U.S. June PPI - Soft data partially offset by revisions but services are leading a slowing in trend

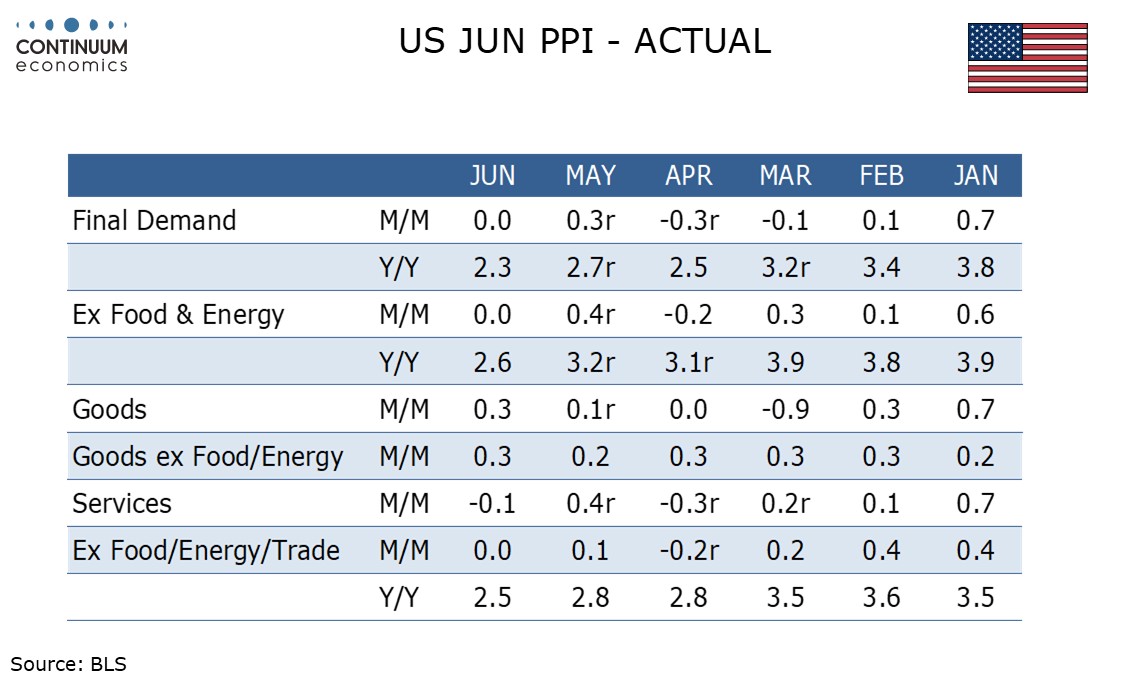

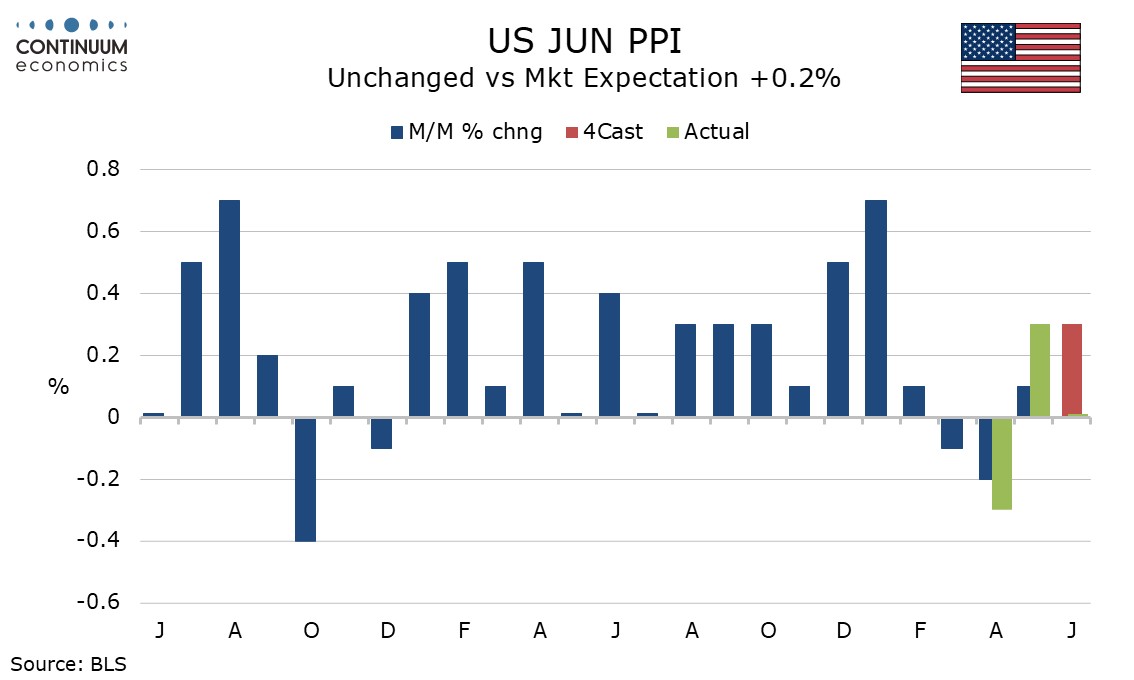

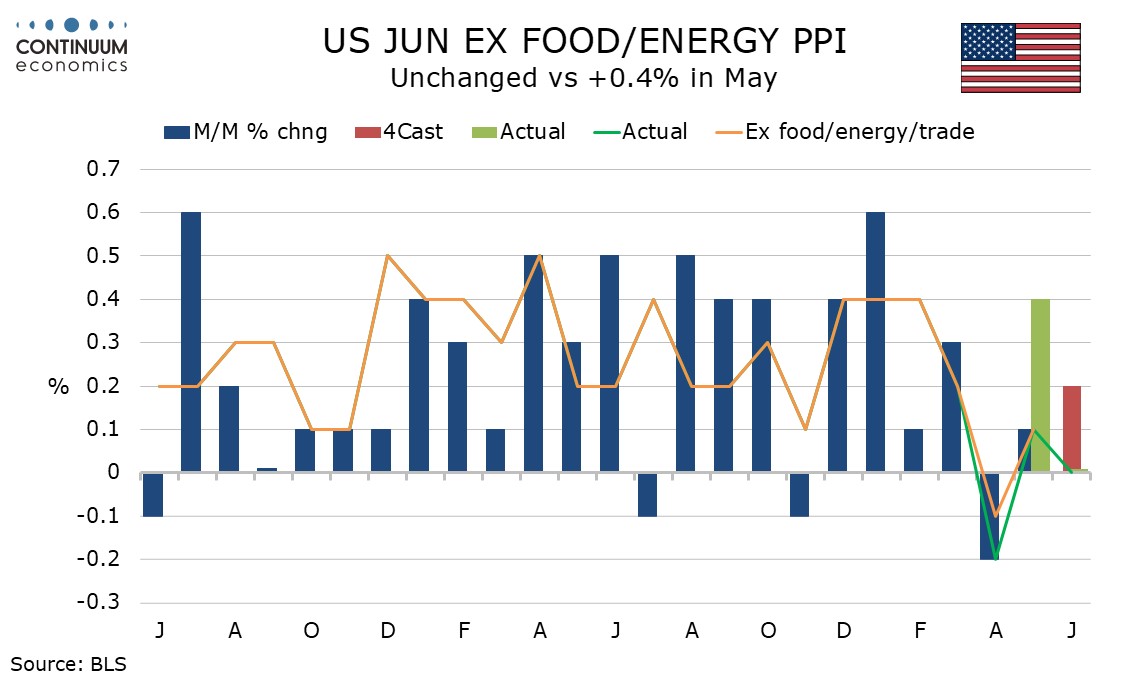

June PPI is, like most recent months softer than expected, unchanged overall and in the core rates ex food and energy and ex food, energy and trade. However consistent with most recent months the preceding month has been revised higher, May to 0.3% overall from 0.1% and ex food and energy to 0.4% overall from 0.1%, though May’s ex food, energy and trade data is unrevised at 0.1%.

