DM Central Banks

View:

August 22, 2025

Fed Powell: Signals September Cut

August 22, 2025 2:35 PM UTC

Fed Chair Powell spent the first 10 minutes at Jackson hole reviewing current data and discussing the policy stance. Powell clearly signaled a September cut, given downside risks to employment after the July employment report revisions. However, Powell did not signal whether the move will be 25b

August 21, 2025

Eurozone: ECB Feels it Has More Reason to ‘Wait and See’?

August 21, 2025 10:02 AM UTC

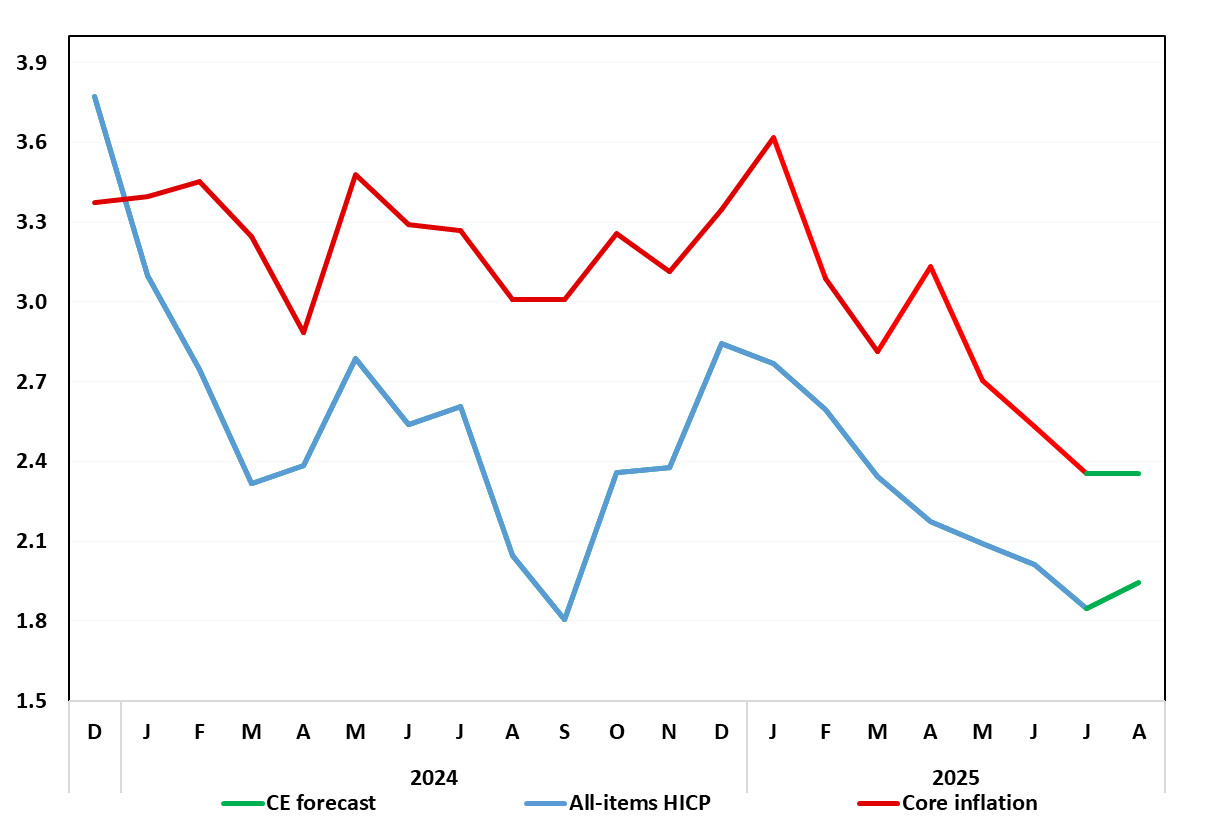

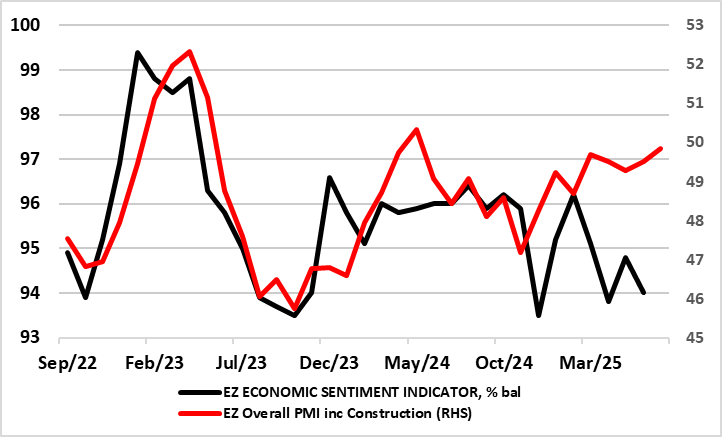

To suggest that recent EZ real economy indicators, such as today’s August PMI flashes, have been positive would be an exaggeration. But, at the same time, the data (while mixed and showing conflicts - Figure 1) have not been poor enough to alter a probable current ECB Council mindset that the ec

August 20, 2025

German Data Preview (Aug 29): Base Effects to Pull Headline Back Up - Temporarily?

