U.S. Initial Claims moving higher again. Few inflationary scares in Q2 Productivity and Costs report

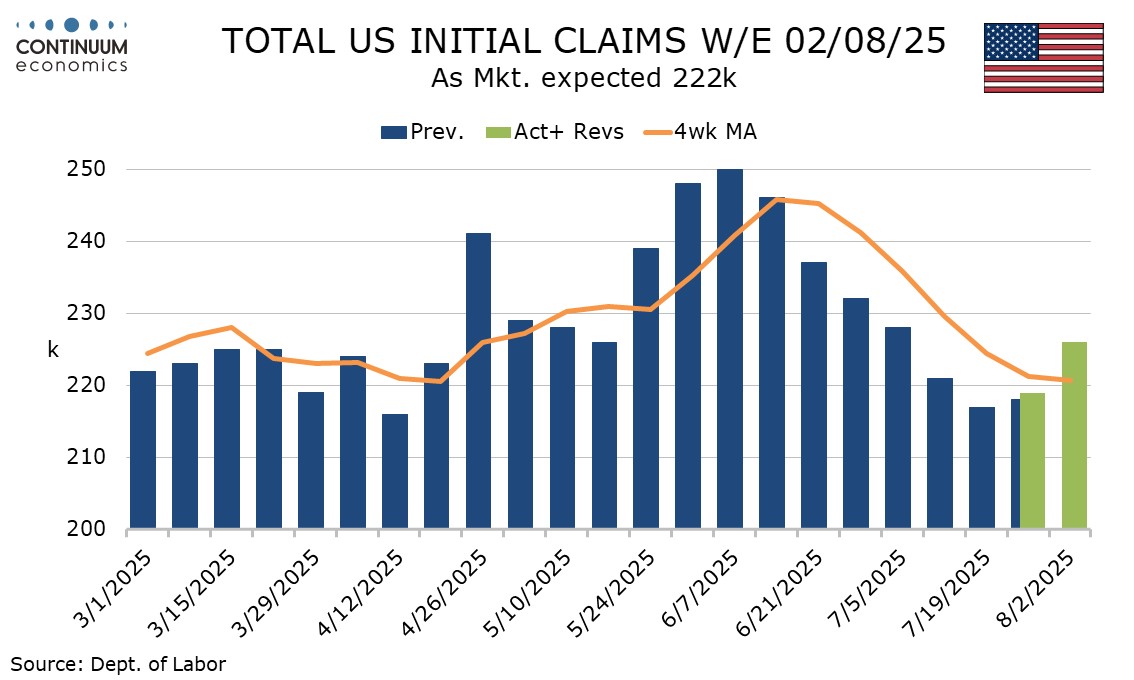

Initial claims at 226k from 219k have now seen two straight gains after six straight losses. The 4-week average of 220.75k is the lowest since April 19 but looks unlikely to fall further. Q2 productivity and costs data does not do anything to add to inflation fears at the Fed.

.

