Free Thematic

View:

January 05, 2026

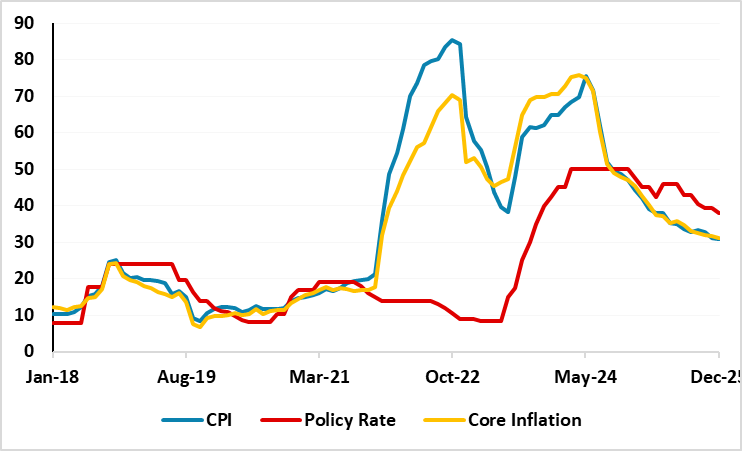

Turkiye Closes the Year with Inflation Easing to 30.9% y/y in December

January 5, 2026 11:25 AM UTC

Bottom line: According to Turkish Statistical Institute’s (TUIK) announcement on January 5, Turkiye’s inflation softened to 30.9% y/y in December backed by the lagged impacts of previous monetary tightening. Food, housing and education drove the inflation in December as education prices recorde

January 02, 2026

Bessent: New Fed Inflation Range and Dropping Dots?

January 2, 2026 11:30 AM UTC

U.S. Treasury Secretary Bessent over the Christmas period suggested that the Fed should shift to targeting an inflation range and drop the quarterly dots. What impact would this have? Such a change would give the Fed more flexibility on the margin, but not significant. This could make communicat

December 23, 2025

Trump’s Peace Framework as a Path to a Late 2026 Settlement?

December 23, 2025 1:48 PM UTC

Bottom Line: With Russia maintaining its long-held demands in Ukraine and negotiations intensifying around President Trump’s latest peace proposal, our baseline view is that this framework will serve as the primary catalyst for a settlement. We anticipate a Russia-friendly peace deal (70% probabil

December 22, 2025

Russia’s Inflation is Expected to Continue to Soften in December

December 22, 2025 2:11 PM UTC

Bottom Line: After edging down to 6.6% in November, we expect Russian inflation to continue its decreasing pattern in December owing to lagged impacts of previous aggressive monetary tightening and relative resilience of RUB. December inflation figures will be announced on December 29, and we forese

December 19, 2025

Mexico: 25bps Cut and Now Pause

December 19, 2025 8:15 AM UTC

Banxico cut by 25bps to 7.0% as expected with a downward revision to 0.3% for 2025 GDP growth. Below trend GDP is forecast in 2026 and we see this prompting further easing in March and June 2026 by 25bps each, but MXN weakness restraining Banxico pace. We then see Banxico going on hold for the rem

December 18, 2025

U.S. November CPI - Is the tariff impact fading?

December 18, 2025 2:10 PM UTC

November’s CPI is significantly lower than expected, at 2.7% yr/yr, 2.6% ex food and energy, compared with 3.0% for both series in September (October data will not be released). November’s core CPI index is up only 0.16% from September’s, implying an average rise of less than 0.1% per month ov

December 17, 2025

UK CPI Review: Down More Than Expected from Likely Peak?

