SA Inflation Review: Inflation Slightly Rose to 3.0% in December

Bottom Line: StatsSA announced on January 22 annual South Africa’s inflation slightly accelerated to 3.0% in December from 2.9% YoY in November due to housing costs and miscellaneous goods and services, which ticked up 4.4% and 6.6%, respectively. We feel unpredictable outlook for the global economy, increasing oil prices following the imposition of harsher sanctions on the Russian oil industry and volatility of ZAR in December also contributed to the moderate surge in prices. The data for December concluded the results for 2024, as the average inflation rate for 2024 stood at 4.4%, down from the average of 6.0% in 2023. We foresee average headline inflation will fall to 4.2% in 2025 considering power cuts are still suspended, inflation expectations continue to fall, and the domestic fiscal outlook is moderately stable.

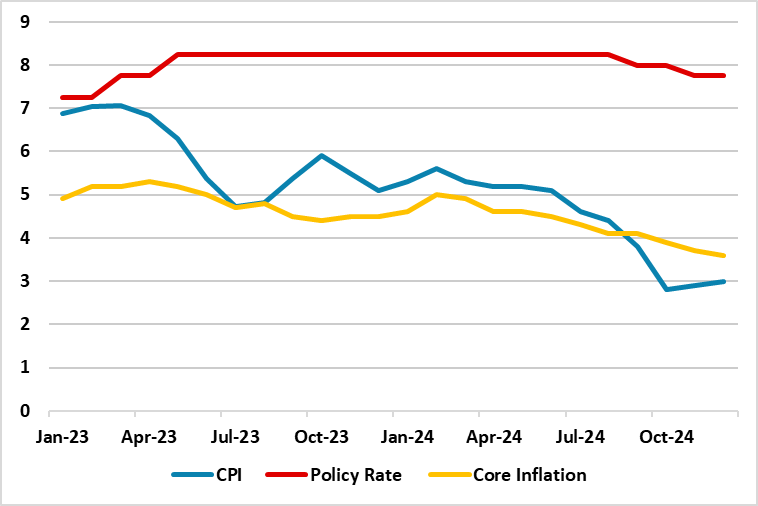

Figure 1: Policy Rate (%), CPI and Core Inflation (YoY, % Change), January 2023 – December 2024

Source: Continuum Economics

South Africa’s inflation slightly increased to 3.0% YoY in December from 2.9% YoY the prior month due to rising prices of food and non-alcoholic beverages (2.5% in December vs 2.3% in November), miscellaneous goods and services (6.6%, unchanged from November) and housing and utilities (4.4% in December vs 4.7% in November). We feel increasing oil prices following the imposition of harsher sanctions on the Russian oil industry, unpredictable global outlook and volatile ZAR in December ignited a moderate hike in inflation in December. (Note: The ZAR lost 3.8% of its value against the USD only in December, which puts pressure on domestic prices).

Core inflation eased to 3.6% in December to the lowest level since February 2022, compared to 3.7% in November. MoM CPI edged up by 0.1% after a flat print in November.

The data for December concluded the results for 2024. The average inflation rate for the year was 4.4%, down from the average of 6.0% in 2023, StatsSA announced. Inflation in 2024 was the lowest in four years since the pandemic in 2020, when the average rate was 3.3%. We foresee average headline inflation will fall to 4.2% in 2025 considering power cuts are still suspended, inflation expectations continue to fall, and the domestic fiscal outlook is moderately stable.

The inflation reading has been supported positively by the suspended power cuts (loadshedding). South Africa’s national electricity utility company, Eskom announced on January 10 that load shedding remained suspended for 289 consecutive days since March 26, 2024 reflecting an improvement in the reliability and stability of the power generations coupled with new investments.

Speaking on inflationary pressures, SARB governor Kganyago said this week that policies being enacted by U.S. president Donald Trump may be inflationary and threaten to derail future rate cuts. “To the extent that the measures taken are inflationary, it could slow down the disinflation process that central banks had so steadfastly worked on since the great inflation of 2022,” governor indicated. “There is a risk that the reduction in the restrictiveness of monetary policy that we had seen over the past year could then be brought to an abrupt halt”, Kganyago added.

We now think moderate December print could back rate cut bets during the next MPC meeting scheduled for January 30 as the inflation remained below the central bank's current 4.5% target, despite unpredictable outlook continues to cause concerns. Under current circumstances, we envisage cautious SARB proceeds carefully on interest-rate adjustments, and likely hold the key rate constant at 7.75% on January 30 (we attach a 60% chance) while another 250 bps rate cut is also probable on slower-than expected inflation in December combined with the recent recovery in the ZAR in the last 10 days as the currency gained 3.2% of its value against the USD (we attach a 40% chance)