South Africa

View:

August 20, 2025

South Africa Inflation Surges: 3.5% YoY in June

August 20, 2025 11:12 AM UTC

Bottom Line: Statistics South Africa (Stats SA) announced on August 20 that annual inflation rose to 3.5% YoY in July from 3.0% in June due to elevated prices of food and non-alcoholic beverages; housing and utilities; and restaurants and accommodation services. MoM prices surged by 0.9% in July, m

August 07, 2025

EM Rates: Domestic Fundamentals Dominate

August 7, 2025 9:30 AM UTC

Once trade is agreed with the U.S., the good fundamentals actually argue for a 10yr Mexico-U.S. spread close to 400bps and this is our favored strategic risk reward for big EM government bonds. In Brazil a case can be made for a 12.75% policy rate end 2026 and 10% in 2027, but this could only mean 1

July 31, 2025

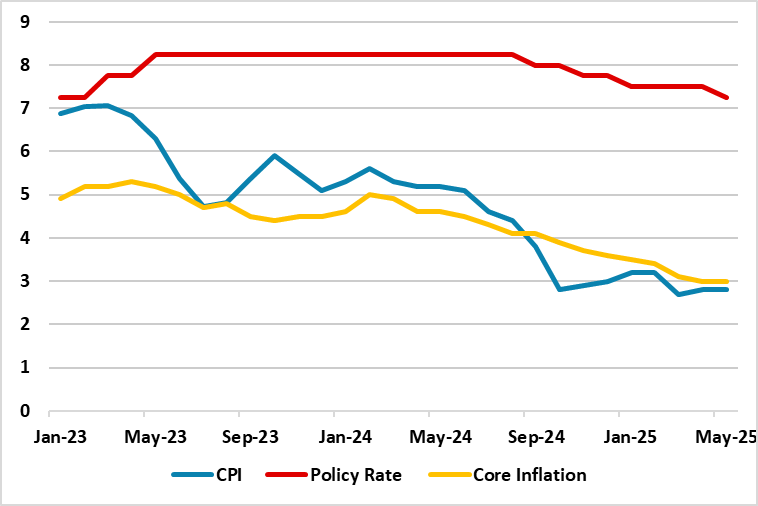

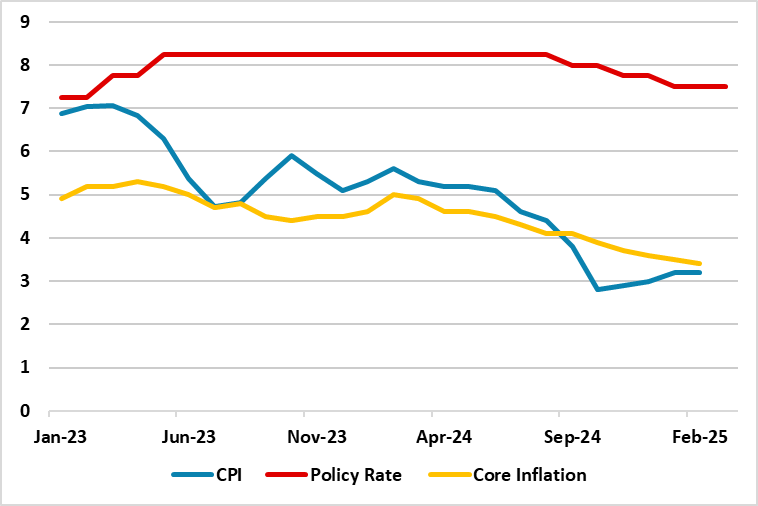

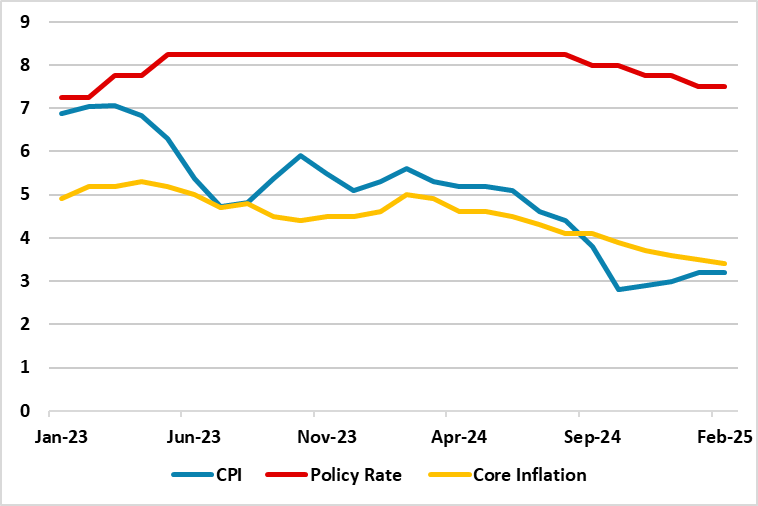

SARB Cuts Key Rate to 7.0% Given Subdued Inflation; Lower CPI Goal Announced

July 31, 2025 3:32 PM UTC

Bottom Line: Despite the uncertainty around United States tariffs and rising domestic food inflation, South African Reserve Bank (SARB) reduced the policy rate by 25 bps to 7.0% during the MPC on July 31 as annual inflation hit 3.0% YoY in June coupled with eased core inflation, and a relatively sta

July 28, 2025

Food Glorious Food

July 28, 2025 10:15 AM UTC

· Global food prices should see small increases in the future, as production continues to rise broadly in line with increasing demand driven by population and a rising consumption per person in EM countries. However, China will remain dependent on food imports given it has limited roo

July 24, 2025

EM Currencies with a USD Downtrend

July 24, 2025 10:15 AM UTC

· BRL, ZAR and MXN have been helped by FX carry trades and bond inflows on still wide interest rate differentials. However, actual reciprocal tariff risks are high for all three countries and a wave of profit-taking could be seen. Elsewhere, though we see a U.S./China trade deal by

