China

View:

January 05, 2026

Venezuela: Oil and Geopolitics

January 5, 2026 12:02 PM UTC

· Venezuela’s oil production will likely take years to increase substantively due to poor infrastructure, the need for substantive investment, and a lack of democratic political stability. In terms of geopolitics, operations in Venezuela reinforce the Trump administration’s pivot

January 02, 2026

December 22, 2025

December 19, 2025

December 18, 2025

EM FX Outlook: High Real Yields Still Help

December 18, 2025 12:14 PM UTC

• EM currency 2026 prospects come against a backdrop of a further but slower USD depreciation against DM currencies, but inflation differentials, domestic central bank policy and politics also matter. We forecast the Mexican Peso (MXN) will likely be more volatile, as President Donald Tru

December 17, 2025

Outlook Overview: Turbulent Times

December 17, 2025 7:44 AM UTC

· The U.S. slowdown remains in focus as the lagged effects of President Trump’s tariff increases continues to feedthrough, though our baseline is for a 2026 soft-landing. The Supreme court will likely rule against part of Trump’s reciprocal tariffs, which will create short-term

December 15, 2025

China: Weak Growth

December 15, 2025 7:39 AM UTC

• November figures show weak growth and are a concern for momentum going into 2026. Retail sales continues to be hurt by adverse wealth effects and slow job and income growth. Though the authorities are promising to boost consumption, we see this only being modest rather than aggressive

December 12, 2025

Equities Outlook: Choppy Up For 2026 and Down for 2027?

December 12, 2025 8:05 AM UTC

· The U.S. equity market is underpinned by the bullish AI/tech story and a soft economic landing into 2026. However, overvaluation is clear and this leaves the market vulnerable to a 5-10% correction on moderate bad news e.g. economic data. We see the S&P500 having a choppy year a

December 11, 2025

China Outlook: Headwinds Get Stronger

December 11, 2025 10:30 AM UTC

· Private domestic demand remains modest, with consumption ranging from modest to moderate (slowed by the housing wealth hit and soft jobs/wage growth) and investment further impacted by the ongoing adverse drag of the residential property bust. China’s authorities prefer a long and

December 09, 2025

Americas First: New National Security Strategy

December 9, 2025 8:40 AM UTC

· The new NSS at one level reads like a Trump/MAGA current list of topics and desires, that may not translate into policy or a major shift of military assets. Trump has blown hot and cold on Europe and China over the past 12 months and could shift again. Nevertheless, the NSS does r

December 04, 2025

China/Japan: The Australia Playbook or Grey Warfare

December 4, 2025 10:05 AM UTC

China will likely escalate pressure on Japan to back down over it less pacifist stance on self-defense, as it wants to drive a wedge between Japan and the U.S. One option is to repeat the 2020 copybook when China banned coal imports from Australia for 3 years. A 2nd alternative is grey warfare a

December 03, 2025

November 28, 2025

China’s Hidden Gold Buying: Why?

November 28, 2025 1:05 PM UTC

Speculation has been growing in the gold market that the surge in unrecorded gold purchases could be linked to China.

Overall, some unreported buying of gold by China could have occurred in 2025 and also in 2022-24. This could be a combination of wanting to avoid upsetting Trump during a tense U.S.-C

November 24, 2025

Japan Aging: Consumption Lessons for Eurozone/China?

November 24, 2025 10:55 AM UTC

· China will likely suffer slowing consumption from population aging in the coming years, as consumption per head falls for over 55’s and large scale immigration is not a likelihood. China’s household wealth is also heavily concentrated in falling illiquid residential property. Chin

November 21, 2025

U.S. Asset Inflows After April’s Trump Tariffs

November 21, 2025 8:00 AM UTC

· Net foreign portfolio inflows have not been hurt by Trump’s April tariff drama, with the AI and tech boom attracting new equity inflows. Flows could become more volatile with a U.S. equity bear market or recession, but these are modest risk alternative scenarios rather than high r

November 18, 2025

Markets 2026

November 18, 2025 10:30 AM UTC

· The Fed, ECB and BOE will likely drive further 10-2yr government bond yield curve steepening, with 10yr Bund yields rising due to ECB QT and German fiscal expansion. 10yr JGB yields are set to surge through 2%, as BOJ QT remains excessive and underestimated. The BOJ could partiall

November 17, 2025

Financial Stability Risks: Vulnerable To A Recession

November 17, 2025 1:00 PM UTC

The November Fed financial stability review highlights continued concern over hedge funds and insurance company leverage, while the IMF GSFR is concerned about U.S. equity market overvaluation and growing links between banks and non-bank financial intermediaries. However, the main adverse shock wo

