U.S. June Retail Sales, Weekly Initial Claims, July Philly Fed - Economy regaining momentum in the tariff pause

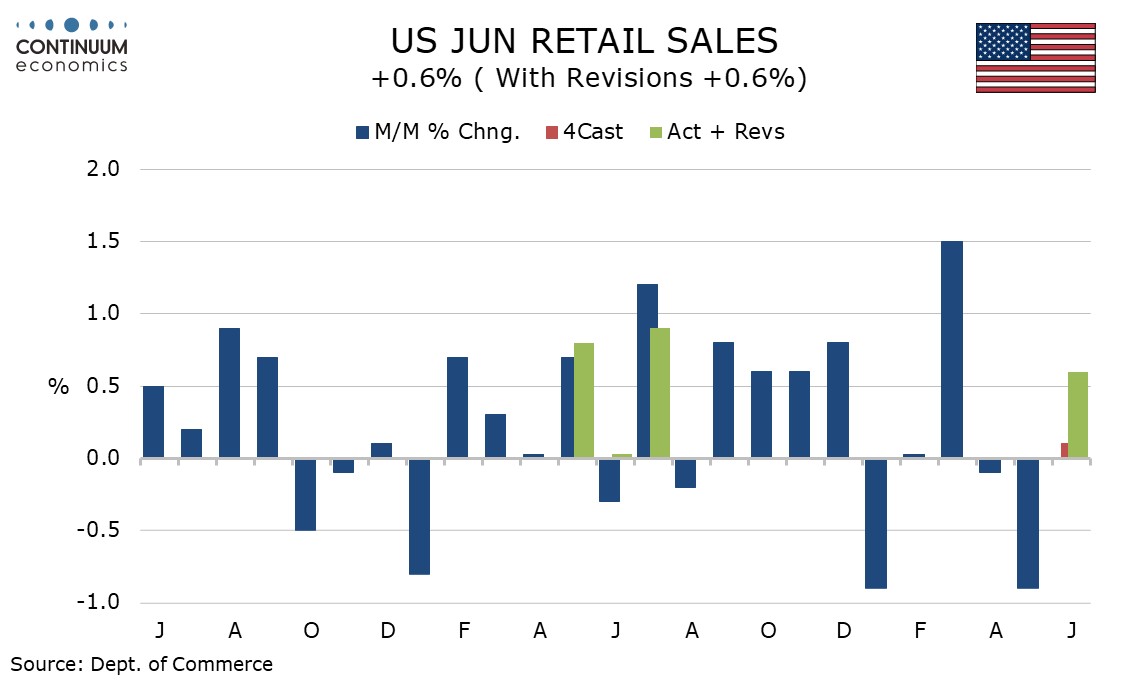

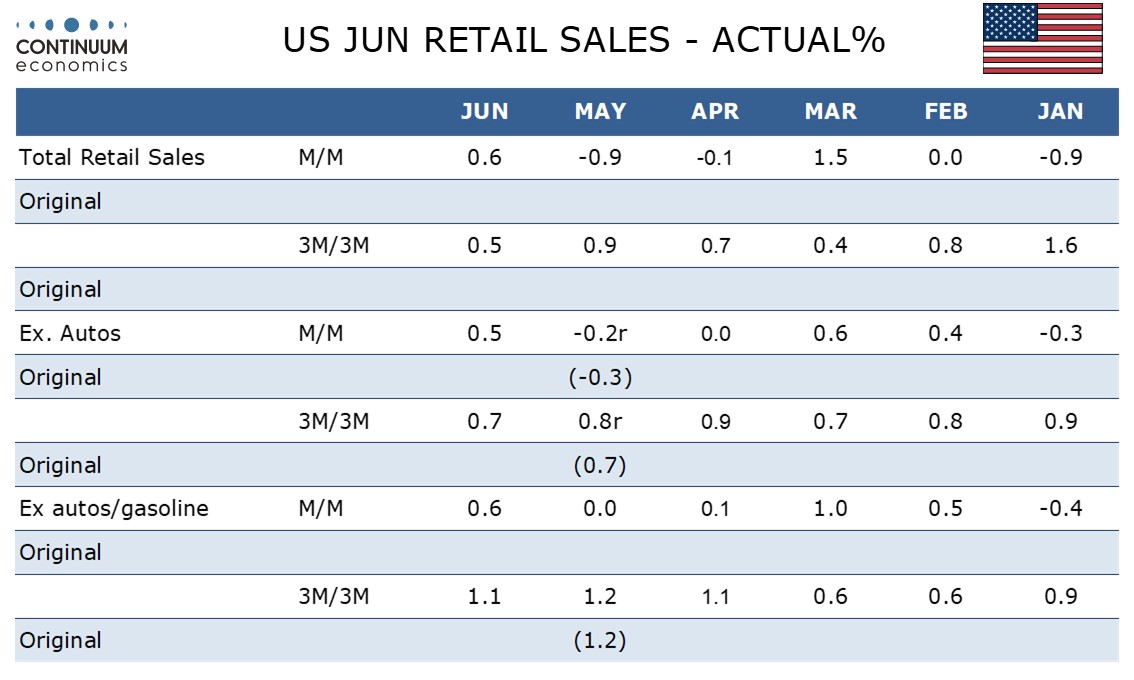

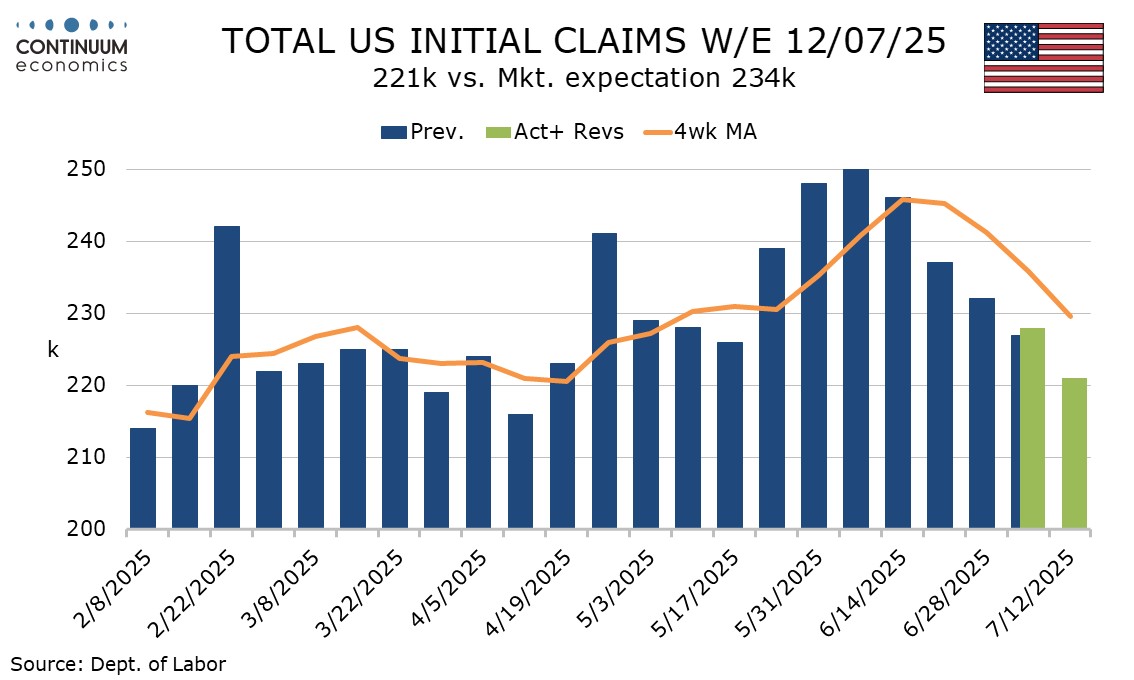

The latest US data presents a picture of an economy regaining some momentum as tariff fears fade, at least temporarily. June retail sales with gains of 0.6% overall and ex auto and gas, with ex autos and the control group which contributes to GDP both up 0.5%, ended Q2 on a firm note. July’s Philly Fed manufacturing survey at 15.9 from -4.0 turned positive, as did Empire State data on Tuesday, while initial claims at 221k from 228k saw a fifth straight decline, in the survey week for July’s payroll.

