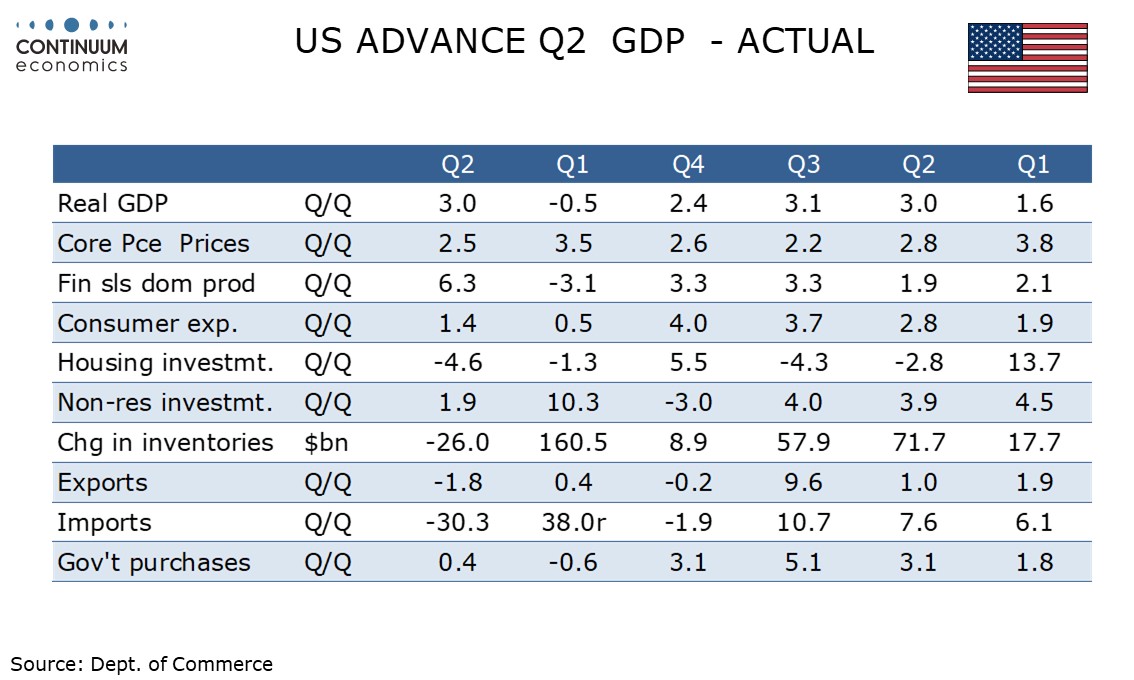

U.S. Q2 GDP - Subdued underlying growth, but with persistent price pressures

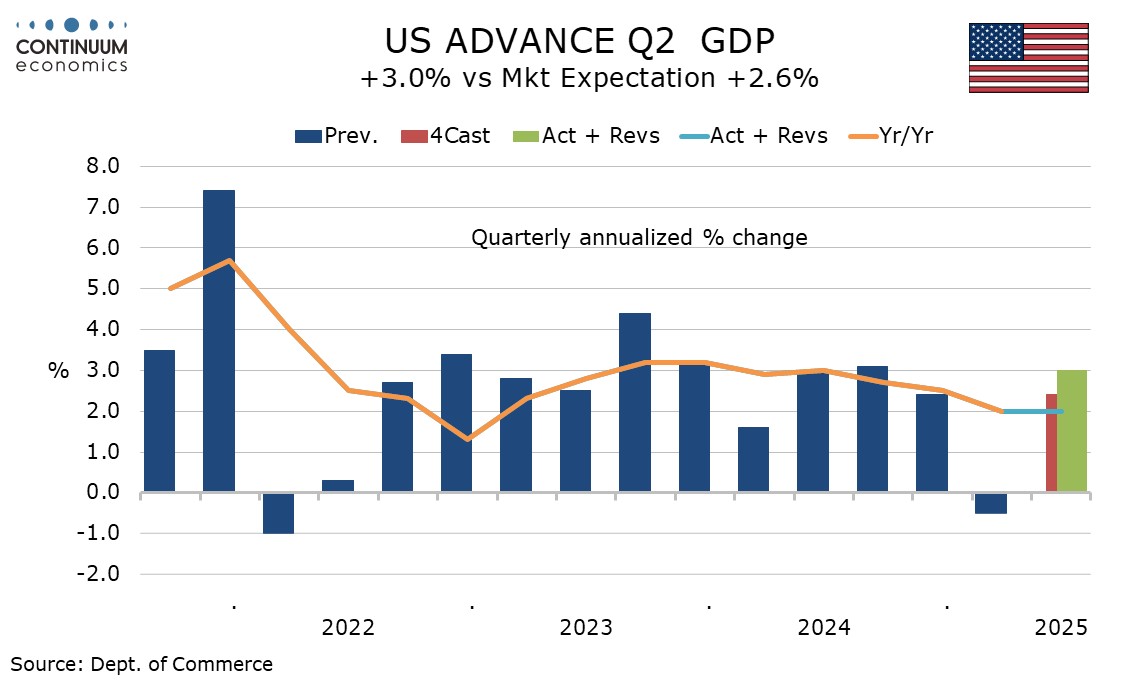

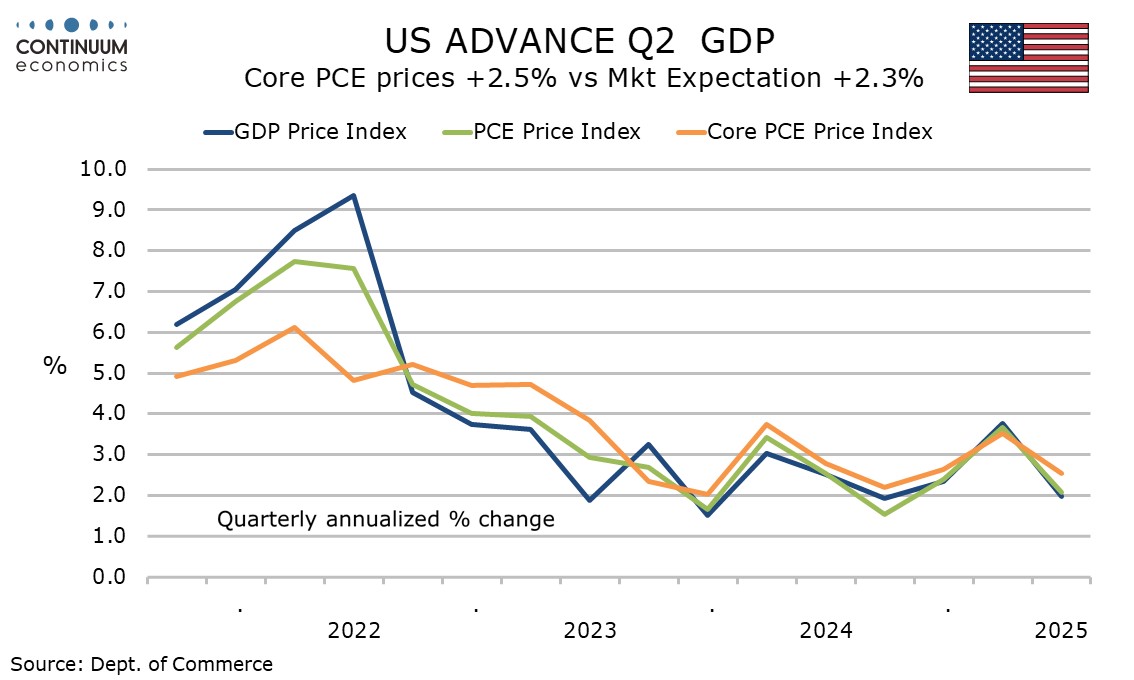

The advance estimate of Q2 GDP at 3.0% is stronger than expected though an above consensus outcome had looked likely after yesterday’s decline in June’s trade deficit. Given extreme volatility in net exports the Q2 data should be seen alongside Q1’s 0.5% decline, giving an average of an unimpressive 1,25%. Price pressures persist, with a 2.5% rise in core PCE Prices slightly above consensus. The price data suggests the case for Fed easing remains weak.

