U.S. July ISM Manufacturing - Deliveries lead slowing, inflationary signals less strong

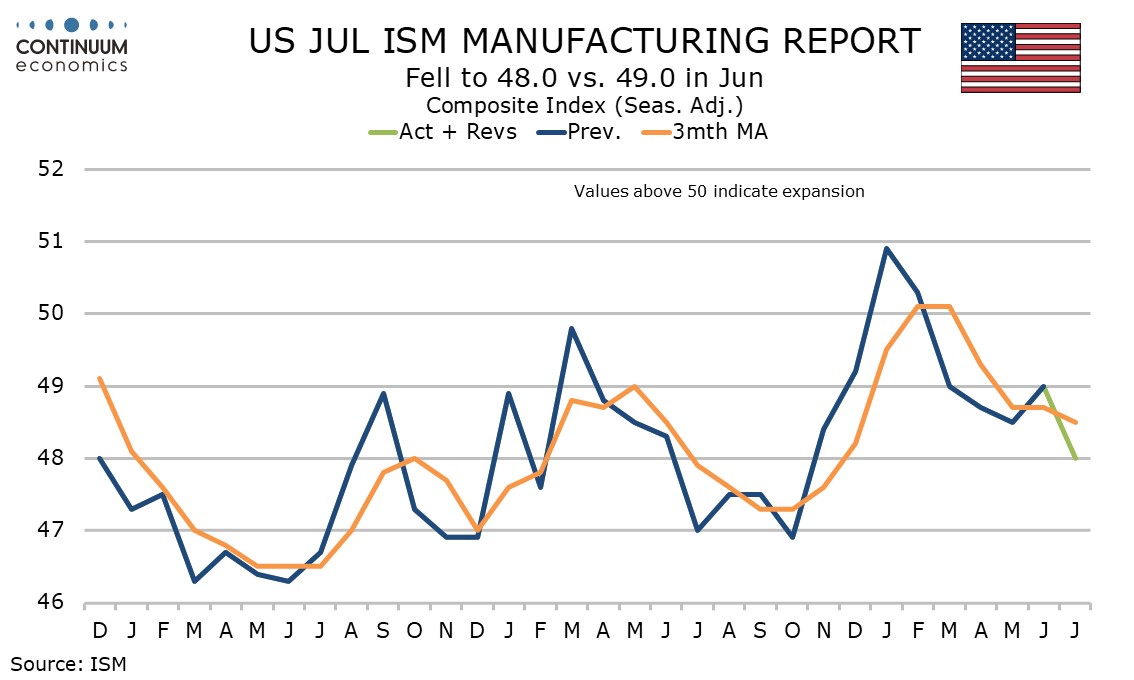

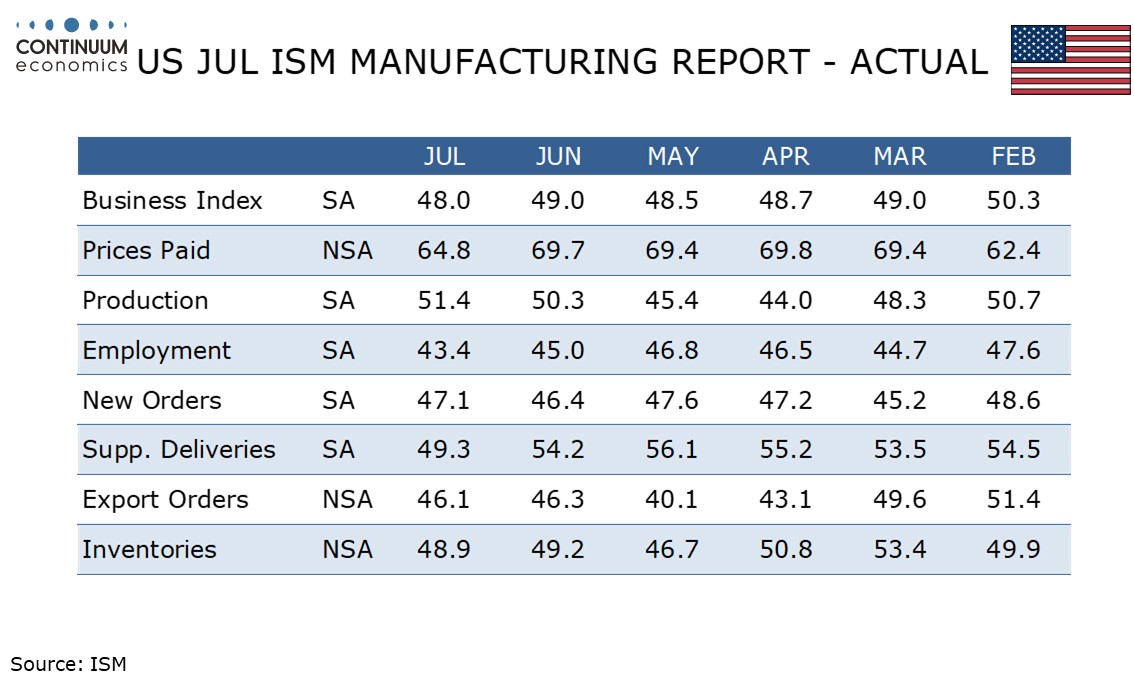

July’s ISM manufacturing index of 48.8 is the weakest since October 2024 and unexpectedly down from 49.0 in June. The sharpest fall in the composite breakdown was in delivery times, to 49.3 from 54.2, and that implies reduced inflationary pressures.

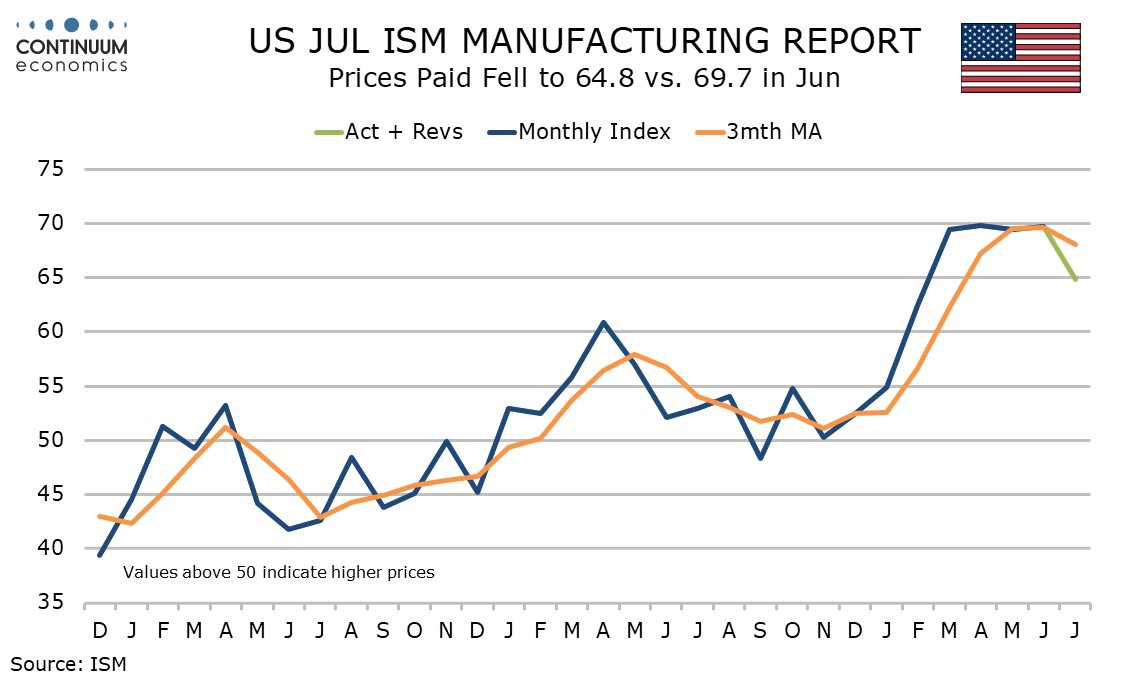

Prices paid also fell, to a 5-month low of 64.8, from 69.7, implying some easing of a tariff-led bounce in the first half of the year, but prices paid do not contribute to the composite.

Two of the five components that contribute to the composite were slightly firmer, production at 51.4 from 50.3 and new orders at 47.1 from 46.4. Inventories saw a marginal dip to 48.9 from 49.2. Employment at 43.4 from 45.0 is the weakest since June 2020 during the pandemic.

Exports and imports do not contribute to the composite and were little changed, exports at 46.1 from 46.3 and imports at 47.6 from 47.4, but this sustains the correction from extreme weakness seen in May, of 40.1 for exports and 39.9 for imports.