The retail sales gain was broad based with few components standing out strongly. The gain fails to fully erase a 0.9% May decline, which followed a 0.1% decline in April, while sales ex autos and gasoline were near flat in April and May. This suggests a recovery in consumer sentiment in June after the hit equities took on tariff risks in April.

3m/3m rates look solid, with overall sales at 0.5% (not annualized) from 0.4% in Q2, ex auto sales at 0.7% in both Q1 and Q2 while sales ex autos and gasoline rose by 1.1% in Q2, up from 0.6% in Q1. Q1 data saw some restraint from bad weather in January, but Q1 ended on a firm note with a strong March which saw Q2 starting up from Q1’s average.

Initial claims are the lowest since April 12, while the 4-week average of 229.5k is the lowest since May 3. Initial claims started to pick up in April after the tariff announcement but have now seen five straight declines. The 4-week average is down significantly from 245.75k in June’s payroll survey week, and 231k in May’s, though still above the 221k seen in April’s.

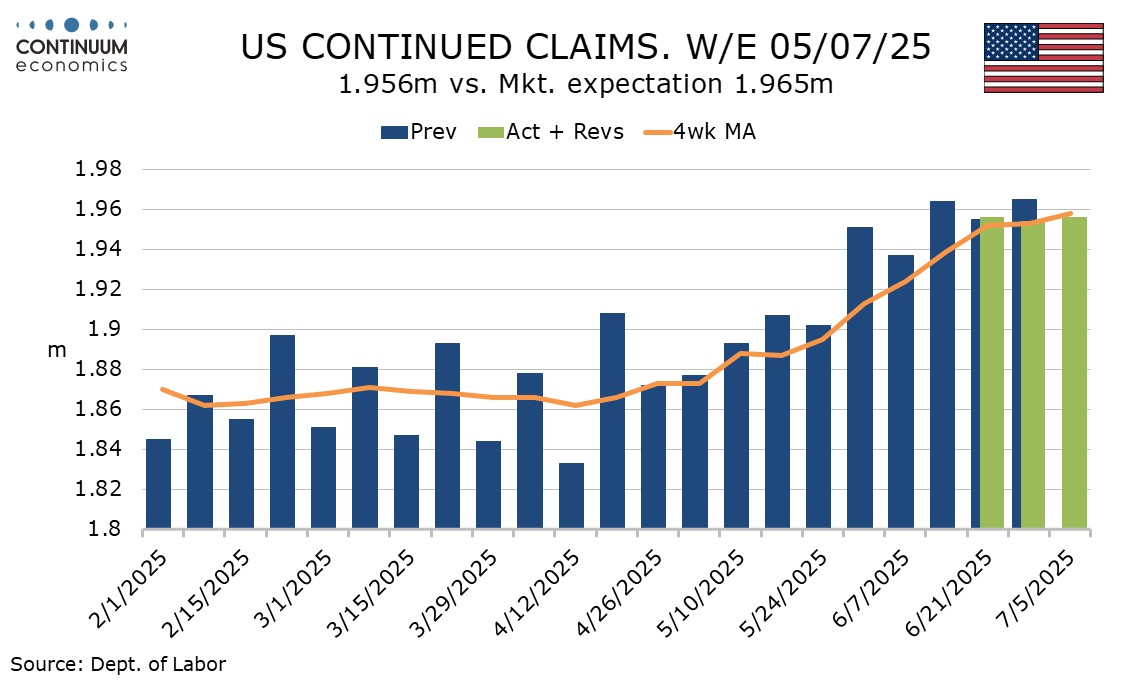

Continued claims cover the week before initial claims. The latest outcome of 1.956m is up by 2k but the preceding number was revised down to 1.954m from 1.965m. An uptrend is losing momentum, but unlike initial claims, is not yet reversing.

