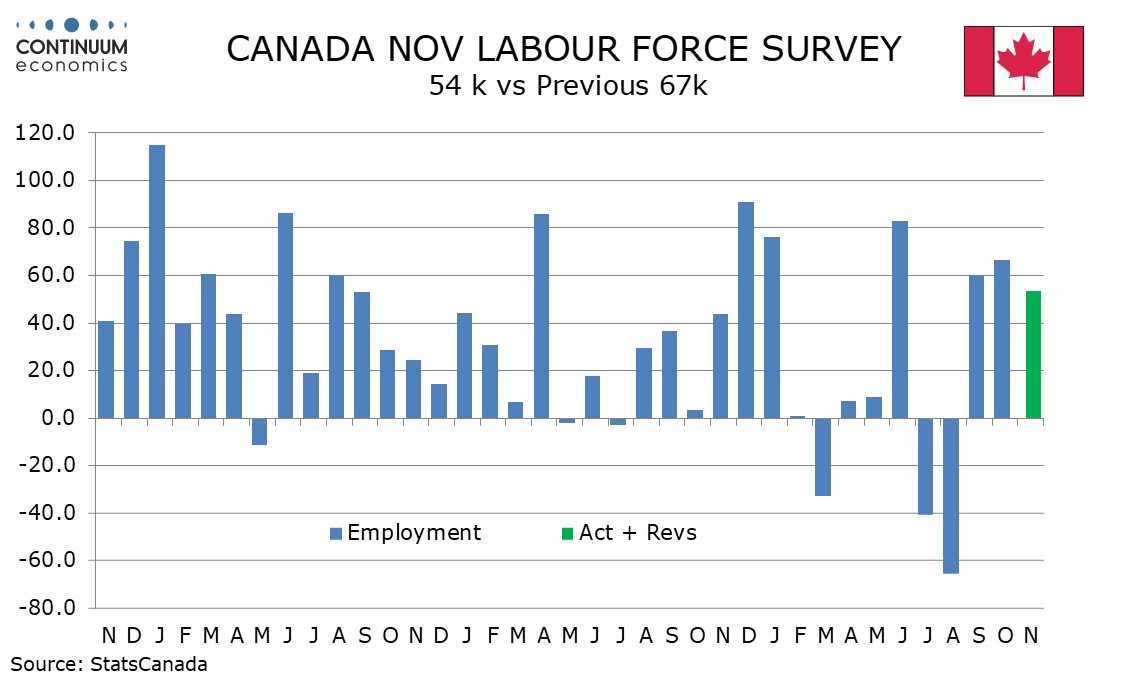

Canada November Employment - Third straight strong rise, unemployment lowest since July 2024

