U.S. June ISM Services - Hit from tariffs shows signs of fading

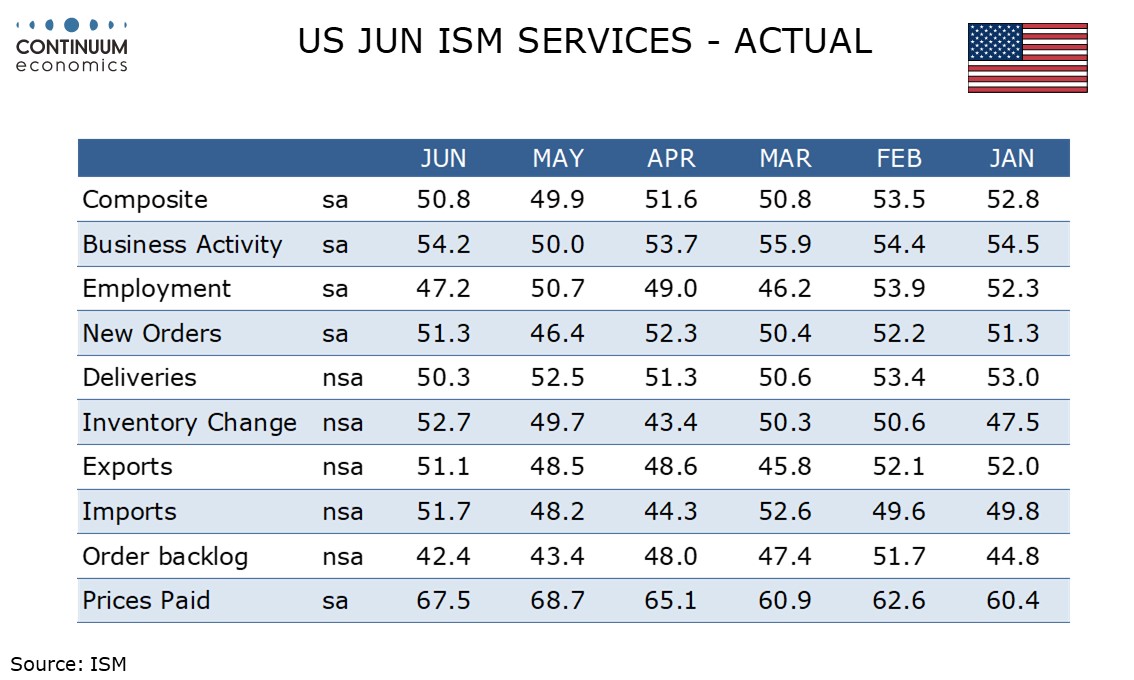

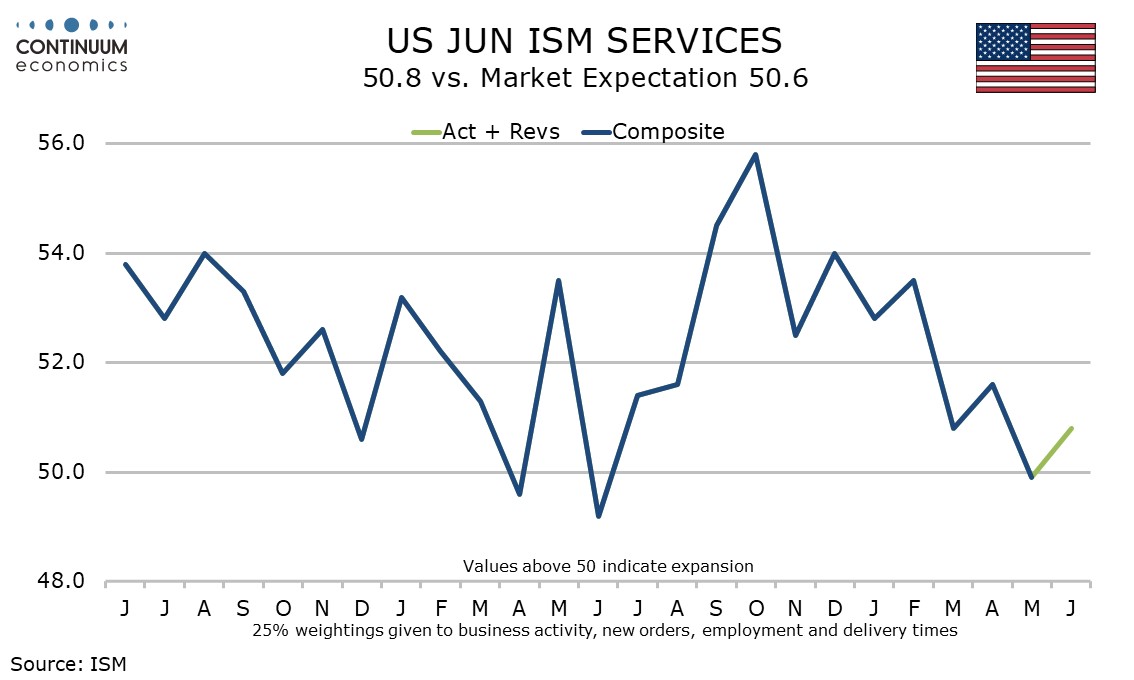

June’s ISM services index of 50.8 from 49.9 has rebounded above neutral after falling to 49.9 in May but is still quite subdued. Detail shows bounces from weakness in May in business activity and new orders but slippage in employment and delivery times restrained the composite.

