Continuum Daily

View:

January 05, 2026

Venezuela: Oil and Geopolitics

January 5, 2026 12:02 PM UTC

· Venezuela’s oil production will likely take years to increase substantively due to poor infrastructure, the need for substantive investment, and a lack of democratic political stability. In terms of geopolitics, operations in Venezuela reinforce the Trump administration’s pivot

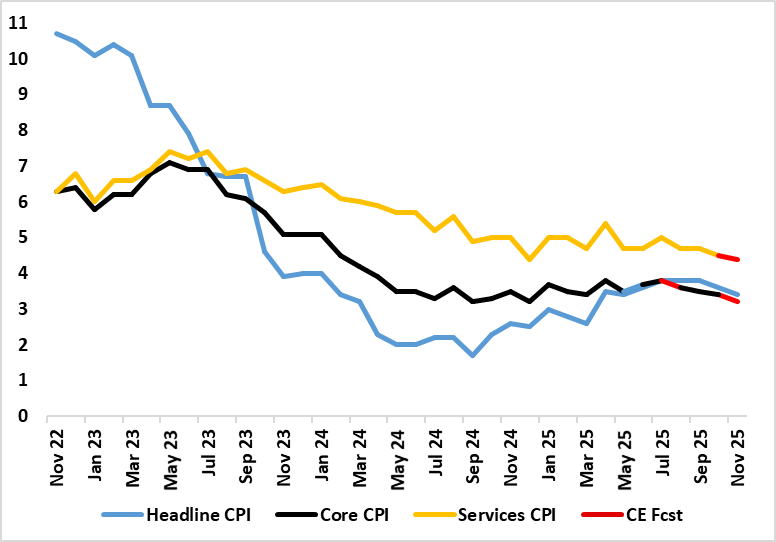

Turkiye Closes the Year with Inflation Easing to 30.9% y/y in December

January 5, 2026 11:25 AM UTC

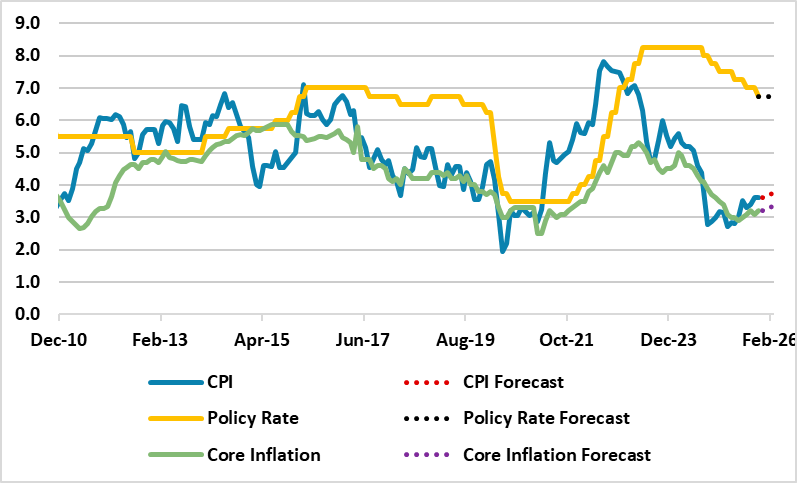

Bottom line: According to Turkish Statistical Institute’s (TUIK) announcement on January 5, Turkiye’s inflation softened to 30.9% y/y in December backed by the lagged impacts of previous monetary tightening. Food, housing and education drove the inflation in December as education prices recorde

AI and U.S. Productivity

January 5, 2026 8:04 AM UTC

· Structural labor and overall productivity will be boosted if current AI adoption is sustained at a pace quicker than the adoption of the internet. However, not all areas of the U.S. economy are exposed to AI benefits, as manual work can only be replaced by humanoid robots with maj

January 02, 2026

Bessent: New Fed Inflation Range and Dropping Dots?

January 2, 2026 11:30 AM UTC

U.S. Treasury Secretary Bessent over the Christmas period suggested that the Fed should shift to targeting an inflation range and drop the quarterly dots. What impact would this have? Such a change would give the Fed more flexibility on the margin, but not significant. This could make communicat

December 30, 2025

U.S. Consumption Vulnerable to Asset Market Hit

December 30, 2025 8:42 AM UTC

Overall, we see consumption growth prospects as being modest for 2026, as low to middle income households still struggle with the cost of living crisis. Additionally, the slowdown in immigration is causing less overall employment gains and in turn less absolute increase in real income and consumptio