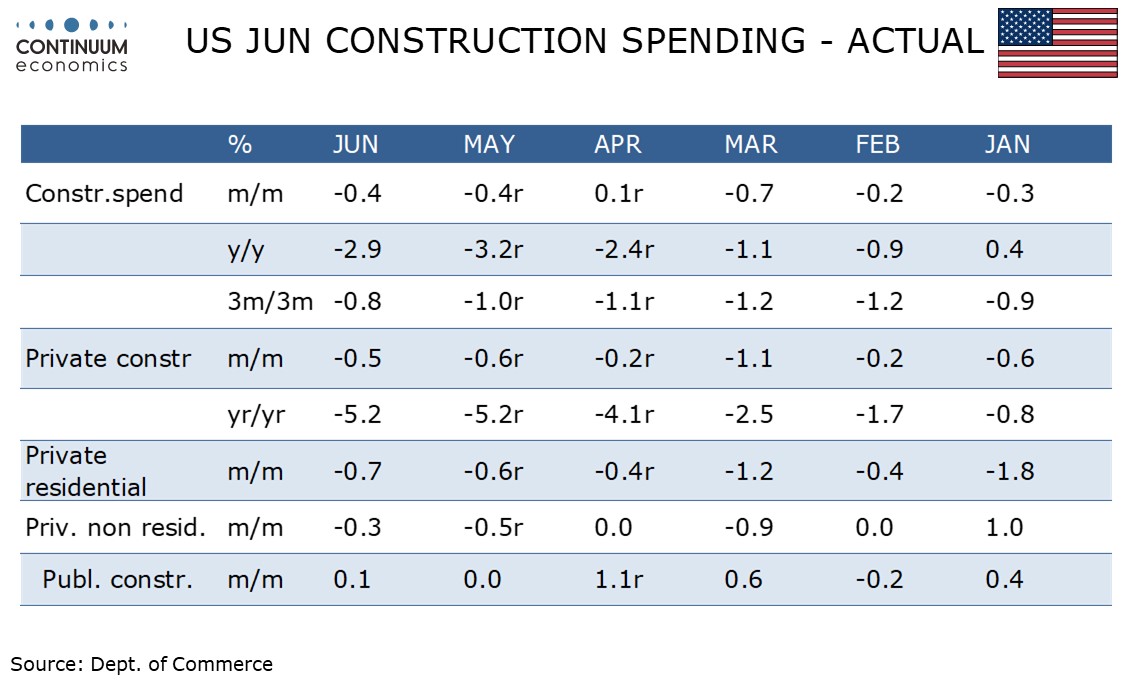

June construction spending saw a second straight decline of 0.4% with private sector data negative in both months but the public sector near flat.

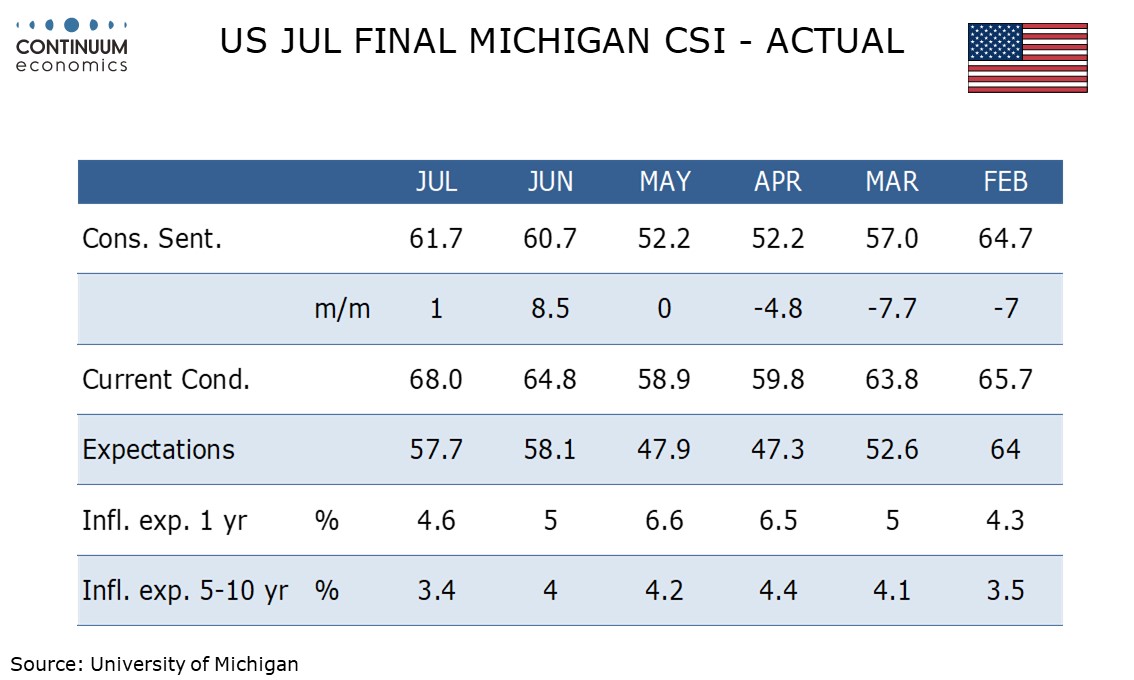

July’s final Michigan CSI of 61.7 was almost unrevised from the preliminary 61.8 but current conditions were revised up and expectations revised down. The 5-10 year inflation view of 3.4% was revised down from 3.6% in the preliminary, and is the lowest since January, well off the 4.4% high seen in April.