December 17, 2025 7:38 AM UTC

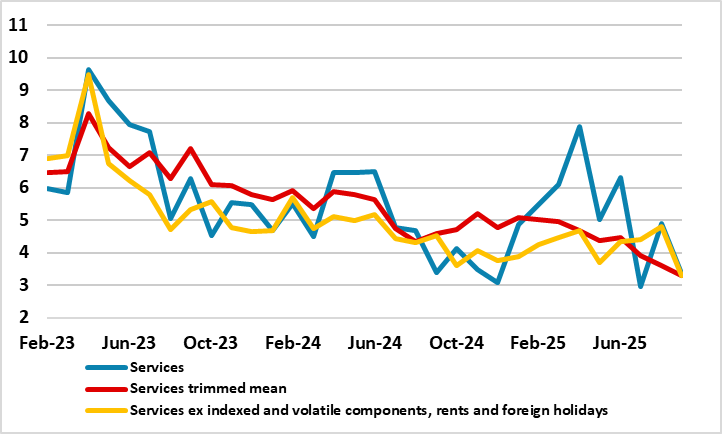

A clear downside surprise adds to the wealth of data suggesting a reining of price and cost pressures. This November result makes it more likely that the September CPI outcome will prove to be the CPI inflation peak. Indeed, although October figure fell a little less than the consensus by 0.2 pp

December 16, 2025

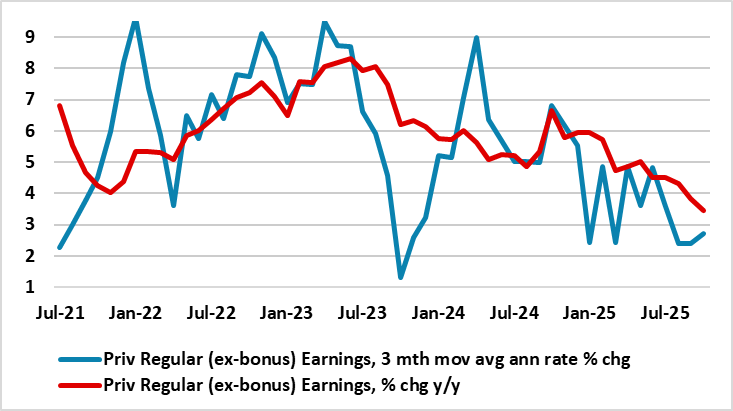

UK Labor Market: Job Losses Weighing Even More Clearly on Wages

December 16, 2025 8:06 AM UTC

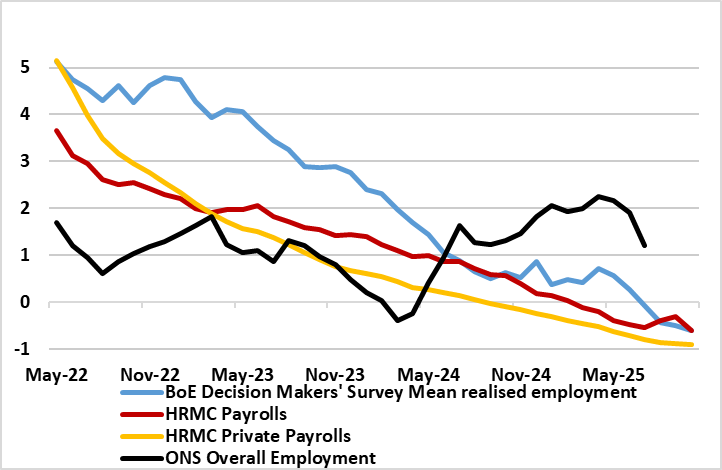

Adding to the array if weak activity updates of late, there are increasing signs that the labor market is haemorrhaging jobs more clearly and broadly with fresh and deeper falls in the more authoritative measure of jobs covering payrolls. Indeed, private sector payrolls are still falling, down alm

