U.S. June ADP Employment - Surprise decline surprisingly led by services

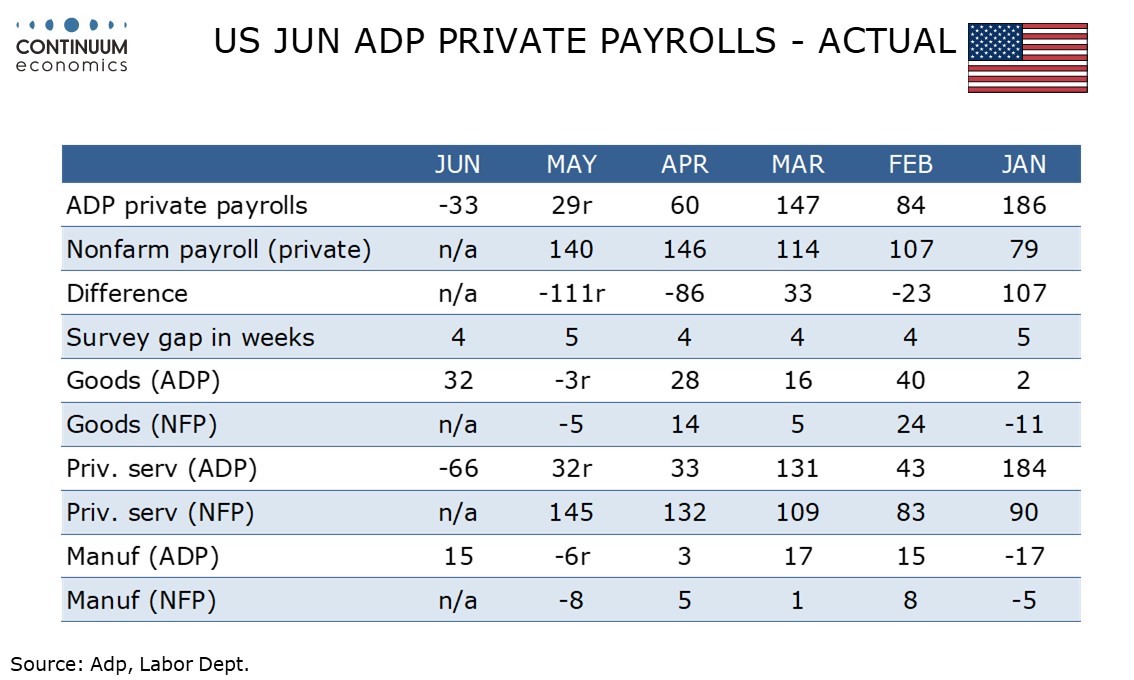

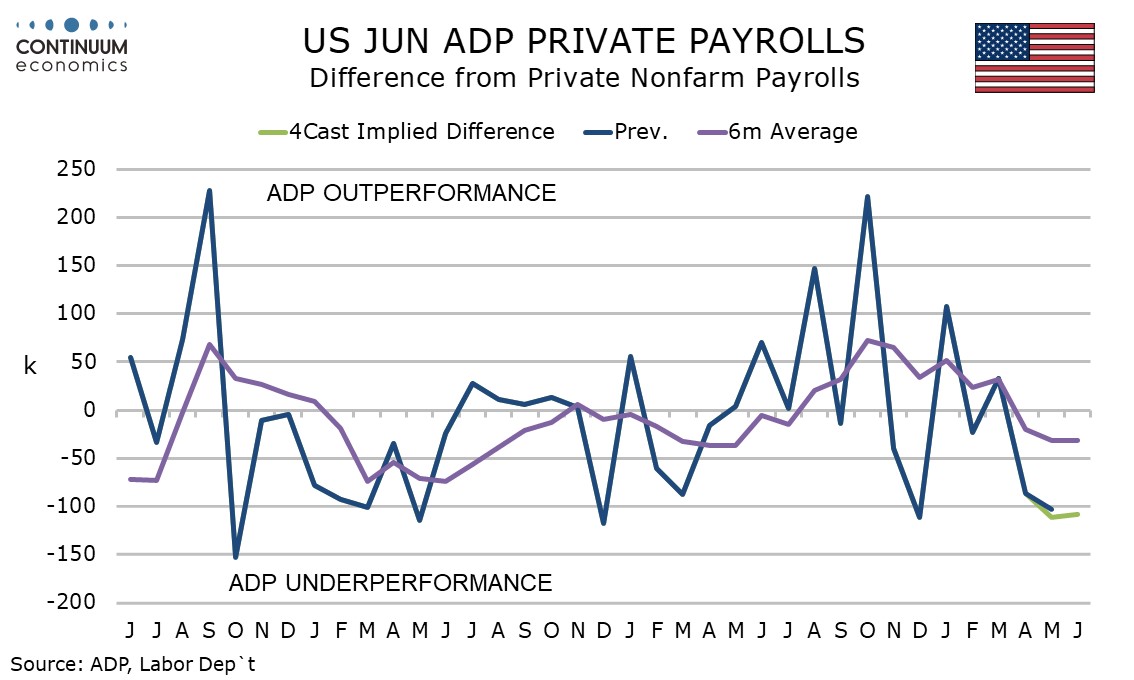

ADP’s June estimate of private sector employment shows the first decline since March 2023, contrasting positive job openings data yesterday but consistent with recent higher initial claims data. ADP surveys have recently been underperforming non-farm payrolls, for which it is not a reliable guide, but we expect a slower non-farm payroll rise in June, by 75k, both private sector and overall.