August 20, 2025 1:39 PM UTC

Germany’s disinflation process continued, with the lower-than-expected July HICP numbers refreshing and reinforcing this pattern, with a 0.2 ppt drop to 1.8% y/y, a 10-mth low (Figure 1). This occurred in spite of adverse energy base effects albeit these likely to feature even more strongly in t

U.S./China Trade Deal: Slow Progress

August 20, 2025 10:25 AM UTC

· Overall, we would attach a 50% probability to a trade framework deal being announced in Q4, though this is unlikely to be comprehensive and could merely be a collection of measures. Even so, the risk also exists of trade negotiations dragging onto 2026 and then reaching a deal or fa

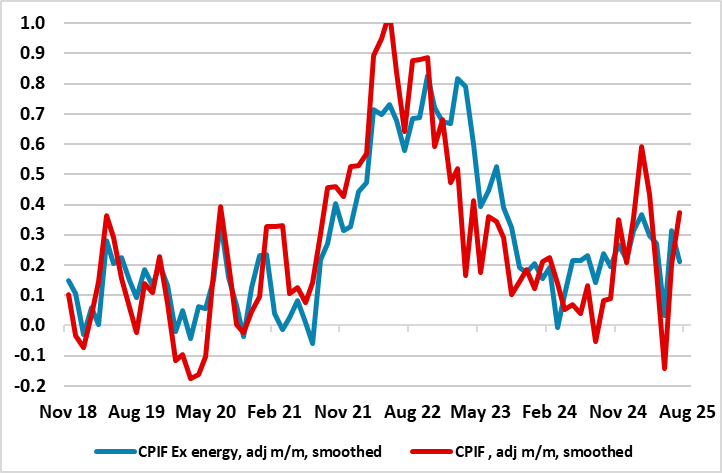

Sweden Review: Riksbank Still Flagging Final Rate Cut?

August 20, 2025 8:37 AM UTC

Although matching nearly all expectations, we are disappointed that the Riksbank did not deliver a further and probably final 25 bp rate cut this time around, especially given its repeated suggestion of prob a cut later this year. Now, there are three more policy verdicts before year-end and we thin

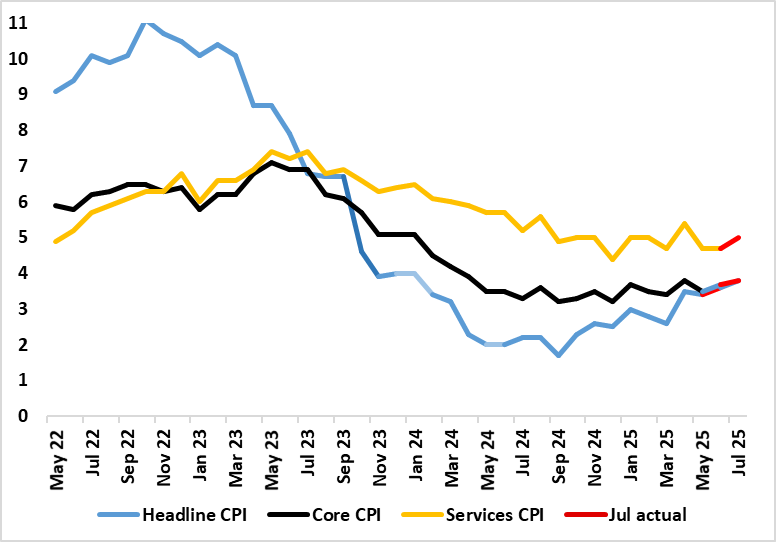

UK CPI Review: Special Factors Pull Inflation Even Higher, but is that an Excuse?

August 20, 2025 6:47 AM UTC

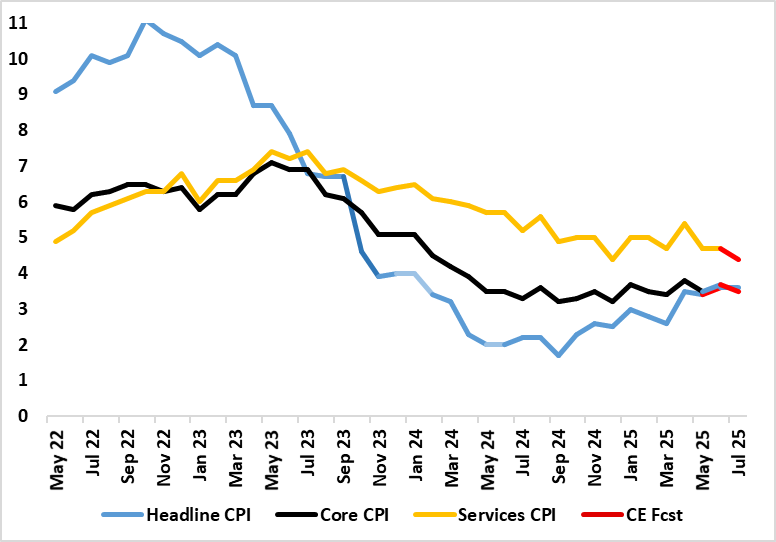

After the upside (and broad) June CPI surprise, CPI inflation rose further, up another 0.2 ppt to 3.8% in July, higher than the consensus but matching BoE thinking. And still the highest since January last year. The notable further 0.3 ppt rise in services inflation to 5.0% was also largely in lin

August 19, 2025

UK Labor Market: Is the BoE too Complacent?

