Germany

View:

January 06, 2026

Markets 2026

January 6, 2026 9:58 AM UTC

• For financial markets, the muddle through for global economics and policy provides support for risk assets, combined with solid earnings prospects from some of the magnificent 7. However, U.S. equities are once again significantly overvalued and we look for a 5-10% correction in 2026, b

January 02, 2026

December 22, 2025

December 19, 2025

EZ HICP Preview (Jan 7): Is Services Inflation Problematic?

December 19, 2025 11:10 AM UTC

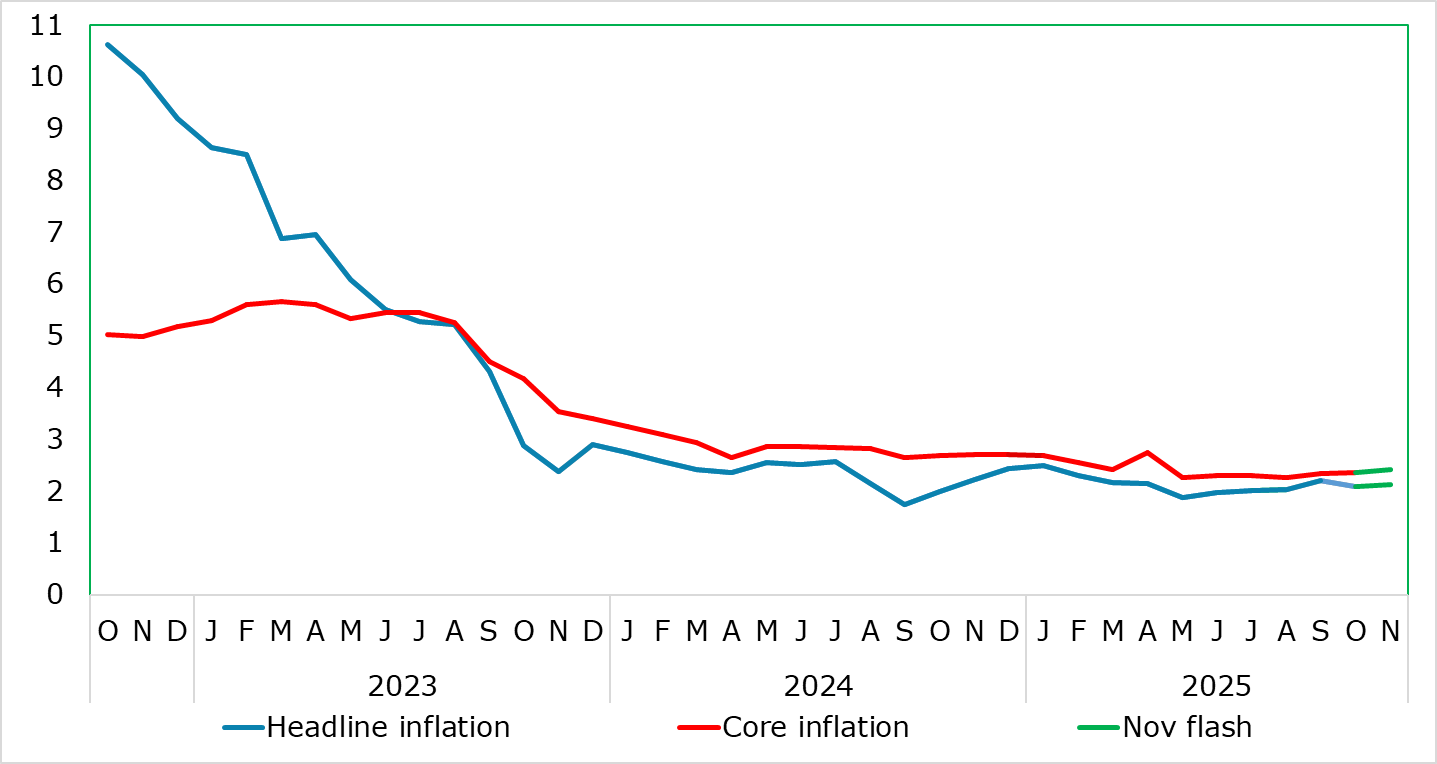

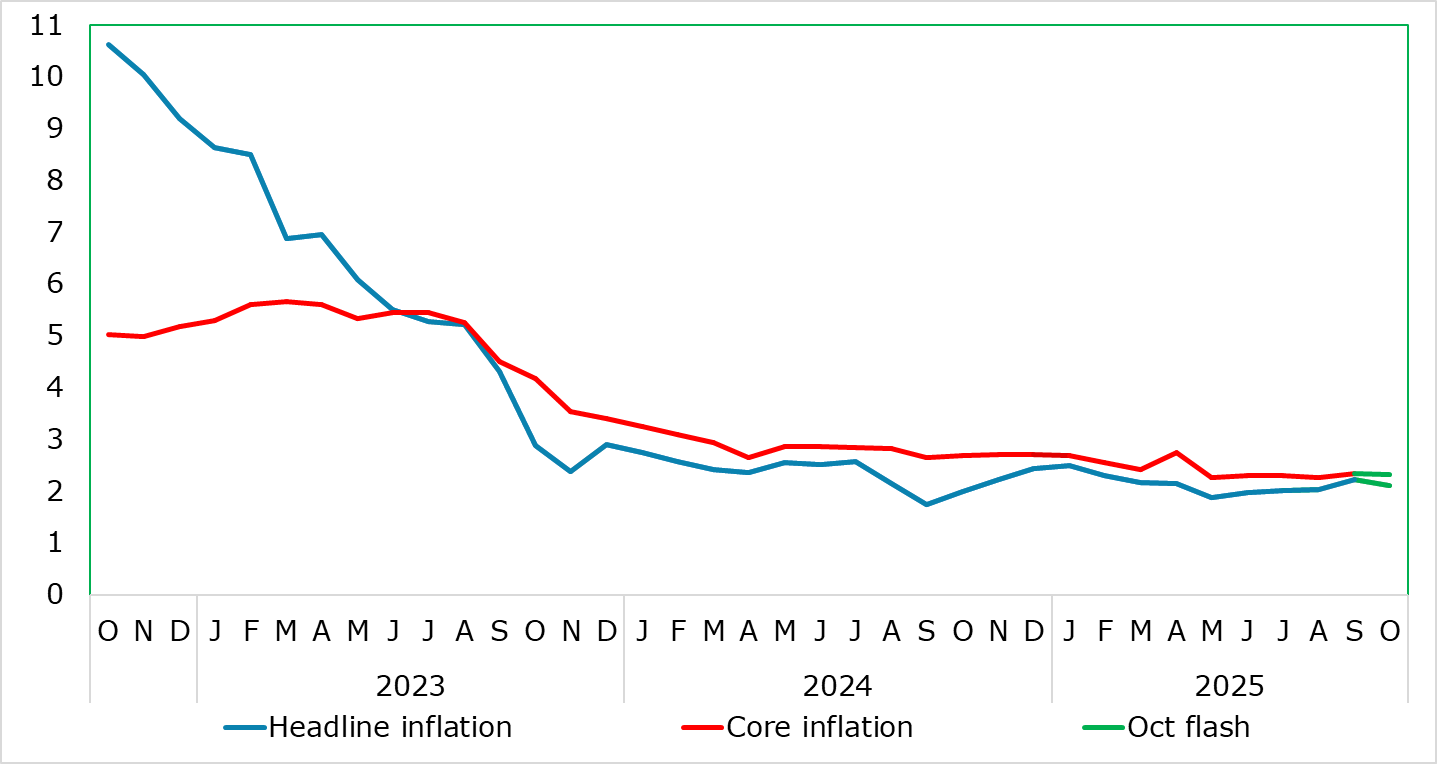

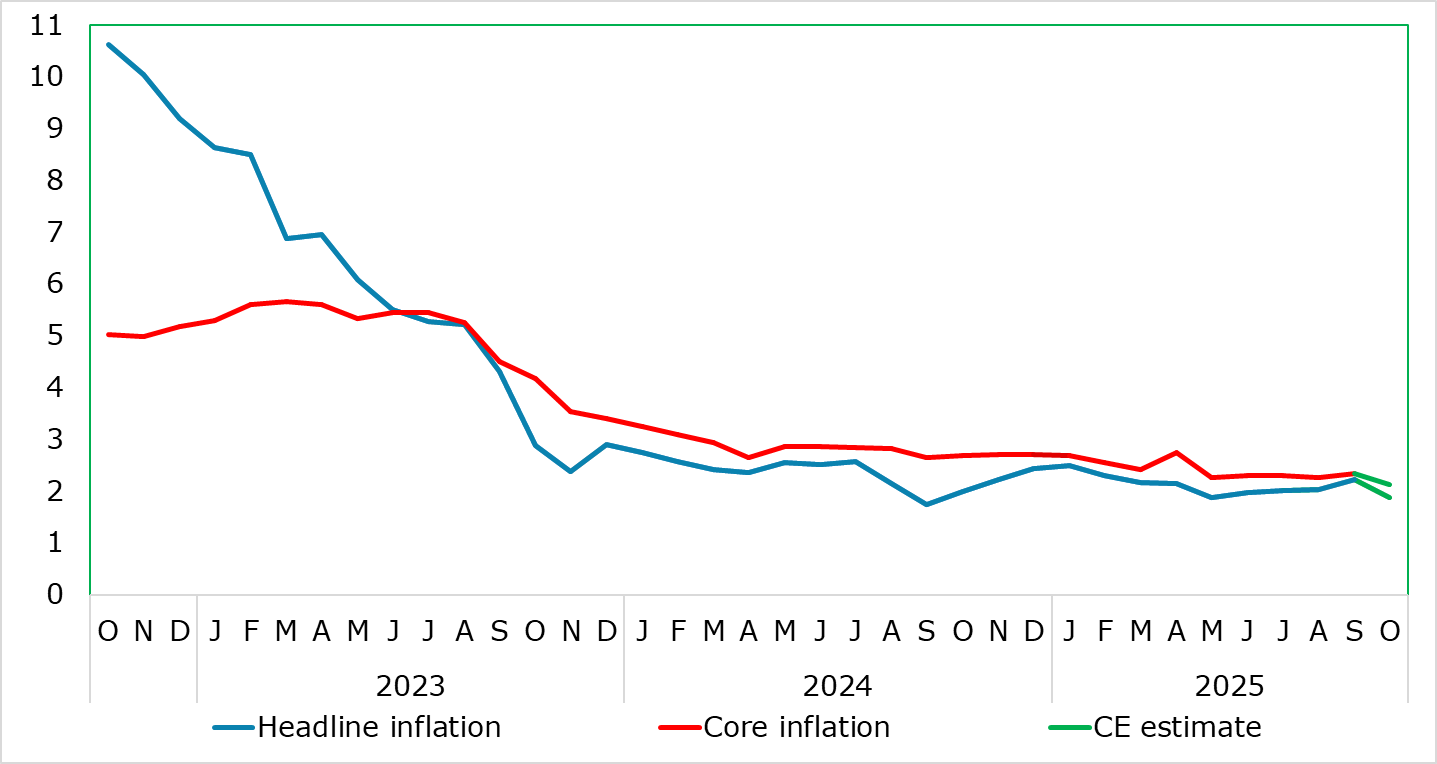

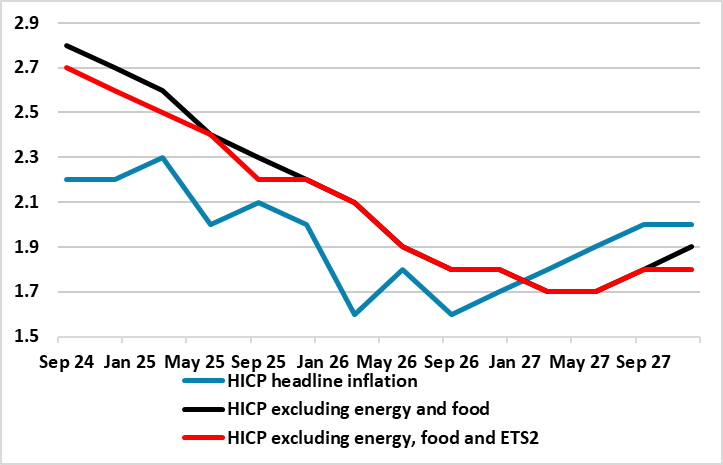

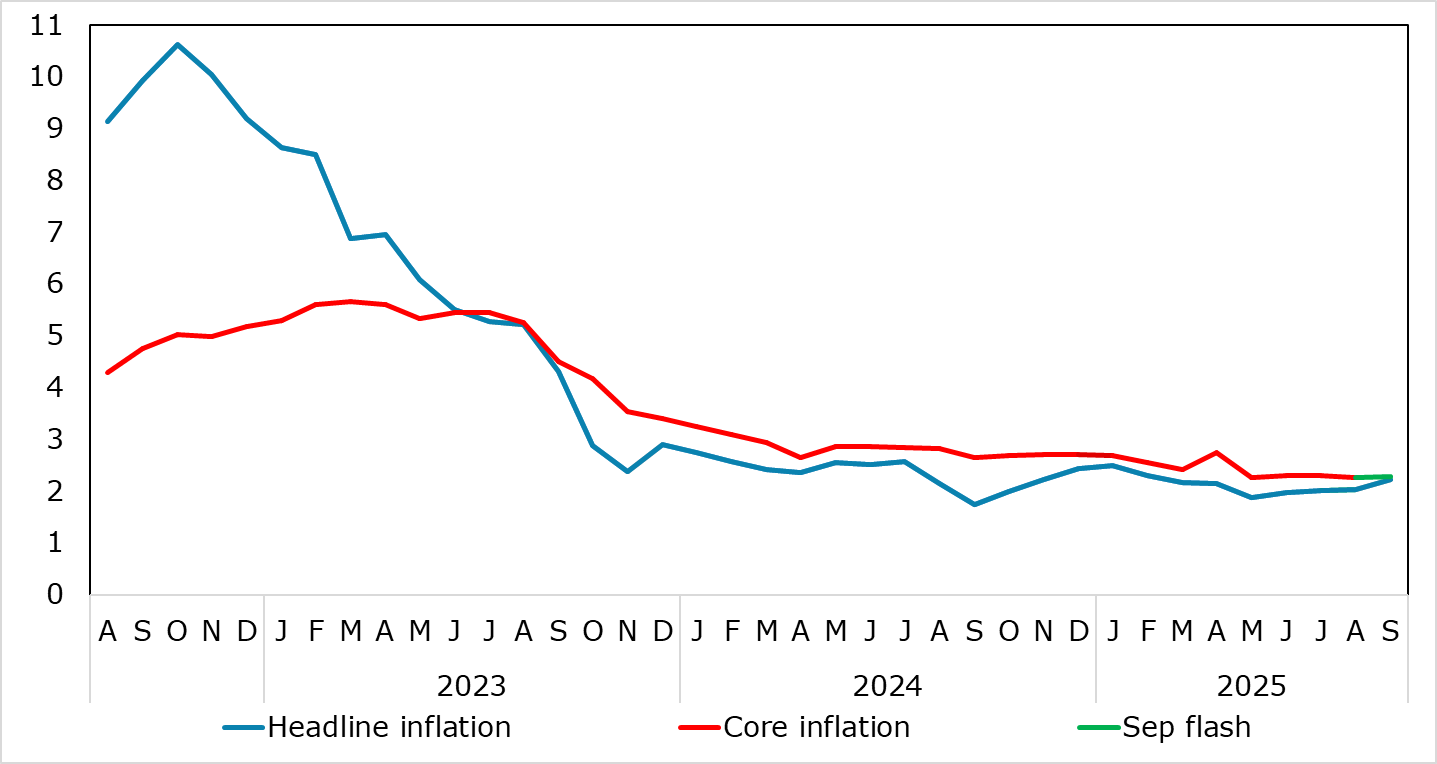