December 23, 2025

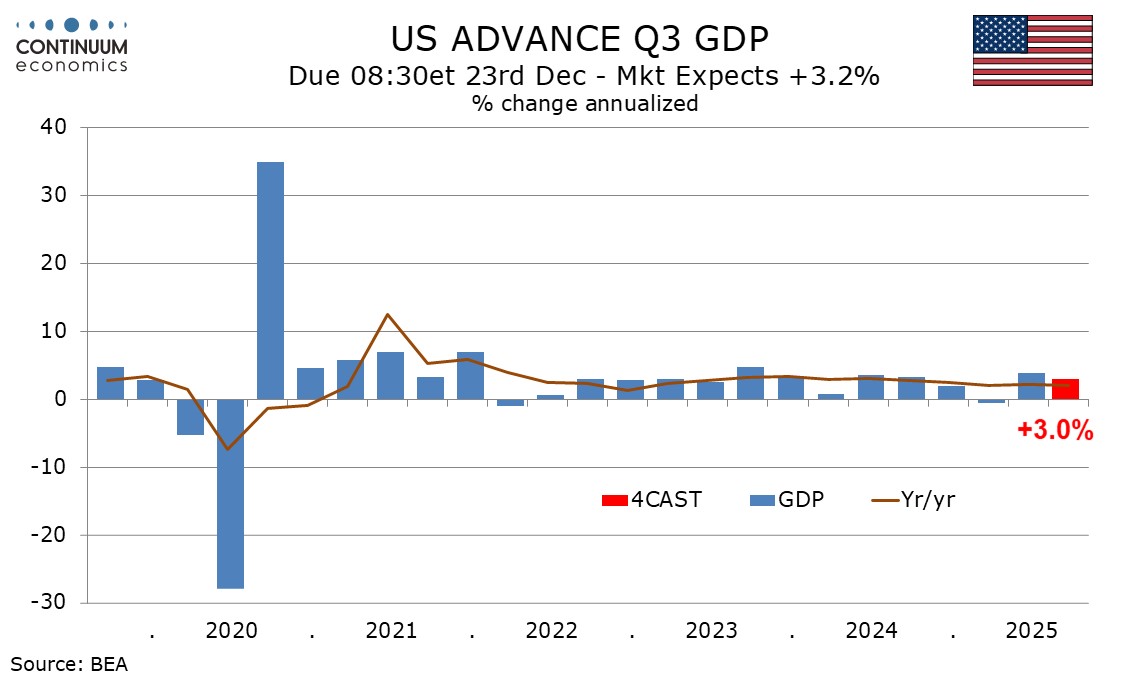

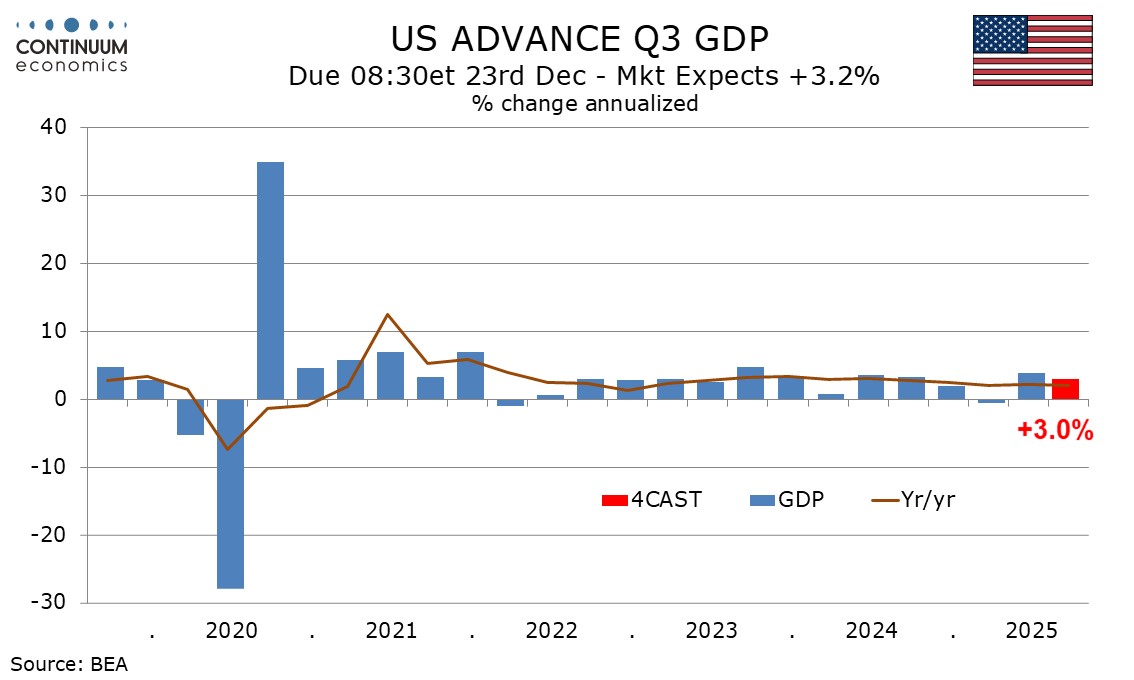

U.S. Q3 GDP: Better Than Expected, But

December 23, 2025 1:54 PM UTC

Q3 GDP came in better than expected due to a big net export contribution to growth. Gross domestic purchases at 2.7% were more in line with expectations, with mixed performance in key expenditure sectors. We see growth slowing in Q4, with net exports unlikely to repeat the Q3 outcome and consume

Trump’s Peace Framework as a Path to a Late 2026 Settlement?

December 23, 2025 1:48 PM UTC

Bottom Line: With Russia maintaining its long-held demands in Ukraine and negotiations intensifying around President Trump’s latest peace proposal, our baseline view is that this framework will serve as the primary catalyst for a settlement. We anticipate a Russia-friendly peace deal (70% probabil

December 22, 2025

Preview: Due December 23 - U.S. Q3 GDP - A second straight solid quarter though Q4 is likely to be slower

December 22, 2025 2:42 PM UTC

We now look for a 3.0% annualized increase in the delayed Q3 GDP release, lifted by some recent data. This would be a second straight solid quarter to follow a weak Q1, though Q4 is likely to be weaker, in part due to the government shutdown that persisted through October and much of November.

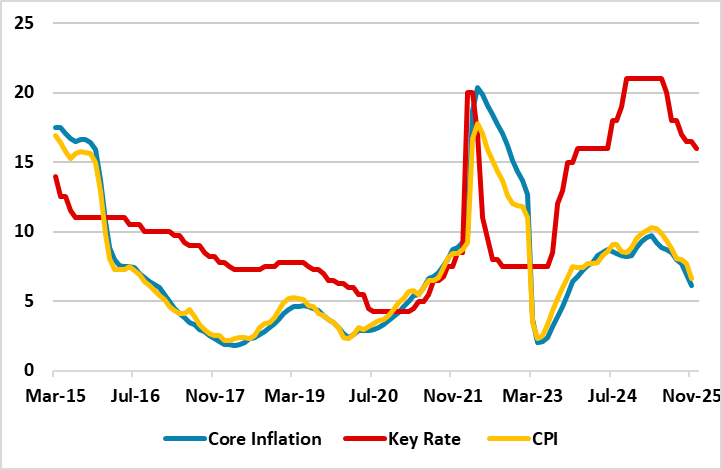

Russia’s Inflation is Expected to Continue to Soften in December

December 22, 2025 2:11 PM UTC

Bottom Line: After edging down to 6.6% in November, we expect Russian inflation to continue its decreasing pattern in December owing to lagged impacts of previous aggressive monetary tightening and relative resilience of RUB. December inflation figures will be announced on December 29, and we forese

December 19, 2025

EZ HICP Preview (Jan 7): Is Services Inflation Problematic?

December 19, 2025 11:10 AM UTC

HICP inflation has been range bound for the last 5-6 months between 2.0% and 2.2% with the November and October numbers in the middle of that range. But we see the headline rate falling out of that range in December to 1.9%, this preceding what may be a short-lived fall toward 1.5% in H1 2026. Som

Easing Cycle Continues: CBR Reduced Key Rate to 16% on December 19

December 19, 2025 11:09 AM UTC

Bottom Line: As expected, Central Bank of Russia (CBR) reduced the key rate by 50 bps to 16% during the MPC on December 19 since the pace of the fall in inflation accelerated in November. CBR said in its written statement that monetary policy will remain tight for a long period, and further decision

Mexico: 25bps Cut and Now Pause

December 19, 2025 8:15 AM UTC

Banxico cut by 25bps to 7.0% as expected with a downward revision to 0.3% for 2025 GDP growth. Below trend GDP is forecast in 2026 and we see this prompting further easing in March and June 2026 by 25bps each, but MXN weakness restraining Banxico pace. We then see Banxico going on hold for the rem

