U.S. May JOLTS report sees sharp rise in Job Openings, June ISM manufacturing rises but detail mixed

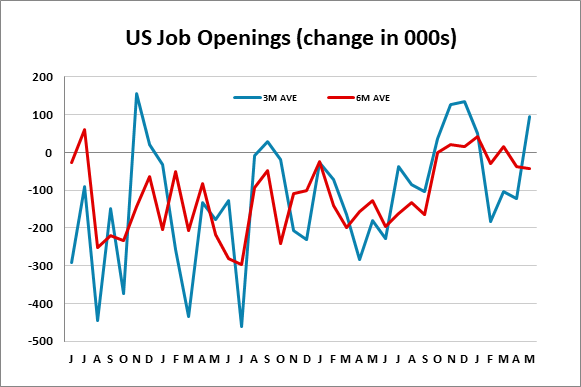

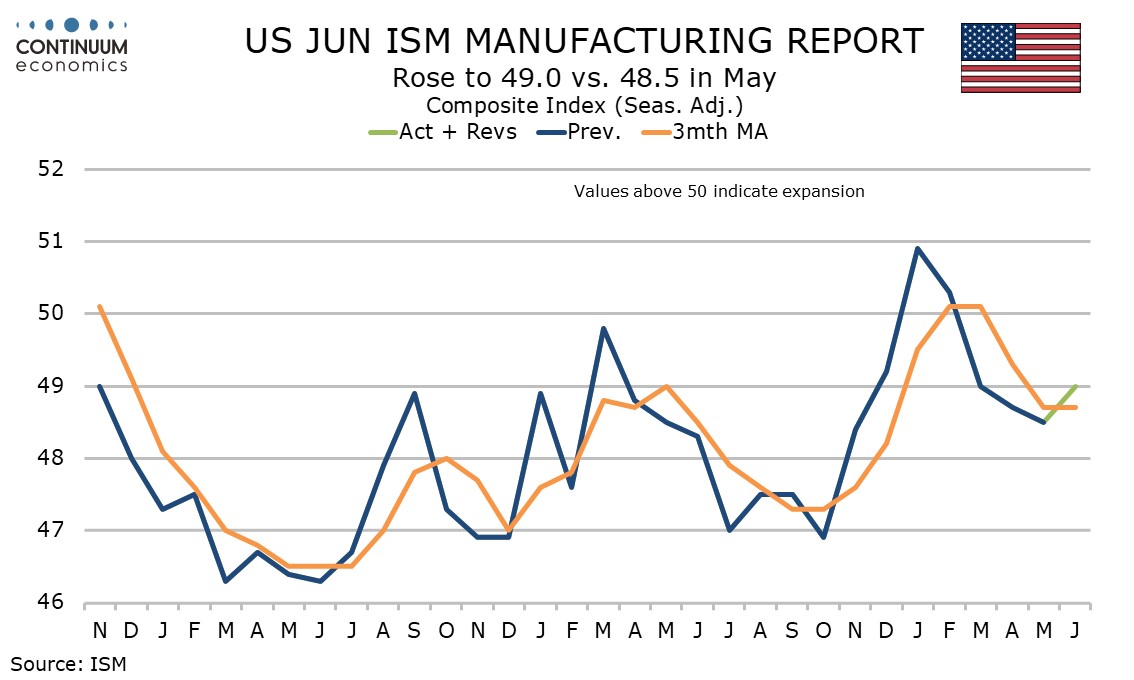

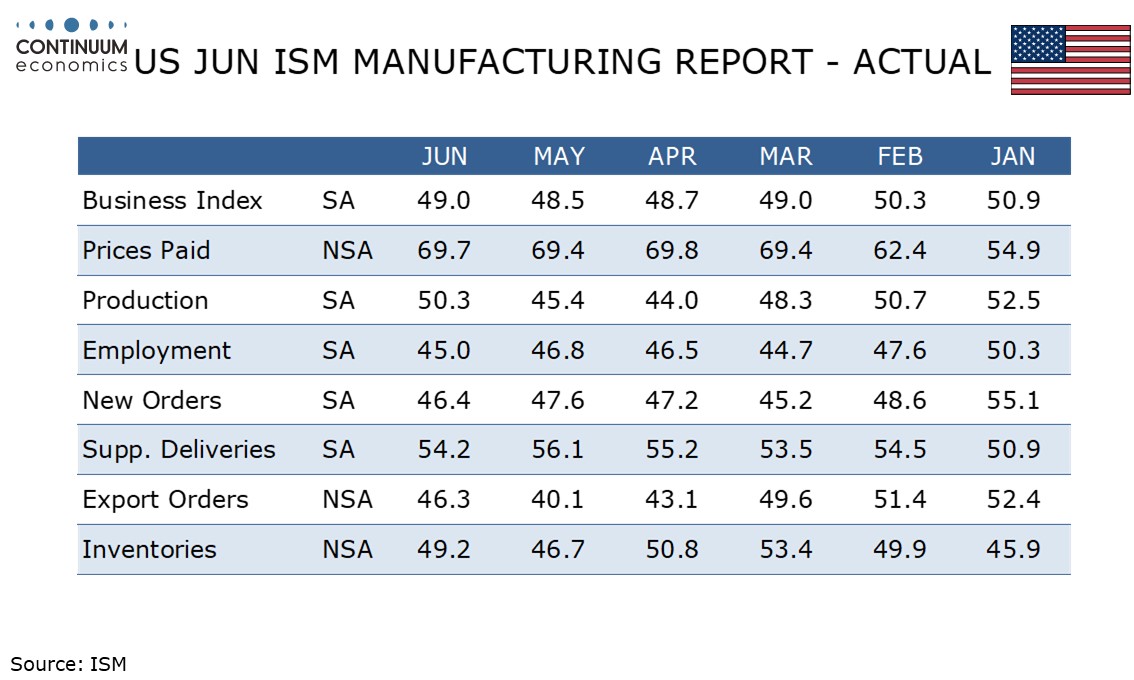

May’s JOLTS report shows a sharp and surprising rise in job openings, by 375k to 7.769m, the highest since November 2024, the gain following a 195k rise in April with the two gains fully erasing declines seen in February and March. June ISM manufacturing data is marginally improved, to 49.0 from 48.5.

The JOLTS report is volatile and the May level is only marginally above January’s, but even if the picture is broadly flat it contrasts negative labor market signals coming from rising initial claims and hints at labor market resilience to tariff risks. The openings rise was led by a 314k increase in accommodation, a subcomponent of leisure and hospitality, hinting at optimism on summer tourism.

