RBNZ Review: Dovish Surprise in Guidance

RBNZ cut its cash rate by 25bp to 3% but vote is 4 to 2 as 50bps considered

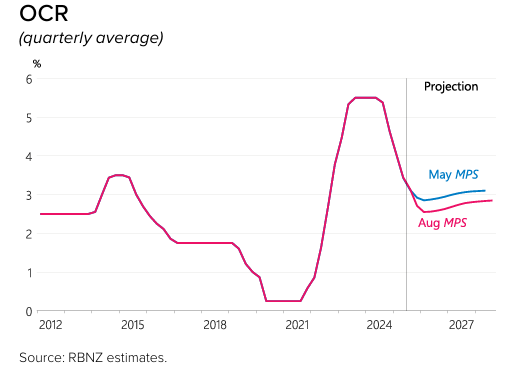

Forward guidance dovish with OCR revised roughly 50bps lower

The RBNZ cut its cash rate by 25bp to 3% in the August meeting, revised OCR forecast to indicate more rate cut in 2025 and keep terminal rate below 3% throughout 2026/27, along with slight revision in the inflation forecast. The move was read as dovish with a 4-2 vote, some members were discussing a 50bps cut in the August meeting.

Some key takeaways:

More Cuts to Come: The August OCR forecast see a revision from the May forecast and see two more cut in 2025. OCR forecast seems trough rate at 2.55%, confirmed by RBNZ governor Hawkesby. By September 2025, the OCR is now forecasting one more cut, almost two more cut by September 2026.

Inflation Expectation: The RBNZ sees headline CPI to be higher by September 2026 at 2.2% from the 2.1% May forecast. There seems to be more clarity from the Trump's tariff end and the RBNZ is able to assess its impact towards inflation better, making them more comfortable in easing.

Dovish Forward Guidance: The RBNZ committee voted 4 to 2 for the 25bps cut, citing discussion of 50bps. While they cited data dependency, they are foreseeing a further moderation in inflation with spare capacity, thus seeing two more cut in the rest of 2025.