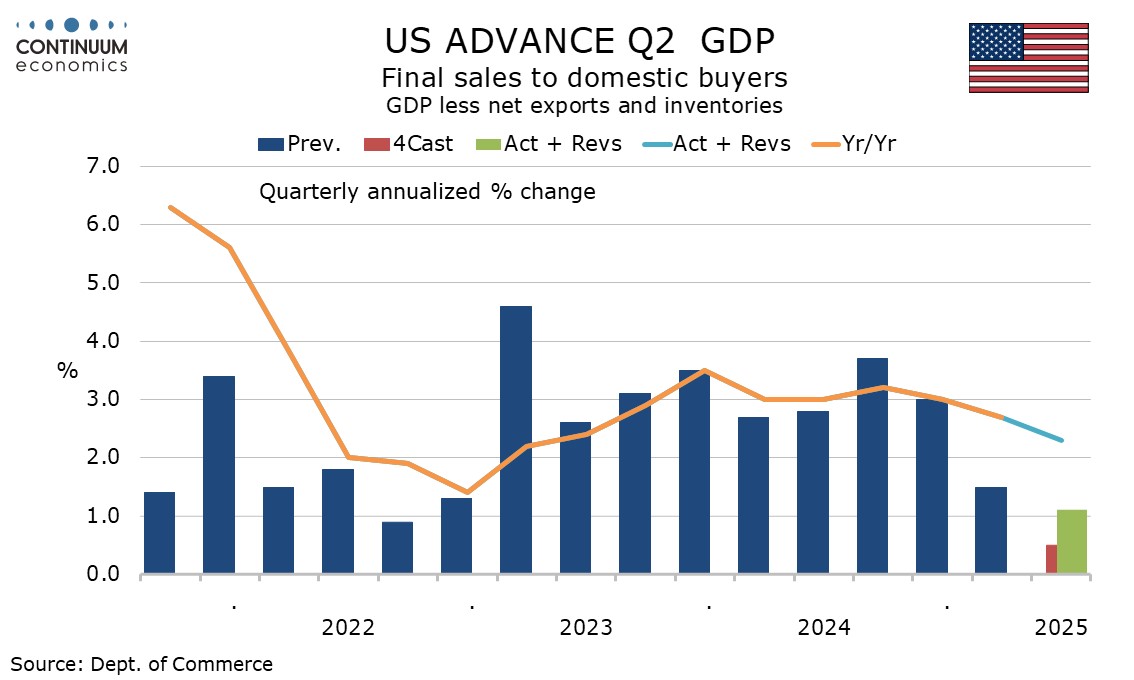

Final sales to private domestic buyers (excluding net exports, inventories and government) saw a modest slowing to 1.2% from 1.8%, while final sales to domestic buyers (excluding net exports and inventories) slowed to 1.1% from 1.5%.