The other details of the JOLTS report were mixed, with a 112k decline in hirings, correcting a 211k April rise, and a 71k in separations correcting a 130k April rise. The fall in separations comes despite a 78k increase in quits, which corrected a fall of 129k in April. Rising quits is seen as a signal of labor market confidence.

While slightly up in the composite the ISM details are mixed, with new orders weaker at 46.4 from 47.6 and employment down to 45.0 from 46.8. Production bounced to 50.3 from 45.4 and inventories bounced to 49.2 from 46.7. Completing the breakdown of the composite, deliveries at 54.2 from 56.1 are a little less firm.

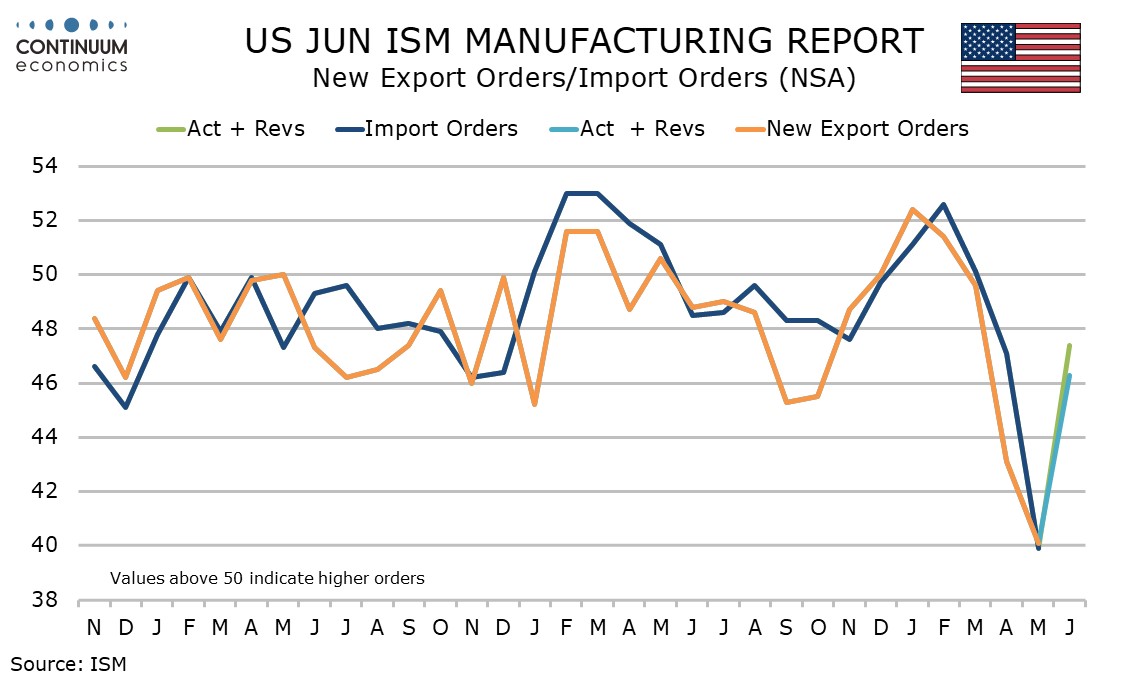

Prices paid do not contribute to the composite and at 69.7 from 69.4 were virtually unchanged for a fourth straight month, though clearly elevated by tariffs. Another component that does not contribute to the composite worth noting is imports, rebounding to 47.4 from May’s very weak 39.9. Exports also bounced, to 46.3 from 40.1, suggesting tariffs may not hold down trade for very long.