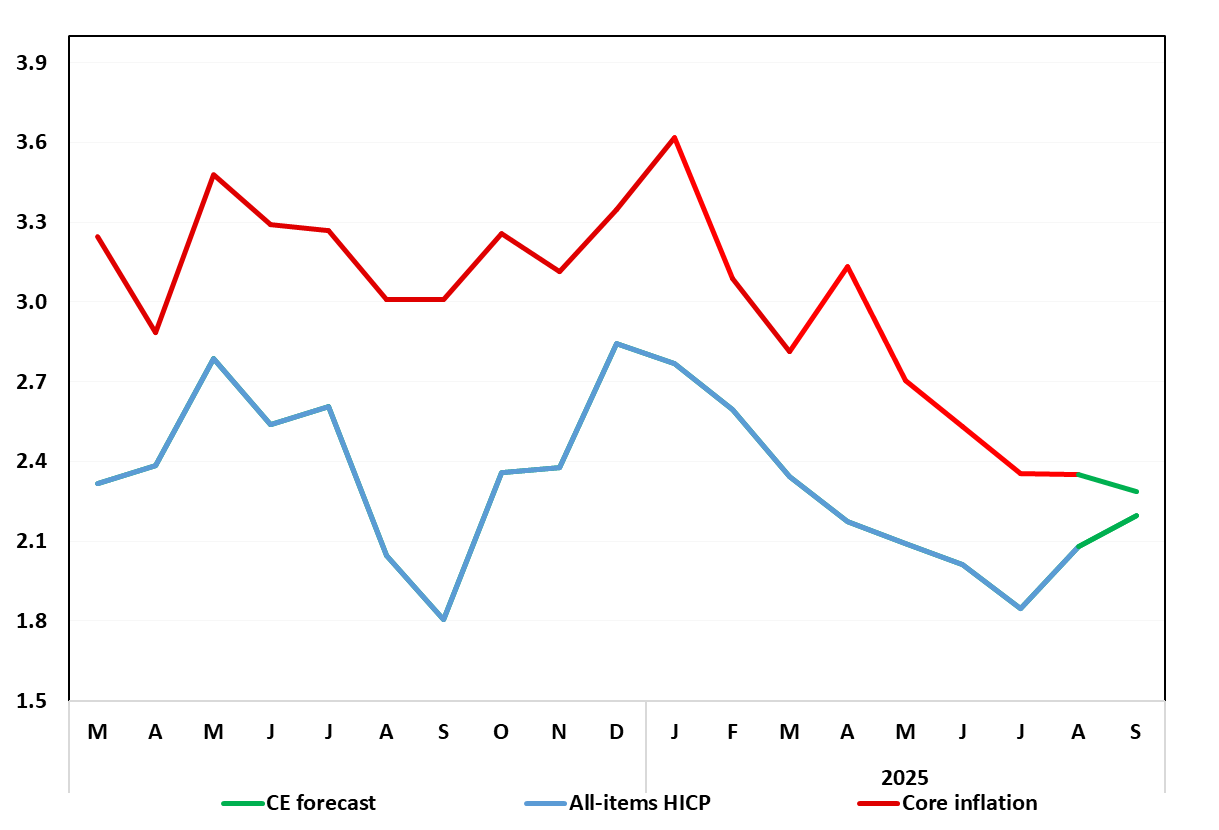

HICP inflation has been range bound for the last 5-6 months between 2.0% and 2.2% with the November and October numbers in the middle of that range. But we see the headline rate falling out of that range in December to 1.9%, this preceding what may be a short-lived fall toward 1.5% in H1 2026. Som

