SARB's Monetary Policy Review Highlights Concerns over the Horizon

Bottom line: According to the Monetary Policy Review Report by the South African Reserve Bank (SARB) on April 15, uncertainties about the global economy, trade tensions and blurry domestic outlook have caused the scope for monetary policy easing had narrowed. In its biannual review of its monetary policy, SARB also indicated that it expects domestic inflation to slow to 3.6% this year from 4.4% in 2024 while its confidence about the medium-term outlook has decreased. We continue to foresee average headline inflation will stand at 4.1% in 2025 as there are upside risks to inflation such as remaining power cuts (loadshedding), tariff hikes by Eskom, and global uncertainties. Our end-year policy rate prediction remains at 7.0% for 2025 while global uncertainties could cause data dependent and cautious to halt the easing cycle longer-than-expected, particularly in H1.

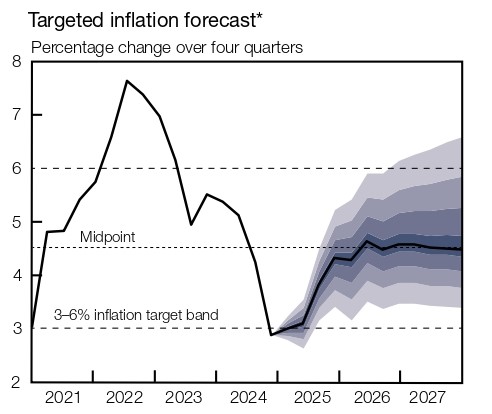

Figure 1: Targeted Inflation Forecast

Source: SARB

According to the Monetary Policy Review report released by SARB on April 15, the headline inflation is projected to average 3.6% this year and to revert to around the 4.5% target midpoint from 2026 while inflation risks remain, and high global economic uncertainty has reduced confidence in the medium-term inflation outlook. The report emphasized that global macroeconomic risks have heightened amid tariff increases and geopolitical tensions, and the inflation has still not fallen to pre-pandemic levels.

Assessing the growth trajectory, SARB indicated that ongoing reforms in the energy and logistics sectors, along with improvements in household real disposable income, are forecast to lift growth to 1.7% this year, rising to 2.0% by 2027 despite the downside risks. In its most severe economic risk scenario, SARB predicted a 0.7% GDP contraction if a preferential trade deal is scrapped alongside a steep tariff shock and a weakening rand.

Concerning monetary policy efforts, SARB noted that the MPC lowered the policy rate by 50 bps over the six-month period from October 2024 to March 2025, bringing it closer to its estimated neutral level, and added that the QPM suggests one more 25 basis point rate cut in the second quarter of this year.

Additionally, SARB governor Kganyago recently emphasized that “Trade tensions have escalated, and longstanding geopolitical relationships are shifting abruptly. (…) While local inflation appears to be contained, the risk balance is to the upside as headline inflation has edged higher over the past few months.”

In this respect, we continue to foresee average headline inflation will stand at 4.1% in 2025 as there are upside risks to inflation such as remaining power cuts, tariff hikes by Eskom, and global uncertainties. Our end-year policy rate prediction remains at 7.0% for 2025 while global uncertainties could cause data dependent and cautious to halt the easing cycle longer-than-expected, particularly in H1. We feel SARB will likely consider restarting cutting cycle if there will be no spikes in inflation in the upcoming months, and there are no major adverse global and domestic developments impacting the South African economy.

We continue to assess the economy will grow by 1.6% in 2025 on the back of improved investor sentiment and rate cuts. We envisage downside risks largely relate to the uncertain external environment and failures in the continuation of structural reforms on enhancing infrastructure investments and fighting loadshedding.