U.S. July Retail Sales - Resilieint entering Q3

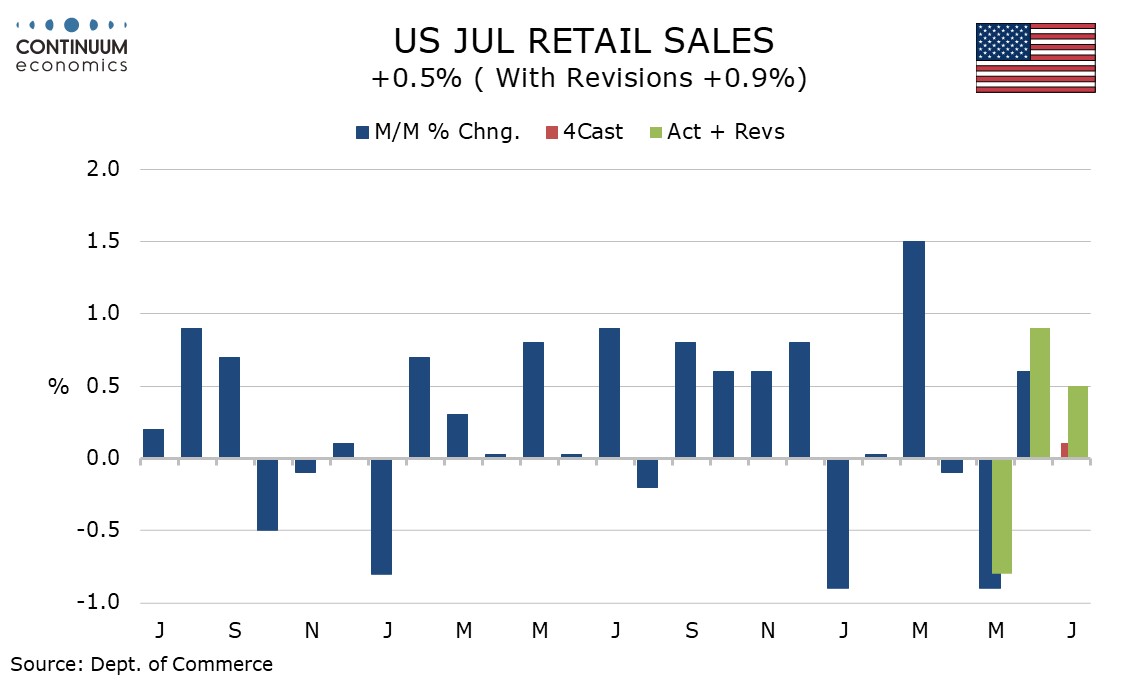

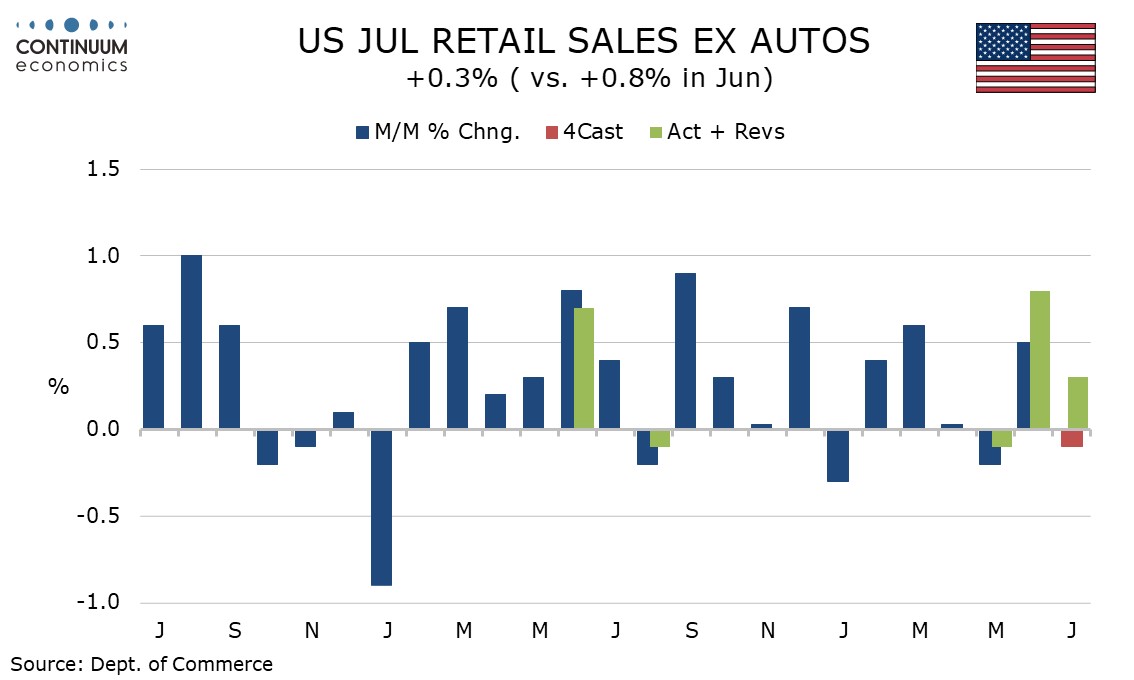

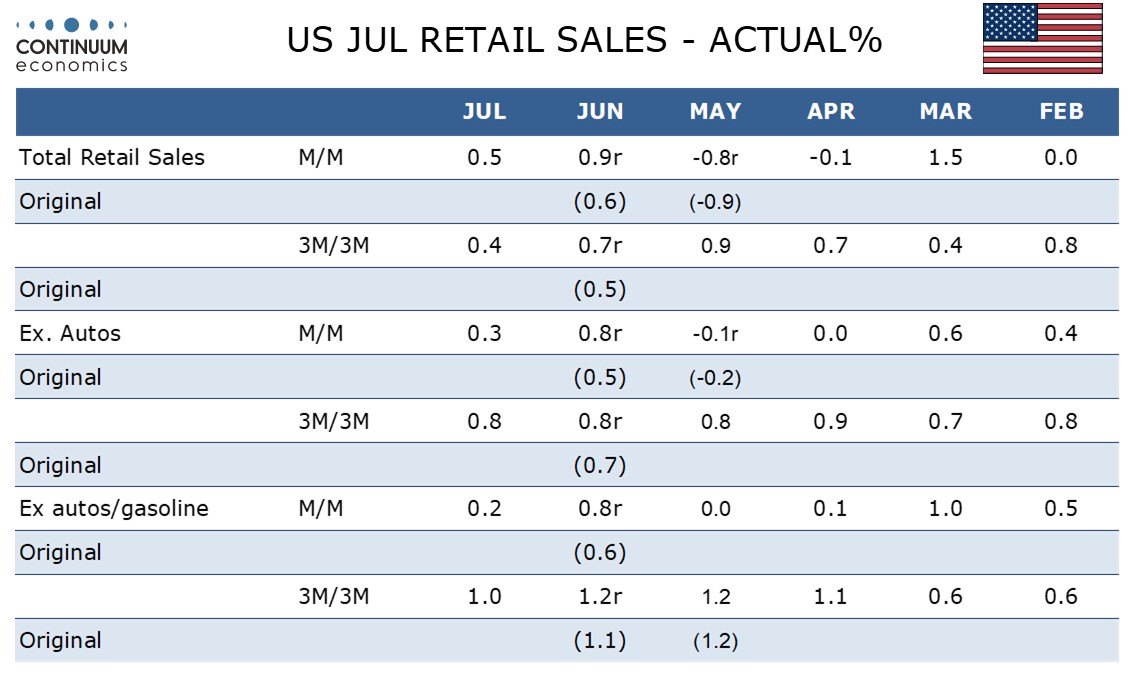

July retail sales with a 0.5% increase are in line with expectations, with net upward revisions totaling 0.4%. Ex auto sales rose by 0.3% also with 0.4% in upward revisions while ex auto and gasoline sales rose by 0.2%, here with revisions of only 0.2%. The data suggest consumer spending is holding up at the start of Q3 despite slowing employment growth.