July 23, 2025

Food Prices Lifted South Africa Inflation to 3.0% YoY in June

July 23, 2025 12:36 PM UTC

Bottom Line: Statistics South Africa (Stats SA) announced on July 23 that annual inflation rose to 3.0% YoY in June from 2.8% in May as food prices reached a 15-month high coupled with elevated restaurant and health services prices. The inflation is still within South African Reserve Bank’s (SARB)

July 09, 2025

South Africa Opposes Trump’s 30% Tariffs

July 9, 2025 3:47 PM UTC

Bottom Line: After a 90-day reprieve, U.S. president Trump announced on July 7 that the U.S. would implement 30% additional tariffs against South Africa-origin products from August 1. Despite President Ramaphosa opposed what he calls the unilateral trade tariffs by the U.S., and emphasized that Sout

July 02, 2025

South Africa: Coalition Under Pressure After President Ramaphosa Fires DA Deputy

July 2, 2025 12:25 PM UTC

Bottom Line: The political tension between the African National Congress (ANC) and Democratic Alliance (DA) has peaked as of late June after President Ramaphosa sacked DA’s deputy minister Andrew Whitfield due to an unauthorized trip to the U.S. at the end of February. Following the dismissal, DA

June 25, 2025

EM FX Outlook: USD Less in Favor, but EM Mixed

June 25, 2025 8:05 AM UTC

• EM currencies face cross currents on a spot basis. The USD downtrend against DM currencies can be a positive for undervalued or strong EM currencies. This could benefit the Brazilian Real (BRL), Mexican Peso (MXN) and Indonesian Rupiah (IDR), though moves will be choppy with occasiona

Outlook Overview: Trump’s Fluid Policies

June 25, 2025 7:20 AM UTC

· President Donald Trump still wants to use the tariff tool, and we see the eventual average tariff rate being in the 13-15% area, lowered by deals but increased by more product tariffs. Any lasting legal block on reciprocal tariffs will likely see the administration pivoting towards ot