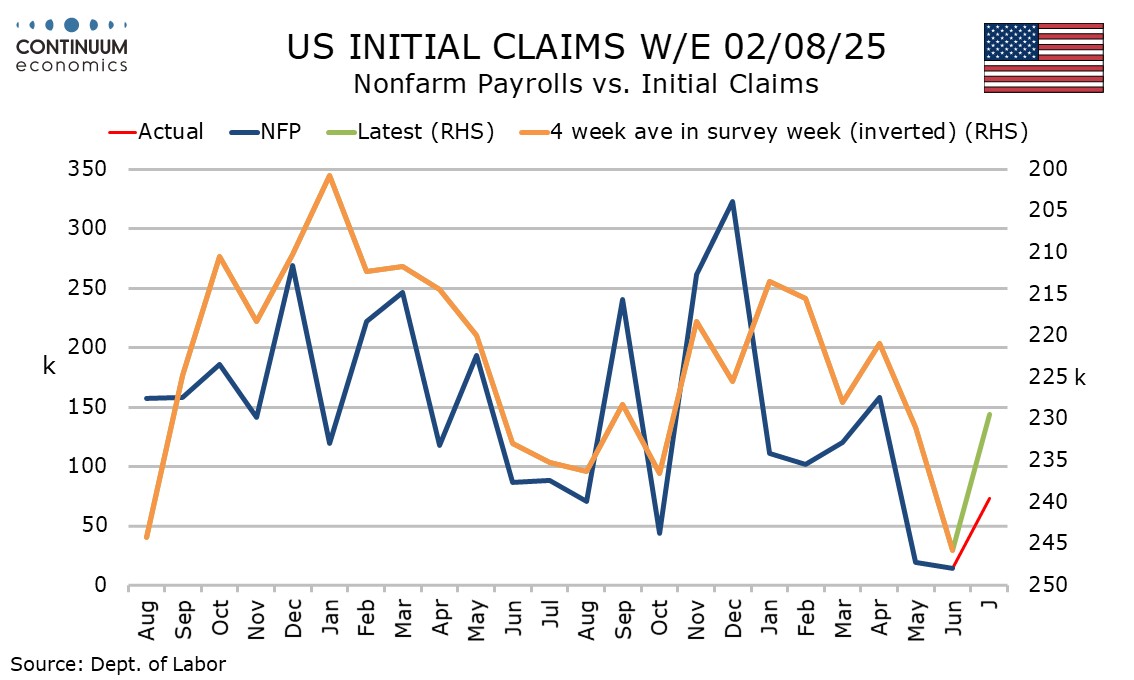

Initial claims accelerated from mid-April to mid-June, which looks consistent with the weakening of payroll growth that revised data eventually showed. The fall in initial claims during July led some to expect a stronger July payroll, but it was strong only in comparison to the April and May data that was revised down so sharply.

The survey week for August’s non-farm payroll is still two weeks away but the latest data suggests August payrolls are likely to remain quite subdued.

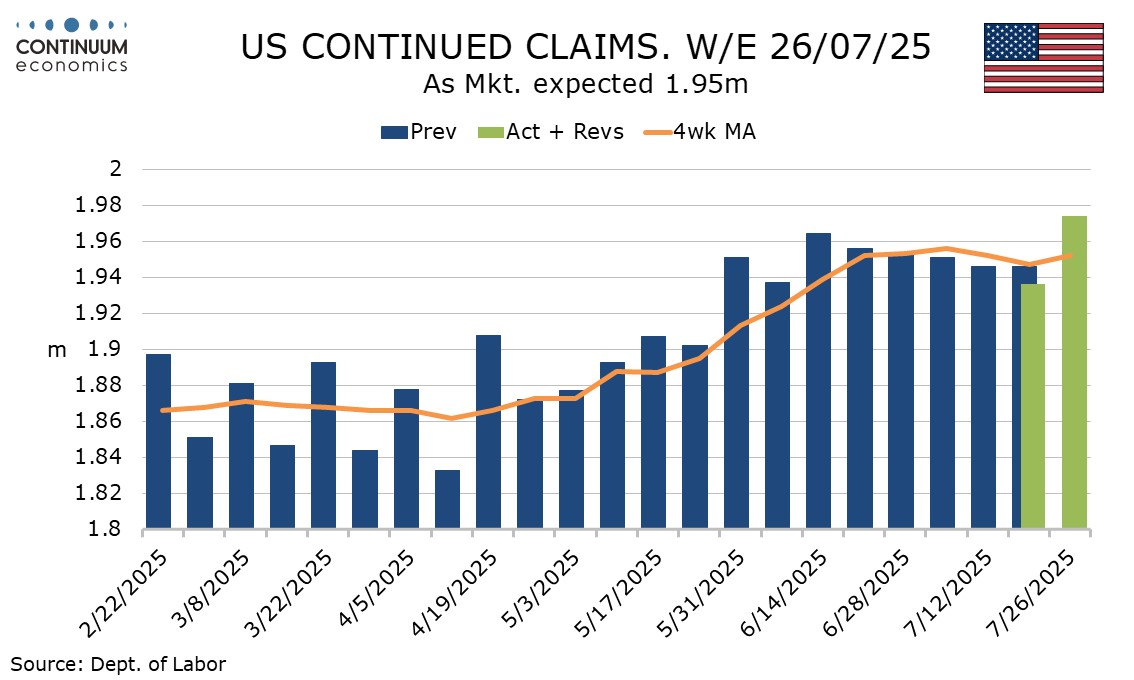

Continued claims cover the week before initial claims and are also higher than expected, up by 38k to 1.974m, which is the highest level since November 2021. The rise more than fully erases five straight marginal declines, suggesting, like initial claims, renewed labor market slowing.