November 14, 2025

China: Unbalanced Growth

November 14, 2025 8:15 AM UTC

· The slowdown in China retail sales continues, with excess production still evident. Nevertheless, the slowdown in industrial production and private sector business investment suggests that companies are becoming less upbeat about domestic demand. Underlying growth is 4.0%, though

November 13, 2025

Japan/China Tensions Over Taiwan

November 13, 2025 10:45 AM UTC

China wants to make Japan cautious about helping the U.S. in future military scenarios. With PM Takaichi tougher stance, China could decide to escalate tensions to reduce the risk of Japan becoming involved in future years. This could be restrictions of some critical minerals from China to Japan

November 10, 2025

China: CPI Rises Helped By Government Pressure

November 10, 2025 8:24 AM UTC

• Less food price decline, plus government pressure to curtail price wars, helped headline and core CPI move higher. However, the September industrial production and retail sales figure shows that the imbalance between supply and domestic demand remains in place. The imbalance of supply a

November 07, 2025

China’s 2nd Tier Banking Problems

November 7, 2025 2:45 PM UTC

China’s residential property bust continues to feedthrough to some bank’s non-performing loans and financial stability. Even so, the latest PBOC financial stability report shows the percentage of high risk rated banks has not increased over the last 12 months, while China authorities early warni

November 06, 2025

November 03, 2025

China: Fiscal Stimulus Modest Rather than Large?

November 3, 2025 9:07 AM UTC

• Overall, we see around a Yuan2.0-2.5trn fiscal stimulus for 2026 and some of this could be announced in December but the majority in March 2026. This reflects the fiscal constraints on China authorities; the targeted focus in the 2026-31 five year plan and reluctance to spending on hous

October 31, 2025

U.S./China Trade Framework: Avoiding Escalation

October 31, 2025 7:48 AM UTC

· The U.S./China framework deal avoids renewed escalation of trade tension, but is unlikely to be followed by a comprehensive trade deal in 2026 as China does not want major import and bilateral trade commitments. The economic effects will likely be small and the deal main aim app