August 19, 2025 10:10 AM UTC

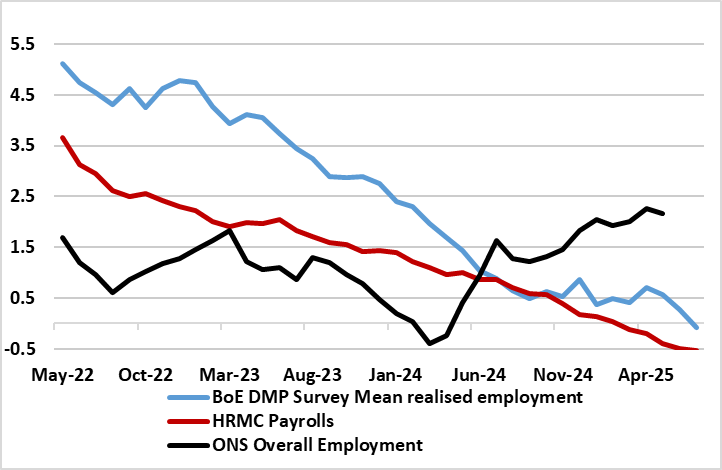

Unlike the Fed, which has dual mandate of curbing inflation and promoting employment, the BoE remit is purely the former. But it is clear that labour market considerations weigh heavily on the dovish contingent of the MPC and possibly increasingly so. However, we feel that the BOE is not fully e

China Slow Diversification: Gold And Others

August 19, 2025 8:05 AM UTC

China’s diversification from U.S. Treasuries appears to be at a slow pace. Gold is the obvious alternative if geopolitical tensions were to rise or skyrocket in the scenario of a China invasion of Taiwan. However, Gold holdings are merely creeping higher and suggesting no urgency from China

August 18, 2025

U.S. Strategic Fiscal Comparisons

August 18, 2025 9:05 AM UTC

The U.S. short average term to maturity is a structural fiscal weakness if higher rates lift U.S. government interest costs close to the nominal GDP trend. Hence, Trump’s pressure for fiscal dominance of the Fed to deliver lower policy rates and reduce U.S. government interest rate costs. Howeve

August 14, 2025

U.S. Markets: Soft Versus Hard Landing

August 14, 2025 1:02 PM UTC

A mild recession would likely trigger the Fed to ease quickly to 2.0-2.5%, which would produce yield curve steepening but would likely drag 10yr yields down to 3.50-3.75%. The S&P500 would likely fall to 5000 in this scenario, as corporate earnings are axed; buybacks slow and the price/ea

Norges Bank Review (Aug 14): Job Concerns Growing?

August 14, 2025 8:52 AM UTC

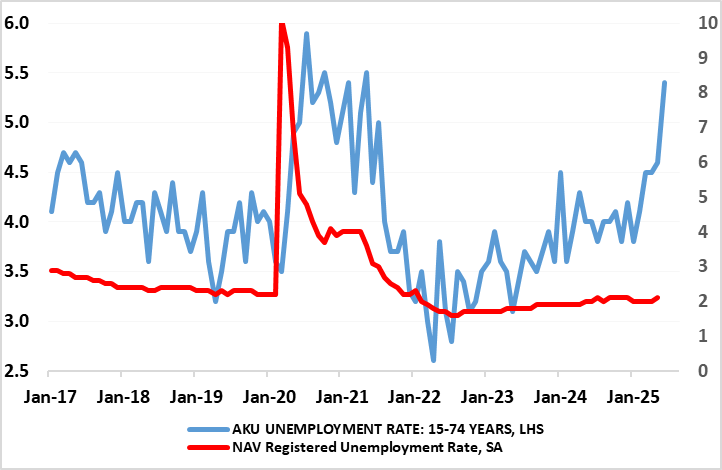

After the surprise 25 bp rate cut in June, it was back to humdrum predictability with the widely expected stable policy decision at 4.25%. Regardless, the Board could be attacked for plagiarism given the manner in which the updated press release mimics that seen in June, save for the fact that bot