December 18, 2025

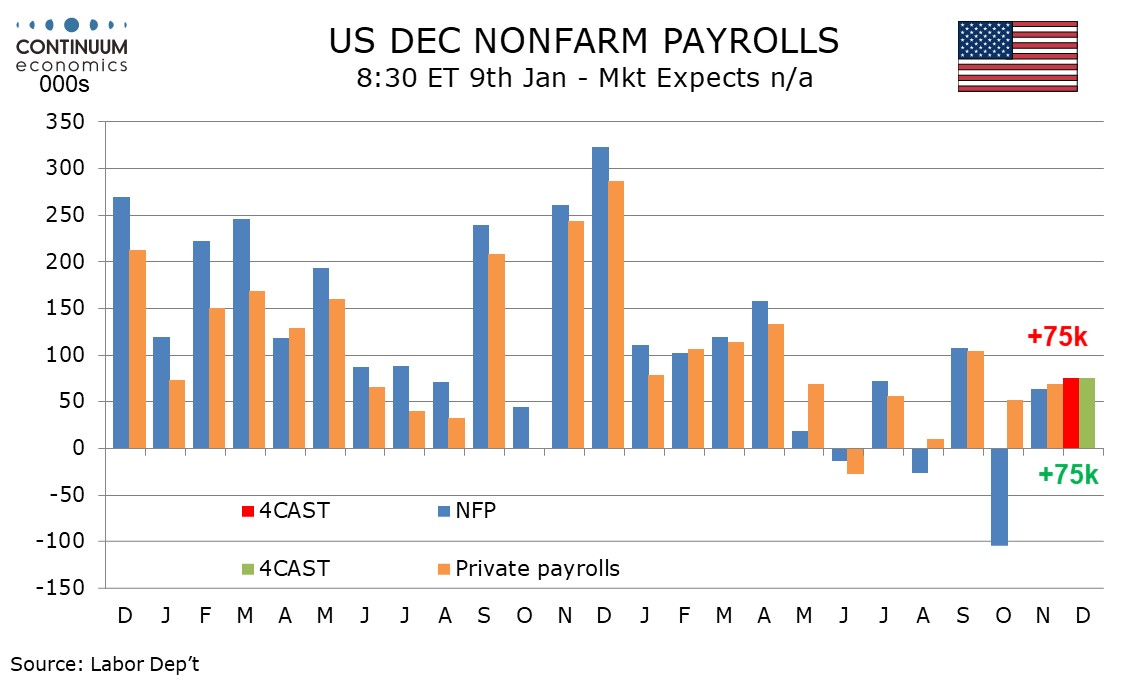

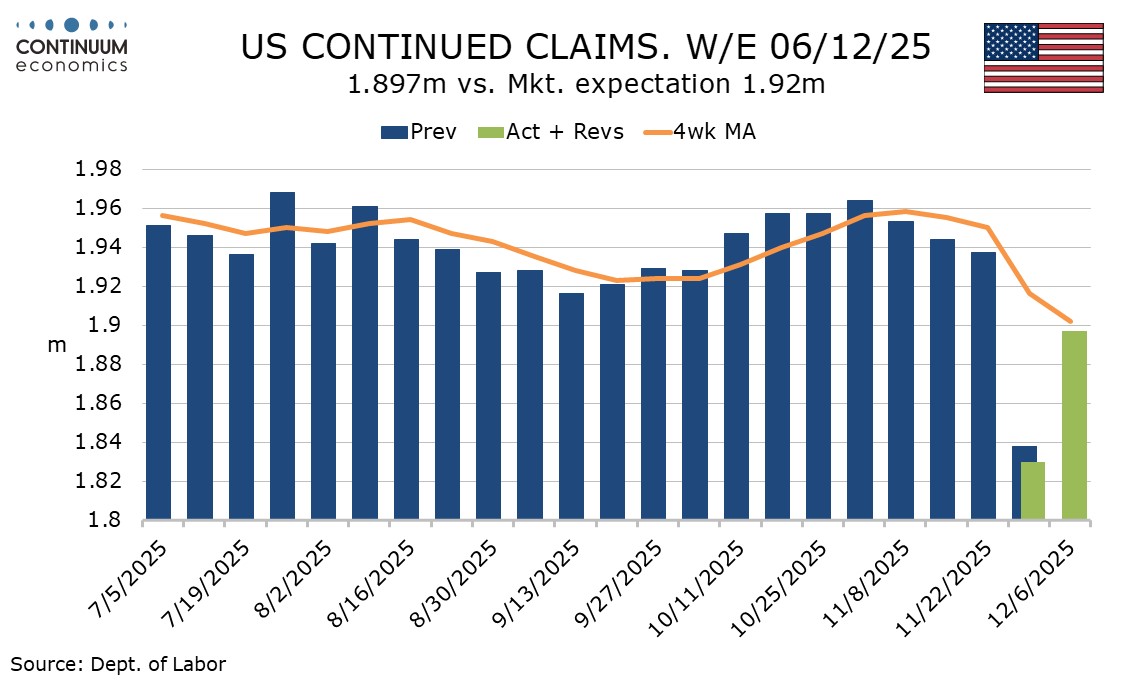

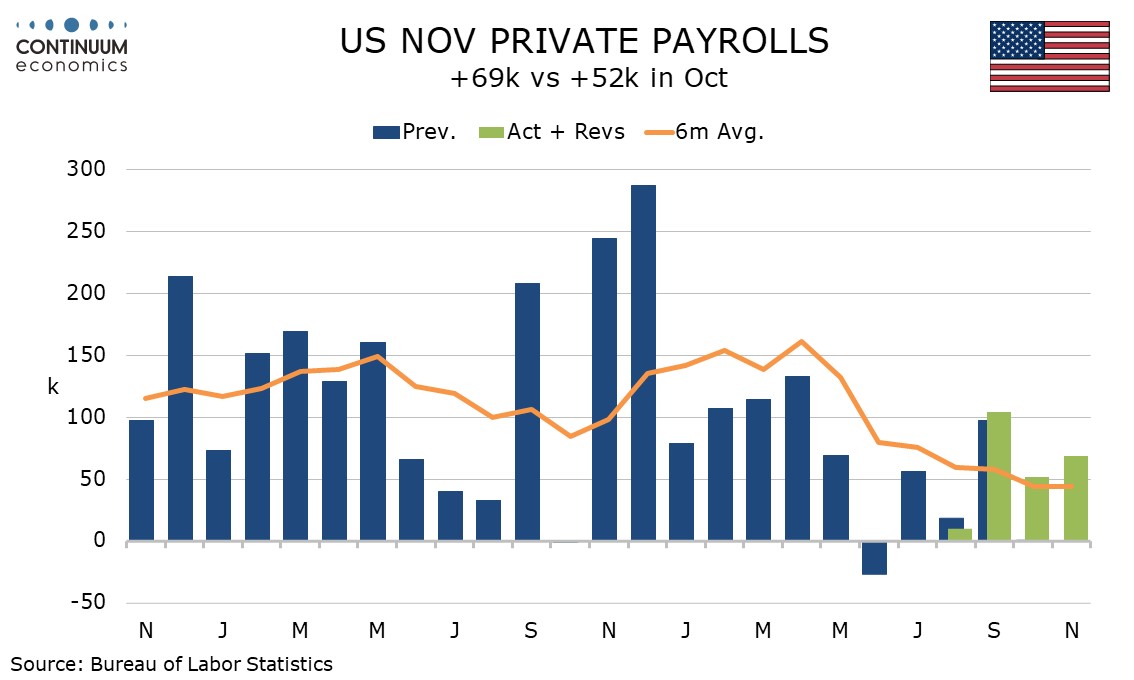

Preview: Due January 9 - U.S. December Employment (Non-Farm Payrolls) - Slightly firmer with unchanged unemployment

December 18, 2025 8:46 PM UTC

We expect December’s non-farm payroll to rise by 75k both overall and in the private sector, up from 64k and 69k respectively in November. We expect unemployment to be unchanged at 4.6% and a modest 0.3% increase in average hourly earnings.

