Data Reviews

View:

September 15, 2025

U.S. September Empire State Manufacturing Survey - Softer but underlying picture near flat and prices still firm

September 15, 2025 12:48 PM UTC

September’s Empire State manufacturing index at -8.7 from a positive 11.9 has broken a string of three straight positives which followed four straight negatives. The index is volatile but now it looks like that the three straight positives were not signaling an untrend. The underlying picture is p

September 12, 2025

U.S. September Preliminary Michigan CSI - Lower as 5-10 year inflation expectations rebound

September 12, 2025 2:22 PM UTC

September’s preliminary Michigan CSI of 55.4 is down from 58.2 and weaker than expected, if still above April and May levels. Worries seem to be longer term, with expectations down by more than current conditions and longer term inflation expectations bouncing while the 1-year view is unchanged.

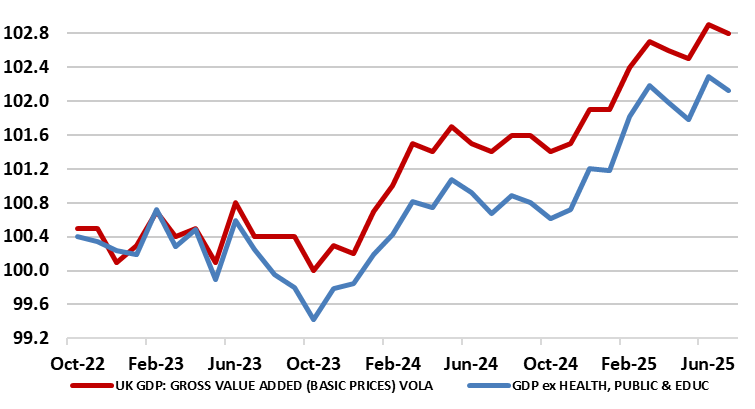

UK GDP Review: Conflicting Signs

September 12, 2025 6:52 AM UTC

Although we are pointed to a flat m/m GDP outcome for the July data, thereby matching the official outcome, the actual outcome was a small m/m fall (before rounding). The three-month rate slowed a notch to 0.2% but we think this overstates what is very feeble momentum, which may actually be nearer

September 11, 2025

U.S. August Budget Deficit falls from a year ago in part due to tariffs

September 11, 2025 6:34 PM UTC

August’s US budget deficit of $344.8bn is down from $380.1bn in August 2024, a $35.3bn decline. Most, but not all of the improvement can be explained by a $22.5bn increase in tariff receipts, to $29.5bn.

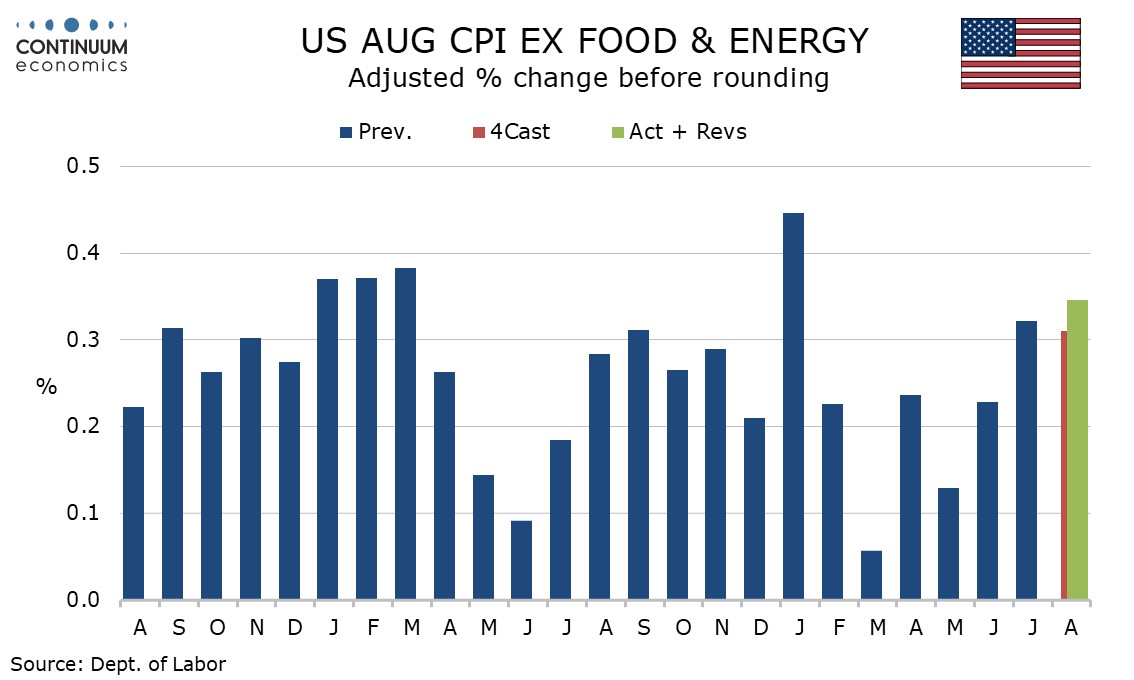

U.S. August CPI, Weekly Initial Claims - Risks on both sides of Fed mandate but possible seasonal adjustment issues for Claims