December 15, 2025

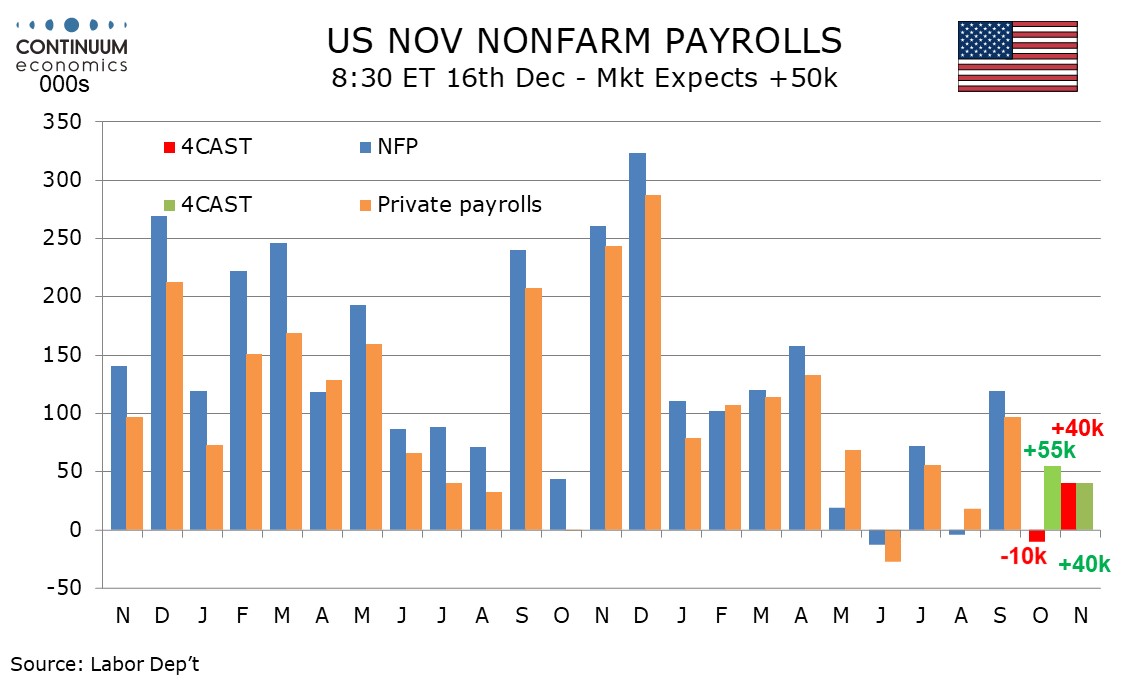

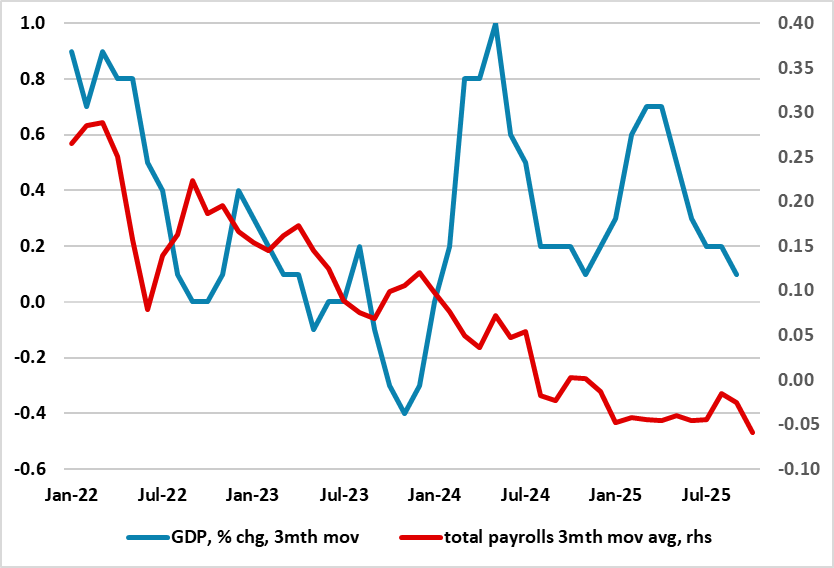

Preview: Due December 16 - U.S. October/November Employment (Non-Farm Payrolls) - Slow but still positive in the private sector

December 15, 2025 3:25 PM UTC

The Labor Department will release October and November non-farm payroll data on December 16. We expect November to see gains of 40k both overall and in the private sector. However we expect October to see a decline of 10k overall but a 55k increase in the private sector.

