Turkiye Closes the Year with Inflation Easing to 30.9% y/y in December

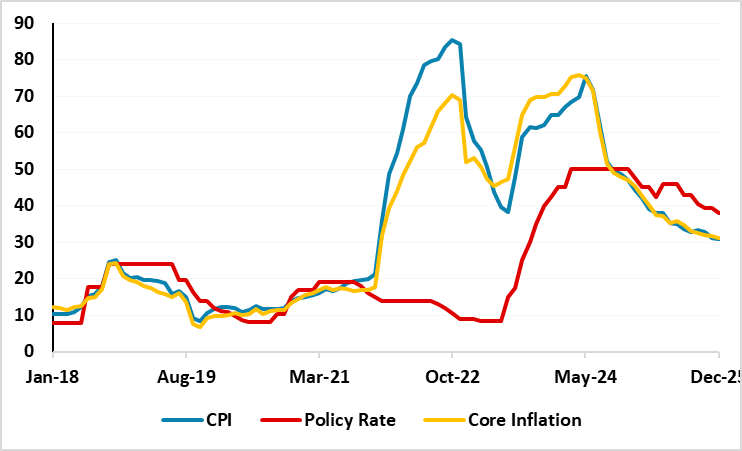

Bottom line: According to Turkish Statistical Institute’s (TUIK) announcement on January 5, Turkiye’s inflation softened to 30.9% y/y in December backed by the lagged impacts of previous monetary tightening. Food, housing and education drove the inflation in December as education prices recorded the highest annual increase with 66.3% YoY followed by housing prices were up by 49.5%. Annual core inflation edged down to 31.1% from 31.7% the prior month, marking the lowest reading in four years, could be considered as a good sign for the inflation trajectory. We think the continuing disinflation process coupled with moderate tax increases and 27% hike in minimum wage will support moderate rate cuts in 2026 while inflationary risks remain strong.

Figure 1: CPI, Core Inflation (YoY, % Change) and Policy Rate (%), January 2015 – December 2025

Source: Continuum Economics

After Turkiye’s annual inflation hit 31.1% y/y in November, the disinflation process resumed in December and inflation stood at 30.9% y/y. Food, housing and education drove the inflation in December. According to TUIK’s announcement on January 5, education prices recorded the highest annual increase with 66.3% YoY followed by housing prices were up by 49.5%. Annual food and non-alcoholic beverages prices also soared by 28.3%. Prices rose at a slower pace across a number of categories, such as footwear and clothing, which came in at 6.5% YoY in December.

Monthly inflation remaining below 1% in December hitting 0.89%, and annual core inflation edging down to 31.1% from 31.7% the prior month, -marking the lowest reading in four years-, could be considered as good signs for the inflation trajectory. TUIK data showed that domestic PPI rose 0.8% m/m in December for an annual rise of 27.7%. The 12-month average inflation rate was 34.9% in 2025, down from 58.5% in 2024.

Commenting on the inflation trajectory, Vice President Cevdet Yilmaz said that “We expect inflation to drop below 20% in 2026 to permanently break the stickiness in pricing behavior, and to return to single-digit inflation starting in 2027." Treasury and Finance Minister Mehmet Simsek indicated that supportive global financial conditions and moderate commodity prices in 2026, combined with tight monetary policy, stronger fiscal discipline, price adjustments aligned with inflation targets, improved expectations, and supply-side policies are expected to contribute to disinflation.

According to the CBRT’s November 2025 inflation report, the inflation targets for end-2026 and end-2027 have been set at 16% and 9%, respectively, while the forecast range kept at 13-19% for 2026. We also expect the slowdown in inflation to continue, but with a slower pace in 2026 as the inflation will likely stay over the CBRT’s upper band at the end of the year due to deteriorated pricing behavior and stickiness of services inflation.

We continue to envisage it will be (very) difficult to grind sticky inflation from 30%s to 10%s rapidly, taking into account that inflation becomes stickier requiring high interest to remain for some time and Central Bank of Republic of Turkiye (CBRT) to act more cautiously. We think CBRT will likely reduce the rate to 29% by end-2026, while stubborn inflation will limit the size of the cuts. We expect the monetary easing cycle to support a continued normalization of funding cost towards the policy rate, but slowly.

As mentioned, we think the continuing disinflation process coupled with moderate tax increases and 27% hike in minimum wage will support moderate rate cuts in 2026, despite inflationary risks remain. (Note: Labor and Social Security Minister Vedat Isikhan announced on December 23 that minimum wage in Turkiye will be increased by 27%. The new rate is effective from January 1, 2026). Our average inflation forecasts stand at 26.5% and 20.2% for 2026 and 2027 respectively since inflation expectations and pricing behavior remain fragile. Upside surprises in food and energy prices, any unexpected resurgence of inflation, and any accelerated TRY depreciation could derail recovery.