ECB Review: On Hold Message to Convert to Easing on Disinflation

December 18, 2025 3:09 PM UTC

· The ECB increased its 2026 GDP and inflation forecast and appears happy with current policy rate levels. However, still tight financial conditions, plus easing wage growth, point to disinflation and growth disappointment. We see this switch the ECB from an on hold message to easin

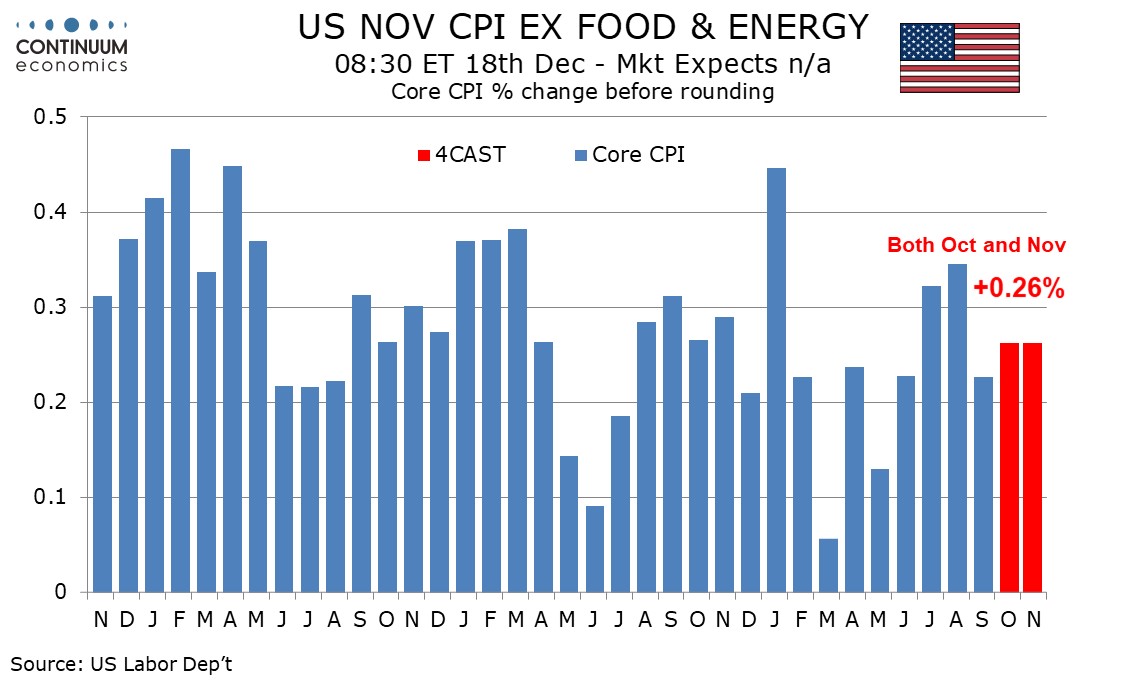

U.S. November CPI - Is the tariff impact fading?

December 18, 2025 2:10 PM UTC

November’s CPI is significantly lower than expected, at 2.7% yr/yr, 2.6% ex food and energy, compared with 3.0% for both series in September (October data will not be released). November’s core CPI index is up only 0.16% from September’s, implying an average rise of less than 0.1% per month ov

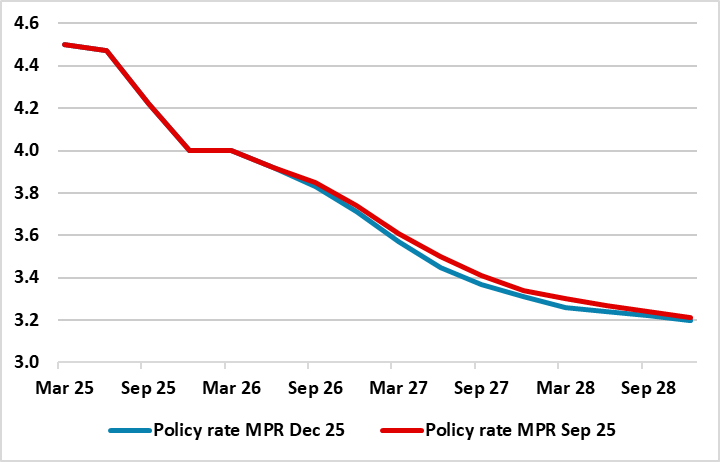

BoE Review (Dec 18): Splits More Entrenched?

December 18, 2025 12:41 PM UTC

That the BoE delivered a sixth 25 bp rate cut (to an almost three-year low of 3.75%) was hardly in doubt. But we were surprised that amid the recent run of weak data, that there were (again) four dissents with Governor Bailey switching sides. Notably, in a clear combative overtone, at least some

EM FX Outlook: High Real Yields Still Help

December 18, 2025 12:14 PM UTC

• EM currency 2026 prospects come against a backdrop of a further but slower USD depreciation against DM currencies, but inflation differentials, domestic central bank policy and politics also matter. We forecast the Mexican Peso (MXN) will likely be more volatile, as President Donald Tru

Norges Bank Review: Still Far Too Cautious Despite Clear Output Gap

December 18, 2025 9:40 AM UTC

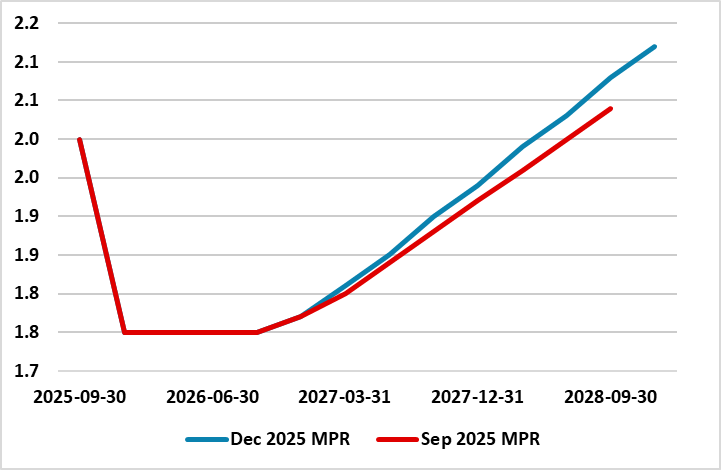

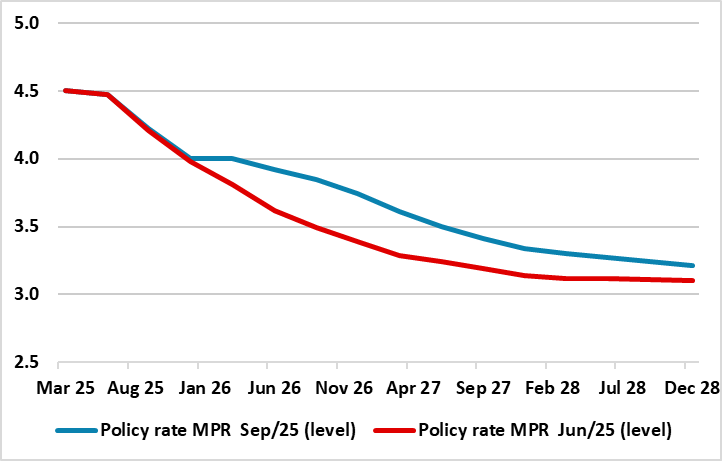

As expected, no change in policy and little shift in rhetoric and/or outlook was the message from the Norges Bank’s latest verdict. After two 25 bp cuts this year (to 4.0%), this month saw a second successive unchanged verdict with the policy outlook also retained (Figure 1). This was consistent