September 11, 2025 1:07 PM UTC

August CPI is firmer than expected overall at 0.4% and while the core rate was as expected at 0.3% its rise before rounding at 0.346% is uncomfortably high emphasizing the upside risks to the Fed’s inflation mandate. Initial claims at 263k from 236k however point to downside risks to the Fed emplo

September 09, 2025

U.S. August NFIB survey - Optimism firmer while price signals slip

September 9, 2025 11:29 AM UTC

August’s NFIB index of Small Business Optimism at 100.8 from 100.3 has reached its highest level since January, extending a bounce from June’s pause at 98.6. Most encouragingly, inflationary signals have slipped for a second straight month after a bounce in June.

September 05, 2025

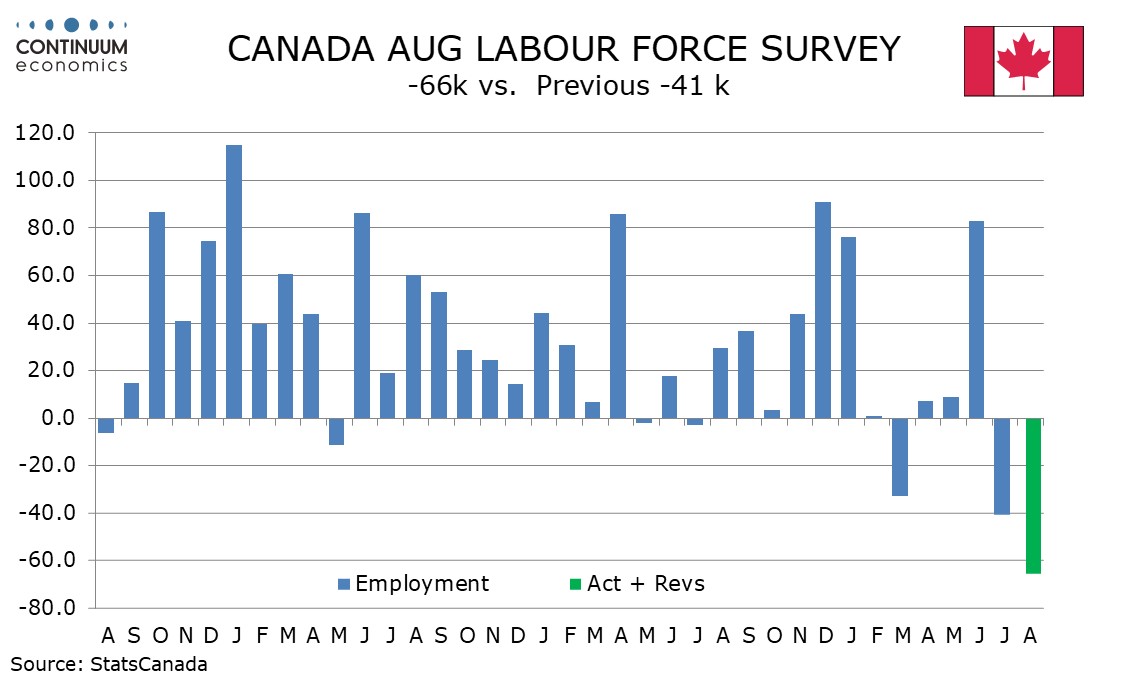

Canada August Employment - With Q3 looking weak, we now expect the BoC to ease in September

September 5, 2025 1:41 PM UTC

Canada’s August employment report with a 65.5k decline with unemployment up to 7.1% from 6.9% is much weaker than expected. While the detail is a little less weak than the headlines suggest, and the data has been volatile recently, we are revising our Bank of Canada call, and now expect a 25bps ea