December 18, 2025

ECB Review: On Hold Message to Convert to Easing on Disinflation

December 18, 2025 3:09 PM UTC

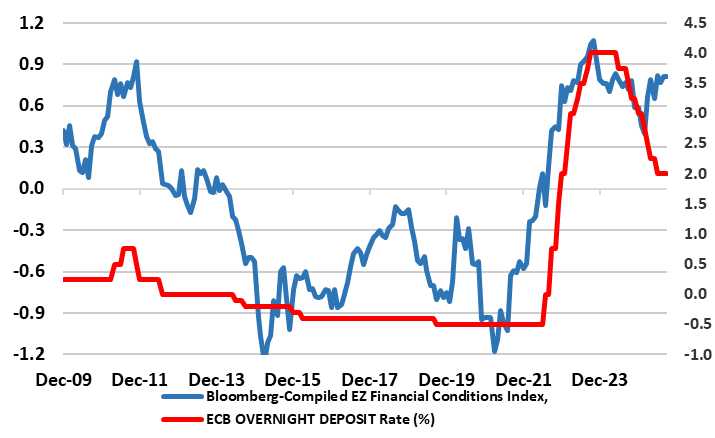

· The ECB increased its 2026 GDP and inflation forecast and appears happy with current policy rate levels. However, still tight financial conditions, plus easing wage growth, point to disinflation and growth disappointment. We see this switch the ECB from an on hold message to easin

DM FX Outlook: Scope for USD decline against JPY, AUD and NOK

December 18, 2025 2:31 PM UTC

· Bottom Line: We expect some modest USD losses across the board over the next couple of years, but there is much more scope for losses against the JPY, AUD and NOK than the other G10 currencies, as yield spreads have moved dramatically in favour of these currencies, and the currencies

December 17, 2025

DM Rates Outlook: 2026 Yield Curve Steepening Before 2027 Flattening

December 17, 2025 9:21 AM UTC

· Multi quarter, we still look for 50bps of further Fed easing by end 2026, which will likely initially bring 2yr yields down to 3.35%. However, once the Fed Funds rate get closer to 3.0-3.25% and the assumed slowdown turns into a soft landing, the 2yr will likely move to a premium ve

Outlook Overview: Turbulent Times

December 17, 2025 7:44 AM UTC

· The U.S. slowdown remains in focus as the lagged effects of President Trump’s tariff increases continues to feedthrough, though our baseline is for a 2026 soft-landing. The Supreme court will likely rule against part of Trump’s reciprocal tariffs, which will create short-term

December 12, 2025

Equities Outlook: Choppy Up For 2026 and Down for 2027?

December 12, 2025 8:05 AM UTC

· The U.S. equity market is underpinned by the bullish AI/tech story and a soft economic landing into 2026. However, overvaluation is clear and this leaves the market vulnerable to a 5-10% correction on moderate bad news e.g. economic data. We see the S&P500 having a choppy year a

December 11, 2025

Eurozone Outlook: Running to Keep Fiscally Still?

December 11, 2025 10:09 AM UTC

· Amid what may still be tightening financial conditions and likely protracted trade uncertainty, we retain our below consensus activity forecast for 2026 but see a fiscally driven pick-up into 2027. However, the picture this year appears to be slightly better but the economy has actual

December 09, 2025

Americas First: New National Security Strategy

December 9, 2025 8:40 AM UTC

· The new NSS at one level reads like a Trump/MAGA current list of topics and desires, that may not translate into policy or a major shift of military assets. Trump has blown hot and cold on Europe and China over the past 12 months and could shift again. Nevertheless, the NSS does r

ECB Preview (Dec 18): Still in Good Place – or Even Better?

December 9, 2025 7:52 AM UTC

A fourth successive stable policy decision will be the almost inevitable outcome of the ECB Council meeting verdict on Dec 18, with the discount rate left at 2.0%. The likely unanimous vote will mask splits about whether policy has troughed or not, this mainly a result of differences within the Co

December 02, 2025

EZ HICP Review: Services Inflation Still Problematic?