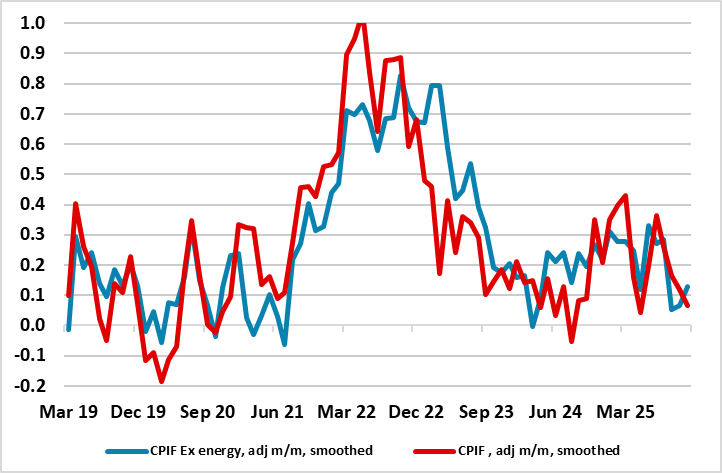

Sweden Riksbank Review: On Hold and For Some Time Ahead?

December 18, 2025 8:54 AM UTC

As widely anticipated, the Riksbank kept policy on hold with the key rate left (again) at 1.75%. It does seem as if the Riksbank Board is (very) pleased with the data flow since its last and very probably final rate cut on Sep 23. GDP saw a strong and unexpected Q3 showing of over 1% q/q while p

December 17, 2025

South Africa Inflation Moderately Softens to 3.5% y/y in November

December 17, 2025 5:08 PM UTC

Bottom Line: Statistics South Africa (Stats SA) announced on December 17 that annual inflation softened moderately to 3.5% y/y in November from 3.6% the previous month, but food and restaurant prices remained worrisome. Despite inflation staying within the South African Reserve Bank’s (SARB) 1 pe

Preview: Due December 18 - U.S. November CPI - A two month change with October canceled

December 17, 2025 1:41 PM UTC

The labor market will not publish monthly changes for each month so it is the two monthly change that will be published, we expect 0.49% for overall CPI, assuming October at 0.16% and November at 0.33%, and the core rate up by 0.53% over the two months. Gasoline prices are likely to dip in October b

UK CPI Review: Down More Than Expected from Likely Peak?

December 17, 2025 7:38 AM UTC

A clear downside surprise adds to the wealth of data suggesting a reining of price and cost pressures. This November result makes it more likely that the September CPI outcome will prove to be the CPI inflation peak. Indeed, although October figure fell a little less than the consensus by 0.2 pp

December 16, 2025

Preview: Due December 23 - U.S. Q3 GDP - A second straight solid quarter though Q4 is likely to be slower

December 16, 2025 4:25 PM UTC

We now look for a 3.0% annualized increase in the delayed Q3 GDP release, lifted by some recent data. This would be a second straight solid quarter to follow a weak Q1, though Q4 is likely to be weaker, in part due to the government shutdown that persisted through October and much of November.

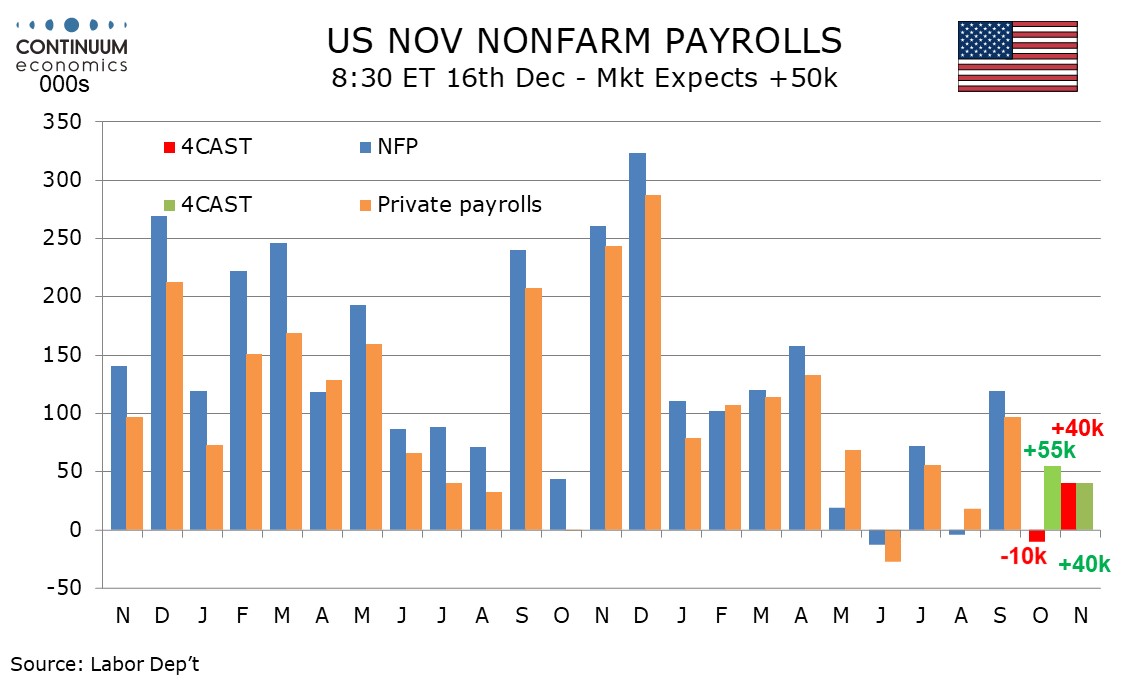

U.S. October and November Employment - Unemployment rising but economy maintains some momentum