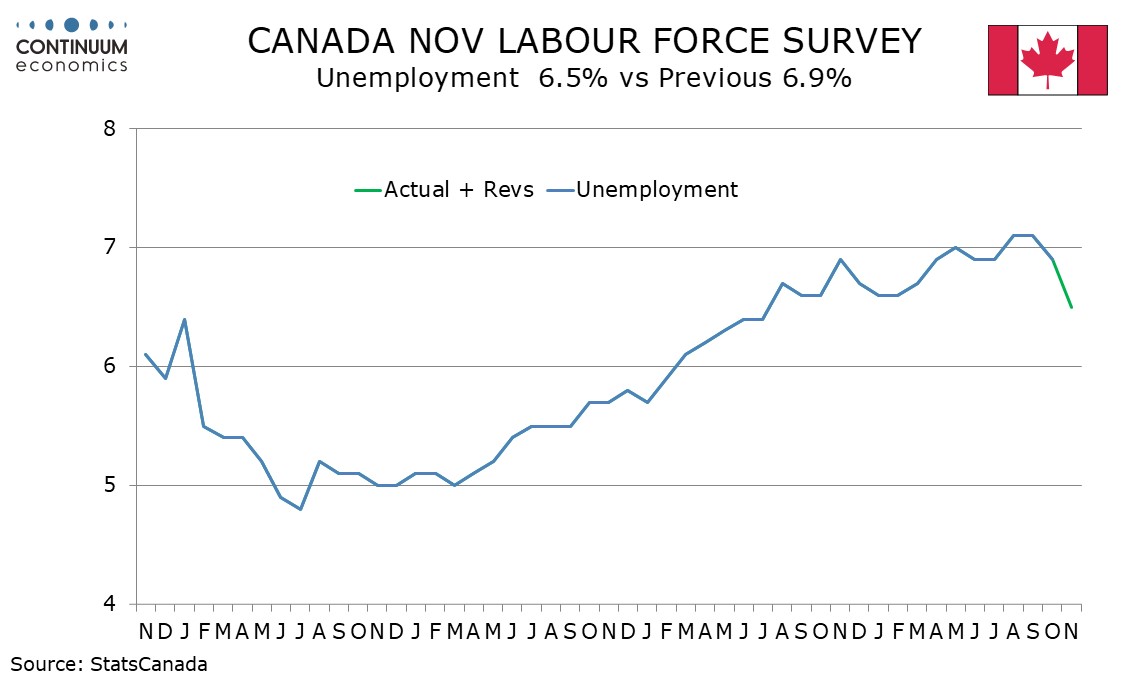

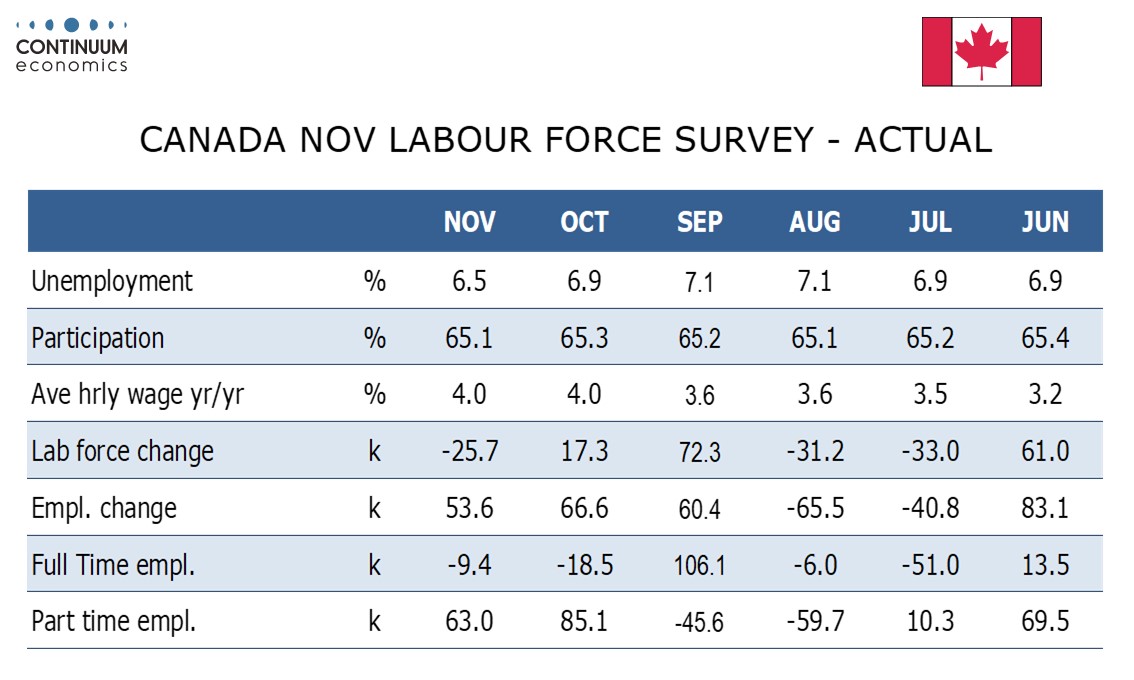

Canada’s November employment report has surprised on the upside for a third straight month, rising by 53.6k, and this time with a sharp fall in unemployment to 6.5% from 6.9%. While the Bank of Canada is unlikely to be thinking about tightening yet, the data adds to hopes generated by a 2.6% annualized rise in Q3 GDP that the Canadian economy is proving more resilient to tariffs than expected.

The three straight strong gains in employment follow weak data in in July and August. Details are not so impressive, with the job gain fully due to a 63.0k rise in part time work with full time employment falling by 9.4k. Private sector employment rose by 52.2k, and public sector employment by 16.3k, though self-employment fell by 14.7k. Most of the job growth came from a 45.5k increase in health care and social assistance. Wholesale and retail fell by 34.1k and manufacturing corrected two straight gains with a drop of 9.3k. Elsewhere moderate growth was generally seen.

The unemployment rate of 6.5% is the lowest since July 2024 and it appears that an upturn that reached 7.1% in August and September has peaked, consistent with the economy regaining momentum, perhaps even growing above potential as Q3 GDP implied, though a weak preliminary estimate for October GDP means this conclusion should be tentative at this point. If the labor market is strengthening, it may be supporting wages, with yr/yr growth in the hourly wage of permanent employees unchanged at 4.0%.

The unemployment fall was assisted by 21.3k fall in the labor force. Three month averages show the labor force rising by 21.3k and employment rising a strong 60.2k, while six month averages are for gains of 10.1k in the labor force, the lowest since June 2021, and employment at 26.2k, the highest since April, suggesting the tariff hit is fading. A change in rates at next week’s BoC meeting already looked unlikely and this data suggests we may have reached the bottom for this easing cycle, though strong data needs to continue in early 2026 before the BoC starts to consider tightening.

I,Dave Sloan, the Senior Economist declare that the views expressed herein are mine and are clear, fair and not misleading at the time of publication. They have not been influenced by any relationship, either a personal relationship of mine or a relationship of the firm, to any entity described or referred to herein nor to any client of Continuum Economics nor has any inducement been received in relation to those views. I further declare that in the preparation and publication of this report I have at all times followed all relevant Continuum Economics compliance protocols including those reasonably seeking to prevent the receipt or misuse of material non-public information.