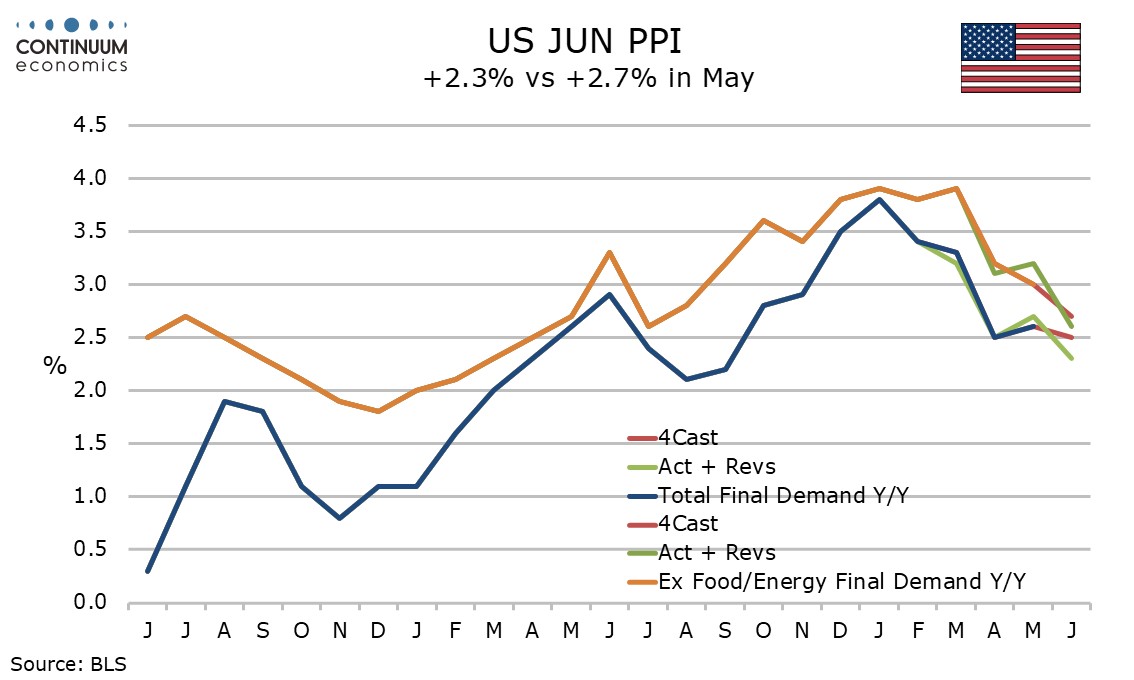

The pattern of softer than expected data offset by upward revisions is becoming persistent, and adds to questions over the reliability of US data given recent cuts to budgets. Ex food energy and trade data does appear to have seen a clear slowing in trend, with no rise above 0.2% in the last four months after seeing three straight gains of 0.4% in December, January and February.