December 16, 2025 2:22 PM UTC

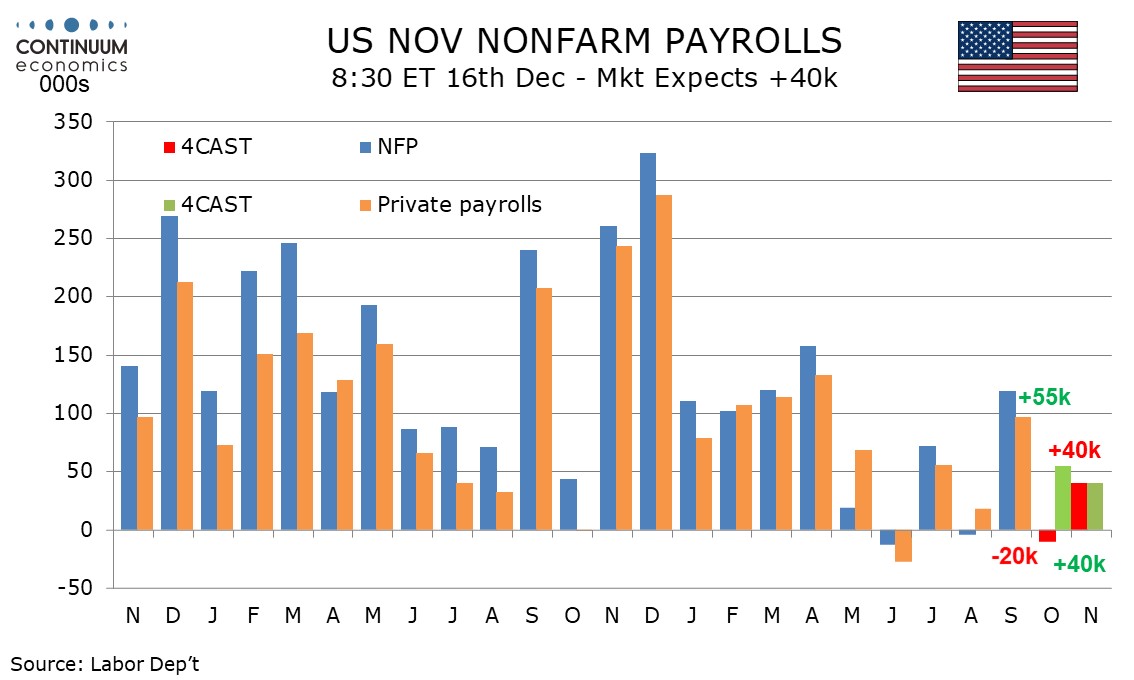

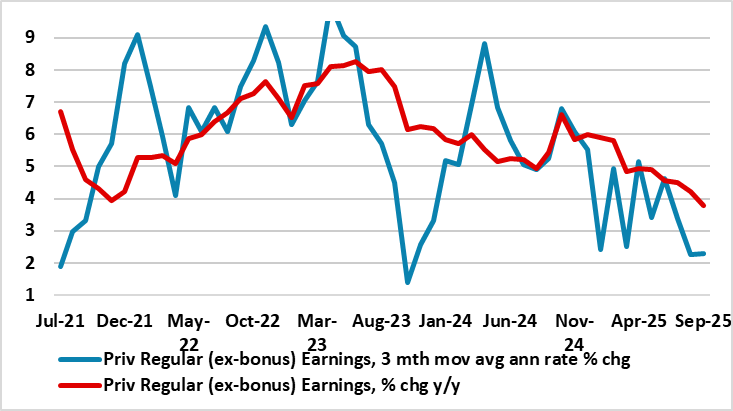

November’s non-non-farm payroll at 64k does not fully erase a 105k decline in October but private payrolls at 69k in November and 52k in October maintain moderate growth, though unemployment at 4.6% in November is the highest since September 2021, and average hourly earnings growth is slowing. Oct

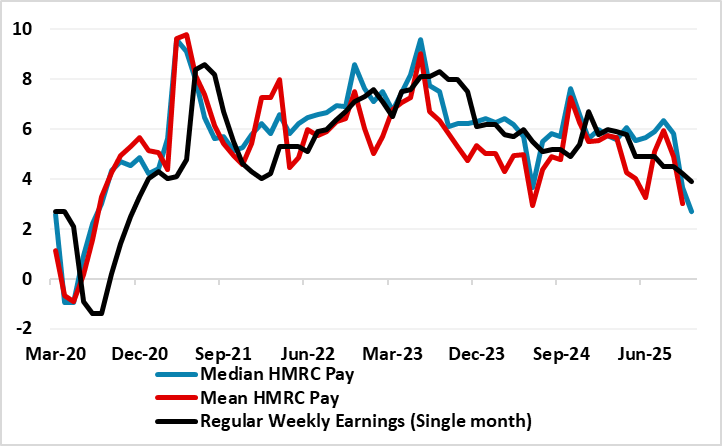

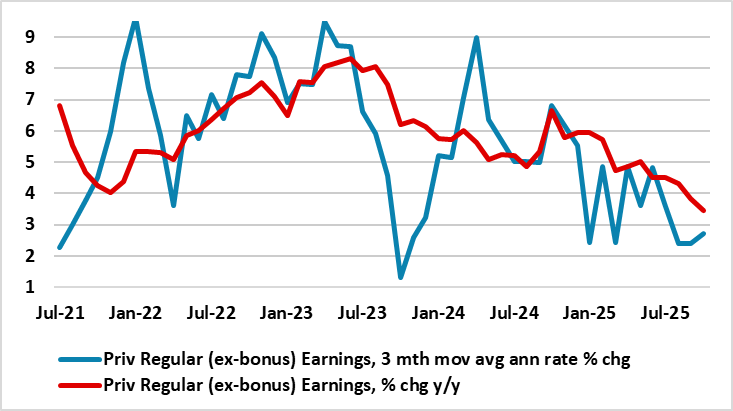

UK Labor Market: Job Losses Weighing Even More Clearly on Wages

December 16, 2025 8:06 AM UTC

Adding to the array if weak activity updates of late, there are increasing signs that the labor market is haemorrhaging jobs more clearly and broadly with fresh and deeper falls in the more authoritative measure of jobs covering payrolls. Indeed, private sector payrolls are still falling, down alm

December 15, 2025

Preview: Due December 16 - U.S. October/November Employment (Non-Farm Payrolls) - Slow but still positive in the private sector

December 15, 2025 3:25 PM UTC

The Labor Department will release October and November non-farm payroll data on December 16. We expect November to see gains of 40k both overall and in the private sector. However we expect October to see a decline of 10k overall but a 55k increase in the private sector.

Preview: Due December 16 - U.S. October Retail Sales - Autos to lead a dip

December 15, 2025 1:16 PM UTC

We expect a 0.4% decline in October retail sales in September, with autos set to be the main negative after the expiry of a tax credit for electrical vehicle purchases. Elsewhere however we expect subdued data, with a 0.1% increase ex autos and a rise of 0.2% ex autos and gasoline.

China: Weak Growth

December 15, 2025 7:39 AM UTC

• November figures show weak growth and are a concern for momentum going into 2026. Retail sales continues to be hurt by adverse wealth effects and slow job and income growth. Though the authorities are promising to boost consumption, we see this only being modest rather than aggressive

December 12, 2025

Equities Outlook: Choppy Up For 2026 and Down for 2027?