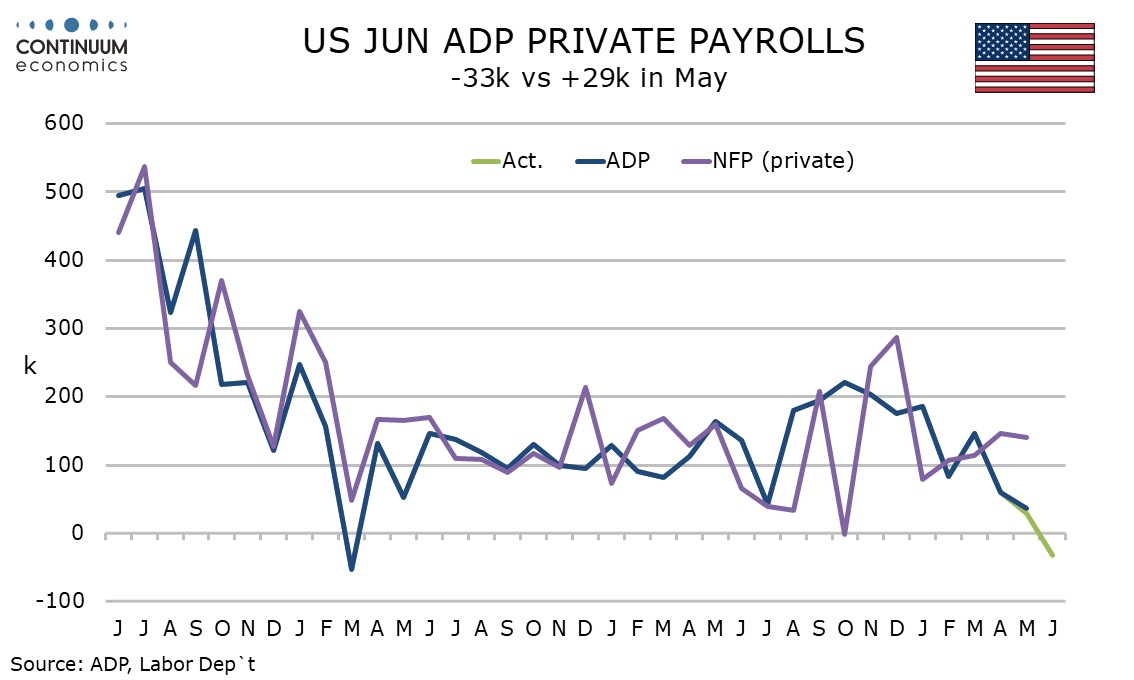

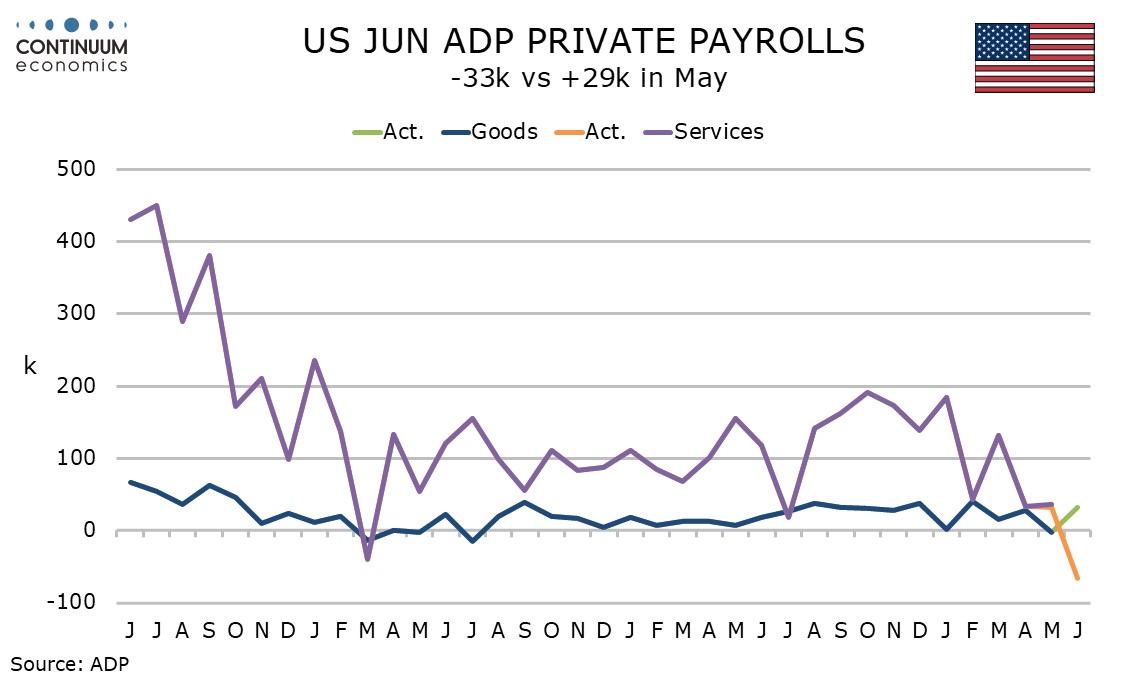

The ADP details are surprising, and look very unlikely to be consistent with the non-farm payroll. Goods employment with a 32k increase, is surprisingly strong, with manufacturing up by 15k and construction by 9k and natural resources and mining by 8k.

Service employment fell by 66k, with the biggest declines coming in professional and business, by 56k, and education and health, by 52k. The rennet tendency of ADP data to underperform payrolls has been largely due to ADP showing weakness in education and health which has continued to lead non-farm payroll gains, and another sharp contrast looks likely this month.

Financial was also weak at -14k but ADP data was positive for leisure and hospitality at 32k, the sector that led the May rise in job openings, while trade, transport and u8tilities rise by 14k, a positive hint for retailing.

Yr/yr growth in wages was slightly weaker in the ADP report, job stayers at 4.4% from 4.5% and job changers at 6.8% from 7.0%. We expect average hourly earnings in the non-farm payroll to rise by a moderate 0.3% on the month, seeing yr/yr growth slowing to 3.8% from 3.9%.