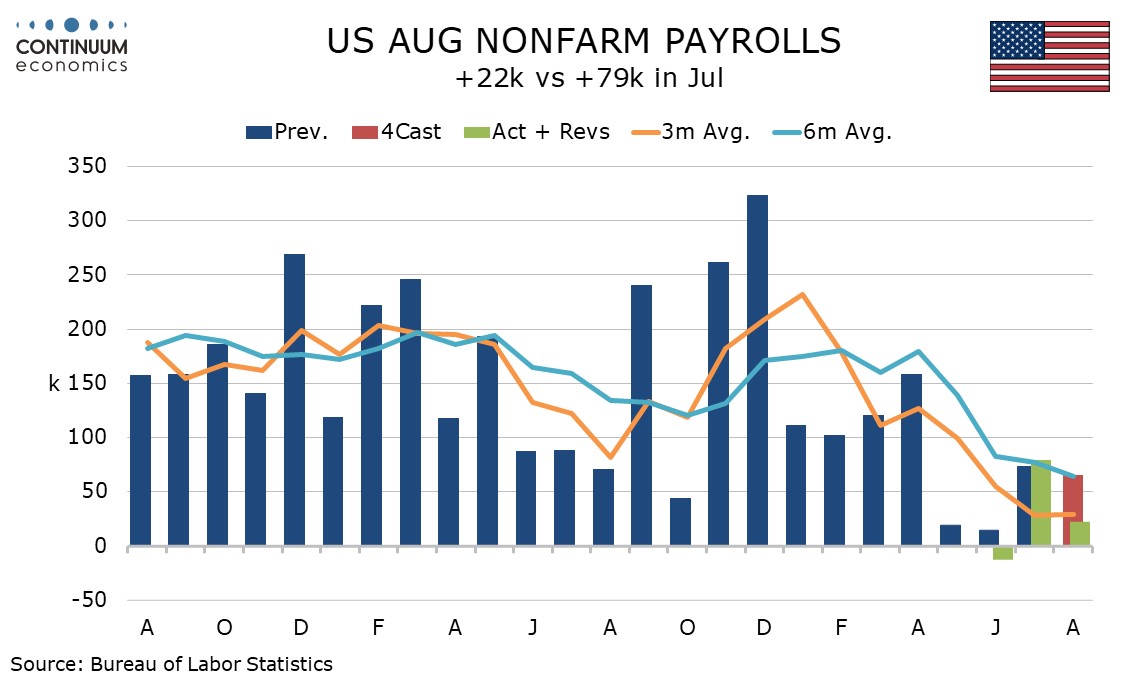

U.S. August Employment - Trend now close to flat, backing case for easing

September 5, 2025 1:03 PM UTC

August’s non-farm payroll shows that job growth is now minimal, with a rise of 22k almost completely offset by a modest 21k in net downward revisions. Unemployment rose to 4.3% from 4.2% while average hourly earnings rose by 0.3%, both as expected, though the workweek was weaker than expected. The

September 04, 2025

July US trade deficit up as imports bounce, deficits with Canada and China increase

September 4, 2025 1:36 PM UTC

July’s US trade deficit of $78.3bn was not far off expectations, but up sharply from $59.1bn in June. Imports bounced by 5.9% after three straight declines, while exports saw a modest rise of 0.3% after two straight declines.

U.S. August ADP Employment - Trend now below 100k per month, Initial claims rise

September 4, 2025 12:49 PM UTC

ADP’s August estimate of private sector employment growth of 54k is only marginally below consensus but supports a picture of slowing employment growth in recent months, after a preceding 106k in July that corrected a 23k decline in June, while April and May both saw gains of less than 100k.

September 03, 2025

Turkiye’s Inflation Slightly Eased to 32.9% YoY in August... But, Monthly Inflation is Still Over 2.0%

September 3, 2025 4:11 PM UTC

Bottom line: Turkish Statistical Institute (TUIK) announced on September 3 that the inflation slightly softened to 32.9% y/y in August from 33.5% y/y in July driven by lagged impacts of previous monetary tightening, tighter fiscal measures and suppressed wages. August figure came in slightly above

U.S. July JOLTS report - Two weak months suggest trend is slowing

September 3, 2025 2:17 PM UTC

July’s JOLTS report is weaker than expected with openings down 176k to 7.181m with June revised down to 7.357m from 7.437m, now a 355k decline. The two straight declines do little more than reverse gains of 317k in May and 195k in April though the level is the lowest since September 2024.

September 02, 2025

EZ HICP Review: Headline Inflation Edges Higher as Services Fall to Fresh Cycle-low

September 2, 2025 9:34 AM UTC

As we repeated again, HICP inflation – even now a notch above target – is very much a side issue for the ECB at present, offset instead by moderate concerns whether the apparent resilience of the real economy may yet falter. This mindset will not have been altered by the flash HICP data for Au

September 01, 2025

Hitting Beyond Expectations thanks to Construction Activities: Turkiye’s GDP Growth Rebounded Strong in Q2

September 1, 2025 10:55 AM UTC

Bottom Line: According to Turkish Statistical Institute’s (TUIK) announcement on September 1, Turkish economy increased by a strong 4.8% YoY despite political turbulence after arrest of Istanbul mayor and opposition’s presidential candidate Ekrem Imamoglu in Q2, prolonged monetary tightening eff

August 29, 2025

U.S. August Final Michigan CSI - Inflation expectations revised down

August 29, 2025 2:12 PM UTC

August’s final Michigan CSI of 58.2 is not much changed from the preliminary 58.6 but a little further off July’s 61.7. There are some surprises in the detail however, in particular a downward revision to the 5-10 year inflation view.