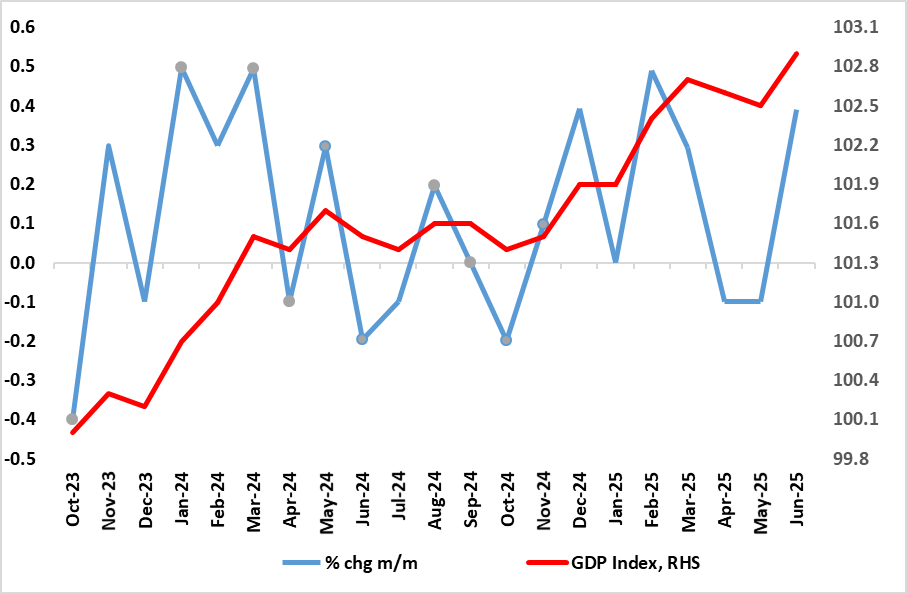

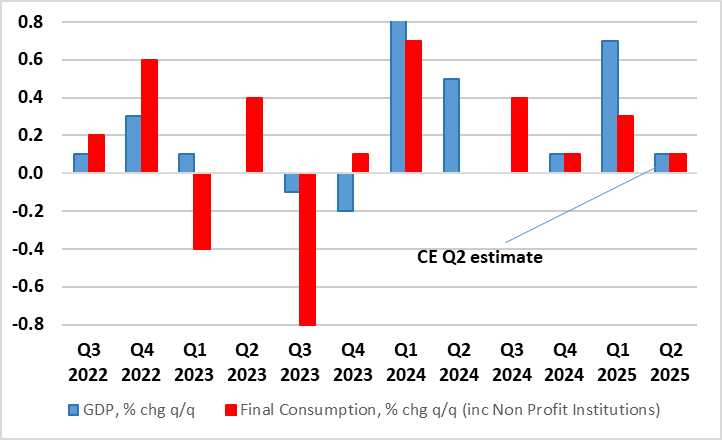

UK GDP Review: Fresh Upside Growth Surprise But Partly Inventory Driven?

August 14, 2025 7:02 AM UTC

To what extent better in June GDP, not least it having been the warmest even such month in England, lay behind the fresh upside surprise that saw the economy grow 0.4%, twice generally expected and with the falls of the two previous months pared back so that a clearer uptrend has emerged (Figure 1).

August 13, 2025

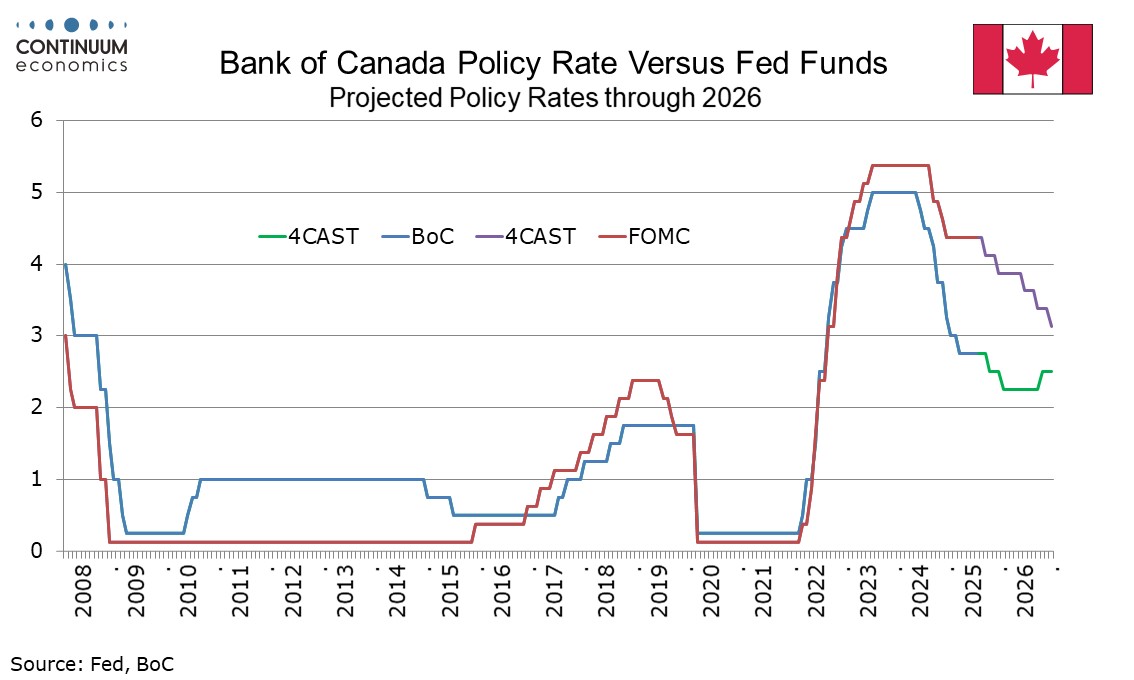

Bank of Canada Minutes from July 30 - Differences of opinion on whether further easing would be needed