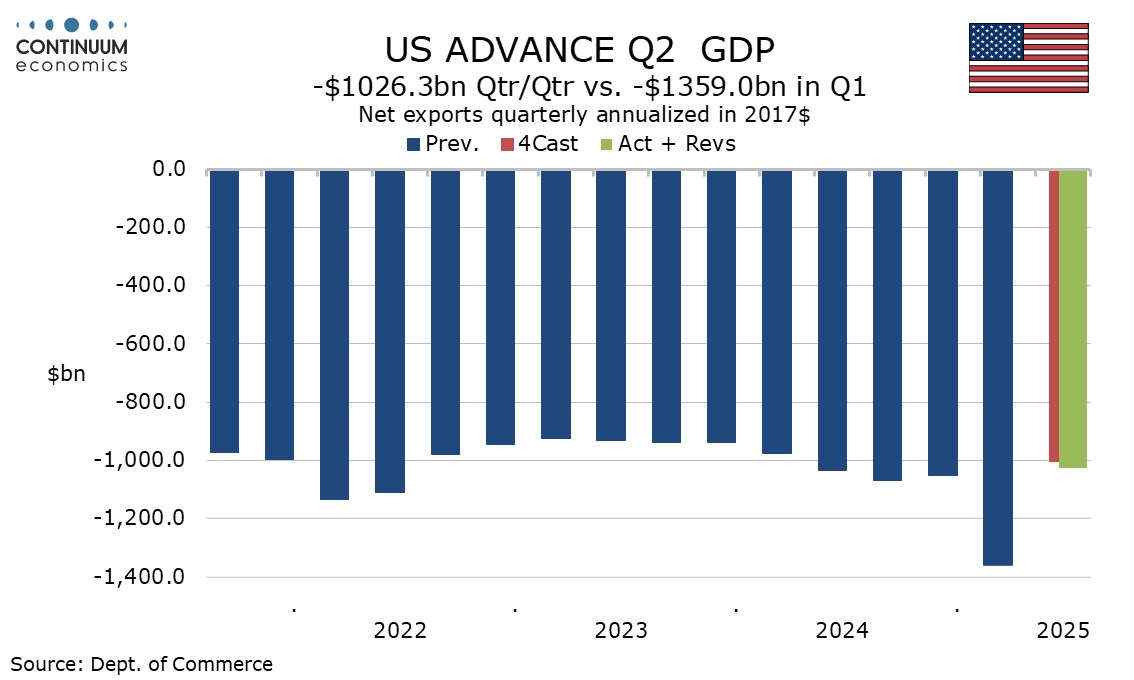

Net exports added 5.0% to GDP after taking off 4.6% in Q1, with imports plunging by 30.3% after a pre-tariff surge of 37.9% in Q1. Exports fell by 1.8% after a 0.4% increase in Q1.

Inventories took 3.2% off Q2 GDP after a 2.6% positive contribution in Q1, though the dip in inventories was not extreme and there is scope for a further negative from inventories in Q3. Final sales (GDP less inventories) surged by 6.3% after a 3.1% decline in Q1.