Canada Q2 GDP falls as exports plunge outweighs stronger domestic demand

August 29, 2025 1:34 PM UTC

Canada’s 1.6% annualized decline in Q2 GDP is weaker than the market expected, though in line with a -1.5% Bank of Canada forecast. Details are mixed with domestic demand positive and the GDP decline due to a plunge in exports due to US tariffs. June GDP was weaker than expected with a 0.1% declin

U.S. July Personal Income and Spending and Core PCE Prices as expected, but Advance Goods Trade Deficit up as imports rebound

August 29, 2025 12:58 PM UTC

July’s personal income and spending report is in line with expectations, with the 0.3% core PCE price index matching the core CPI, and gains of 0.4% in income and 0.5% in spending also as expected. However a rise in the July advance goods trade deficit to $103.6bn from $84.9bn is unexpected, and l

German HICP Review: Headline Back Higher But EZ Price Picture Still Reassuring?

August 29, 2025 12:12 PM UTC

Germany’s disinflation process hit a slightly more-than-expected hurdle in August, as the HICP measure rose 0.3 ppt from July’s 1.8% y/y, that having been a 10-mth low (Figure 1). This occurred largely due to energy base effects with food prices also contributing slightly. The result was that

August 28, 2025

August 26, 2025

U.S. August Consumer Confidence resilient but worries on jobs and prices increase

August 26, 2025 2:19 PM UTC

August’s Conference Board’s Consumer Confidence Index has held up a little better than expected, particularly given a weaker preliminary August Michigan CSI, falling to 97.2 from 98.7 only because July as revised up from 97.2. There has not been much change in the index in the last four month

U.S. July Durable Goods Orders - Signs of underlying improvement

August 26, 2025 12:51 PM UTC

July durable goods orders with a 2.8% decline are less weak than expected given a strong 1.1% rise ex transport, where trend appears to be gaining some momentum. While manufacturing surveys are mixed August’s S and P manufacturing survey was stronger too.

EZ HICP and Jobs Review: Headline at Target as Services Inflation at Fresh Cycle-low

August 26, 2025 11:51 AM UTC

HICP, inflation – still at target – is very much a side issue for the ECB at present, albeit with the likes of oil prices and tariff retaliation and a low but far from authoritative jobless rate (Figure 3) possibly accentuating existing and looming Council divides. Regardless, despite adverse

August 25, 2025

U.S. July New Home Sales - Trend has little direction, prices weak

August 25, 2025 2:14 PM UTC

July new home sales at 652k are on the firm side of expectations and down 0.6% from June only because June was revised up to 656k from 627k, now up 4.1% rather than 0.6%. Trend still looks fairly stable and downside risks are fading as prospects of Fed easing increase.

August 21, 2025

Eurozone: ECB Feels it Has More Reason to ‘Wait and See’?

August 21, 2025 10:02 AM UTC

To suggest that recent EZ real economy indicators, such as today’s August PMI flashes, have been positive would be an exaggeration. But, at the same time, the data (while mixed and showing conflicts - Figure 1) have not been poor enough to alter a probable current ECB Council mindset that the ec

August 20, 2025

South Africa Inflation Surges: 3.5% YoY in June

August 20, 2025 11:12 AM UTC

Bottom Line: Statistics South Africa (Stats SA) announced on August 20 that annual inflation rose to 3.5% YoY in July from 3.0% in June due to elevated prices of food and non-alcoholic beverages; housing and utilities; and restaurants and accommodation services. MoM prices surged by 0.9% in July, m

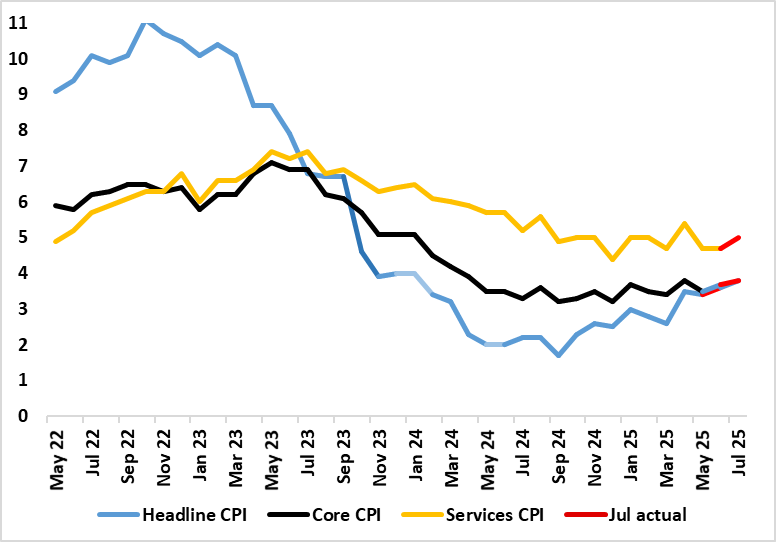

UK CPI Review: Special Factors Pull Inflation Even Higher, but is that an Excuse?

