U.S. July ISM Services - Consistent with payroll weakness

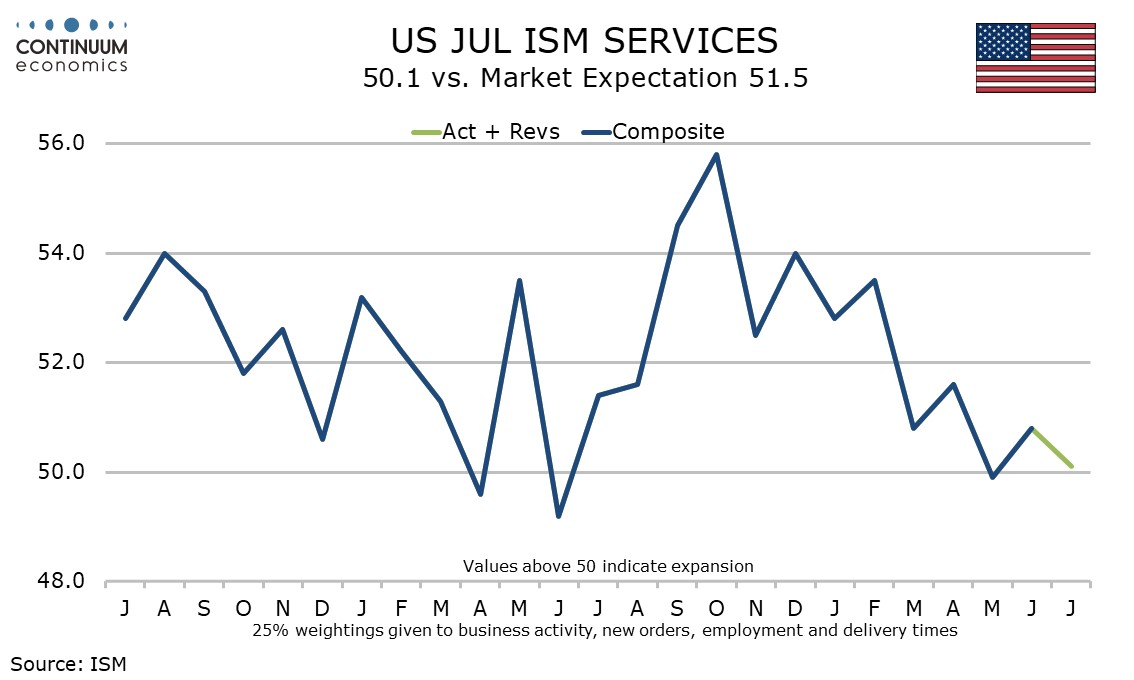

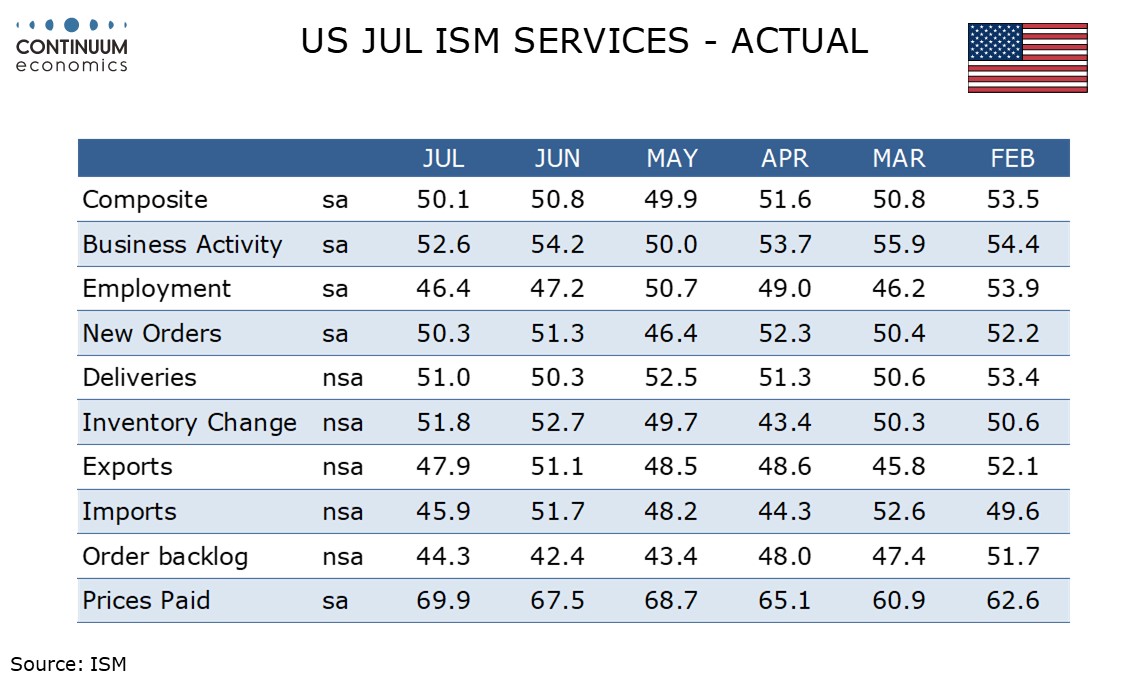

July’s ISM services index of 50.1 is down from June’s 50.8 and while still above May’s 49.9 suggests minimal growth in activity, and gives support to the weak message of recent non-farm payroll data.