December 12, 2025

UK GDP Review: Underlying and Headline Economy Negative, Fragile and Listless

December 12, 2025 7:47 AM UTC

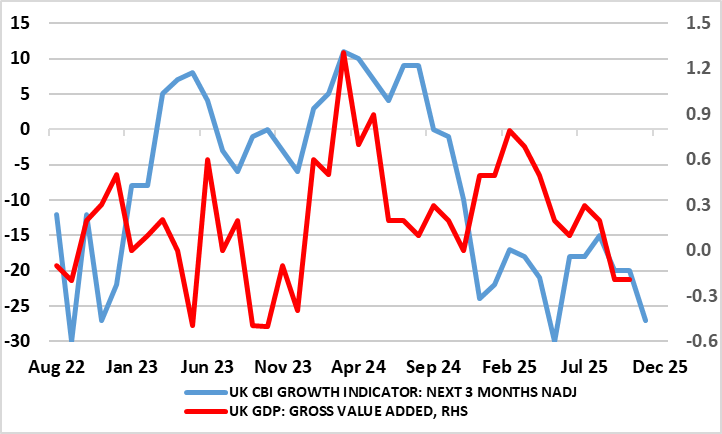

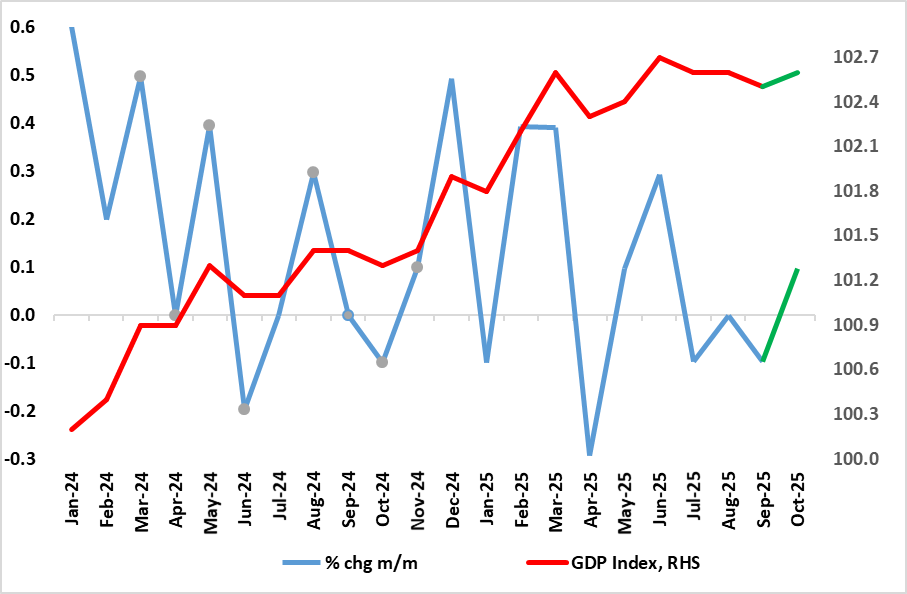

As we have underlined, GDP has hardly moved since March and this became even clearer with the October GDP release, the question being whether weakness is getting more discernible and significant. Indeed, it has fallen in three of the last four months (Figure 1), and where the unexpected further 0.

December 11, 2025

Eurozone Outlook: Running to Keep Fiscally Still?