December 12, 2025 8:05 AM UTC

· The U.S. equity market is underpinned by the bullish AI/tech story and a soft economic landing into 2026. However, overvaluation is clear and this leaves the market vulnerable to a 5-10% correction on moderate bad news e.g. economic data. We see the S&P500 having a choppy year a

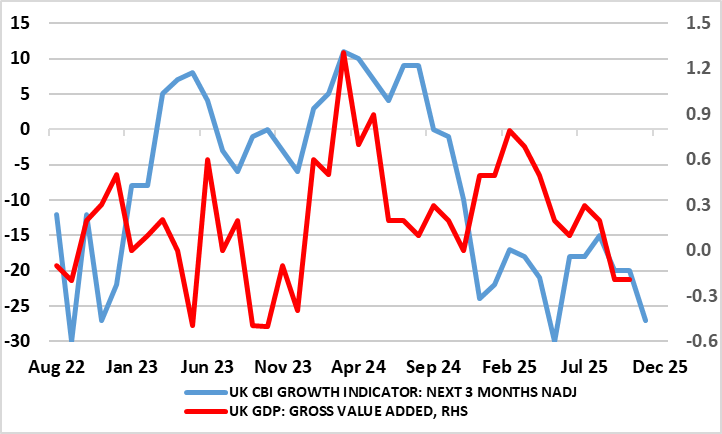

UK GDP Review: Underlying and Headline Economy Negative, Fragile and Listless

December 12, 2025 7:47 AM UTC

As we have underlined, GDP has hardly moved since March and this became even clearer with the October GDP release, the question being whether weakness is getting more discernible and significant. Indeed, it has fallen in three of the last four months (Figure 1), and where the unexpected further 0.

December 11, 2025

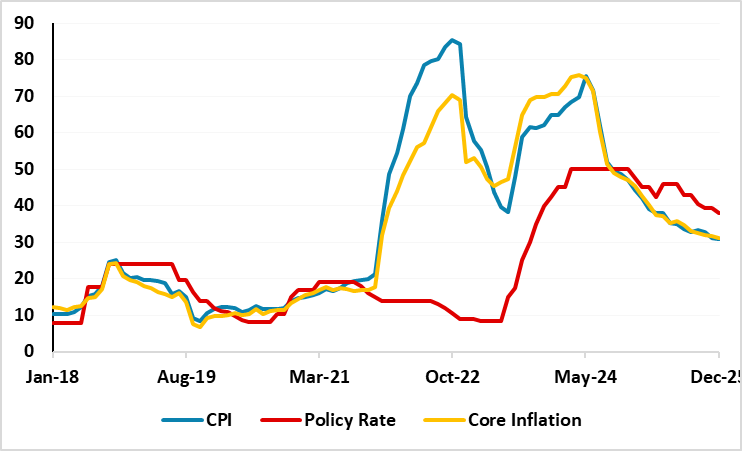

Softer November CPI Print Encouraged CBRT to Cut Key Rate to 38% on December 11

December 11, 2025 8:54 PM UTC

Bottom Line: As we expected, Central Bank of Turkiye (CBRT) cut the policy rate by 150 bps to 38% during the MPC meeting on December 11 encouraged by softer November inflation. The committee said inflation expectations and pricing behavior are showing signs of improvement even as they continue to po

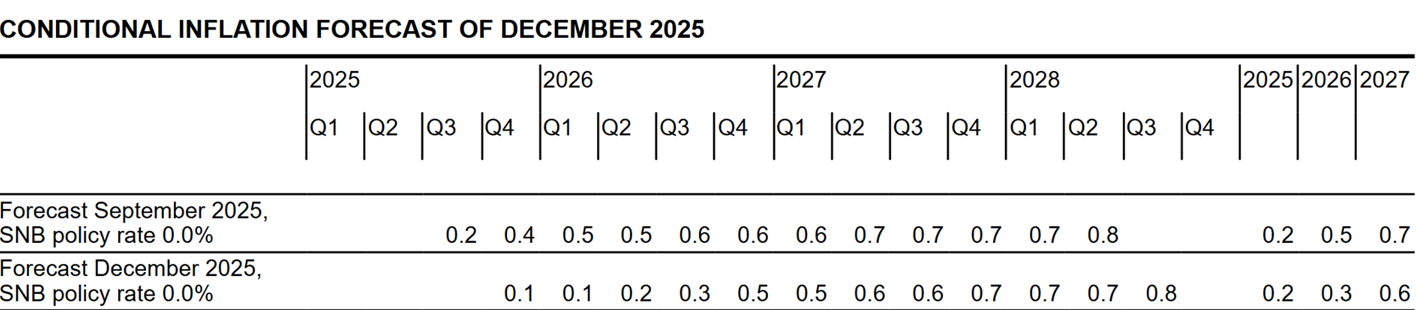

Swiss SNB Review: Preserving Ammunition

December 11, 2025 9:39 AM UTC

Although the tone of the economic outlook was a little perkier, the latest SNB analysis saw no real change. Policy was unchanged, as widely expected, with little shift in the forecast fir either growth or inflation. Overall it sees medium-term inflation at 0.6% (Figure 1), this despite a gloomy

Exceeding Expectations: Russia Inflation Eased Fast to 6.6% y/y in November

December 11, 2025 8:15 AM UTC

Bottom Line: Russian inflation continued its decreasing pattern in November and edged down to 6.6% owing to lagged impacts of previous aggressive monetary tightening, and relative resilience of RUB despite food and services prices continued to surge in November. We think the inflation will continue

Brazil: March 50bps Cut?

December 11, 2025 8:00 AM UTC

BCB remain focused on getting inflation converging towards the centre of the inflation target range at 3% looking at the December statement. It appears that the economic weakness is not yet great enough to get the BCB to signal a January cut. Nevertheless, with headline inflation falling, the real i

December 10, 2025

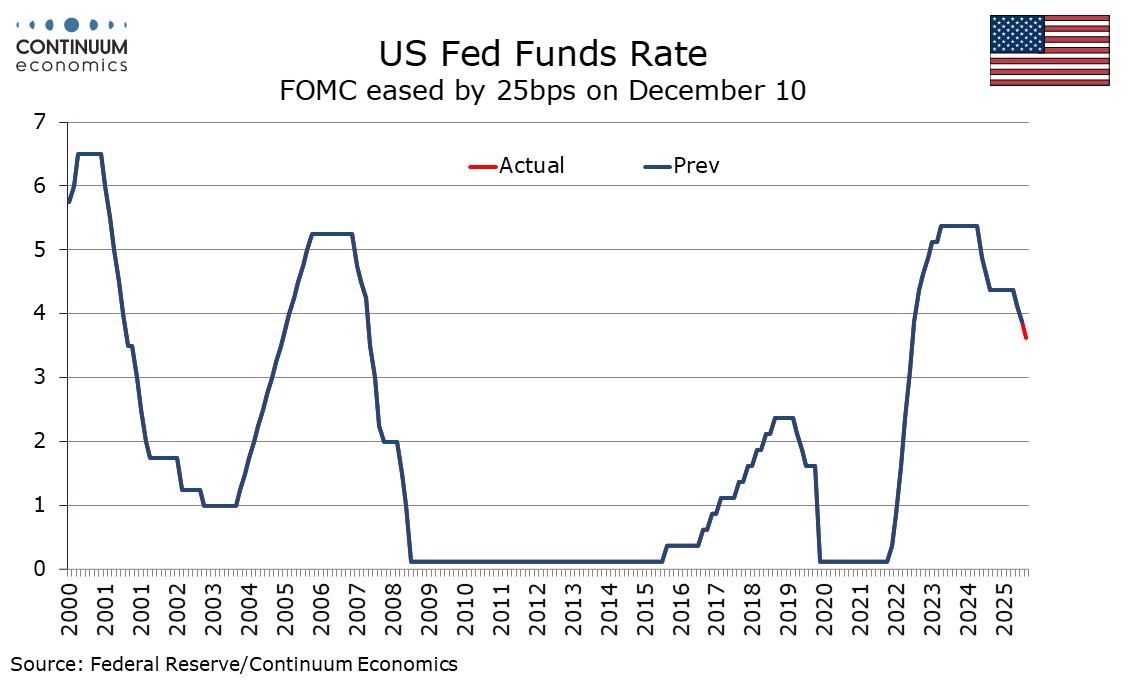

Fed: Slower 2026 Easing

December 10, 2025 8:34 PM UTC

Powell in the press conference made clear that the Fed is now in a wait and see mood, with policy rates entering a broad measure of neutral policy rates. This means further weakening in labor demand and then consumption would be required to prompt an early 2026 cut. We are less upbeat than the Fed

