Fed's Powell Remains Cautious Over Tariff Risk

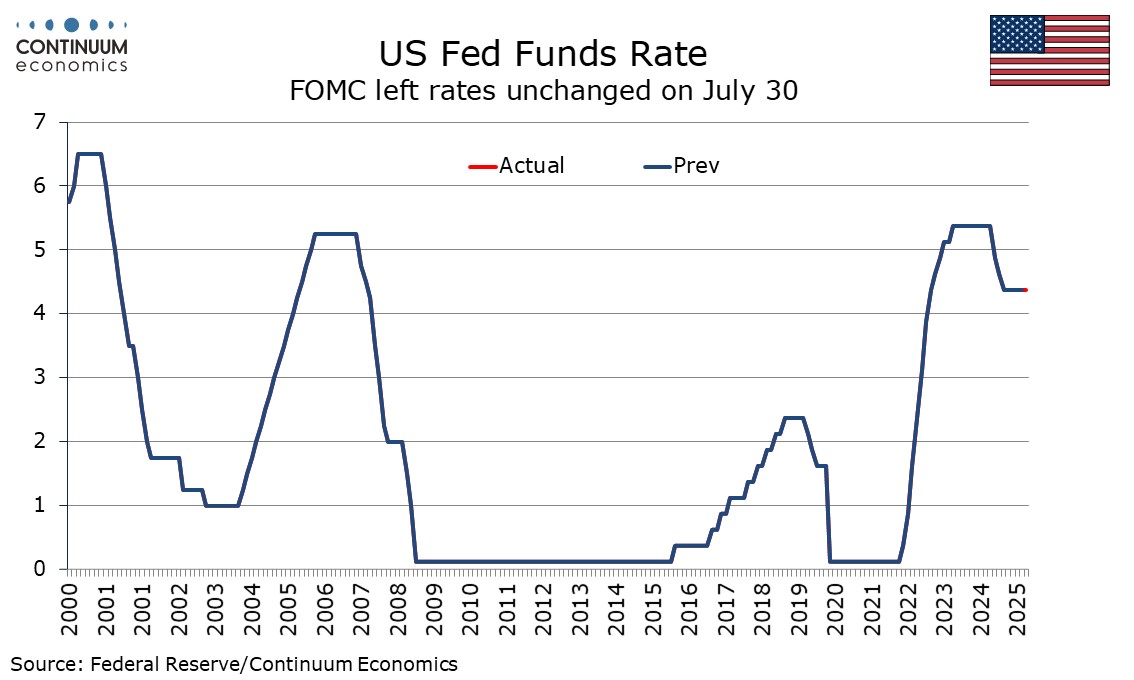

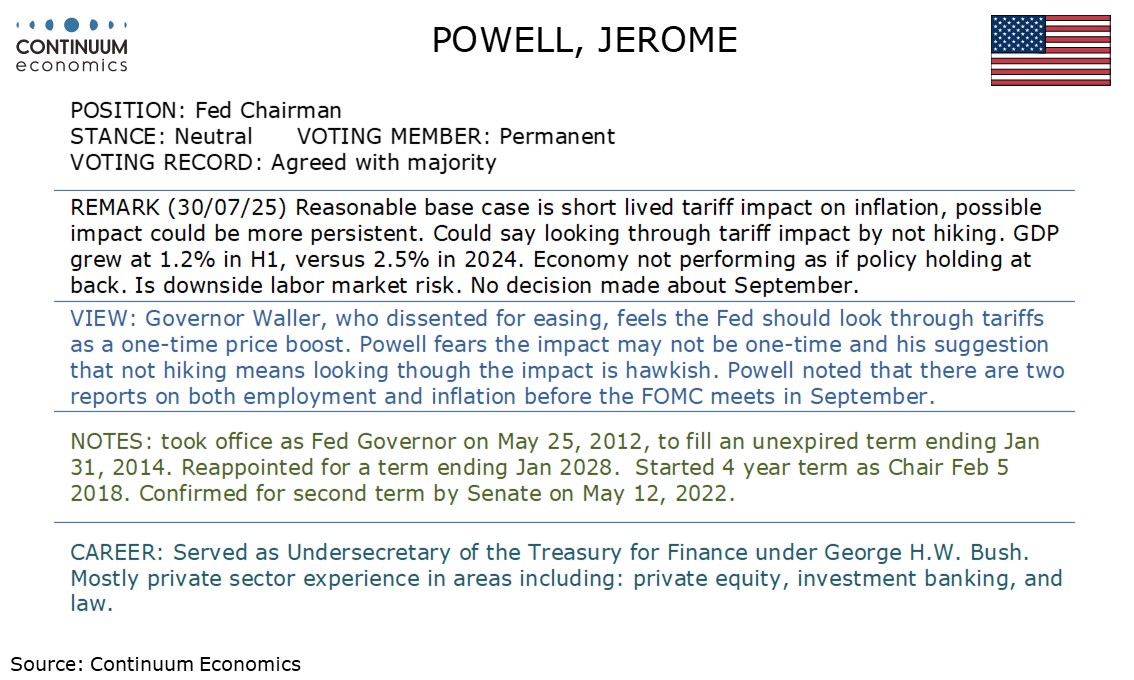

The FOMC left rates unchanged at 4.25-4.5% as expected, though there were two dissenting votes for easing, from Governors Waller and Bowman, who had already given signals in that direction. The statement made a concession to the doves stating that growth moderated in the first half of the year, but Chairman Powell in the press conference still sounded cautious about the inflationary impact of tariffs.