December 11, 2025 10:09 AM UTC

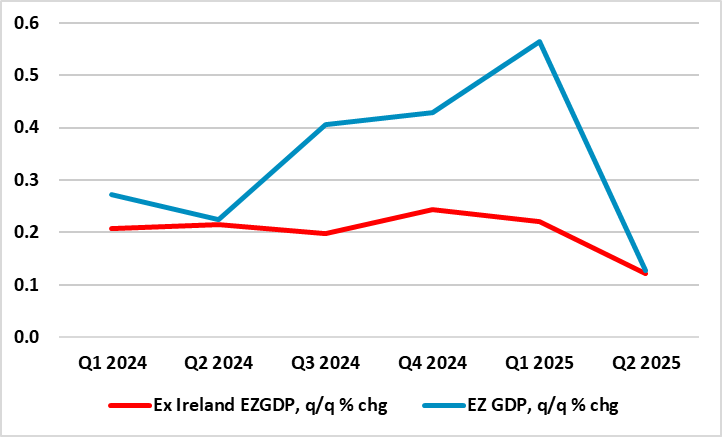

· Amid what may still be tightening financial conditions and likely protracted trade uncertainty, we retain our below consensus activity forecast for 2026 but see a fiscally driven pick-up into 2027. However, the picture this year appears to be slightly better but the economy has actual