August 20, 2025 6:47 AM UTC

After the upside (and broad) June CPI surprise, CPI inflation rose further, up another 0.2 ppt to 3.8% in July, higher than the consensus but matching BoE thinking. And still the highest since January last year. The notable further 0.3 ppt rise in services inflation to 5.0% was also largely in lin

August 19, 2025

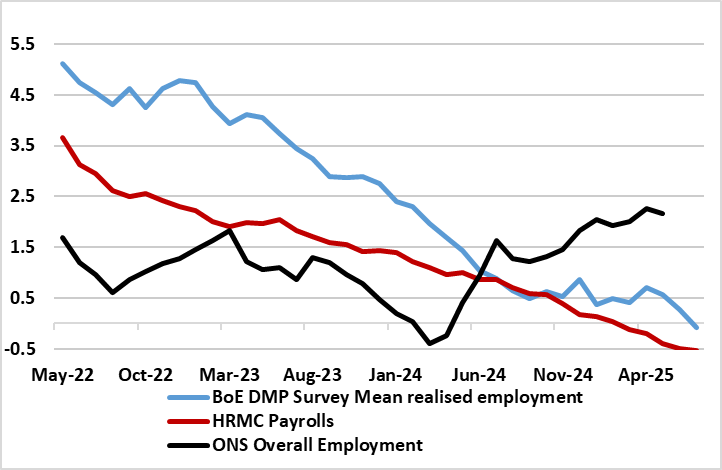

UK Labor Market: Is the BoE too Complacent?

August 19, 2025 10:10 AM UTC

Unlike the Fed, which has dual mandate of curbing inflation and promoting employment, the BoE remit is purely the former. But it is clear that labour market considerations weigh heavily on the dovish contingent of the MPC and possibly increasingly so. However, we feel that the BOE is not fully e

August 15, 2025

U.S. August Preliminary Michigan CSI - Suggests worries about jobs and prices

August 15, 2025 2:15 PM UTC

August’s preliminary Michigan CSI is a disappointment, falling to 58.6 from 61.7 in July and 60.7 in June, while remaining above the 52.2 seen in April and May. The fall was led by current conditions while inflation expectations saw a disappointing bounce.

U.S. July Industrial Production - A flat picture, but Empire State survey stronger in August

August 15, 2025 1:28 PM UTC

July industrial production has seen a 0.1% decline overall with manufacturing unchanged, both following two straight gains. Mining fell by 0.4%, a second straight drop, while weather-sensitive utilities saw a marginal 0.2% decline after a rise of 1.8% in June.

