South Africa’s Inflation Softened to a Five-Year Low with 2.7% YoY in March

Bottom Line: StatsSA announced on April 23 that annual South Africa’s inflation softened to a five-year low with 2.7% YoY in March, due to a drop in fuel, education and housing costs. Taking into account that the inflation rate is now below the lower band of South African Reserve Bank's (SARB) target range of 3% to 6%, and there are signals that trade wars will cool off, we feel SARB may consider reducing the key rate during the next MPC meeting scheduled for May 29 despite there are still moderate upside pressure on inflation from the global tariff developments and a weaker currency. April inflation will also be critical for SARB’s rate decision.

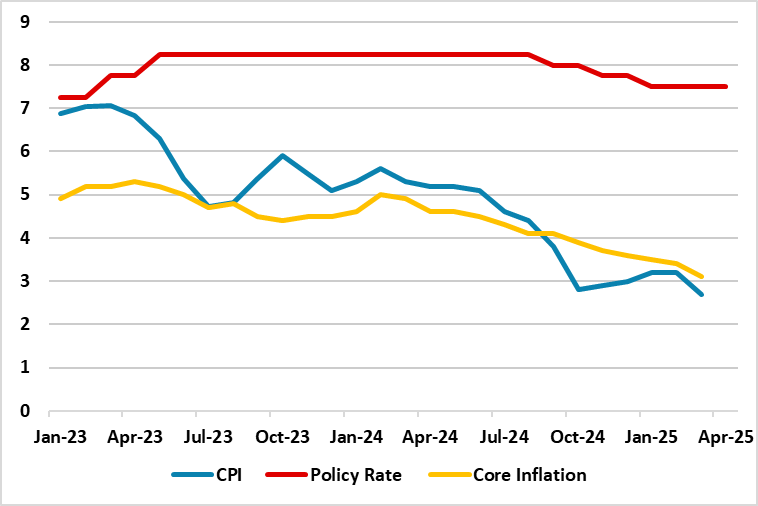

Figure 1: Policy Rate (%), CPI and Core Inflation (YoY, % Change), January 2023 – April 2025

Source: Continuum Economics

South Africa’s inflation eased to 2.7% YoY in March and went below the lower band of SARB’s target range of 3% to 6%. Inflation for housing and utilities was at 4.4% YoY, while food and non-alcoholic beverages came in at 2.7%. Another driver of the moderate increase was restaurants and accommodation services, which surged by 4.2% YoY.

According to StatsSA, the fuel index softened by 0.4% from February, taking the annual rate from -3.6% to -8.8%. A litre of 95-octane petrol (inland) was R22,34 in March, down from R24,45 a year before.

According to the announcement, core inflation eased to 3.1% YoY in March compared to 3.4% YoY in February. MoM CPI softened to 0.4% in March after a 0.9% rise in February.

Despite inflation remaining soft, we still think power cuts (loadshedding) trajectory will be critical for inflation in the upcoming months, which could reignite inflation during winter season. (Note: Eskom announced on March 7 that Stage 3 loadshedding was implemented until March 10, after a Stage 6 power cut on February 23. According to a recent notice by Eskom, loadshedding remained suspended as of April 18).

Taking into account that the inflation is now below the lower band of SARB’s target range of 3% to 6%, and there are signals that trade wars will cool off, we feel SARB may consider reducing the key rate by 25 bps to 7.25% during the next MPC meeting scheduled for May 29 despite there are still moderate upside pressure on inflation from the global tariff developments and a weaker currency.

Of course, cautious SARB could also act carefully on interest-rate adjustments playing it safe in May. As noted, given inflation expectations are still well anchored and core inflation remains moderate, it will not be surprising to see SARB (re)continues its cutting cycle on May 29 while SARB’s decision will be a close-call. April inflation will also be critical.