FOMC eases by 25bps, dots unchanged from September

December 10, 2025 7:21 PM UTC

The FOMC has eased by 25bps as expected to a 3.50-3.75% Fed Funds target range, with two hawkish dissents for no change from Schmid (who dissented in October) and Goolsbee, while Miran again dissented for a steeper 50bps ease. The dots are unchanged from September, implying one 25bps ease in both 20

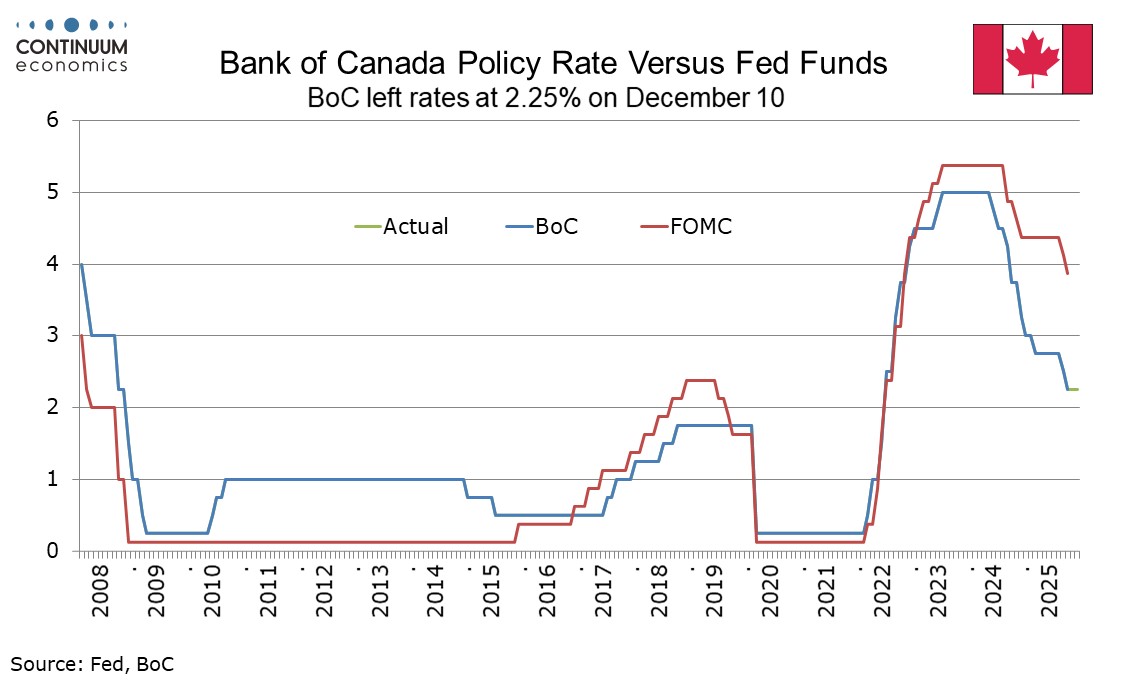

Bank of Canada - Rate Level Still Appropriate Despite Stronger Data

December 10, 2025 4:21 PM UTC

Since the Bank of Canada eased rates to 2.25% in October and stated that policy was now at an appropriate level, Canada has delivered stronger than expected data on GDP and employment. The data has not been dismissed, but the BoC view that policy is at an appropriate level persists after today’s m

Norges Bank Preview (Dec 18): Still Far Too Cautious

December 10, 2025 9:17 AM UTC

No change in policy and little shift in rhetoric was the message from the Norges Bank’s latest verdict. After what was to some a surprise (and seemingly far from a formality) move in September, in which the Norges Bank cut is policy rate by a further 25 bp to 4.0%, we see no change at the loomin

December 09, 2025

Preview: Due December 16 - U.S. October/November Employment (Non-Farm Payrolls) - Slow but still positive in the private sector

December 9, 2025 5:01 PM UTC

The Labor Department will release October and November non-farm payroll data on December 16. We expect November to see gains of 40k both overall and in the private sector. However we expect October to see a decline of 10k overall but a 55k increase in the private sector.

BoE Preview (Dec 18): How Big a Split?

December 9, 2025 11:29 AM UTC

That the BoE will deliver a fifth 25 bp rate cut (to 3.75%) on Dec 18 is almost certain, even after a Budget that did not accentuate current emerging demand weakness. The question is whether the MPC vote will be as close as the 5:4 split seen last month but with Governor Bailey switching sides.

Americas First: New National Security Strategy

December 9, 2025 8:40 AM UTC

· The new NSS at one level reads like a Trump/MAGA current list of topics and desires, that may not translate into policy or a major shift of military assets. Trump has blown hot and cold on Europe and China over the past 12 months and could shift again. Nevertheless, the NSS does r

ECB Preview (Dec 18): Still in Good Place – or Even Better?

December 9, 2025 7:52 AM UTC

A fourth successive stable policy decision will be the almost inevitable outcome of the ECB Council meeting verdict on Dec 18, with the discount rate left at 2.0%. The likely unanimous vote will mask splits about whether policy has troughed or not, this mainly a result of differences within the Co

December 08, 2025

Preview: Due December 18 - U.S. November CPI - A two month change with October canceled

December 8, 2025 2:00 PM UTC

The labor market will not publish monthly changes for each month so it is the two monthly change that will be published, we expect 0.49% for overall CPI, assuming October at 0.16% and November at 0.33%, and the core rate up by 0.53% over the two months. Gasoline prices are likely to dip in October b

Sweden Riksbank Preview (Dec 18): Policy to be Unchanged and little Move in Projections?

December 8, 2025 1:18 PM UTC

As we anticipated in our review, the Riksbank Board will be very pleased with the data flow since its last and very probably final rate cut on Sep 23 (to 1.75%). GDP saw a strong and unexpected Q3 showing of over 1% q/q while previously troublesome CPI data have softened appreciably thereby confir

UK CPI Preview (Dec 17): Down Further from Likely Peak?

December 8, 2025 9:43 AM UTC

It does seem as if the September CPI outcome will prove to be the CPI inflation peak. Indeed, although October figure fell a little less than the consensus to 3.6%, the looming November numbers may show a same-sized fall to 3.4%, a six-month low. We see the core rate seen also dropping 0.2 ppt b