Before the FOMC next meets in September there will be two more employment and CPI reports, and Powell stated that no decision has yet been made on that meeting. He did note that there were downside labor market risks, despite the statement still seeing unemployment as low and labor market conditions as solid. Easing could be seen in September if the labor market weakens, but recent declines in initial claims argue against a weak employment report being seen for July on Friday.

The statement continues to see inflation as somewhat elevated. Doves, notably Waller, have argued that inflationary risks from tariffs should be looked through as a a one-time impact. However Powell sounded fairly hawkish here, seeing a one-time boost as a reasonable base case but also seeing risks that the impact could be more persistent. A comment that by not hiking the FOMC could be seen as looking through the tariff impact was notably hawkish. Risks that an increased tariff impact could be seen in July and August inflation data are significant, particularly so for August if companies become more confident of the persistence of tariffs once the August 1 deadline passes.

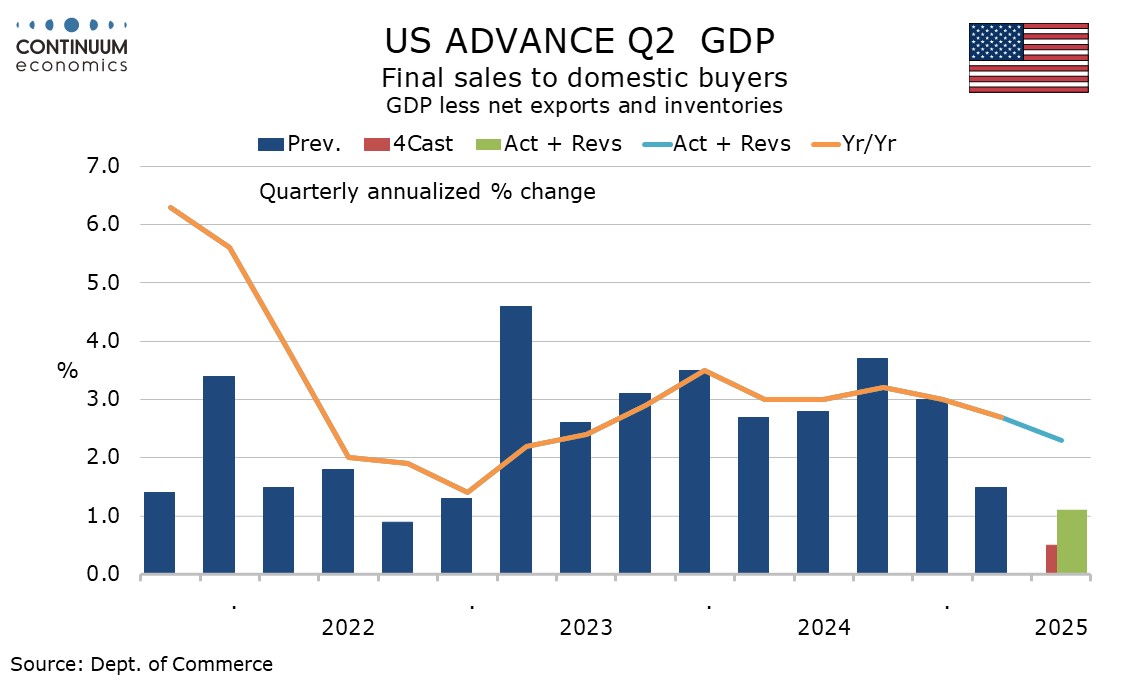

Powell’s press conference offset the dovish impact coming from the two dissents, and the downgrading of the growth assessment. In June the FOMC said that although swings in net exports have affected the data, recent indicators suggest that economic activity has continued to expand at a solid pace. This statement again saw the FOMC refer to swings in net exports, which depressed Q1 and lifted Q2 GDP, but now states that growth of economic activity moderated in the first half of the year. The pace is 1.2% when Q1’s 0.5% decline and Q2’s 3.0% increase are averaged. Final sales to domestic buyers (GDP excluding net exports and inventories) slowed to 1.1% in Q2 from 1.5% in Q1.

While policy will be data-dependent, we continue to expect the FOMC to keep rates on hold until December, when we expect a 25bps easing. We expect three 25bps easings in 2026, leaving the end 2026 Fed Funds target at 3.25-3.5%, still above the FOMC’s median estimate of neutral of 3.0% as seen in June’s Summary of Economic Projections.