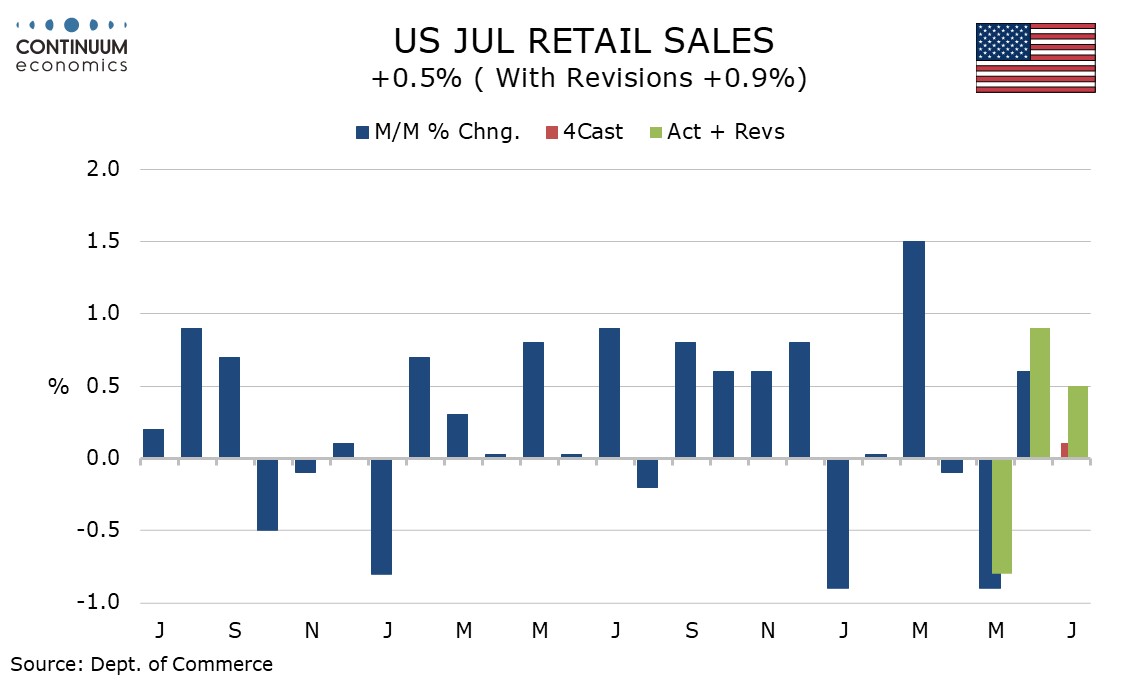

U.S. July Retail Sales - Resilient entering Q3

August 15, 2025 12:51 PM UTC

July retail sales with a 0.5% increase are in line with expectations, with net upward revisions totaling 0.4%. Ex auto sales rose by 0.3% also with 0.4% in upward revisions while ex auto and gasoline sales rose by 0.2%, here with revisions of only 0.2%. The data suggest consumer spending is holdin

August 14, 2025

Russian Economy is Slowing: GDP Growth Continued to Lose Steam in Q2 2025

August 14, 2025 9:23 AM UTC

Bottom Line: According to Russian Federal Statistics Service (Rosstat) figures, Russia's GDP expanded by 1.1% YoY in Q2, the slowest pace of growth since the economy resumed expansion in Q2 2023, driven by military spending, investments, higher wages and fiscal stimulus. We think Central Bank of R

August 13, 2025

Deceleration in Inflation Resumes in Russia: 8.8% YoY in July

August 13, 2025 7:28 PM UTC

Bottom Line: According to Russian Federal Statistics Service (Rosstat) data on August 13, inflation stood at 8.8% YoY in July after hitting 9.4% YoY in June, ignited by higher non-food and services prices. Despite inflation eased for a fourth straight month, we foresee inflation will continue to st

August 12, 2025

U.S. Budget moves back into deficit in July

August 12, 2025 6:27 PM UTC

Contrasting June’s $27.0bn budget surplus, July has recorded a deficit of $291.1bn, which is up from $243.7bn a year ago. Outlays bounced by 9.7% yr/yr after a 7.0% decline in June while receipts rose by only 2.5% yr/yr w3hixch is the weakest since October 2024, and down from a 12.9% rise in June.