August 13, 2025 7:32 PM UTC

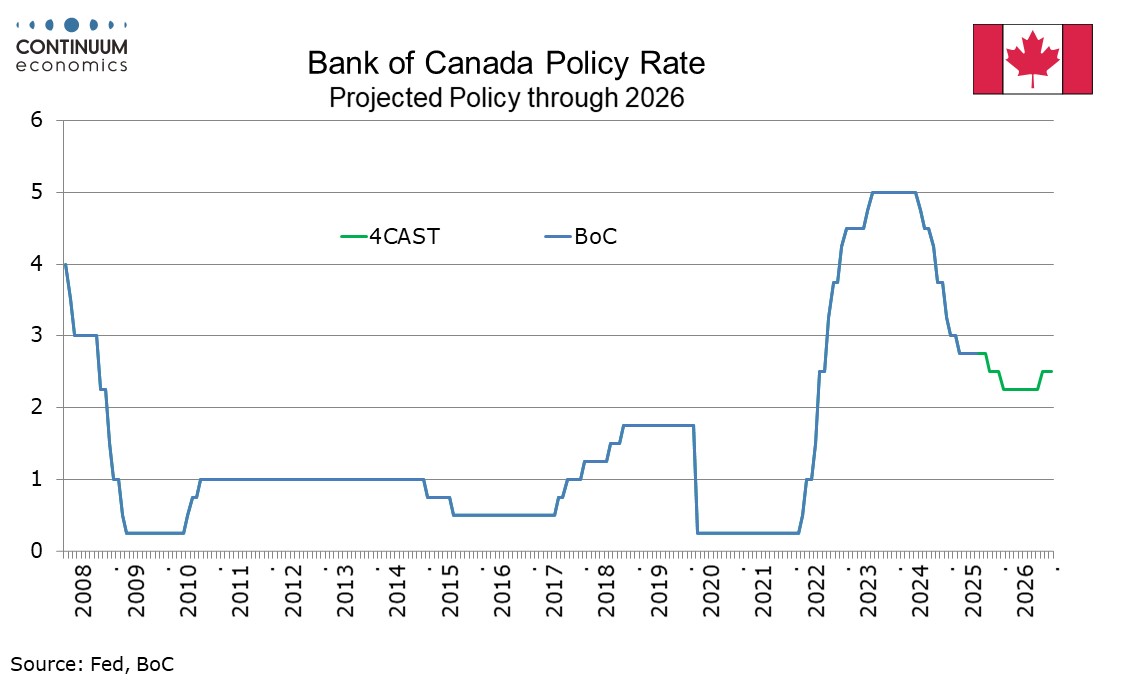

The Bank of Canada has released minutes from its July 30 meeting, which saw rates left unchanged at 2.75% with Governor Macklem stating after the meeting that there was a clear consensus to do so. However the minutes show that some felt the rate had been reduced sufficiently, while others felt that