December 2, 2025 10:51 AM UTC

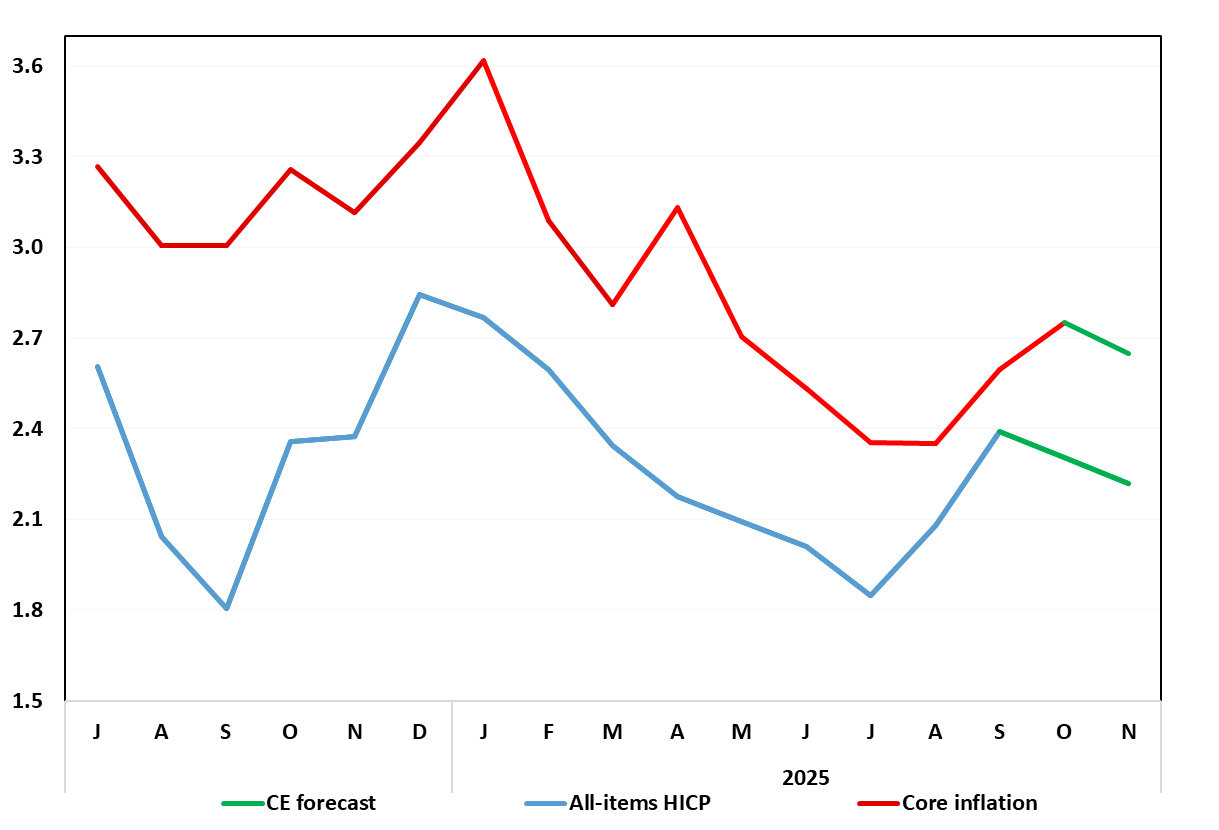

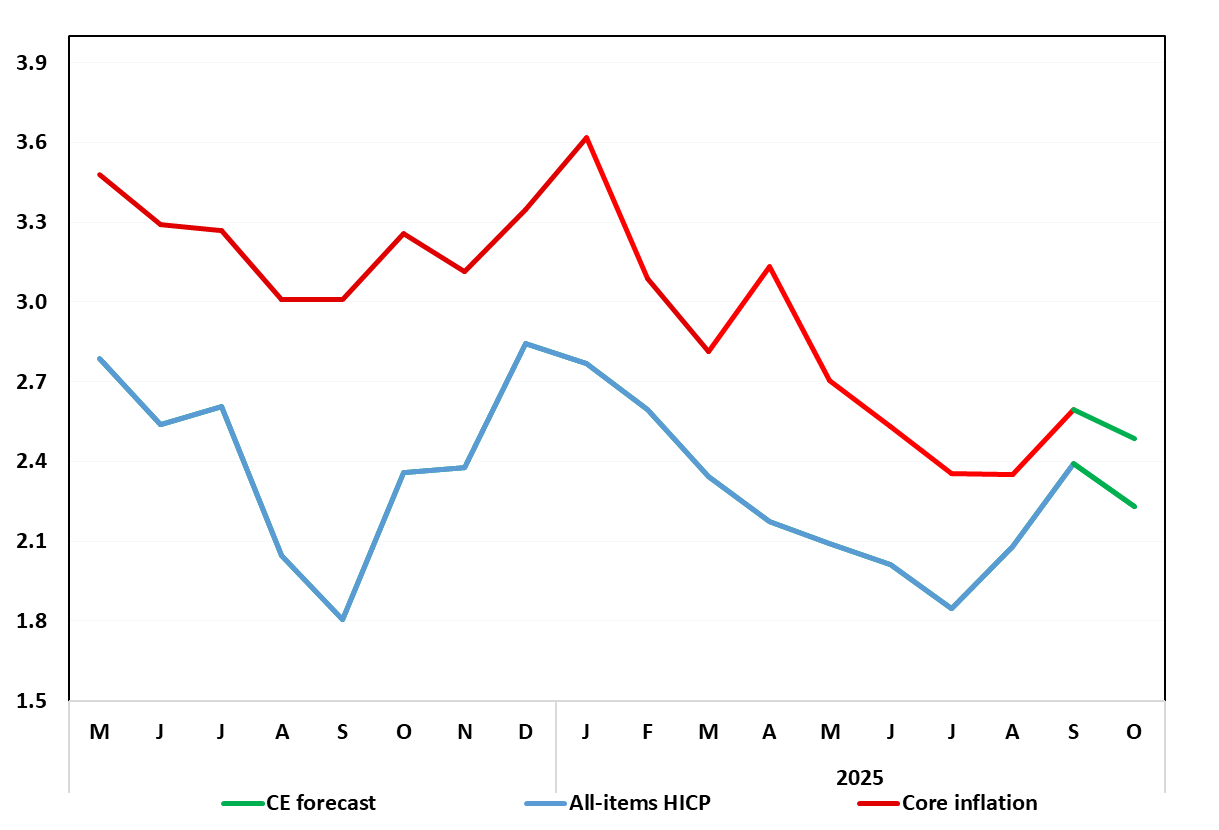

With what were previously unfavourable energy-related base effects reversing, EZ inflation edged down 0.1 ppt to 2.1% in October, largely in line with consensus thinking, but with the main core rate stable at 2.4%. This reversed in the flash November numbers in what was an outcome a notch above bo

November 28, 2025

November 27, 2025

ECB: Financial Stability Review Less Complacent than Council?

November 27, 2025 1:36 PM UTC

The ECB is clearly split about whether policy has troughed or not, this mainly a result of differences within the Council as to where inflation risks lie. Regardless, as the account of the Oct 29-30 Council meeting chimed with comments from the meeting’s press conference, it does seem to us as i

November 24, 2025

EZ HICP Preview (Dec 2): Services Inflation Less Problematic?

November 24, 2025 2:19 PM UTC

The HICP inflation picture has clouded somewhat of late at least to some. With what were previously unfavourable energy-related base effects reversing, EZ inflation edged down 0.1 ppt to 2.1% in October, largely in line with consensus thinking, but with the main core rate stable at 2.4%. The latte

Japan Aging: Consumption Lessons for Eurozone/China?

November 24, 2025 10:55 AM UTC

· China will likely suffer slowing consumption from population aging in the coming years, as consumption per head falls for over 55’s and large scale immigration is not a likelihood. China’s household wealth is also heavily concentrated in falling illiquid residential property. Chin

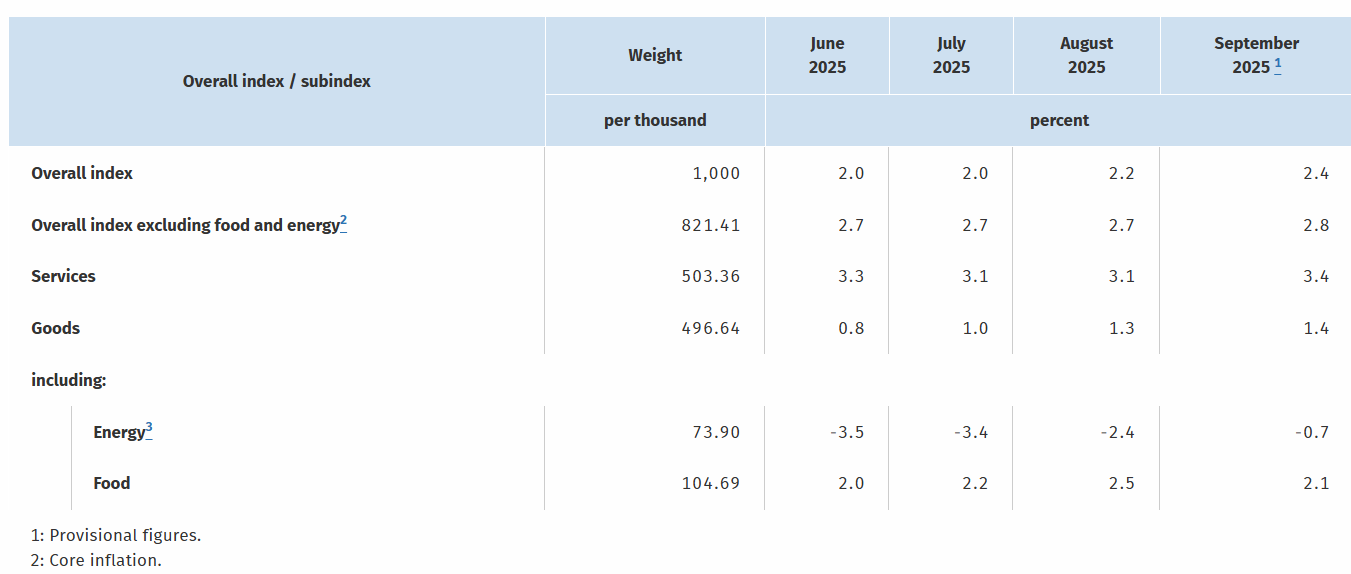

German HICP Preview (Nov 28): Headline and Core To Edge Down Further?