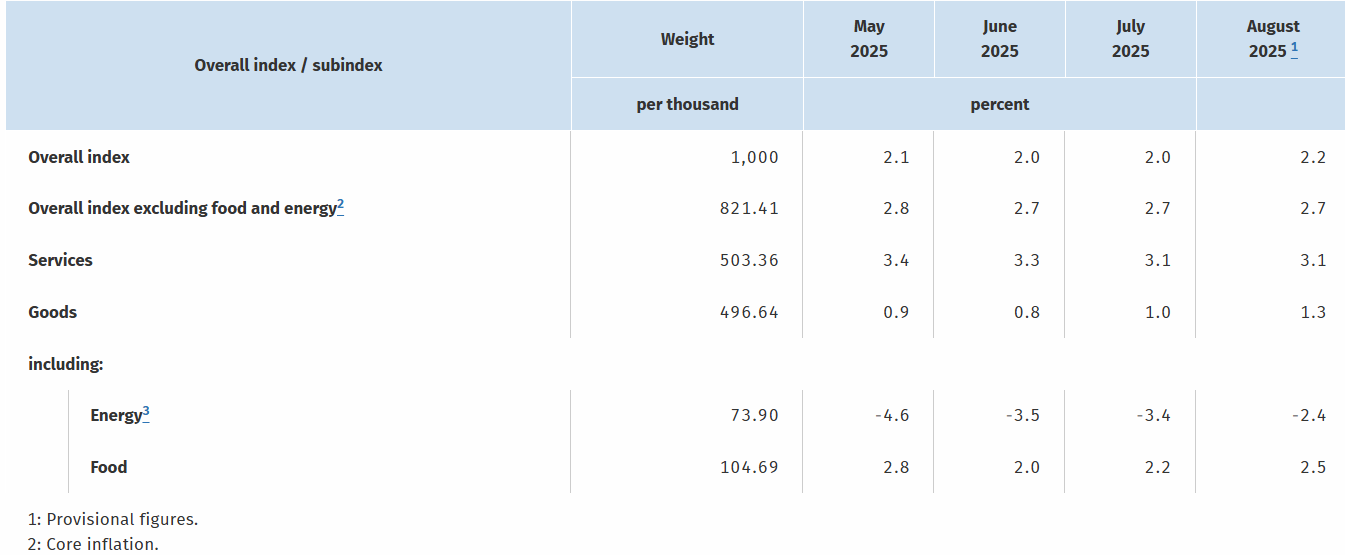

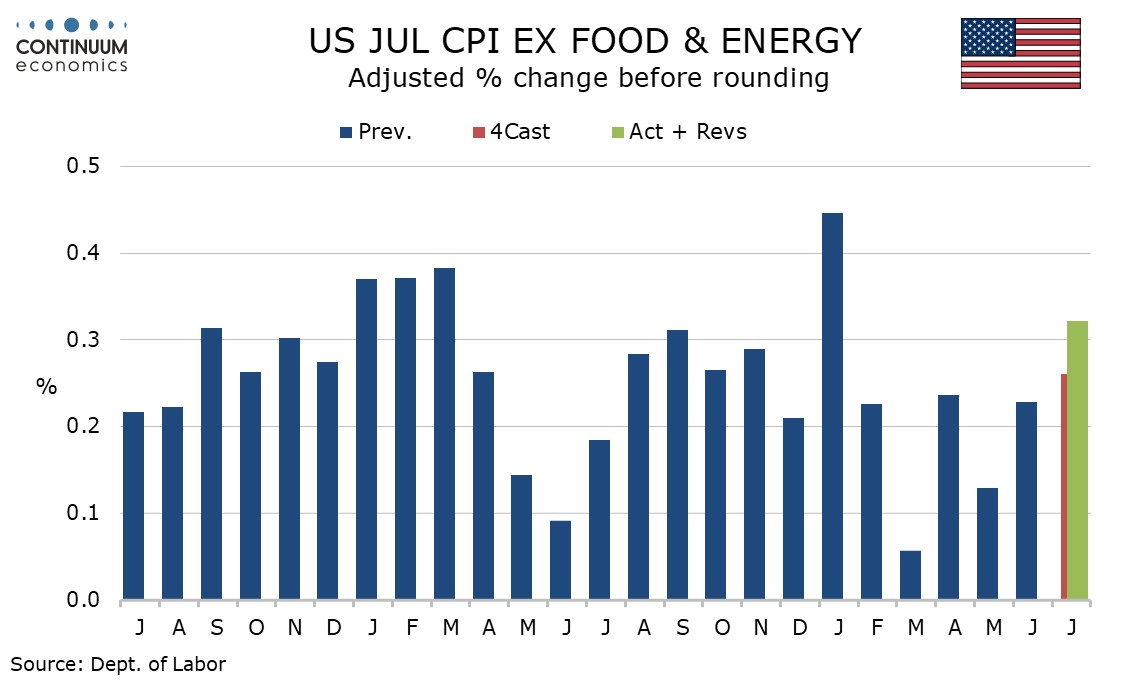

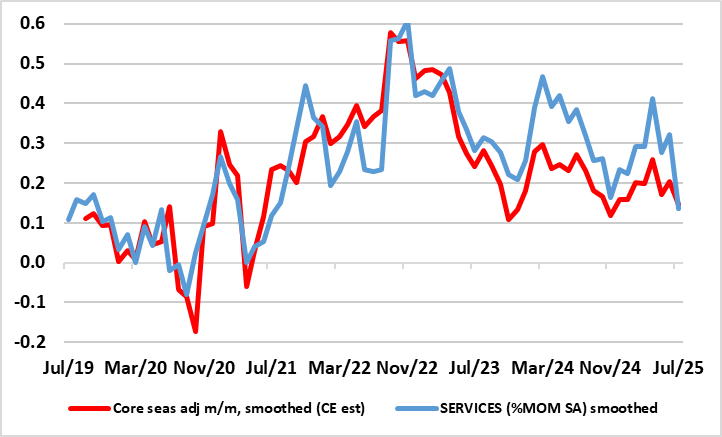

U.S. July CPI - Core rate, particularly services, a marginal disappointment

August 12, 2025 1:02 PM UTC

July’s CPI is in line with consensus at 0.2% overall, 0.3% ex food and energy, but the core rate of 0.322% before rounding is a little high for comfort. The detail shows the acceleration from June was more in services than goods, so the story is not a simple one of tariffs.

U.S. July NFIB survey - Optimism pricks up, inflationary signals slip

August 12, 2025 11:48 AM UTC

July’s NFIB index of Small Business Optimism at 100.3 from 98.6 has reached its highest level since February, regaining momentum after a pause in June. Encouragingly, inflationary signals have slipped back after a bounce in June.

August 11, 2025

August 08, 2025

Canada July Employment - A weak month after a strong month

August 8, 2025 12:54 PM UTC

Canada’s surprisingly strong June employment report has been followed by a significant correction lower in July, with a fall of 40.8k to follow a rise of 83.1k, Full time work is negative over the two months, a 51.0k fall after a 13.5k increase, while part time work with a rise of 10.3k extended a

August 07, 2025

U.S. Initial Claims moving higher again. Few inflationary scares in Q2 Productivity and Costs report

August 7, 2025 12:59 PM UTC

Initial claims at 226k from 219k have now seen two straight gains after six straight losses. The 4-week average of 220.75k is the lowest since April 19 but looks unlikely to fall further. Q2 productivity and costs data does not do anything to add to inflation fears at the Fed.

.