December 10, 2025

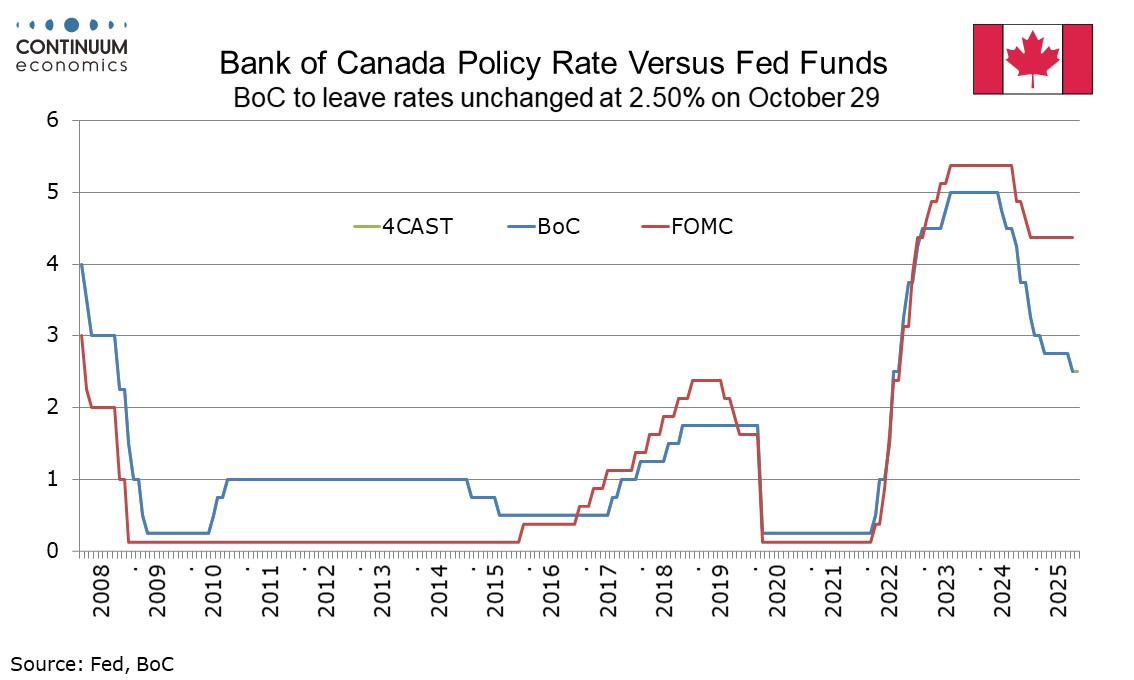

Bank of Canada - Rate Level Still Appropriate Despite Stronger Data

December 10, 2025 4:21 PM UTC

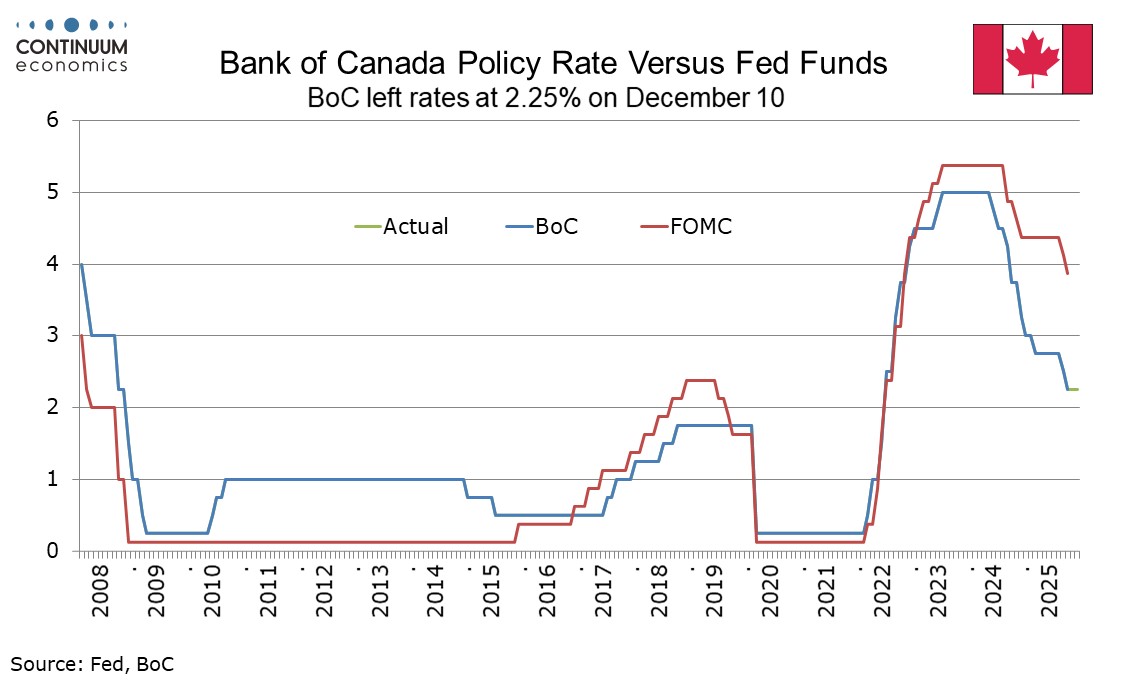

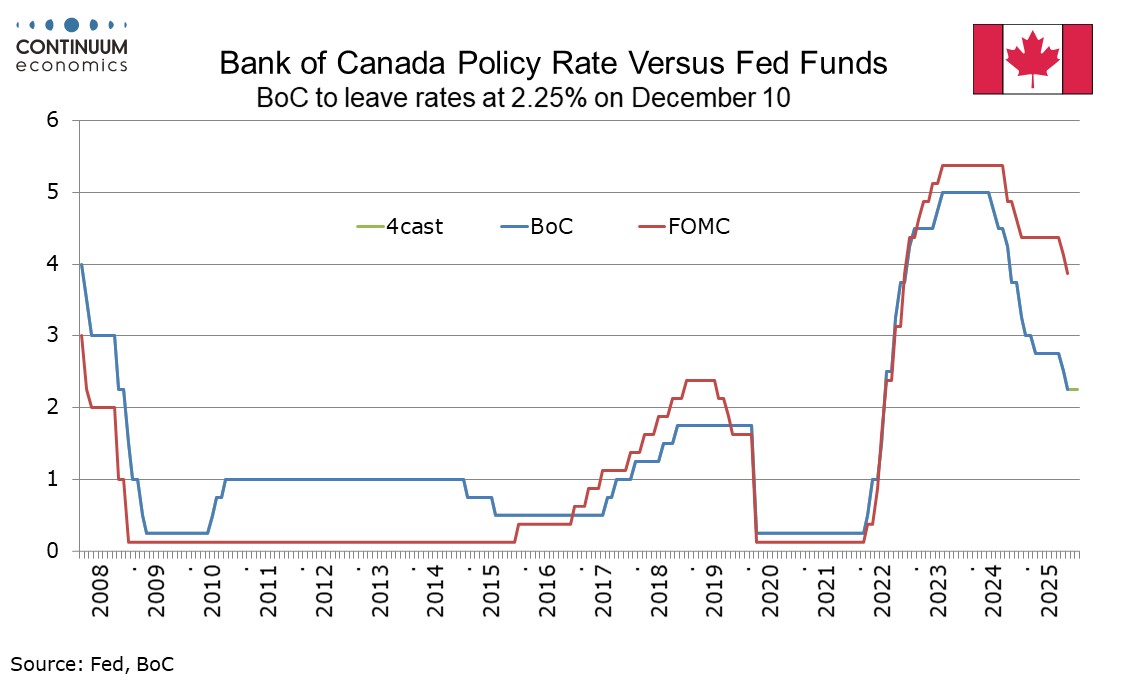