November 24, 2025 9:00 AM UTC

Germany’s disinflation process hit a further and more-than-expected hurdle in September, as the HICP measure rose 0.3 ppt for a second successive month, thereby even more clearly up from July’s 1.8% y/y, that having been a 10-mth low. But a notch of this rise was reversed in the October number

November 21, 2025

U.S. Asset Inflows After April’s Trump Tariffs

November 21, 2025 8:00 AM UTC

· Net foreign portfolio inflows have not been hurt by Trump’s April tariff drama, with the AI and tech boom attracting new equity inflows. Flows could become more volatile with a U.S. equity bear market or recession, but these are modest risk alternative scenarios rather than high r

November 18, 2025

Markets 2026

November 18, 2025 10:30 AM UTC

· The Fed, ECB and BOE will likely drive further 10-2yr government bond yield curve steepening, with 10yr Bund yields rising due to ECB QT and German fiscal expansion. 10yr JGB yields are set to surge through 2%, as BOJ QT remains excessive and underestimated. The BOJ could partiall

November 17, 2025

Financial Stability Risks: Vulnerable To A Recession

November 17, 2025 1:00 PM UTC

The November Fed financial stability review highlights continued concern over hedge funds and insurance company leverage, while the IMF GSFR is concerned about U.S. equity market overvaluation and growing links between banks and non-bank financial intermediaries. However, the main adverse shock wo

November 14, 2025

ECB – In a Good Place or Just Complacent?

November 14, 2025 11:55 AM UTC

The ECB is of the view that downside growth risks have dissipated somewhat, this possibly helped by its recent actions which it suggests leave its current policy stance in a good place. However, amid a hint of what we think is a complacent upgrade about the EZ’s alleged resilience, we think, the

November 11, 2025

EZ Rates: 2026 ECB Easing But 2027 French Crisis?

November 11, 2025 9:45 AM UTC

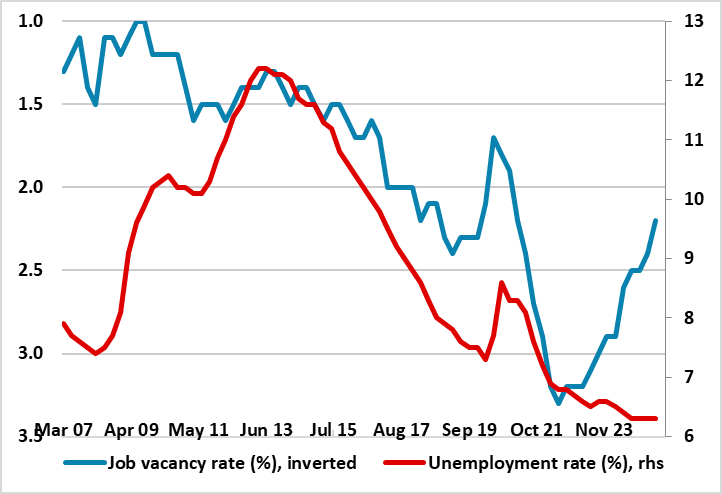

· Financial conditions are tighter than suggested by a 2% ECB depo rate, which will both dampen an EZ economic pick-up and cause further disinflation. We see the ECB delivering two further 25bps cuts to a 1.5% ECB depo rate, which can mean a further decline in 2yr Bund yields. Howev

October 31, 2025

EZ HICP Review: Services Inflation Problematic?

October 31, 2025 10:39 AM UTC

With what were previously unfavourable energy-related base effects reversing, EZ inflation edged down 0.1 ppt to 2.1% in October, largely in line with consensus thinking, but with the main core rate stable at 2.4%. The latter reflected a slight pick-up in services (up 0.2 ppt to a six-mth high of

October 30, 2025

ECB Review: Hedging its Bets, Hoping to Stay in a Good Place

October 30, 2025 3:23 PM UTC

There ie nothing tangible in the ECB update today to suggest that a further easing is likely at the next meeting on Dec 17-18. However, amid a hint of what we think is a complacent upgrade about the EZ’s resilience alongside a perceived reduction in global risks, the easing window has not been c

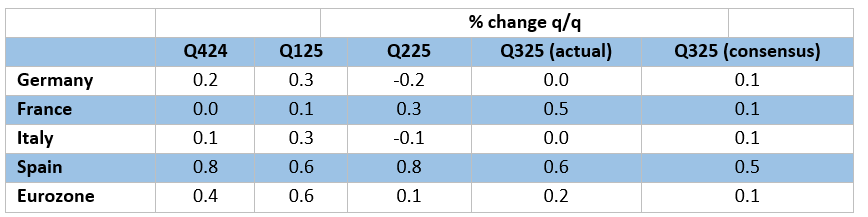

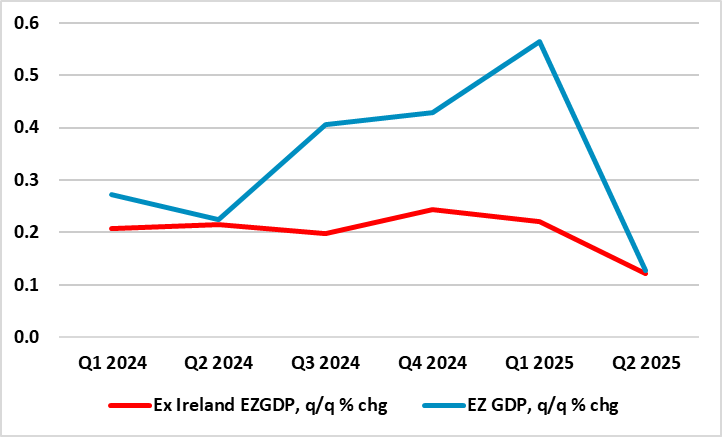

Eurozone Flash GDP Review: The Haves and the Have-Nots

October 30, 2025 10:25 AM UTC

It continues to be the case that, for an economy that has seen repeated upside surprises and apparently above trend growth, now some 1.3% in the year to Q3, GDP data do not seem to have had much impact is shaping, let alone dominating, ECB policy thinking save to encourage a Council view of EZ eco

