SA Inflation Preview: Inflation Will Likely Slightly Rise in December

Bottom Line: Despite inflation stood at 2.9% YoY in November, we now foresee annual inflation will slightly accelerate to 3.1% - 3.2% in December due to rising fuel pieces, which will be announced on January 22. We feel unpredictable outlook for the global economy, increasing oil prices following the imposition of harsher sanctions on the Russian oil industry and volatility of ZAR particularly after November continue to pressurize domestic prices. We think cautious SARB will likely hold the key rate constant at 7.75% during the next MPC meeting scheduled for January 30 due to mentioned negative developments.

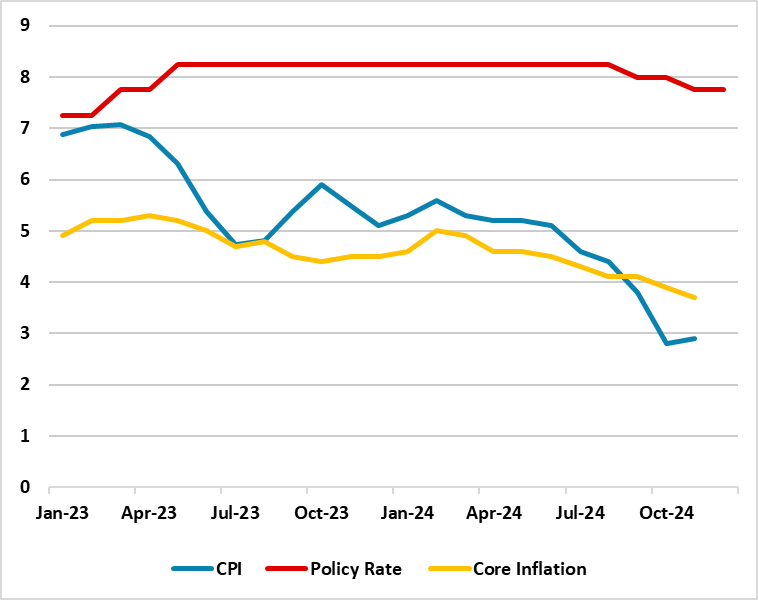

Figure 1: Policy Rate (%), CPI and Core Inflation (YoY, % Change), January 2023 – December 2024

Source: Continuum Economics

After South Africa’s inflation slightly increased to 2.9% YoY in November from 2.8% YoY the prior month, we now foresee annual inflation will accelerate further to 3.1% - 3.2% in December due to rising fuel prices. (Note: December inflation figures will be announced on January 22). We feel increasing oil prices following the imposition of harsher sanctions on the Russian oil industry, unpredictable global outlook and volatile ZAR continue to threaten South Africa’s inflation and interest rate trajectory.

Despite this, the inflation print is still supported positively by the suspended power cuts (loadshedding). South Africa’s national electricity utility company, Eskom announced on January 10 that load shedding remained suspended for 289 consecutive days since March 26, 2024 reflecting an improvement in the reliability and stability of the power generations coupled with new investments.

We see an upside risk on the inflation outlook particularly comes from ZAR performance. ZAR has held out relatively well against major currencies compared to its EM peers in 2024 despite the slide after November 2024. The ZAR lost 3.8% of its value against the USD only in December, which puts pressure on domestic prices.

On another note, December print could partly back rate cut bets during the next MPC meeting scheduled for January 30 as the inflation will likely remain below the central bank's current 4.5% target, but unpredictable outlook continues to cause concerns.

Speaking on prospective rate cuts, it is worth noting that SARB governor Kganyago said late December “In an environment of uncertainty, it is very important for the central bank to move with caution and not add to the noise that you have in the data.” Kganyago added that “We should not be creating uncertainty by making moves that we would later regret.”

In this respect, we consider SARB will closely monitor unpredictable outlook for the global economy, trade tariffs, and oil price movements in Q1 as they could significantly impact inflation forecasts. Under current circumstances, we envisage cautious SARB proceeds carefully on interest-rate adjustments, and likely hold the key rate constant at 7.75% on January 30. SARB will probably consider continuing its easing cycle in March, if inflation trajectory will allow.