September Fed ease now more likely than not, but far from assured

August 13, 2025 3:29 PM UTC

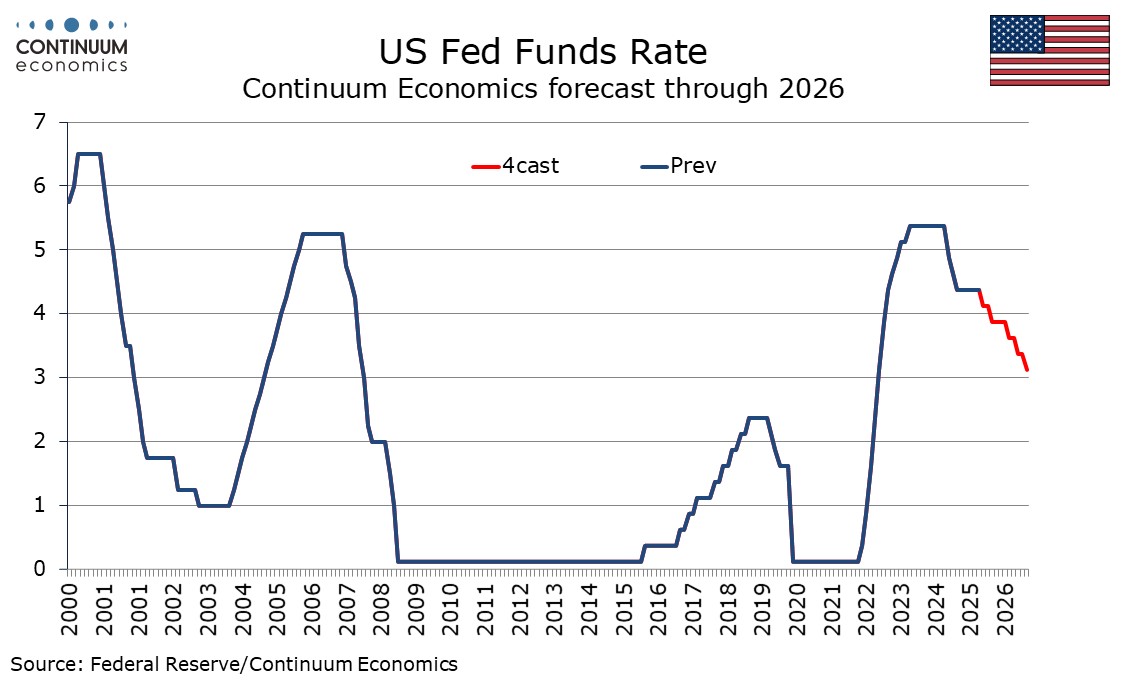

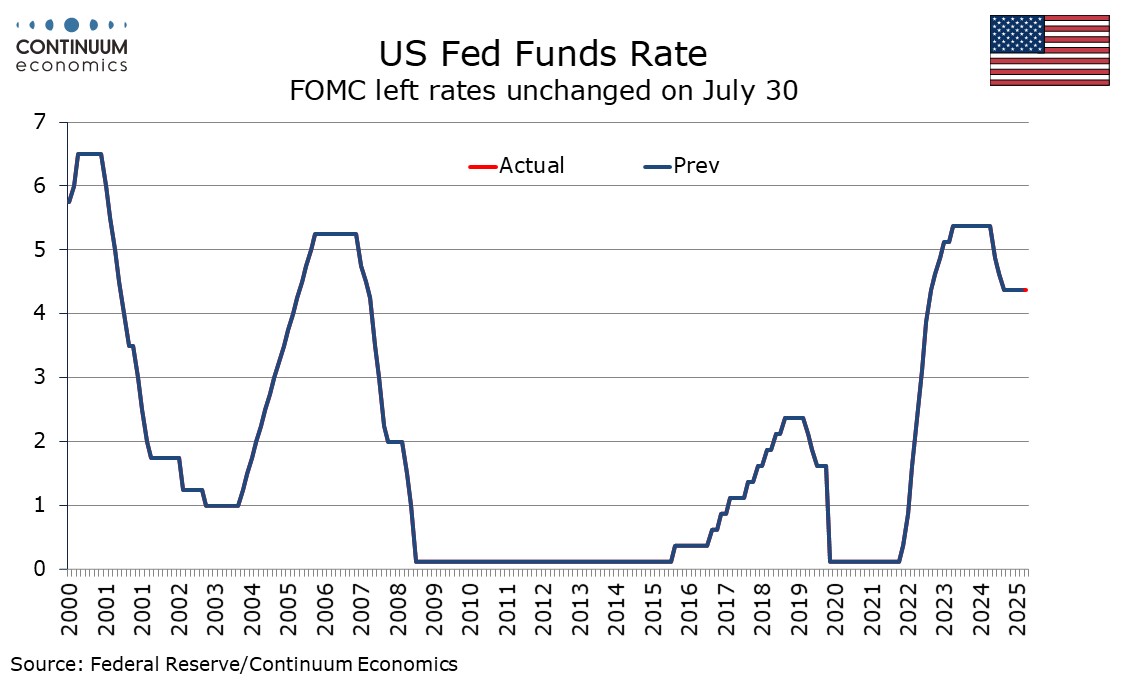

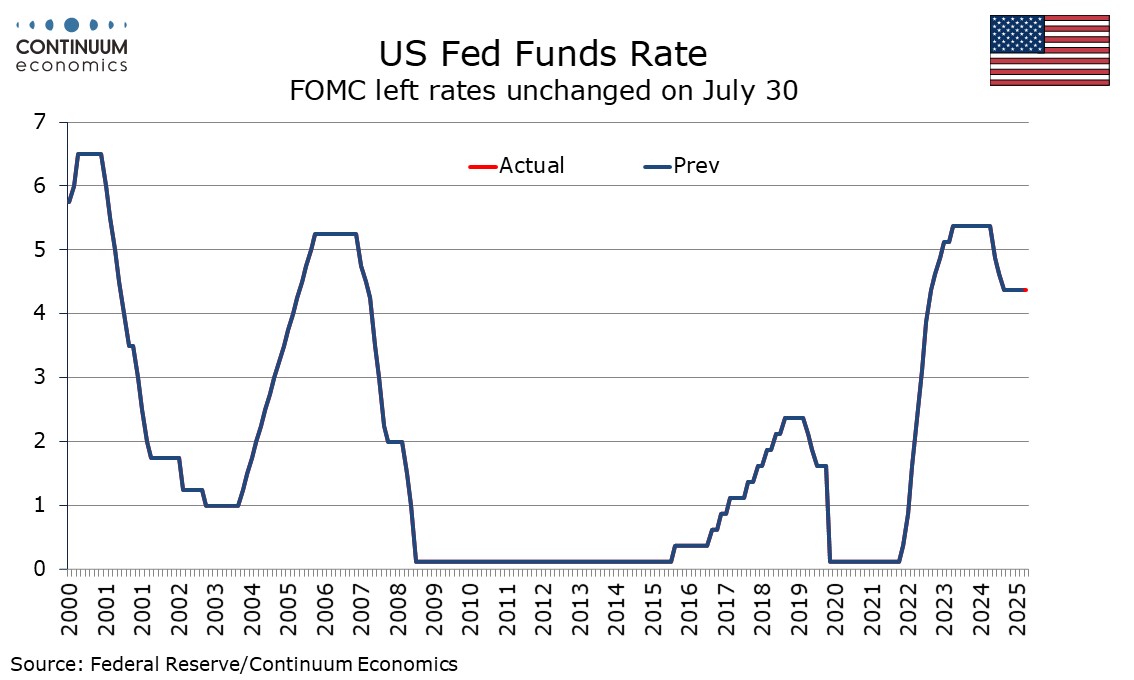

A September FOMC easing now looks more likely than not, but remains far from a done deal. We are however revising our call to two 25bps FOMC easings this year, in September and December, from just one, in December. 2026 is harder still to call given threats to Fed independence, but we continue to ex

August 12, 2025

August 11, 2025

UK CPI Preview (Aug 20): Services Inflation Fall Afresh r as Headline Stabilises?

August 11, 2025 2:24 PM UTC

After the upside (and broad) June CPI surprise, we see CPI inflation steady at 3.6% in July, 0.2 ppt below BoE thinking. Our relatively lower estimate factors in lower services inflation (Figure 1) and a fall back in that for food, the former allowing the core rate to unwind the increase to 3.7% s

Sweden Preview (Aug 20): Riksbank to Cut for Final Time?