October 28, 2025

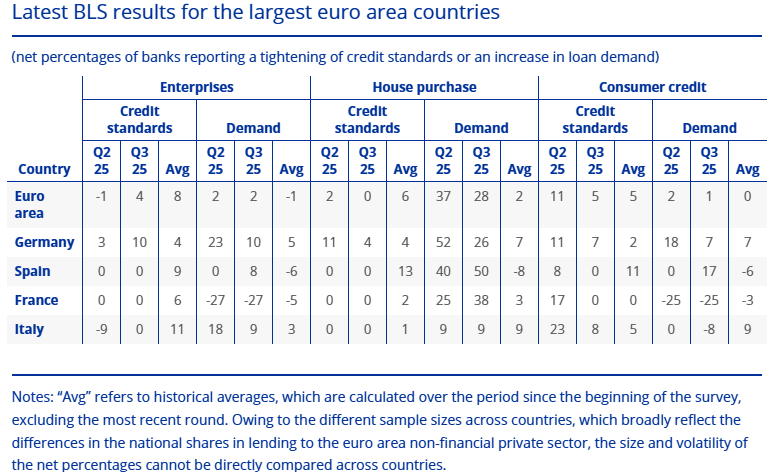

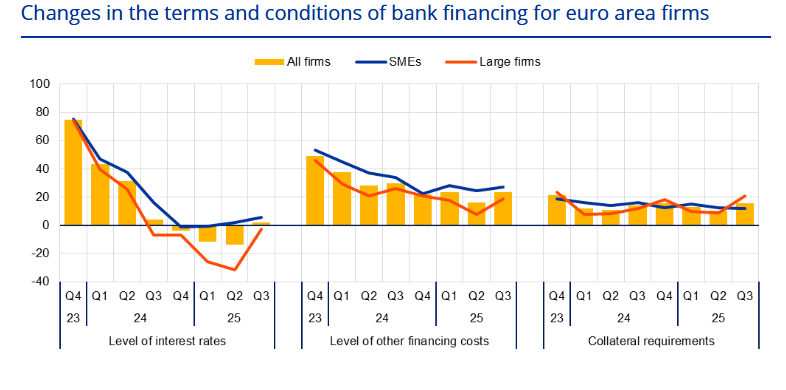

Eurozone: Tighter Credit Standards By EZ Banks Confirmed

October 28, 2025 9:44 AM UTC

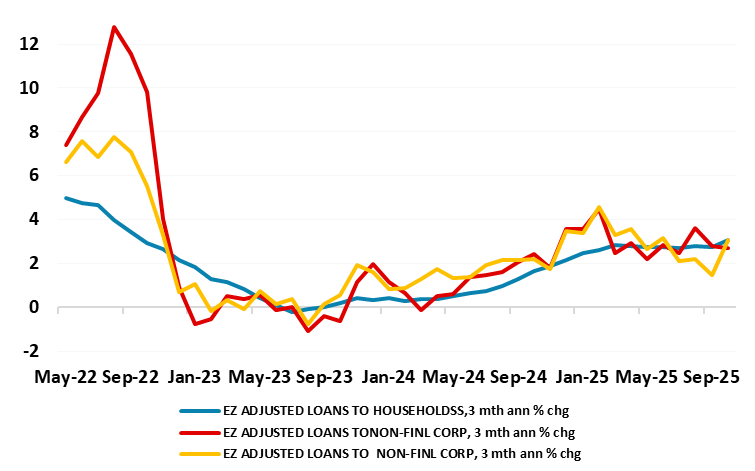

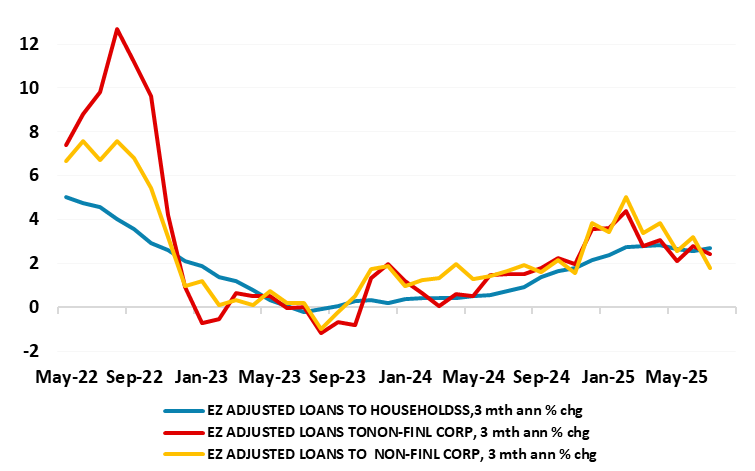

Hardly a surprise despite the ECB suggestions to the contrary as the reported net tightening credit standards merely accentuates trends in the two previous Bank Lending Surveys (BLS). This updated BLS therefore echoes what we have seen in other ECB surveys and in actual credit dynamics and thus un

October 27, 2025

ECB Monetary Worries Emerging as Corporate Credit Dynamics Weaken More Clearly

October 27, 2025 10:36 AM UTC

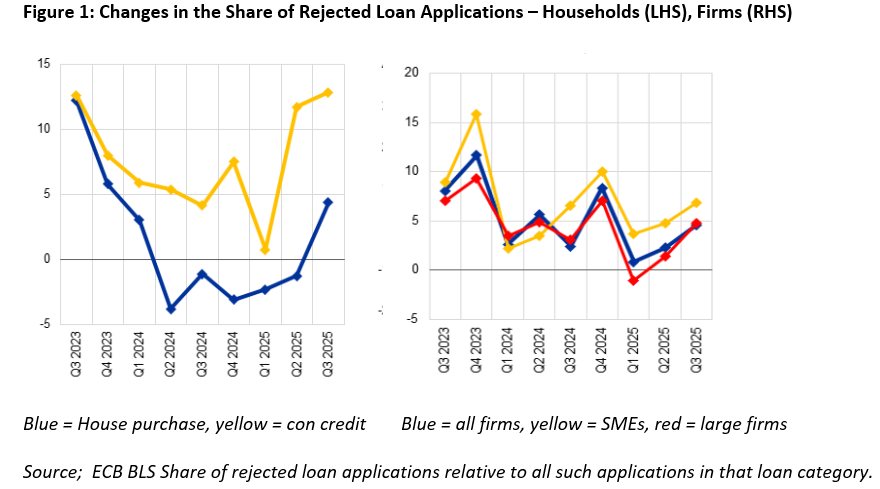

As a foretaste of the Bank Lending Survey BLS) due tomorrow, the ECB released two associated pieces of data today, both corroborating and continuing an ever worrying pattern, namely weakness in corporate credit. The data showed growth in later has fallen to its lowest in almost two years (Figure 1).

