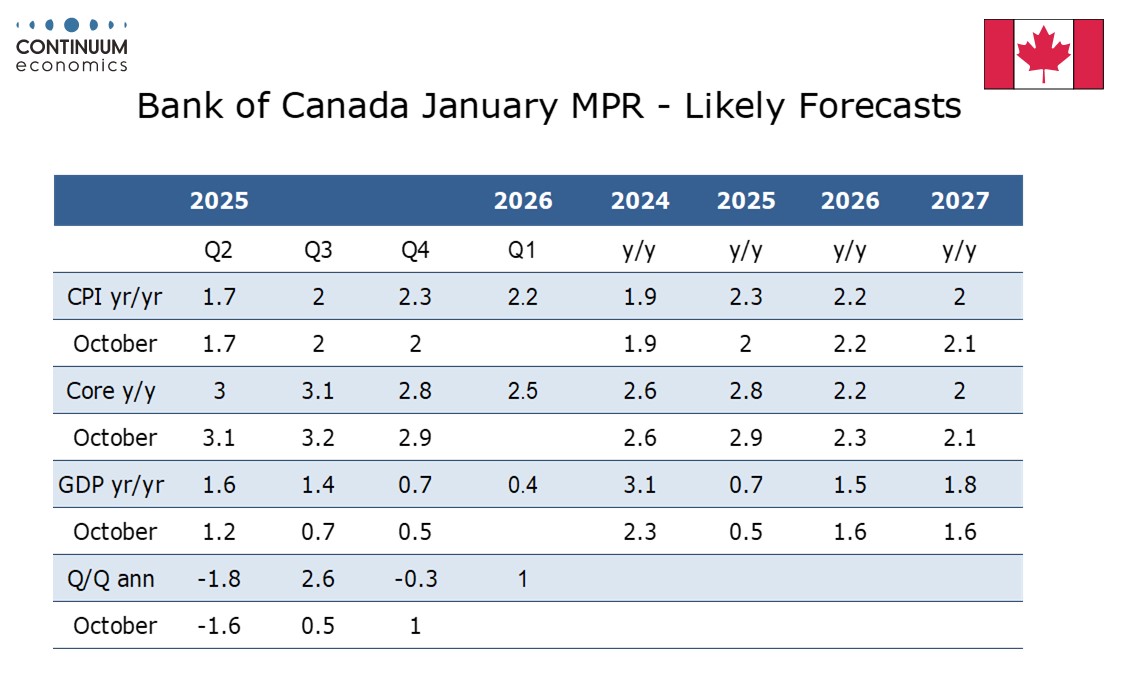

This meeting will be of most interest for updated economic forecasts. Since October’s forecasts ere made we have seen Q3 GDP significantly exceed the BoC’s expectations with 2024 also revised significantly higher, though we expect that the BoC will expect a modest correction lower in Q4 and a moderate start to 2025. We expect revisions to 2026 and 2027 GDP forecasts will be modest, but overall the economy is looking a little stronger than the BoC had expected.

CPI has exceeded the BoC’s expectation in Q4, though their core rate, as measured by the average of CPI-Median and CPI-Trim, was a little softer than expected. The Q4 acceleration in overall CPI is in part due to a sales tax holiday a year ago inflating the base, and that will continue in early Q1, though the BoC was aware this was coming when it made its forecasts in October. In April the year ago base will be boosted as the abolition of the carbon tax in April 2025 drops out of the base, and that’s should see overall and core CPI rates converging. The BoC has reason to feel a little more optimistic about underlying inflation than in October, and may trim its 2026 and 2027 projections. We expect they will now look for the 2.0% target to be reached in 2027, which in October it saw at 2.1%.

A slightly stronger growth view than in October but a slightly softer inflation view suggests that despite the surprises seen in data since October, the BoC will not need to change its view that rates are at about the right level. High uncertainty given the geopolitical environment, with Greenland and the upcoming USMCA negotiations both carrying significant risks for Canada, will mean that the BoC will reiterate that if the outlook changes it is prepared to respond. Our central view has the economy in late 2026 seeing growth back in line with potential and inflation getting close to target, with a 25bps tightening in October and another in 2027 to put rates in the middle of the neutral range. However, a shock that damages the outlook sufficiently to see the BoC resuming easing is a significant risk.