The index contrasts strength in July’s S and P Services PMI, which was revised up to 55.7 from 55.2, up from 52.9 in June and the highest since December 2024. The two series are not well correlated.

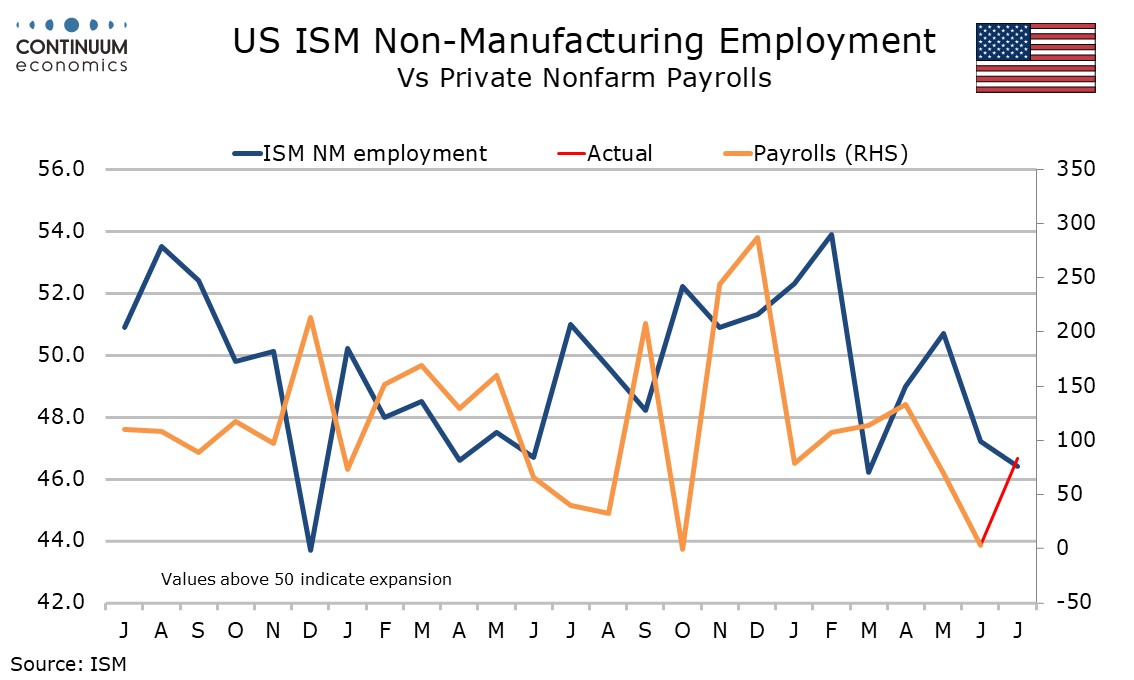

The ISM services employment index of 46.4, down from 47.2, looks consistent with the non-farm payroll, though is the only component of the composite below 50.