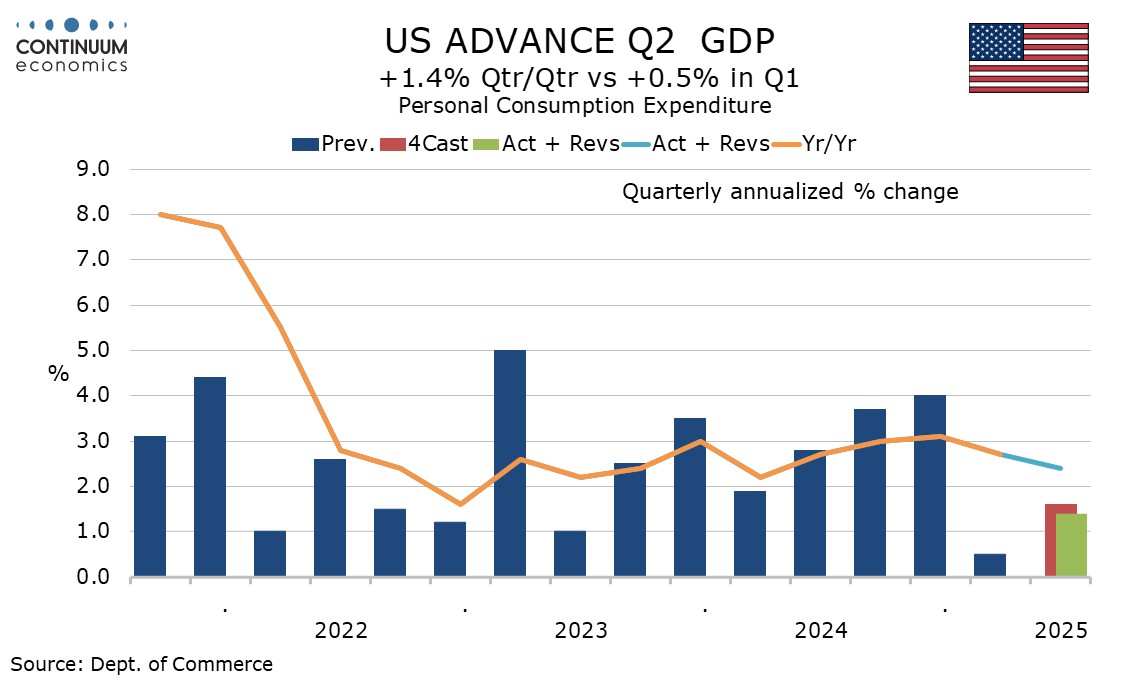

Consumer spending has seen two straight subdued quarters with Q2 rising by 1.4% after a rise of 0.5% in Q1, where weather was a negative. Consumer spending has underperformed real disposable income, which rose by 3.0% in Q2 after a 2.5% increase in Q1, suggesting that consumers can pick up spending if prices are not lifted by tariffs.

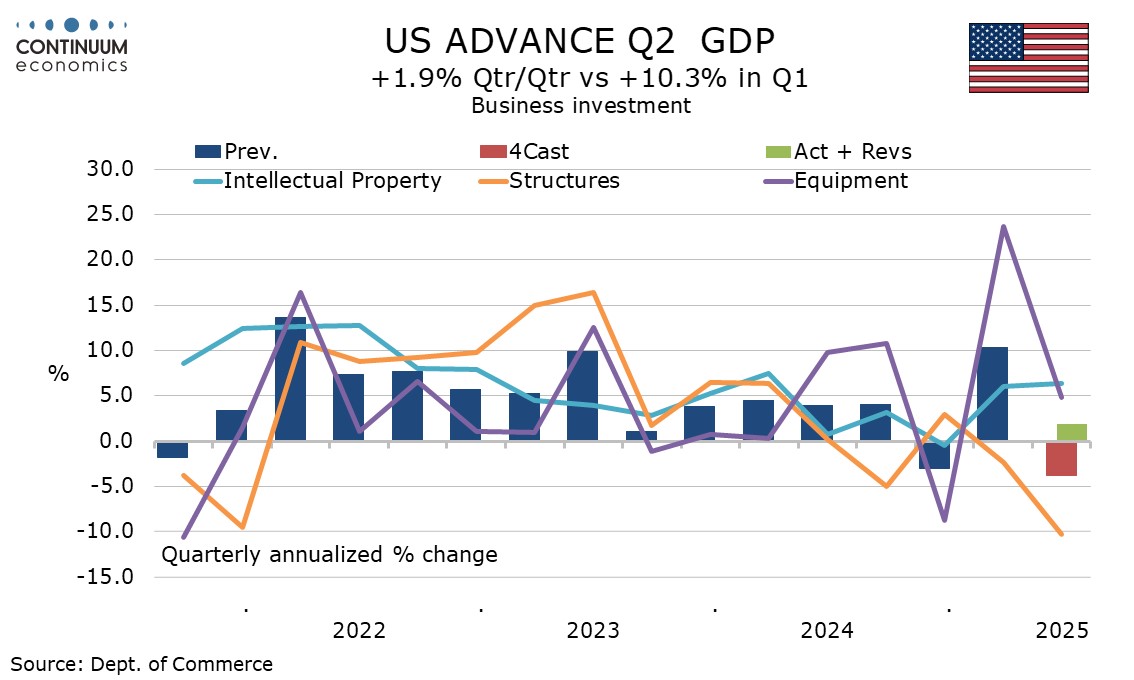

Business investment with a 1.9% rise held up well after a 10.3% surge in Q1. Structures at -10.3% were weak but equipment at 4.8% and intellectual property at 6.4% saw solid gains. Housing at -4.6% however saw a second straight decline.

Government rose by a modest 0.4% after a 0.6% decline in Q1. Federal non-defense spending plunged by 11.2% but defense rose by 2.2% and sate and local rose by 3.0%.

The GDP price index rise by 2.0% and the PCE price index rose by a near target 2.1%, but the core rate at 2.5% remains too high for comfort. The 2.5% Q2 core PCE price index flows a 3.5% rise in Q1 and leaves yr/yr growth at 2.7%.