August 11, 2025 12:42 PM UTC

We see the Riksbank delivering a further 25 bp rate cut on Aug 20, taking the policy rate to new cycle low of 1.75%. This would chime with the hints after the last meeting and cut in July of a further move is possible. And with both real activity and CPI data having delivered downside news and s

August 08, 2025

Canada July Employment - A weak month after a strong month

August 8, 2025 12:54 PM UTC

Canada’s surprisingly strong June employment report has been followed by a significant correction lower in July, with a fall of 40.8k to follow a rise of 83.1k, Full time work is negative over the two months, a 51.0k fall after a 13.5k increase, while part time work with a rise of 10.3k extended a

August 07, 2025

BoE Review: The (Fiscal) Elephant in the Room as the BoE Splits

August 7, 2025 12:48 PM UTC

The widely expected 25 bp Bank Rate cut (to 4% and the fifth in the current cycle) duly arrived although the anticipated three-way split on the MPC was not quite as expected. It is puzzling how policy makers, faced obviously with both the same array of data and the same remit, can think so relativel

August 06, 2025

UK GDP Preview (Aug 14): Small GDP Rises Hardly Worth Shouting About?

August 6, 2025 2:48 PM UTC

There are some better signs as far as June GDP is concerned, not least it having been the warmest even such month in England. But we see only a 0.1% m/m rise (Figure 1), even with slightly better property and retail signals for the month. However, such an outcome, while a contrast to the two suc

U.S. Immigration Slowdown and the Labor Market

August 6, 2025 7:58 AM UTC

Overall, slower illegal and legal immigration will likely slow employment growth and curtail the rise in the unemployment rate from the U.S. economic slowdown. More older workers or an increase in the percentage of female workers would help, but are not a priority for the Trump administration and

August 05, 2025

Norges Bank Preview (Aug 14): Amid Very Restrictive Stance, A Policy Pause – Already?

August 5, 2025 1:48 PM UTC

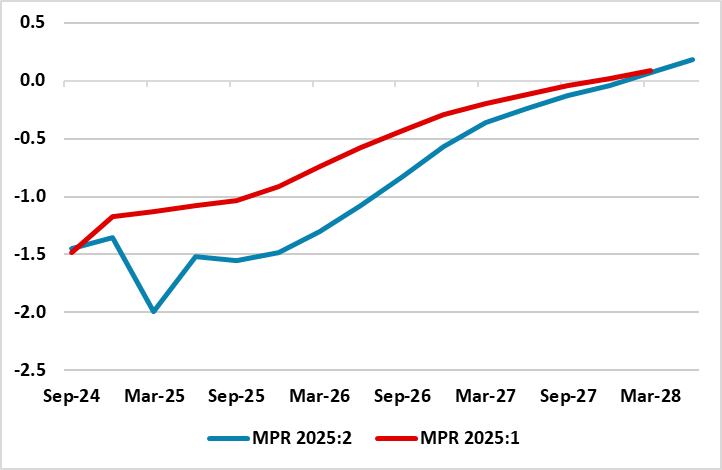

Although surprised, we thought the Norges Bank’s unexpected easing in June was very much warranted, as are the further cuts being flagged in the Monetary Policy Report (MPR) that came alongside – ie two more such moves by end year. We actually envisage up to three more moves this year and arou

DM Rates: Slowdown Debate Trump’s Independence Question for Now

August 5, 2025 9:50 AM UTC

U.S. Treasury spreads versus other DM government bond markets or 10-2yr U.S. Treasuries are not yet showing a risk premium from the Trump administration attacks on the Fed and economic data. Debate over whether the U.S. is seeing a soft or hard landing are reemerging and this will dominate the outlo

August 04, 2025

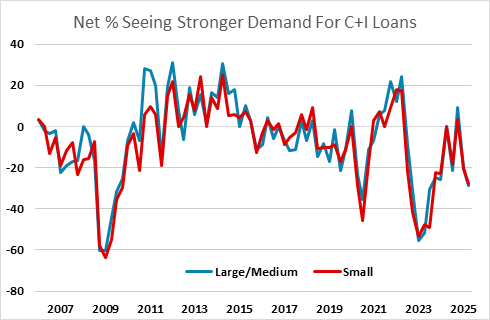

Fed Senior Loan Officer Opinion Survey Suggests Weaker Demand For Business Investment

August 4, 2025 6:44 PM UTC

The Fed’s July Senior Loan Officer Opinion Survey of bank lending practices suggests uncertainty is restraining investment demand, with supply signals on balance fairly neutral but demand signals weaker.

Trump Tougher Posture with Russia

August 4, 2025 8:31 AM UTC

We suspect that Trump will not follow-through with an across the board secondary sanction on importers of Russia oil, as it would freeze U.S./China trade again and could boost U.S. gasoline prices – high inflation is one main reason for Trump’s softer approval rating. Trump could agre