Sales slipped in April and May which might be related to stock market slippage in the aftermath of the Liberation Day tariff announcement, but the decline was reversed in June as equities rebounded, and now extended further in July. While July’s payroll gain was subdued a rise in the workweek did suggest a respectable rise in personal income for the month.

The rise ex auto and gasoline is unimpressive but does follow a 0.8% increase in June. Gasoline sales saw a rise despite price slippage. Non-durable goods generally showed moderate gains though eating and drinking places (counted as services in the GDP report) were weak with a 0.4% decline. Durables were mixed with gains exceeding 1.0% in autos and furniture but slippage in building materials and electronics.

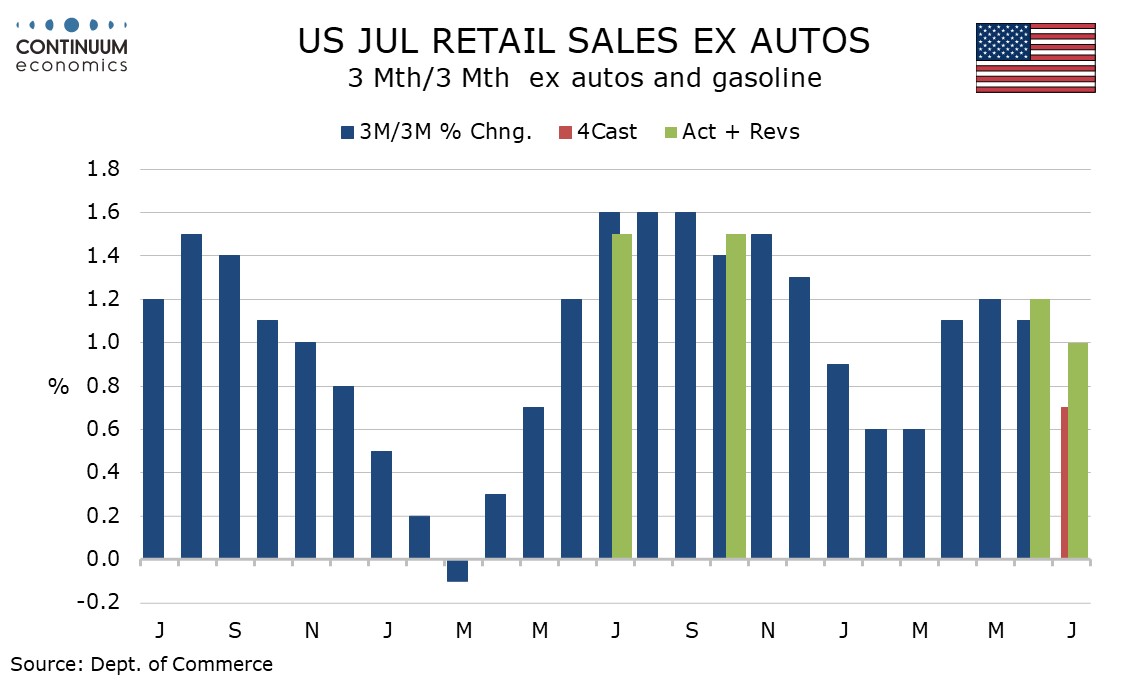

3 month/3 month growth is modest overall at 0.4% (not annualized) but should pick up in August when May’s sharp fall drops out. Ex autos the pace is solid at 0.8% and ex auto and gasoline firmer still at 1.0%.

Should employment growth slow further there are downside risks to consumer spending going forward, but this data suggests growth persists at the start of Q3, with the economy not looing threatened by recession at this point.