June 24, 2025

EMEA Outlook: Global Uncertainties and Domestic Dynamics Continue to Dominate

June 24, 2025 7:00 AM UTC

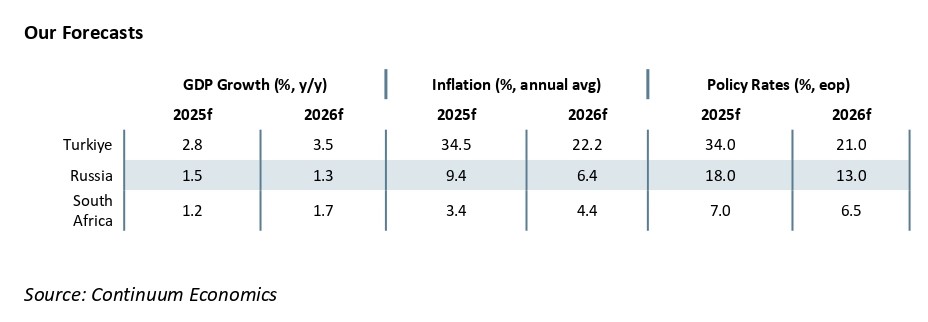

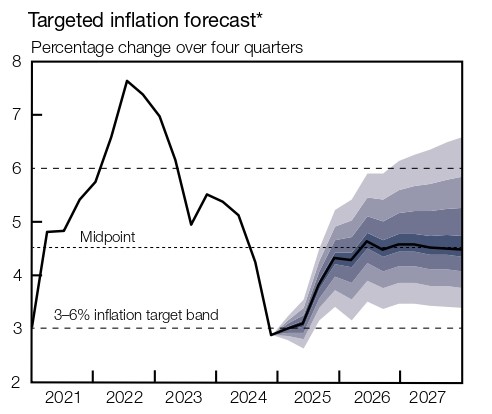

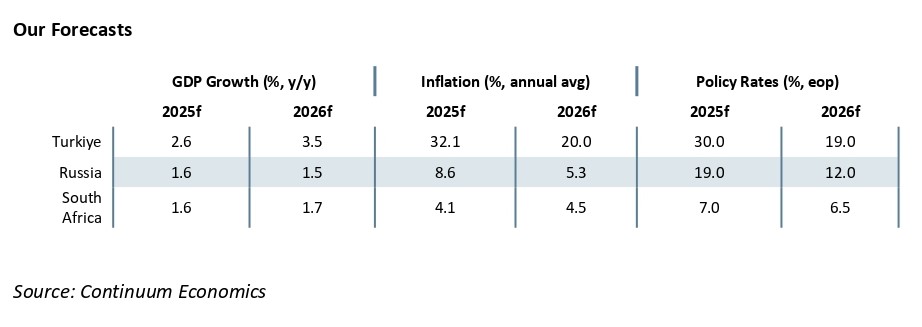

· In South Africa, we foresee average headline inflation will stand at 3.4% and 4.4% in 2025 and 2026, respectively, despite upside risks to inflation such as power cuts (loadshedding), tariff hikes by Eskom, spike in food prices, and global uncertainties. We see growth to be 1.2% and 1.7%

June 18, 2025

South Africa Inflation Stayed Unchanged in May 2.8% YoY

June 18, 2025 9:50 AM UTC

Bottom Line: Annual inflation stayed stable at 2.8% in May after April as food prices rose, remaining below the lower bound of South African Reserve Bank’s (SARB) target range of 3% to 6%. We think unpredictable outlook for the global economy, and return of power cuts (loadshedding) pressurized do

June 04, 2025

June 03, 2025

Moderate GDP Growth for South Africa in Q1: 0.1% QoQ, 0.8% YoY

June 3, 2025 11:02 AM UTC

Bottom line: South African economy grew moderately by 0.1% QoQ and 0.8% on a year-on-year basis in Q1 2025. According to Department of Statistics of South Africa (Stats SA) announcement on June 3, despite growth in agriculture, transport and finance, a strain on the mining and manufacturing industri

May 29, 2025

SA MPC Review: SARB Cuts Key Rate to 7.25% on May 29 Given Subdued Inflation

May 29, 2025 4:03 PM UTC

Bottom Line: South African Reserve Bank (SARB) reduced the policy rate to 7.25% during the MPC on May 29 highlighting that annual inflation remained below SARB’s target range of 3%-6% hitting 2.8% YoY in April coupled with eased core inflation in April and a stronger Rand. We think the recent with