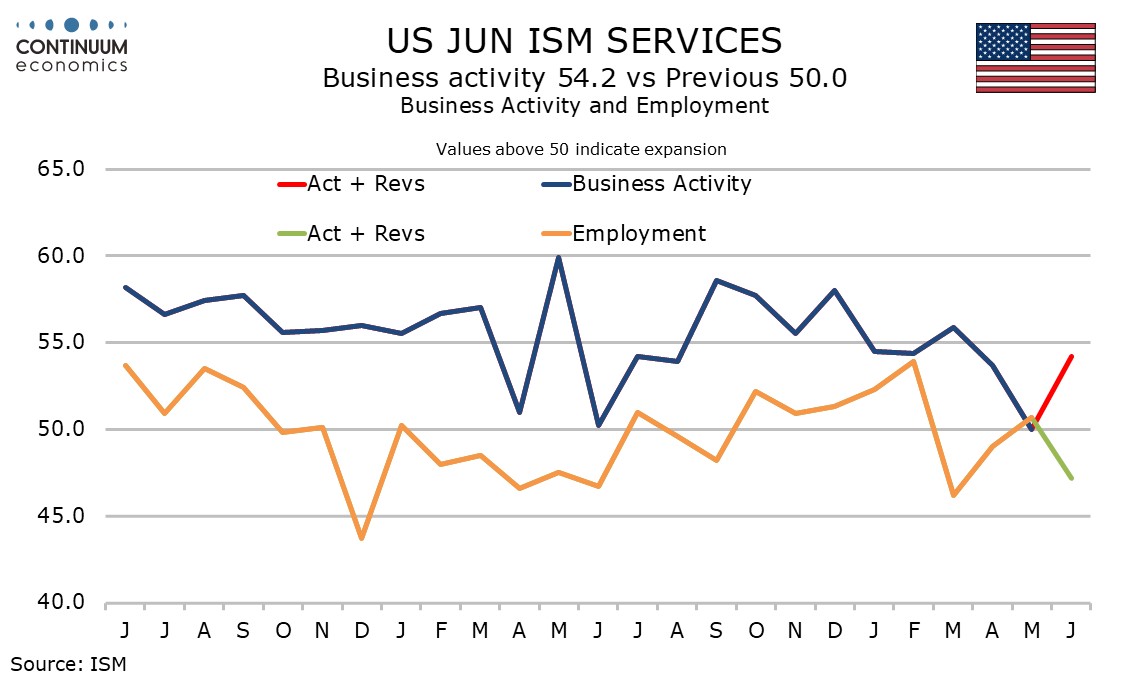

Business activity at 54.2 is up from 50.0 in May and even above April’s 53.7. New orders at 51.3 are up significantly from May’s very weak 46.4 but still below April’s 52.3. Seasonal adjustments for each of these indices were more supportive in June but gains after May dips were seen even before seasonal adjustment.

The other two components of the composite slipped, employment to 47.2 from 50.7 and deliveries to 50.3 from 52.5. Employment saw tougher seasonal adjustments but still weakened before seasonal adjustment, while deliveries are not seasonally adjusted.