August 05, 2025

June US trade deficit falls on weak imports, Canada trade deficit increases on one-time imports bounce

August 5, 2025 1:02 PM UTC

June’s US trade deficit of $60.2bn is even lower than expected, down from $71.7bn in May and in slipping marginally below April’s $60.3bn has reached its lowest level since September 2023. Exports fell by 0.5%, a second straight decline, but imports fell by 3.7%, a third straight fall as strong

August 04, 2025

EZ HICP and Jobs Review: Headline at Target as Services Inflation at Fresh Cycle-low

August 4, 2025 8:25 AM UTC

HICP, inflation – still at target – is very much a side issue for the ECB at present, albeit with the likes of oil prices and tariff retaliation and a low but far from authoritative jobless rate (Figure 3) possibly accentuating existing and looming Council divides. Regardless, despite adverse

August 01, 2025

U.S. July ISM Manufacturing - Deliveries lead slowing, inflationary signals less strong

August 1, 2025 2:27 PM UTC

July’s ISM manufacturing index of 48.8 is the weakest since October 2024 and unexpectedly down from 49.0 in June. The sharpest fall in the composite breakdown was in delivery times, to 49.3 from 54.2, and that implies reduced inflationary pressures.

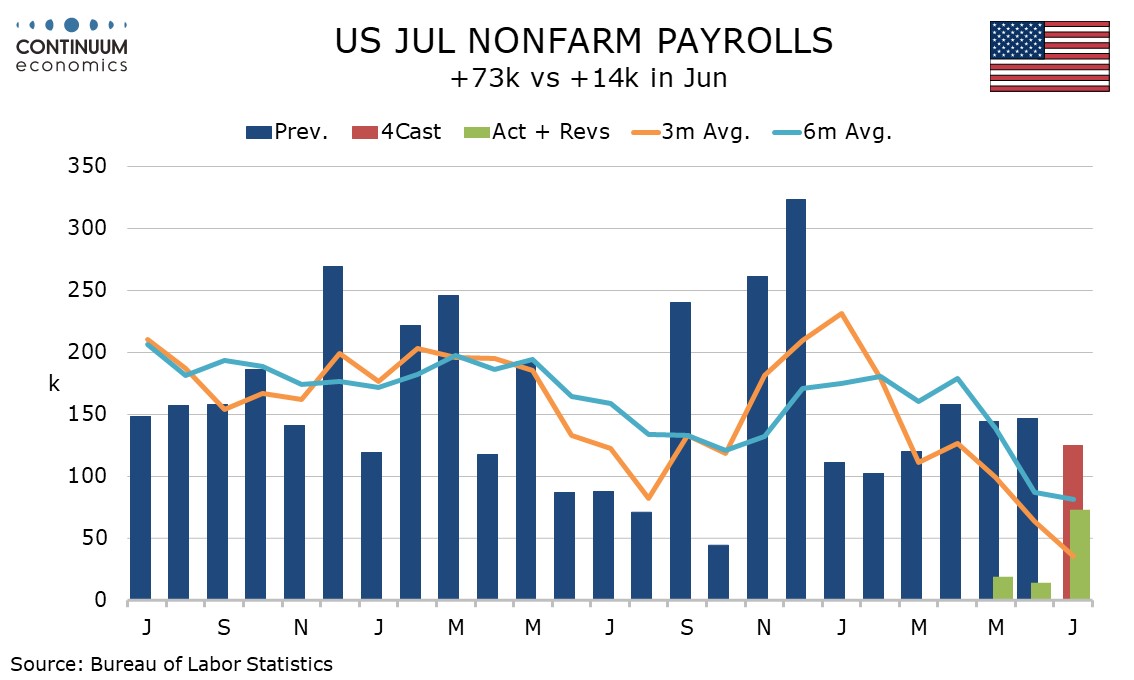

U.S. July Employment - Revisions to May and June mean trend has slowed significantly

August 1, 2025 1:06 PM UTC

July’s non-farm payroll is weaker than expected not only with the 73k headline and 83k rise in the private sector, but also with large downward revisions totaling 258k for May and June. Unemployment remains low but edged up to 4.2% from 4.1% while average hourly earnings were on consensus at 0.3%,

July 31, 2025

U.S. Initial Claims still low, Employment Cost Index still firm, Q2 income and spending totals confirmed

July 31, 2025 1:03 PM UTC

Initial claims with a 1k rise to 218k may have marginally broken a string of six straight declines but are lower than expected, while a 0.9% rise in the Q2 employment cost index is stronger than expected, further signaling continued labor markets strength. June’s personal income and spending repor

German Data Review: Services Inflation Slows Further?

July 31, 2025 12:39 PM UTC

Germany’s disinflation process continues, with the lower-than-expected July preliminary HICP numbers reinforcing this pattern, with a 0.2 ppt drop to 1.8%, a 10-mth low (Figure 1)! This occurred in spite of adverse energy base effects. Regardless, there was some reversal of June’s surprise and