May 21, 2025

SA MPC Preview: No Rate Cuts Are Expected on May 29 Due to Uncertainties

May 21, 2025 1:10 PM UTC

Bottom Line: Taking into account that annual inflation increased to 2.8% YoY in April due to higher food prices, we think South African Reserve Bank (SARB) will likely hold the rate constant at 7.5% during the next MPC scheduled on May 29 given plenty of upside risks to inflation including unpredict

As Predicted, South Africa Inflation Slightly Increased in April

May 21, 2025 10:44 AM UTC

Bottom Line: Despite inflation stood at 2.7% YoY in March, the lowest reading since June 2020, annual inflation slightly accelerated to 2.8% in April due to higher food prices but remained below South African Reserve Bank’s (SARB) target range. We think unpredictable outlook for the global economy

May 14, 2025

SA Inflation Preview: Inflation Will Likely Slightly Rise in April

May 14, 2025 9:21 AM UTC

Bottom Line: Despite inflation stood at 2.7% YoY in March, the lowest reading since June 2020, we foresee annual inflation will slightly accelerate to 2.8-2.9% in April, which will be announced on May 21. We feel unpredictable outlook for the global economy, return of power cuts (loadshedding), and

May 06, 2025

South Africa’s Automotive and Agricultural Sectors Will Be Tested Amid Trump’s Additional Tariffs

May 6, 2025 3:14 PM UTC

Bottom Line: Taking into account that the 31% U.S. additional tariffs on South African goods could still come into effect despite a 90-day reprieve from the U.S. president Trump, the threat is still alive as South African economy will be negatively impacted by tariffs partly nullifying the African G

April 24, 2025

USD Rebalancing: Some to EM?

April 24, 2025 8:30 AM UTC

Some portfolios rotations towards EM assets will likely be evident, as we see the USD decline is now extending and broadening. However, flows will likely be selective, both given underwhelming EM performance in the last 5-10 years and the uncertainty over how much Trump will reduce reciprocal tari

April 23, 2025

South Africa’s Inflation Softened to a Five-Year Low with 2.7% YoY in March

April 23, 2025 1:50 PM UTC

Bottom Line: StatsSA announced on April 23 that annual South Africa’s inflation softened to a five-year low with 2.7% YoY in March, due to a drop in fuel, education and housing costs. Taking into account that the inflation rate is now below the lower band of South African Reserve Bank's (SARB) tar

April 15, 2025

SARB's Monetary Policy Review Highlights Concerns over the Horizon

April 15, 2025 7:29 PM UTC

Bottom line: According to the Monetary Policy Review Report by the South African Reserve Bank (SARB) on April 15, uncertainties about the global economy, trade tensions and blurry domestic outlook have caused the scope for monetary policy easing had narrowed. In its biannual review of its monetary p

Nervous U.S. Long Term Asset Holders

April 15, 2025 8:30 AM UTC

Overall, foreign equity investors can no longer count on U.S. exceptionalism and could face lower long-term corporate earnings growth, which at a minimum will likely slow net inflows. Bond investors also face ongoing policy volatility, which likely means a need for an extra risk premium – t

April 10, 2025

Trade Deals with the U.S.: Pressures and Obstacles

April 10, 2025 7:17 AM UTC

Pressures to do trade deals include the weaker U.S. economy and higher inflation when it arrives/foreigners becoming nervous of their USD30trn plus holdings of U.S. securities and more crucially risks to Trump and GOP approval ratings from Republican voters. Obstacles to quick trade deals include Tr

April 08, 2025

Reciprocal Tariffs: The Hit To Other Countries

April 8, 2025 9:30 AM UTC

Overall, we are still assessing the effects on non U.S. countries from the tariffs being imposed by the U.S. via direct trade/business investment/currency and financial & monetary conditions swings. The impact will be adverse to GDP, but for some major countries could be less than the U.S. How

April 07, 2025

EMEA Economies Will Be Tested Amid U.S. Tariff Heat

April 7, 2025 5:29 PM UTC

Bottom Line: The impacts of U.S. additional tariffs announced on April 2 could likely have multifaceted impacts over EMEA countries. Relatively-low 10% tariffs could open new doors for Turkiye to capture a higher global market share if it can act quickly on trade diversification. We foresee the coun

March 31, 2025

U.S. Trade Surplus Countries: No Special Treatment?