October 23, 2025

EZ HICP Preview (Oct 31): No Halloween Horror from HICP Update

October 23, 2025 12:09 PM UTC

Mainly due to unfavourable base effects, EZ inflation has edged up in the last few months, but we think that this is temporary and that a fresh fall, possible to below the 2% target may occur in the October flash numbers – with a formal forecast of a 0.3 ppt drop to 1.9% and the core falling almos

October 22, 2025

Eurozone Flash GDP Preview (Oct 30): Resilience in the Dock?

October 22, 2025 9:11 AM UTC

As we highlighted repeatedly of late, for an economy that has seen repeated upside surprises and apparently above trend growth, now some 1.4% in the year to Q2, GDP data do not seem to have had much impact is shaping, let alone dominating, ECB policy thinking. But we think this may shift as the ECB

October 21, 2025

ECB Preview (Oct 30): Assessing the ‘Punchbowl’

October 21, 2025 12:55 PM UTC

As with recent Council meetings, what is important when the ECB gives its next (almost certain) stable verdict on Oct 30, is not what it says. Instead, in particular, it is how much the impression is left that the easing window has not closed. The ECB is clearly split about whether policy has trou

October 20, 2025

German HICP Preview (Oct 30): Headline Core To Edge Down as Disinflation Resumes?

October 20, 2025 4:36 PM UTC

Germany’s disinflation process hit a further and more-than-expected hurdle in September, as the HICP measure rose 0.3 ppt for a second successive month, thereby even more clearly up from July’s 1.8% y/y, that having been a 10-mth low. But we see most, if not all, of this rise being reversed in

October 17, 2025

EZ Inflation Outlook: The Deeper Debate About 2028?

October 17, 2025 10:24 AM UTC

The ECB is clearly split about whether policy has troughed or not, this mainly a result of differences within the Council as to where inflation risks lie. Hawks perceive upside risks emerging while the dovish camp feels the opposite. These divisions are likely to magnify when the ECB updates its

October 10, 2025

Eurozone: Data Disappointments Off the ECB Radar

October 10, 2025 12:35 PM UTC

Although not fully high-profile,and mostly off the radar that the Council focuses on. the last few days have brought a series of data releases that will disappoint the ECB, certainly the hawks. These range from weak services production data, further signs of a loosening in the labor market and mor

October 09, 2025

ECB Council Meeting Account Review: Complacency Rules the Day as Financial Conditions Tighten!

October 9, 2025 12:52 PM UTC

Unsurprisingly there was little in the account of the ECB Council Meeting of 10-11 September to suggest any rush to change policy with it clear that members on both sides of the hawks vs doves debate wanted more data amid what was considered to be great uncertainty. Thus, the ECB offered little in

October 02, 2025

DM Central Banks: Wider-Ranging Conditions More Than Neutral Rates

October 2, 2025 6:55 AM UTC

· Neutral policy rate estimates and forward guidance provide some help at the start of easing cycles, but less so at mid to mature stages. For the Fed, ECB and BOE we look at a wider array of economic and financial conditions, alongside our own projections over the next 2 years to m

October 01, 2025

EZ HICP Review: Headline Inflation Moves Higher as Services Ticks Up From Cycle-low

October 1, 2025 10:28 AM UTC

A second successive upside surprise is unlikely to make inflation any more of an issue for the ECB at present. Instead, moderate concerns whether the apparent resilience of the real economy may yet falter should remain the order of the day, this possibly a result of a still somewhat unresponsive t

AI/Humanoid Robots and Disinflation?

October 1, 2025 9:40 AM UTC

· Overall, a number of forces from the AI wave will impact inflation. Power demand could push up power prices, but productivity enhancements and product innovation could be disinflationary like Information and Communications technology (ICT). One other key uncertainty on a 1-5 year

September 30, 2025

German HICP Review: Headline Higher And Core Rises Due to Fresh Services Push?

September 30, 2025 12:25 PM UTC

Germany’s disinflation process hit a further more-than-expected hurdle in September, as the HICP measure rose 0.3 ppt for a second successive month, thereby even more clearly up from July’s 1.8% y/y, that having been a 10-mth low (Figure 1). This (again) occurred largely due to energy base eff

September 29, 2025

DM Government Bond Saints v U.S.

September 29, 2025 7:35 AM UTC

· Overall, although the fiscal saints (Australia/Canada/Germany/Sweden) have merits over the U.S. in the scenario where Fed independence is undermined and more Fed rate cuts occur than warranted by the economics, the 10yr area of other government bond markets may not outperform. 10yr go

September 26, 2025

September 25, 2025

September 24, 2025

EZ HICP Preview (Oct 1): Headline Inflation to Edges Higher as Services Slows to Fresh Cycle-low

September 24, 2025 10:54 AM UTC

As we have underlined of late, HICP inflation – at target for the last three months – is very much a side issue for the ECB at present, offset instead by moderate concerns whether the apparent resilience of the real economy may yet falter. This mindset will not be altered by the flash HICP dat

September 23, 2025

DM FX Outlook: USD steadies but vulnerable to equity correction

September 23, 2025 2:48 PM UTC

· Bottom Line: The USD has continued to edge lower against the EUR in the last quarter as market expectations of Fed easing have increased following clear weakening in U.S. employment growth. But at this stage the data doesn’t indicate we are heading for recession, and this suggests w

German HICP Preview (Sep 30): Headline Higher But Core to Fall Further?

September 23, 2025 2:21 PM UTC

Germany’s disinflation process hit a slightly more-than-expected hurdle in August, as the HICP measure rose 0.3 ppt from July’s 1.8% y/y, that having been a 10-mth low (Figure 1). This occurred largely due to energy base effects with food prices also contributing slightly. The result was that

Outlook Overview: Into 2026

September 23, 2025 8:25 AM UTC

· The critical question is how much the U.S. economy is slowing down with the feedthrough of President Donald Trump’s tariffs to boost inflation and restrain GDP growth, with the effective rate currently around 17% on U.S. imports. Though semiconductor tariffs are likely, the bulk of

DM Rates Outlook: Steepening Yield Curve The Old Normal?

September 23, 2025 7:53 AM UTC

• We continue to forecast further yield curve steepening across the U.S./EZ and UK, driven by cumulative easing. For the U.S. this can see a modest further decline in 2yr yields, but the prospect is for a move to a premium of 2yr to Fed Funds (unless a hard landing is seen). 10yr yields