South Africa’s Inflation Held Steady at 3.2% in February

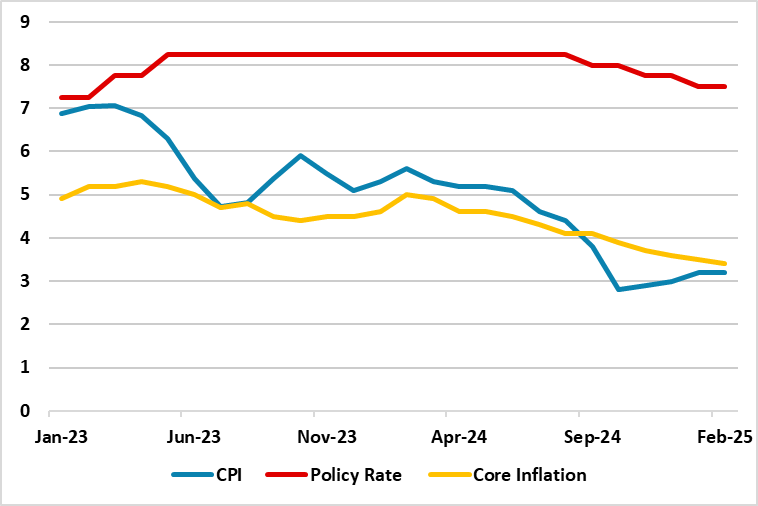

Bottom Line: StatsSA announced on March 19 that annual South Africa’s inflation remained unchanged at 3.2% YoY in February while the main contributors were housing and utilities, food and non-alcoholic drinks, as well as services related to restaurants and accommodation. Taking into account that the inflation rate is still within the South African Reserve Bank's (SARB) target range of 3% to 6%, and core inflation hit its the lowest level since December 2021, we feel SARB will likely continue its cutting cycle and reduce the key rate by 25 bps to 7.25% during the next MPC meeting scheduled for March 20. The decision will be a very close call considering unpredictable global outlook, trade risks, and uncertainty over the national budget could limit SARB’s rate-cutting cycle.

Figure 1: Policy Rate (%), CPI and Core Inflation (YoY, % Change), January 2023 – February 2025

Source: Continuum Economics

South Africa’s inflation stabilized at 3.2% YoY in February and remained within the SARB’s target range of 3% to 6%. The annual rate for food and non-alcoholic beverages accelerated to a four-month peak in February, rising to 2.8% from 2.3% the month before. Another driver of the increase was housing and utilities prices, which surged by +4.4%.

According to StatsSA, fuel prices climbed by 3.9% between January and February, taking the annual rate to -3.6% from -4.5% in January. The price for inland 95-octane petrol was R22,41 in February, up from R21,59 in January. Slowdown in personal care and miscellaneous services inflation was also notable (1.1% in February vs. 5.9% in January), which helped relieve inflationary pressures.

According to the announcement, core inflation eased to 3.4% YoY in February to the lowest level since December 2021, compared to 3.5% YoY in January. MoM CPI edged up by 0.9% after a 0.3% rise in January, indicating some fluctuations within specific categories while overall rates steadied.

Despite inflation remaining moderate, there were some bad news from power cuts (loadshedding), which could ignite inflation in the upcoming months. Eskom announced on March 7 that Stage 3 loadshedding was implemented until March 10, after a Stage 6 power cut on February 23. Energy experts warn that the recent load shedding reminded that rolling blackouts are still a threat since Eskom’s generation capacity remains unreliable and unpredictable.

We think February print backs rate cut bets during the next MPC meeting scheduled for March 20 as the inflation remains well below the central bank's current 4.5% target, despite unpredictable global outlook and deadlock over the national budget cause concerns. Given inflation expectations are still well anchored and core inflation hit its the lowest level since December 2021, we feel SARB will likely continue its cutting cycle, and reduce the key rate by 25 bps to 7.25% on March 20.

Of course, cautious SARB could also act carefully on interest-rate adjustments playing it safe this time due the risks, and halt the cutting cycle after three straight cuts, despite we feel there is still a room for the cut to take place in March. No matter what the SARB’s decision will be, it will be a close-call. Our end-year key rate prediction remains at 7.0% for 2025.