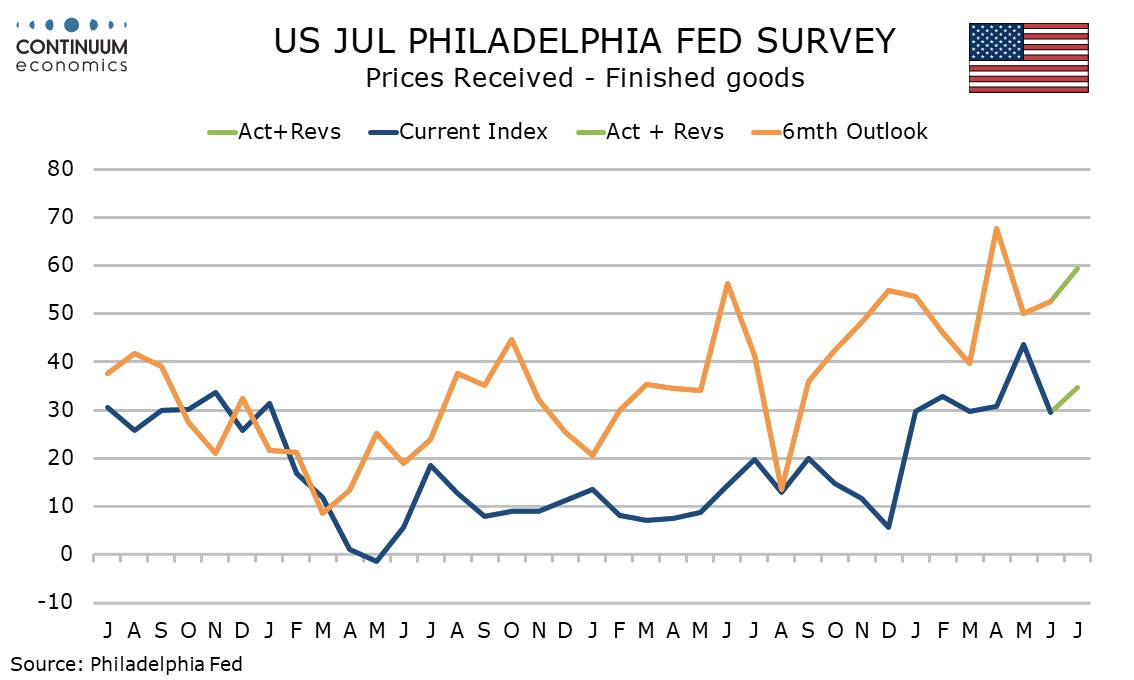

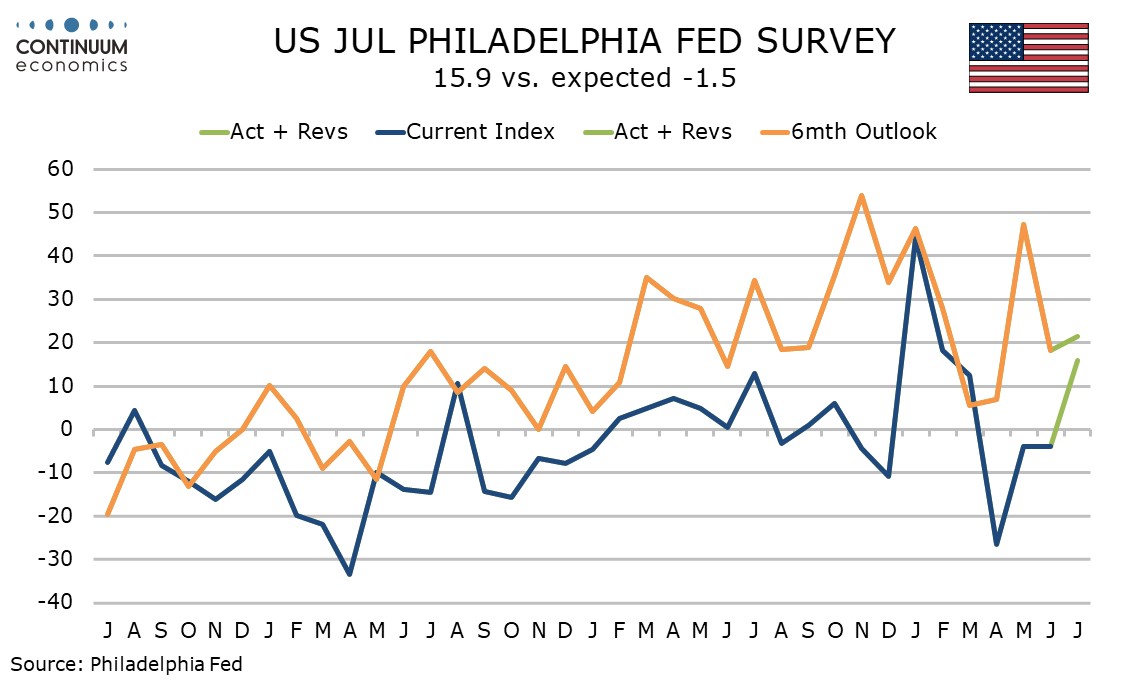

July’s Philly Fed survey shows broad based improvement in current activity, with the headline at 15.9 from -4.0, new orders at 18.4 from 2.3 and employment at 10.3 from -9.8. Six month expectations for activity saw a modest improvement to 21.5 from 18.3.

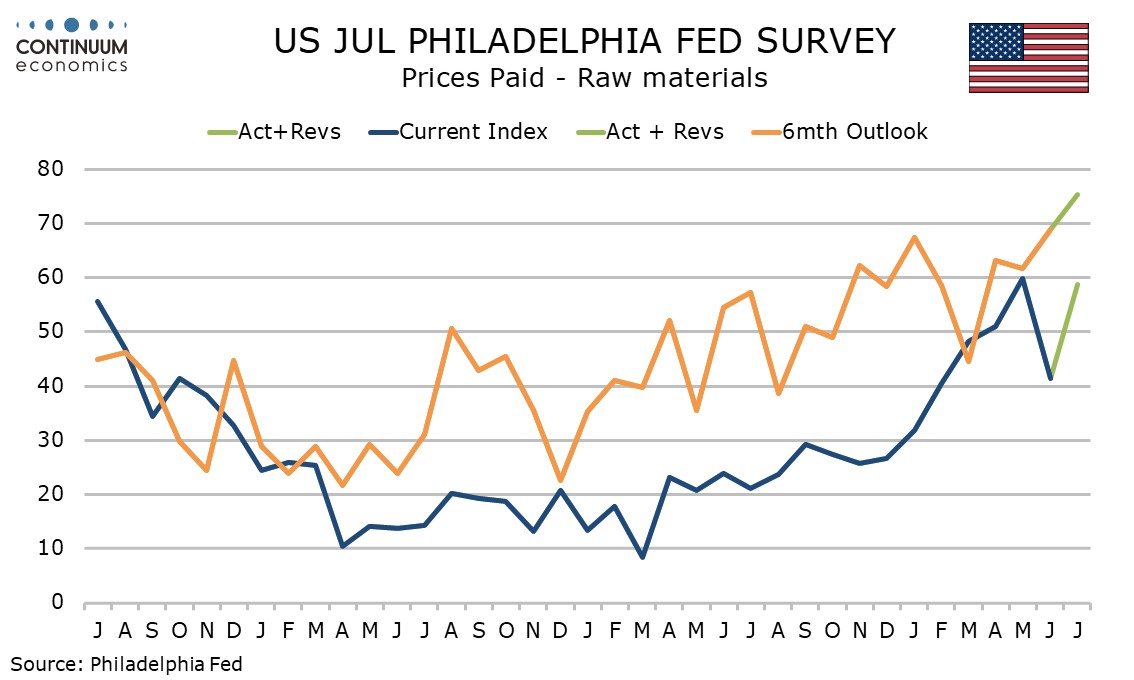

Price data was generally firm, with current month prices paid at 58.8 from 41.4, and current month prices received at 34.8 from 29.5, though both were below May’s respective levels of 59.8 and 43.6.

6-montb expectations for prices paid at 75.3 from 68.9 are the highest since January 2022. June retail sales with a 0.9% decline are slightly weaker than expected. 6-month expectations for prices received at 34.8 are up from 29.5 in June but still below May’s 43.6.