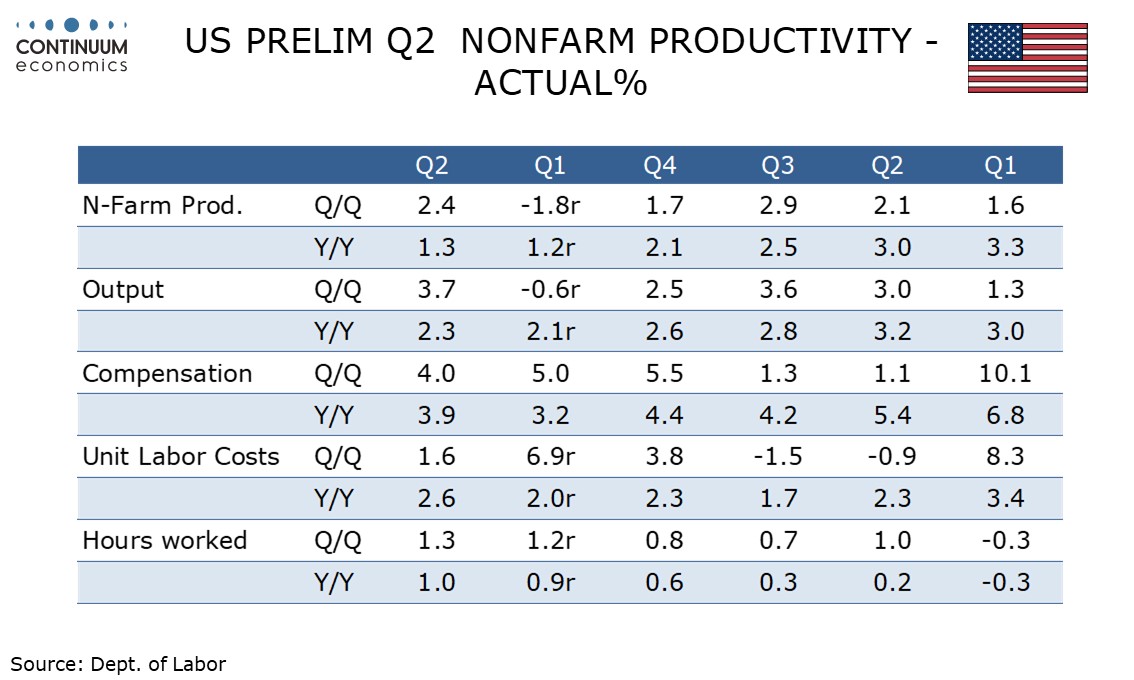

Q2 non-farm productivity increased by a stronger than expected 2.4% annualized. Non-farm business output rose by 3.7% as seen in the GDP report but a 1.3% rise in aggregate hours worked was a little slower than implied by non-farm payroll data which was lifted by hours rather than employment.