October 27, 2025

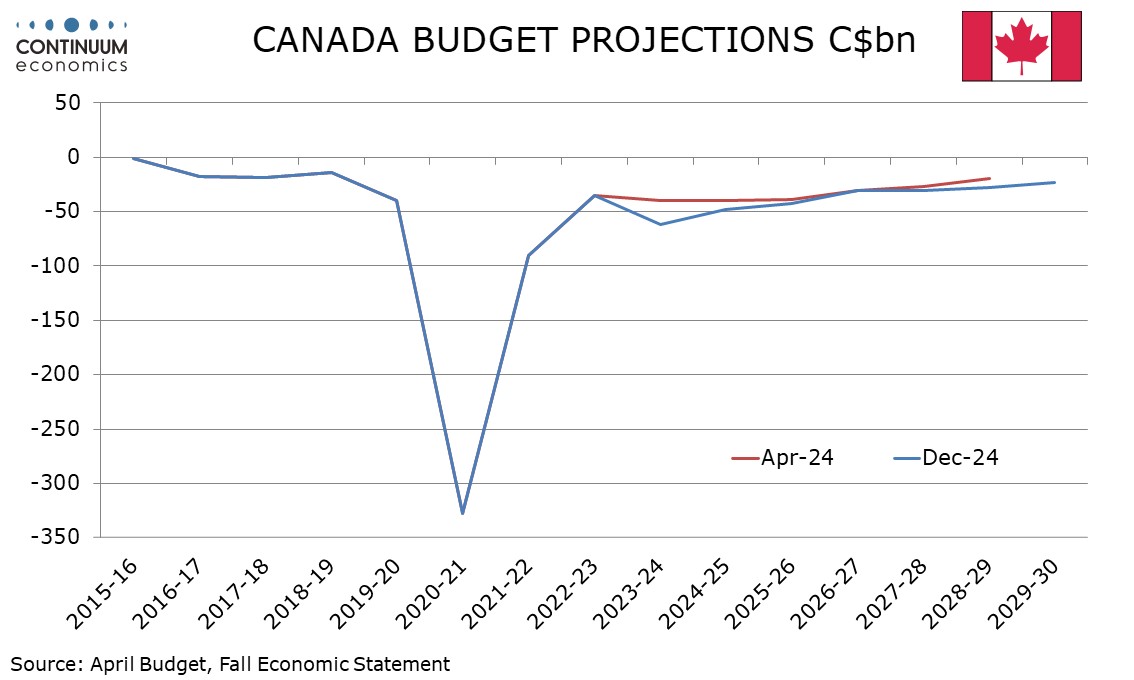

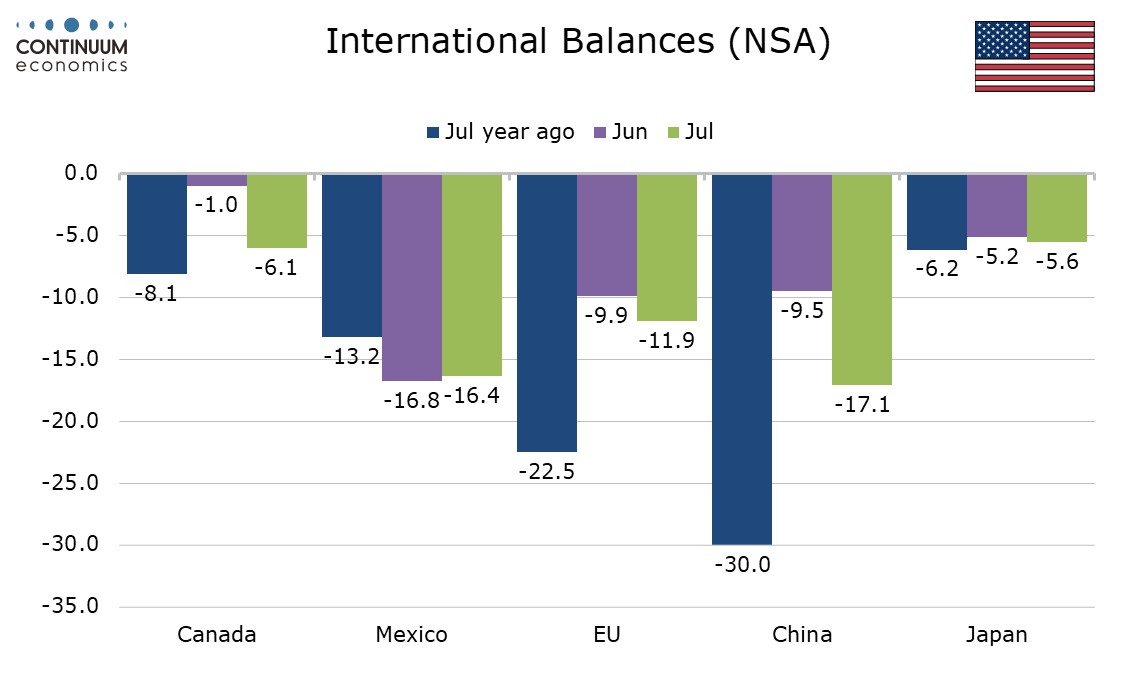

U.S-China Trade Tensions Ease, US-Canada Tensions Escalate

October 27, 2025 3:32 PM UTC

Trade tensions between the US and China appear to be easing, with it looking increasingly unlikely that the US will impose a threatened extra 100% tariff on China on November 1. However trade tensions with Canada have increased, with Canada receiving an extra 10% tariff, adding to downside economic

October 17, 2025

October 13, 2025

U.S-China Trade Tensions May Escalate Further Before Eventually Fading

October 13, 2025 3:19 PM UTC

Trump’s more conciliatory words after announcing a 100% tariff on China starting November 1 have eased market worries, though the issue is far from resolved. It is still possible that Trump will follow through with his threat on November 1, but unlikely that tariffs would remain elevated for very

October 01, 2025

AI/Humanoid Robots and Disinflation?

October 1, 2025 9:40 AM UTC

· Overall, a number of forces from the AI wave will impact inflation. Power demand could push up power prices, but productivity enhancements and product innovation could be disinflationary like Information and Communications technology (ICT). One other key uncertainty on a 1-5 year

September 30, 2025

Trump Tariffs: China, Mexico and Semiconductors

September 30, 2025 8:00 AM UTC

· Our baseline (60% probability) remains that a U.S./China trade deal will be agreed in Q4/Q1 2026 and it is possible though unlikely that this could be announced at the Trump/Xi meeting at the October 31 APEC summit – China requests that the U.S. changes policy on Taiwan could slo

September 26, 2025

September 25, 2025

September 24, 2025

September 23, 2025

Outlook Overview: Into 2026

September 23, 2025 8:25 AM UTC

· The critical question is how much the U.S. economy is slowing down with the feedthrough of President Donald Trump’s tariffs to boost inflation and restrain GDP growth, with the effective rate currently around 17% on U.S. imports. Though semiconductor tariffs are likely, the bulk of

Equities Outlook: Correction Then Up In 2026

September 23, 2025 7:15 AM UTC

• The U.S. equity market’s bullishness reflects good corporate earnings reality, buybacks and the AI story. However, we feel that the U.S. economy can deteriorate still further in the coming months, as the lagged effects of tariffs boost inflation and restrain spending/hurt corporate ea

September 19, 2025

China Outlook: Headwinds into 2026?