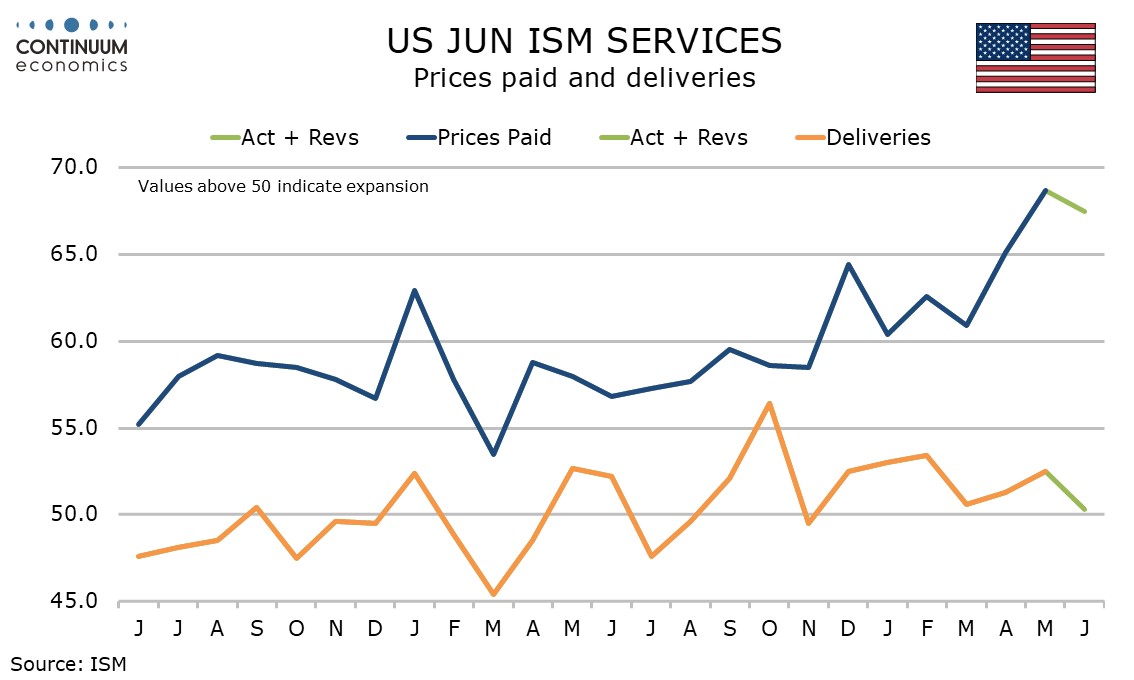

Prices paid do not contribute to the composite and remain firm if marginally less so at 67.5 from 68.7, which was the highest since November 2022. Tariffs are still causing inflationary concerns.

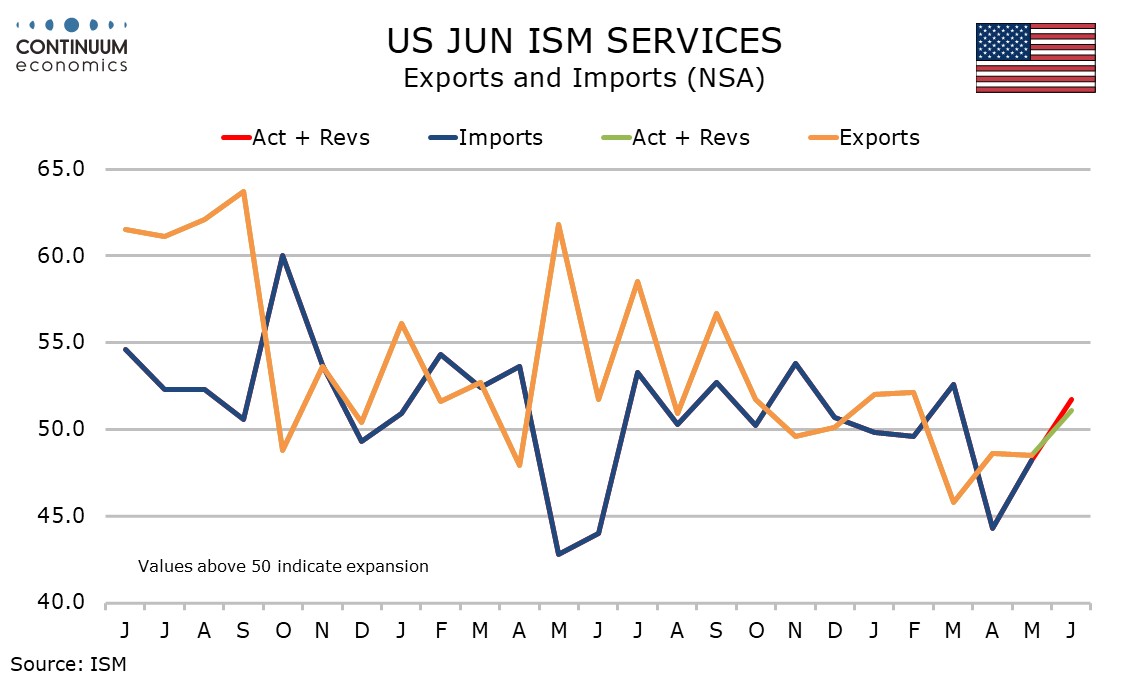

As in the ISM manufacturing survey, exports and imports saw some recovery from recent weakness, exports to 51.1 from 48.5, its first positive reading since February, while imports rose to 51.7 from 48.2, the first positive reading since March.

These readings suggests tariffs may provide only a temporary hit to trade while the gains in new orders and business activity suggest activity may see only a temporary hit too. Prices paid however suggest a sustained lift to prices.