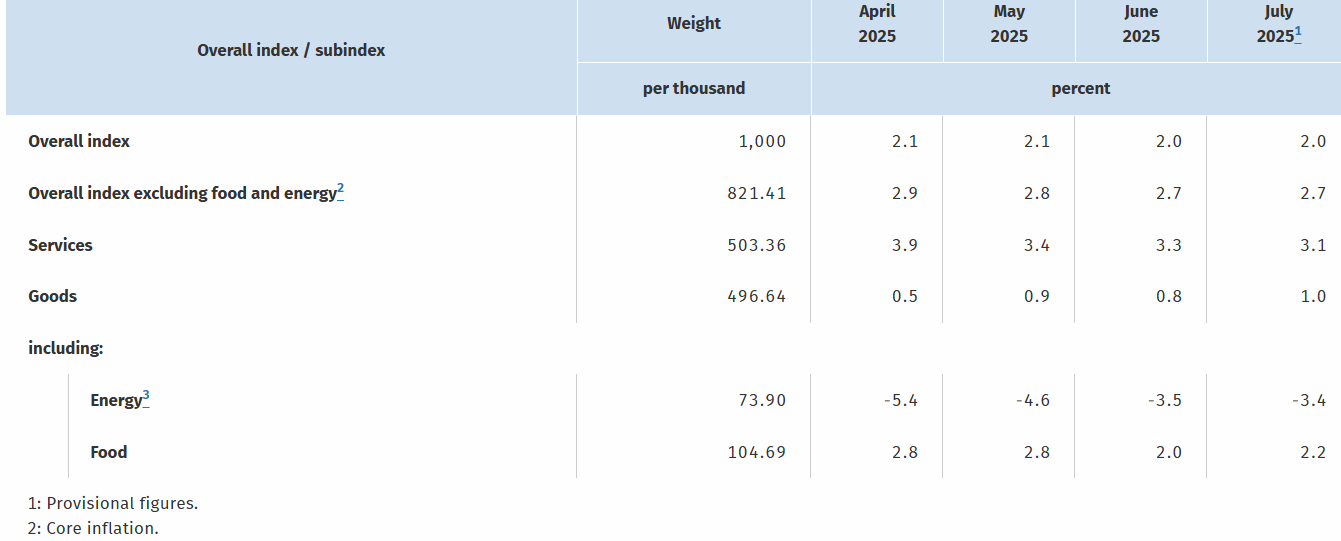

EZ HICP and Jobs Review: Headline at Target as Services Inflation at Fresh Cycle-low

August 4, 2025 8:25 AM UTC

HICP, inflation – still at target – is very much a side issue for the ECB at present, albeit with the likes of oil prices and tariff retaliation and a low but far from authoritative jobless rate (Figure 3) possibly accentuating existing and looming Council divides. Regardless, despite adverse

August 01, 2025

Reciprocal Tariffs: Some Hikes, Deals and Delays

August 1, 2025 8:40 AM UTC

Though high reciprocal tariffs with some countries catches the headline, five of the top 10 countries with large bilateral deficits have reached framework trade deals, two have delays and three have higher tariffs imposed. With exemptions on some USMCA Canada/Mexico goods, plus phones/ semicondu

July 31, 2025

German Data Review: Services Inflation Slows Further?

July 31, 2025 12:39 PM UTC

Germany’s disinflation process continues, with the lower-than-expected July preliminary HICP numbers reinforcing this pattern, with a 0.2 ppt drop to 1.8%, a 10-mth low (Figure 1)! This occurred in spite of adverse energy base effects. Regardless, there was some reversal of June’s surprise and

BoE Preview (Aug 7): Labour Market Softness to Trigger Further Cut, But Fiscal Risks Loom

July 31, 2025 7:14 AM UTC

After what was widely considered to be a dovish hold at the last (June) MPC meeting (Bank Rate staying at 4.25%) which saw three dissents in favor of easing at that juncture, a 25 bp reduction is very much on the cards for the August decision. Likely to discuss its two alternative scenarios still,

July 30, 2025

Fed's Powell Remains Cautious Over Tariff Risk

July 30, 2025 7:34 PM UTC

The FOMC left rates unchanged at 4.25-4.5% as expected, though there were two dissenting votes for easing, from Governors Waller and Bowman, who had already given signals in that direction. The statement made a concession to the doves stating that growth moderated in the first half of the year, but

FOMC leaves rates unchanged, two dissents for easing, language more dovish on growth

July 30, 2025 6:16 PM UTC

The FOMC left rates unchanged at 4.25-4.5% as expected, though there were two dissenting votes for easing, from Governors Waller and Bowman, who had already given signals in that direction. The wording of the statement also contains a dovish shift, stating that growth moderated in the first half of

Bank of Canada - Consensus to hold, but cautious bias towards easing

July 30, 2025 3:34 PM UTC

Bank of Canada Governor Tiff Macklem stated that there was a clear consensus to leave rates steady at 2.75% at the latest meeting, as was also the case in June. There does however appear to be scope for further easing ahead. We still expect rates to bottom at 2.25% and end 2026 at 2.5%, but we now

DM Household Sluggish Borrowing

July 30, 2025 10:45 AM UTC

· Overall, restrained credit supply from banks; abundant employment/income or wealth for most households but restrained financial conditions for low income households could have restrained household lending growth to GDP. However, the surge in government debt and ensuing fear of fut

Eurozone Flash GDP Review: Resilience or Irrelevance?

July 30, 2025 9:52 AM UTC

As we highlighted in our preview, for an economy that has seen repeated upside surprises and above trend growth, now some 1.4% in the year to Q2, GDP data do not seem to have had much impact is shaping, let alone dominating, ECB policy thinking. We think this will continue to be the case even after

July 29, 2025

EZ Real Economy – Diverging Sentiment Indictors Complicate Outlook

July 29, 2025 9:26 AM UTC

The ECB contends that the EZ economy has shown resilience of late. Maybe so, albeit where GDP data (likely to average a satisfactory 0.3% q/q performance so far this year) are probably offering a misleading picture of underlying trends in real activity. Indeed, recent GDP data gains have been pr