March 31, 2025 9:04 AM UTC

Quick dilutions of tariffs or exemption will likely be slow in coming for countries that the U.S. has trade surpluses with, as the Trump administration are currently more focused on tariffs for tax revenue and trying to switch production back to the U.S. than trade deals. Trade policy uncertainty

March 27, 2025

Car Tariffs Then Lenient Reciprocal Tariffs?

March 27, 2025 8:59 AM UTC

The 25% tariffs on cars underlines that tariffs are not just about getting better trade deals, but in Trump’s view raising (tax) revenue and trying to shift production back to the U.S. Combined with other tariffs being implemented, plus policy uncertainty, we see a moderate overall hit from t

March 26, 2025

Outlook Overview: Navigating the Turbulence

March 26, 2025 9:30 AM UTC

· More tariffs will arrive from the U.S. from April with product (car, pharma, semiconductors and lumber) and reciprocal tariffs. President Trump has a 3-part approach to tariffs to raise (tax) revenue; bring production back to the U.S. and get fairer trade deals. This means some of t

EMFX Outlook: Divergence versus the USD

March 26, 2025 9:16 AM UTC

EM currencies will be helped by the ongoing USD downtrend against DM currencies, but prospects also depend on relative inflation differentials versus the USD and starting point in terms of valuations. The Brazilian Real (BRL), Mexican Peso (MXN) and Indonesian Rupiah (IDR) should all make modest s

March 25, 2025

EMEA Outlook: Mixed Prospects Due to Global Uncertainties and Domestic Dynamics

March 25, 2025 7:00 AM UTC

· In South Africa, we foresee average headline inflation will stand at 4.1% and 4.5% in 2025 and 2026, respectively, despite there are upside risks to inflation such as remaining power cuts (loadshedding), tariff hikes by Eskom, spike in food and housing prices, and global uncertainties. We

March 21, 2025

Trump Product and Reciprocal Tariffs

March 21, 2025 9:00 AM UTC

It appears that we will get bad news from April 2 on extra tariffs before any good news. Firstly, the announcement effect of tariffs for many countries and extra products will hurt U.S. business and consumer sentiment. Secondly, part of the reason for tariffs is extra tax revenue and to try to s

March 20, 2025

SARB Kept Key Rate Steady at 7.5% Due to Global and Domestic Uncertainties

March 20, 2025 2:01 PM UTC

Bottom Line: Despite we thought it was likely that South African Reserve Bank (SARB) will cut the key rate from 7.5% to 7.25% during the MPC scheduled on March 20 as inflation remained below SARB’s target of 4.5% and core inflation continued to decelerate in February, SARB decided to keep the poli

March 19, 2025

South Africa’s Inflation Held Steady at 3.2% in February

March 19, 2025 3:40 PM UTC

Bottom Line: StatsSA announced on March 19 that annual South Africa’s inflation remained unchanged at 3.2% YoY in February while the main contributors were housing and utilities, food and non-alcoholic drinks, as well as services related to restaurants and accommodation. Taking into account that t

March 14, 2025

SA MPC Preview: 25 bps Rate Cut on March 20 is Likely, But a Very Close Call Due to Uncertainties

March 14, 2025 8:29 PM UTC

Bottom Line: Taking into account that annual inflation in January stood at 3.2% in January, which is below midpoint of target band of 3% - 6%, we think it is likely that South African Reserve Bank (SARB) will cut the key rate from 7.5% to 7.25% during the MPC scheduled on March 20 as inflation remai

March 10, 2025

Trump and Dollar Policies

March 10, 2025 6:04 AM UTC

The Trump administration could decide to more broadly talk the USD down or less likely try to reach a cooperative Mar A Lago accord with big DM and EM countries. A more cohesive alternative is a forced currency deal for countries to appreciate their currencies to avoid more tariffs and withdraw