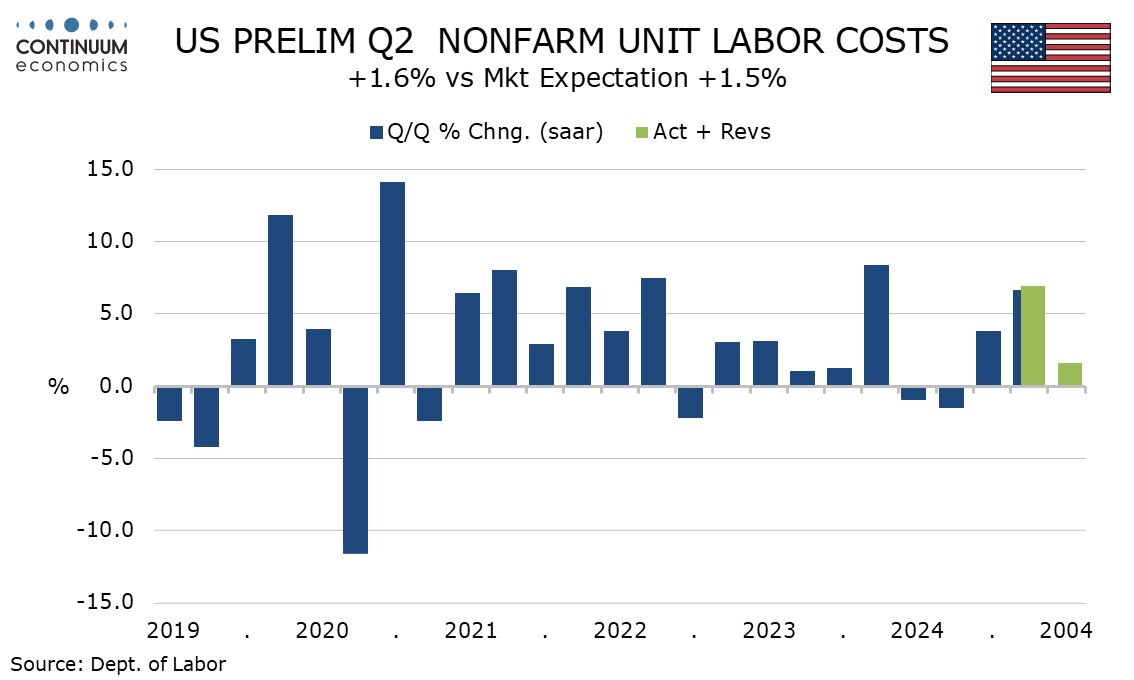

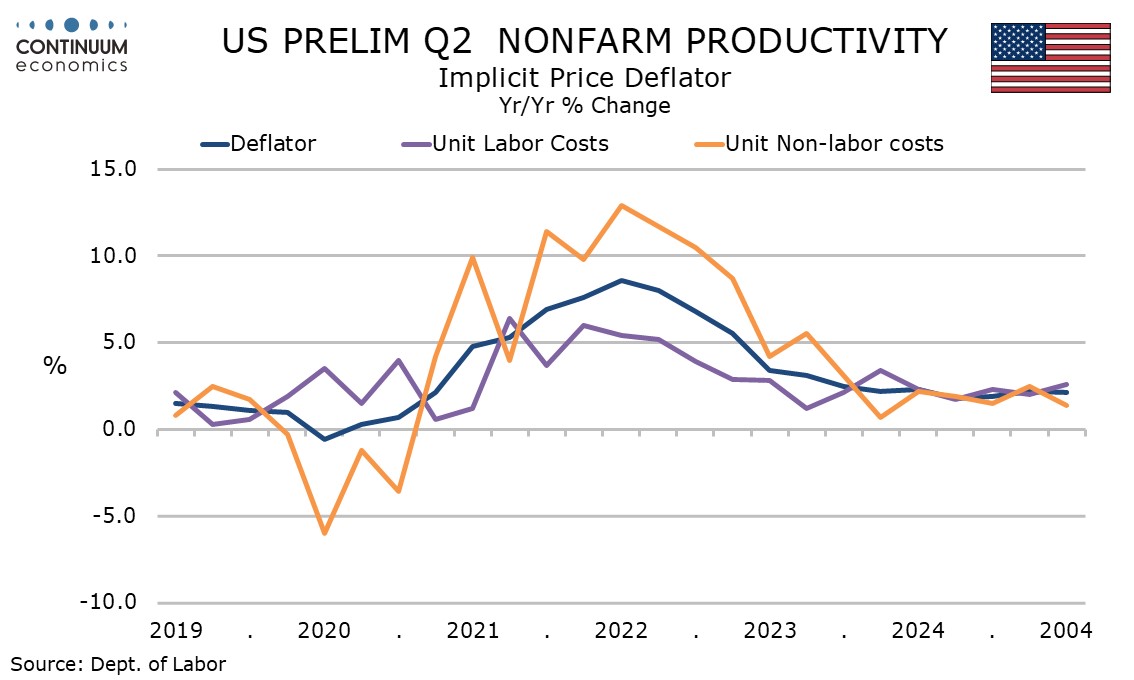

Hourly compensation saw a 4.0% increase leaving unit labor costs up by a moderate 1.6%. Tariffs do not appear to have had a dramatic impact on non-labor costs, which rose by a moderate 2.0%.

This leaves the implicit deflator up by 1.8% in the quarter and 2.1% yr/;yr. which is consistent with the Fed’s inflation target, as it was in 2024 with a 2.1% annual rise. Productivity however has slowed from 2024, when a 2.8% annual increase was seen, with Q2 up only 1.3% yr/yr, Q2’s 2.5% quarterly rise following a 1.8% Q1 decline.