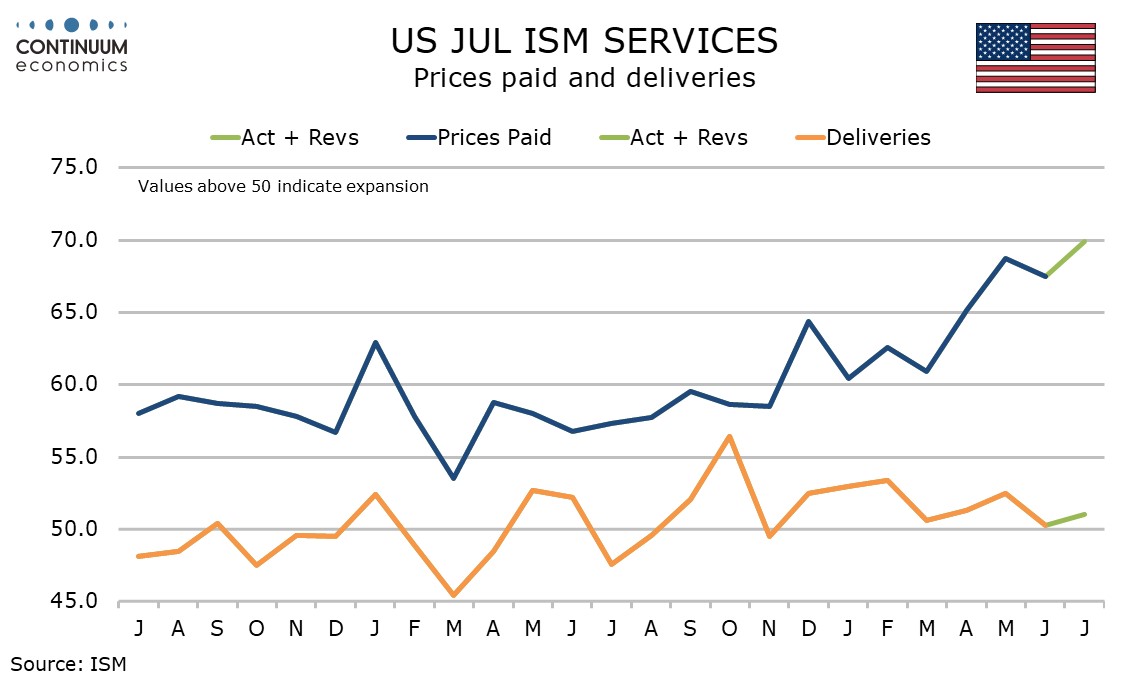

Business activity slipped to 52.6 from 54.2 and new orders slipped to 50.3 from 51.3. A rise in deliveries to 51.0 from 50.3 completes the breakdown of the composite.

Prices paid do not contribute to the composite but at 69.9 from 67.5 reached their highest since October 2022. Trend had already picked up from the high 50s seen through most of 2024, a sign that tariffs are having some impact.

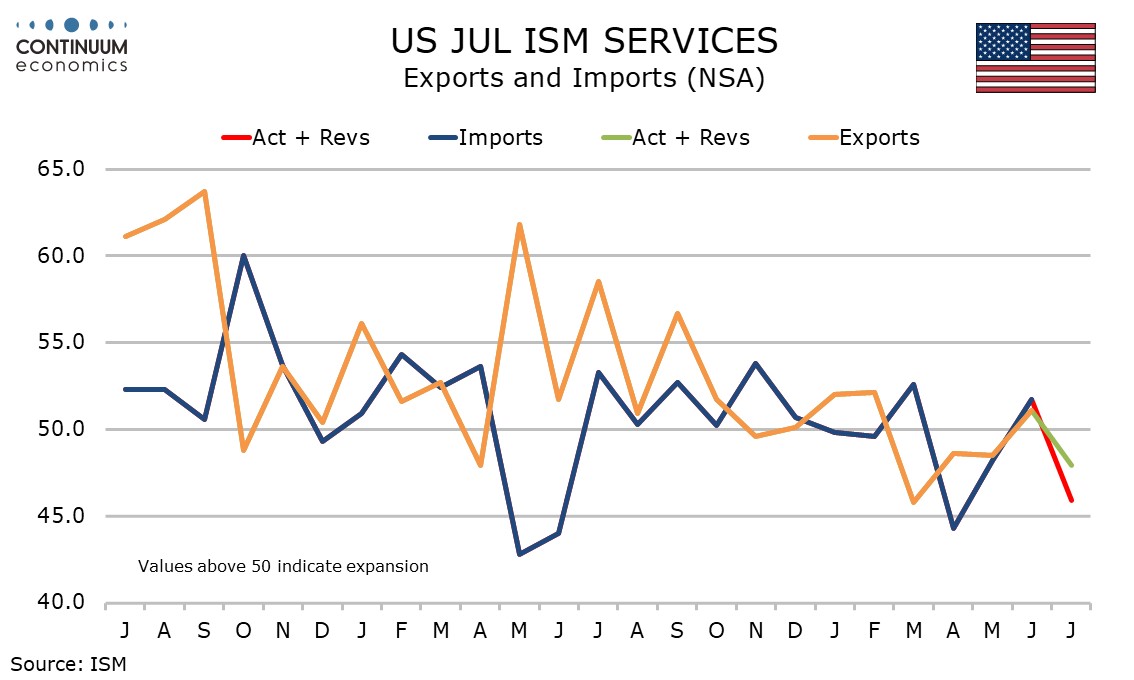

Exports and imports also do not contribute to the composite but were notably weak, exports at 47.9 from 51.1 and imports at 45.9 from 51.7, more than fully erasing recoveries seen in June.