March 04, 2025

South Africa’s Economy Expanded by a Moderate 0.6% in Q4

March 4, 2025 12:02 PM UTC

Bottom line: South African economy grew modestly by 0.6% YoY in Q4 2024 driven by strong performances by agricultural sector and finance. According to Department of Statistics of South Africa (Stats SA) announcement on March 4, demand side of the economy was lifted by household consumption expenditu

February 28, 2025

February 26, 2025

South Africa's Inflation Slightly Rose to 3.2% in January

February 26, 2025 12:09 PM UTC

Bottom Line: StatsSA announced on February 26 annual South Africa’s inflation slightly accelerated to 3.2% YoY in January from 3.0% YoY in December and the main contributors were housing and utilities, food and non-alcoholic drinks, fuel and restaurant. We feel unpredictable outlook of the global

January 30, 2025

As Expected, SARB Cut the Key Rate to 7.5% on January 30

January 30, 2025 4:54 PM UTC

Bottom Line: After StatsSA announced on January 22 that annual inflation stood at 3.0% in December, which is below midpoint of target band of 3% - 6%, South African Reserve Bank (SARB) decided to cut the key rate from 7.75% to 7.5% on January 30 as inflation remains moderate, power cuts (loadsheddin

January 24, 2025

SA MPC Preview: SARB will Likely Cut the Key Rate to 7.5% on January 30

January 24, 2025 1:19 PM UTC

Bottom Line: After StatsSA announced on January 22 that annual inflation stood at 3.0% in December, which is below midpoint of target band of 3% - 6%, we now think it is likely that South African Reserve Bank (SARB) will cut the key rate from 7.75% to 7.5% on January 30 as inflation remains moderate

January 22, 2025

SA Inflation Review: Inflation Slightly Rose to 3.0% in December

January 22, 2025 3:24 PM UTC

Bottom Line: StatsSA announced on January 22 annual South Africa’s inflation slightly accelerated to 3.0% in December from 2.9% YoY in November due to housing costs and miscellaneous goods and services, which ticked up 4.4% and 6.6%, respectively. We feel unpredictable outlook for the global econo

January 20, 2025

Brazil Risk Premia and EM Debt

January 20, 2025 8:15 AM UTC

Brazil debt market has two domestic crises rather than a spillover from the U.S. in the form of inflation and fiscal policy. Very restrictive BCB policy can help produce some disinflation and we forecast 4.1% for 2026, which some allow some rate cuts in H2. Brazil risk premium will likely be reduced

January 17, 2025

SA Inflation Preview: Inflation Will Likely Slightly Rise in December

January 17, 2025 2:39 PM UTC

Bottom Line: Despite inflation stood at 2.9% YoY in November, we now foresee annual inflation will slightly accelerate to 3.1% - 3.2% in December due to rising fuel pieces, which will be announced on January 22. We feel unpredictable outlook for the global economy, increasing oil prices following th

January 09, 2025

SARB to Continue Rate Cuts in 2025, but the Pace Will Depend on Inflation Trajectory and Global Developments

January 9, 2025 11:23 AM UTC

Bottom line: After South African Reserve Bank (SARB) started cutting the key rate on September 19 and decreased the rate from 8.25% to 7.75% in 2024 given fall in inflation below midpoint of target band of 3% - 6%, suspended power cuts (loadshedding) and deceleration in inflation expectation, we for

January 06, 2025

Markets 2025: A Tale of Two Halves

January 6, 2025 8:10 AM UTC

· For financial markets, 2025 will likely be a game of two halves. US exceptionalism will likely drive US equities to extend outperformance in H1, while the USD rises further as tariffs (threats and actual) escalate. However, 10yr U.S. Treasury yields will likely push higher in H2, which can

January 02, 2025

EM Government Debt: BRICS Divergence

January 2, 2025 8:05 AM UTC

Brazil and South Africa suffer from debt servicing costs outstripping nominal GDP, which will remain a concern unless a consistent primary budget surplus is seen – though S Africa enjoys a much longer than average term to maturity than Brazil. India and Indonesia, in contrast, enjoy nominal