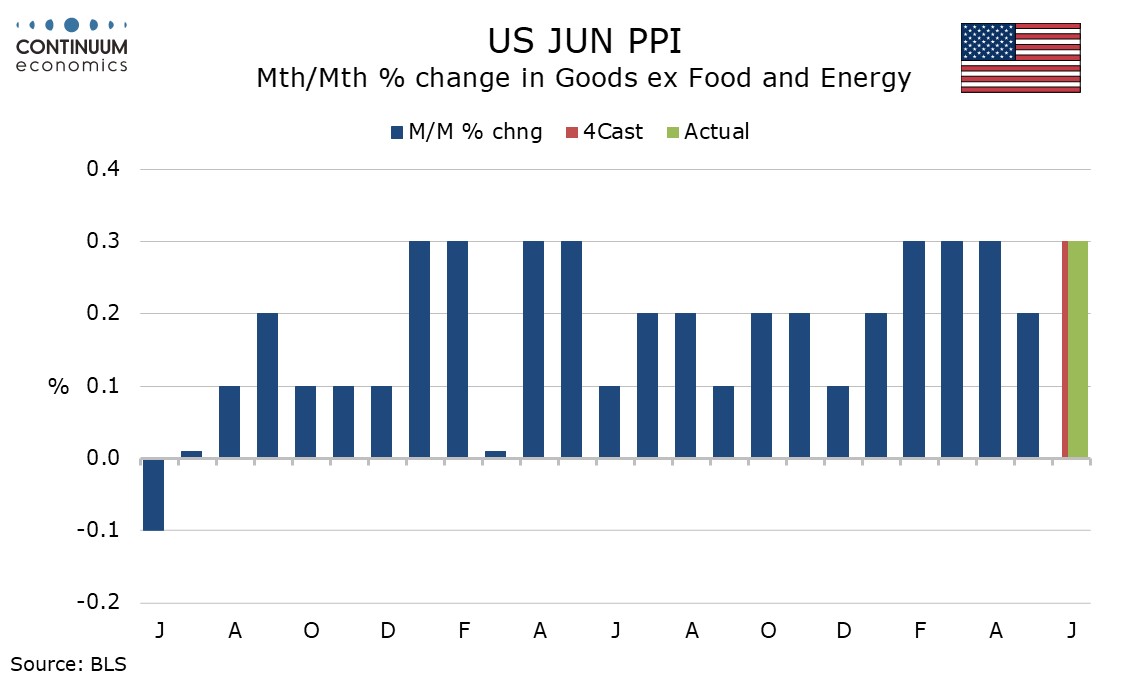

Goods less food and energy are seeing a somewhat firm picture, with June’s gain of 0.3% following a 0.2% rise in May, gains of 0.3% in February, March and April which followed a 0.2% rise in January. Each of the last six month have seen gains of 0.2% or 0.3%. The final six months of 2024 saw gains of either 0.1% or 0.2% in goods ex food and energy, suggesting some upward pressure is coming from tariffs.

Food saw a subdued 0.2% rise, the first gain since eggs-led surges from November through February, maintaining a soft recent profile that has been in place since a strong bounce was seen in January. June’s 0.2% rise however came despite a 19.8% fall in eggs, meaning strong data elsewhere. Energy rose by 0.6%, a modest gain after four straight declines.

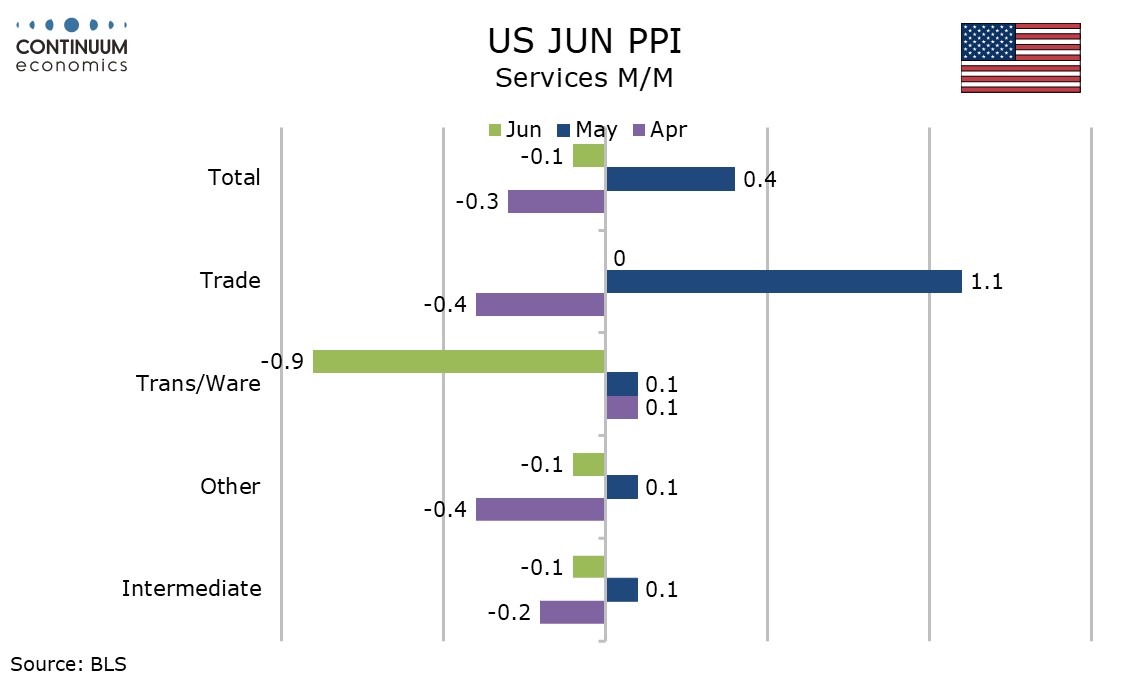

Services have been the reason why overall trend has slowed significantly since January, and were particularly soft in June, falling by 0.1%. Transportation and warehousing led the fall with a 0.9% decline, but trade prices were unchanged and others services, the largest category, fell by 0.1%.

Intermediate data shows processed goods up only 0.1% with ex food and energy unchanged but unprocessed goods rose by 0.7% with a 1.1% rise ex food and energy, neither fully erasing a May decline. Intermediate services remain soft with a 0.1% decline, and have been subdued since a 0.6% rise in December.

Yr/yr PPI growth of 2.3% from 2.7% is the slowest since September 2024 with ex food and energy at 2.6% from 3.2% the slowest since July 2024. Ex food, energy and trade at 2.5% from 2.8% is the slowest since November 2023. Despite some strength in goods, services are causing trend to slow.