FOMC leaves rates unchanged, two dissents for easing, language more dovish on growth

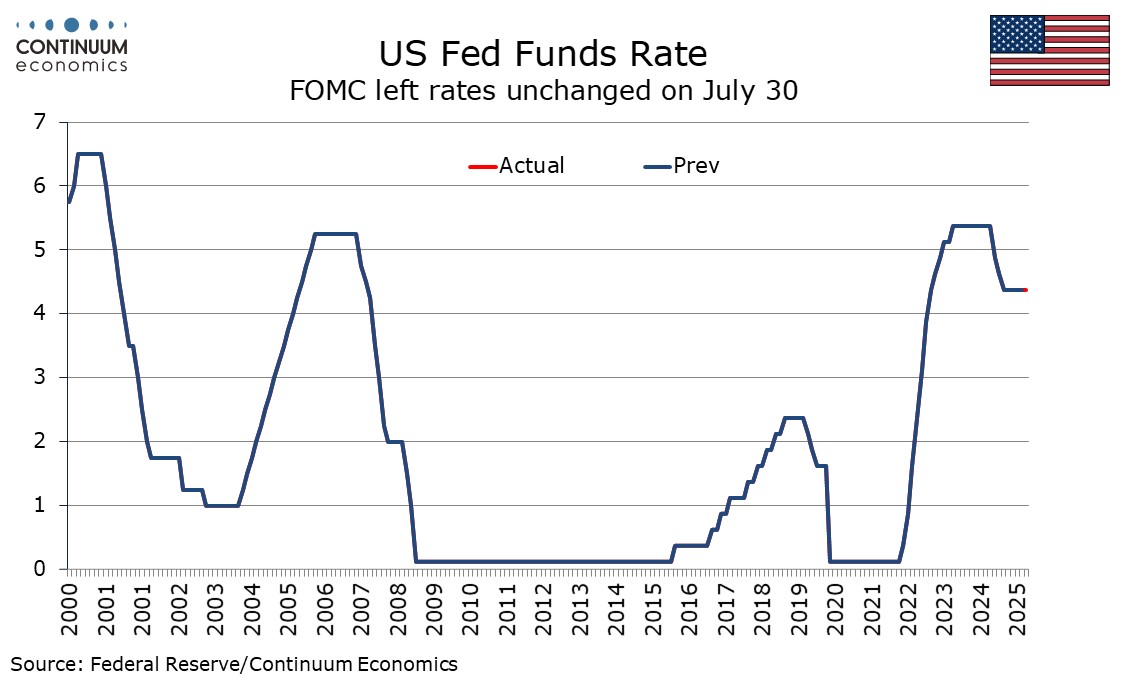

The FOMC left rates unchanged at 4.25-4.5% as expected, though there were two dissenting votes for easing, from Governors Waller and Bowman, who had already given signals in that direction. The wording of the statement also contains a dovish shift, stating that growth moderated in the first half of the year, despite the stronger than expected Q2 GDP outcome.

In June’s statement the FOMC said that although swings in net exports have affected the data, recent indicators suggest that economic activity has continued to expand at a solid pace. This statement again saw the FOMC refer to swings in net exports, which depressed Q1 and lifted Q2 GDP, but now state that growth of economic activity moderated in the first half of the year. The pace averages less than 1.5% when Q1’s 0.5% decline and Q2’s 3.0% increase are averaged. Final sales to domestic buyers (GDP excluding net exports and inventories) slowed to 1.1% in Q2 from 1.5% in Q1.

Uncertainty was described as elevated with a reference to it having diminished removed. Otherwise the statement is left unchanged apart from the addition of the two dissents. The FOMC still sees the unemployment rate as low, labor market conditions as solid and inflation as somewhat elevated. The slight shift in the language on growth leaves the FOMC with the option of easing in September, though with both July and August employment and CPI data to be released before that meeting, the decision may depend on data.