September 19, 2025 9:30 AM UTC

• Overall, net exports contribution to GDP growth should be tempered in H2 2025, as 30% tariffs bite more progressively and other countries more closely monitor the redirection of China’s exports. A trade deal with the U.S. remains our baseline, which should reduce tariffs to around 20%

September 16, 2025

Succession and Strongmen Leaders

September 16, 2025 10:53 AM UTC

In the unexpected scenario of an early death, Putin and Xi have no clear successors, and any new Russia or China leader would have to spend time building domestic strength and compromising on external goals. Erdogan also has no clear successors, which could create political uncertainty. For Trump su

September 15, 2025

China: Broad Based Slowdown

September 15, 2025 7:55 AM UTC

• The latest monthly data from China show a broad based slowdown in the economy, due to the tariffs and structural weakness. Though we keep 2025 real GDP at 4.8%, the underlying trend suggest a slowdown to 4.0% for 2026. China authorities will start to announce fiscal measure

September 12, 2025

Taiwan: Grey Warfare or Naval Quarantine?

September 12, 2025 11:15 AM UTC

· The most likely option for China is to continue the air and naval grey warfare around Taiwan, combined with support for pro-China factions in Taiwan parliament to build pressure for reunification at some stage. With invasion being too high risk for President Xi (with the U.S. main

September 04, 2025

September 01, 2025

Aging: Slow Growth for Some in 2020’s

September 1, 2025 8:35 AM UTC

Population aging always seems to be beyond the market horizon, but the 2020’s are already seeing population aging in some countries. What is the economic impact? Aging is already causing a peak in labor force in China and the EU. Meanwhile, the population pyramid also means less consumptio

August 20, 2025

U.S./China Trade Deal: Slow Progress

August 20, 2025 10:25 AM UTC

· Overall, we would attach a 50% probability to a trade framework deal being announced in Q4, though this is unlikely to be comprehensive and could merely be a collection of measures. Even so, the risk also exists of trade negotiations dragging onto 2026 and then reaching a deal or fa

August 19, 2025

China Slow Diversification: Gold And Others

August 19, 2025 8:05 AM UTC

China’s diversification from U.S. Treasuries appears to be at a slow pace. Gold is the obvious alternative if geopolitical tensions were to rise or skyrocket in the scenario of a China invasion of Taiwan. However, Gold holdings are merely creeping higher and suggesting no urgency from China

August 15, 2025

China Slowdown In July

August 15, 2025 7:03 AM UTC

• Retail sales sluggishness reflects households cautious due to the hit to housing wealth and uncertainty over jobs and wage growth. Investment softness reflects not only residential property weakness, but also a slowdown in government infrastructure. This weakness could see a top up fi

August 13, 2025

China: Echoes of Japan?

August 13, 2025 8:05 AM UTC

Overall, some of China’s private businesses and households are suffering from Japan’s style balance sheet recession. Combined with slowing productivity and a shrinking workforce, this points to slower trend growth in the coming years. However, fiscal stimulus and the clean-up of Loca

August 07, 2025

EM Rates: Domestic Fundamentals Dominate

August 7, 2025 9:30 AM UTC

Once trade is agreed with the U.S., the good fundamentals actually argue for a 10yr Mexico-U.S. spread close to 400bps and this is our favored strategic risk reward for big EM government bonds. In Brazil a case can be made for a 12.75% policy rate end 2026 and 10% in 2027, but this could only mean 1

August 04, 2025

Trump Tougher Posture with Russia

August 4, 2025 8:31 AM UTC

We suspect that Trump will not follow-through with an across the board secondary sanction on importers of Russia oil, as it would freeze U.S./China trade again and could boost U.S. gasoline prices – high inflation is one main reason for Trump’s softer approval rating. Trump could agre

August 01, 2025

Reciprocal Tariffs: Some Hikes, Deals and Delays

August 1, 2025 8:40 AM UTC

Though high reciprocal tariffs with some countries catches the headline, five of the top 10 countries with large bilateral deficits have reached framework trade deals, two have delays and three have higher tariffs imposed. With exemptions on some USMCA Canada/Mexico goods, plus phones/ semicondu

July 29, 2025

China/U.S. Trade Talks Into the Autumn

July 29, 2025 8:20 AM UTC

· Our baseline (Figure 1) remains that a U.S./China deal will be reached (most likely in Q4), but a moderate probability exists of no deal being done this year and China being stuck with 30% tariffs – the worst-case scenario of still higher tariffs is now less likely with Trump in a

July 28, 2025

Food Glorious Food

July 28, 2025 10:15 AM UTC

· Global food prices should see small increases in the future, as production continues to rise broadly in line with increasing demand driven by population and a rising consumption per person in EM countries. However, China will remain dependent on food imports given it has limited roo