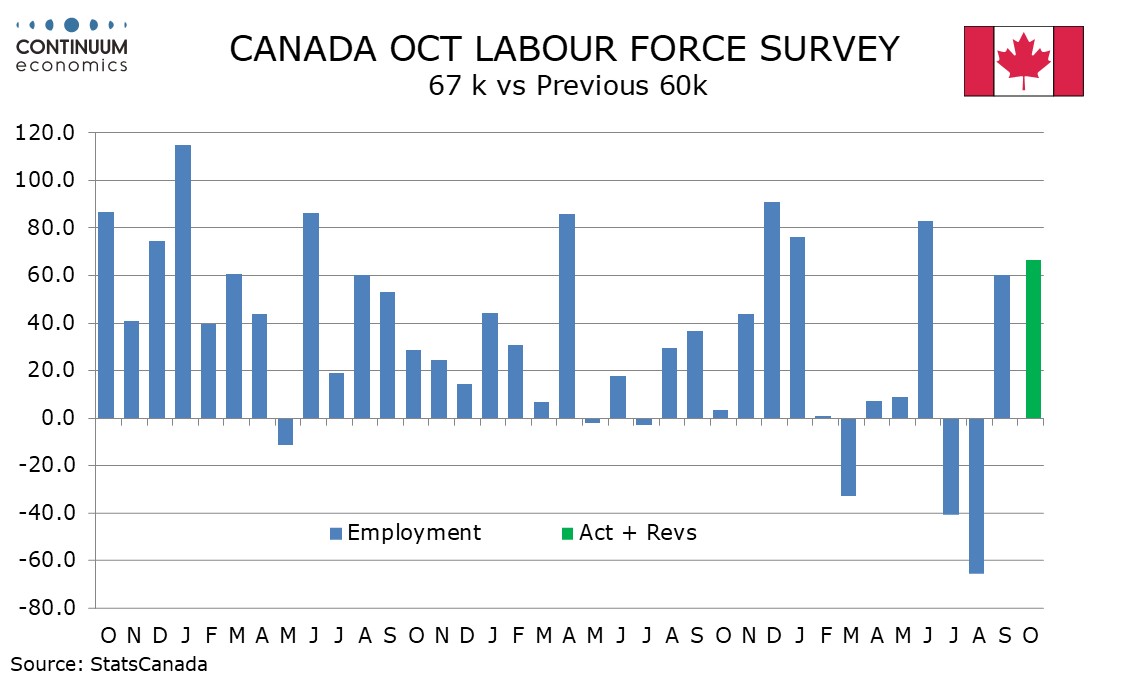

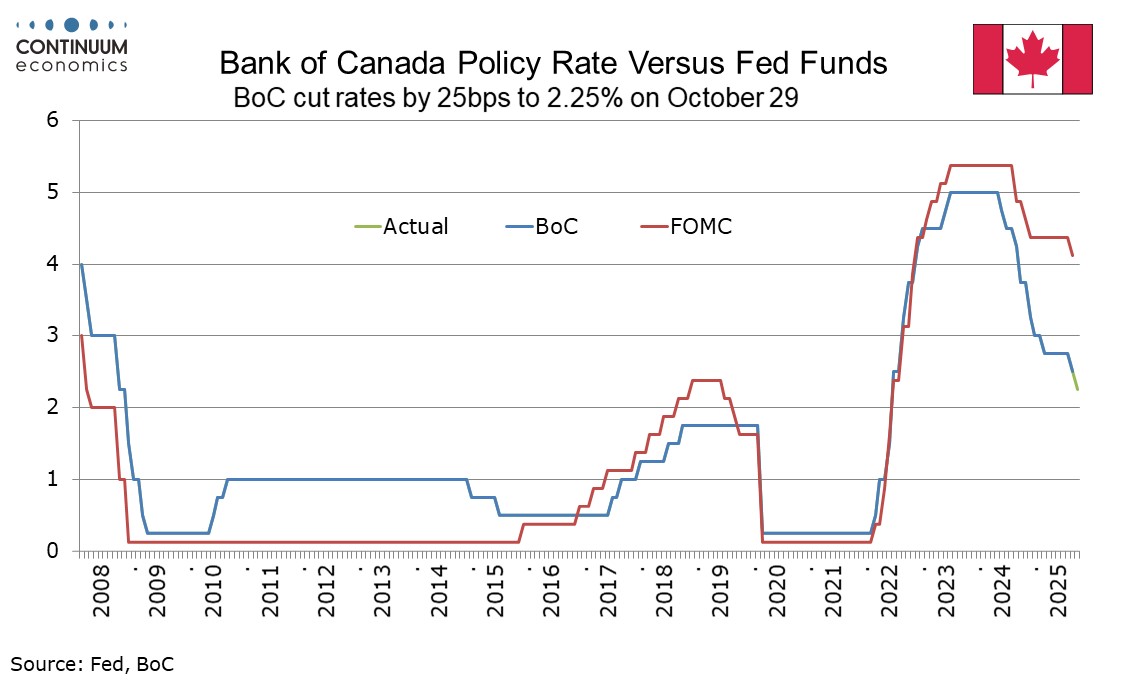

Since the Bank of Canada eased rates to 2.25% in October and stated that policy was now at an appropriate level, Canada has delivered stronger than expected data on GDP and employment. The data has not been dismissed, but the BoC view that policy is at an appropriate level persists after today’s m

December 09, 2025

December 08, 2025

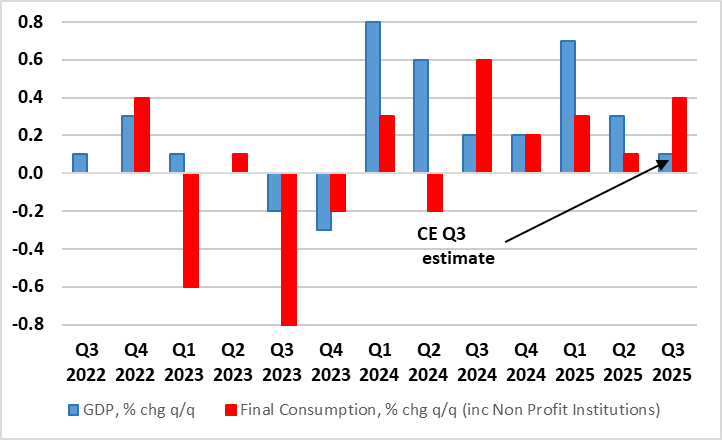

Sweden Riksbank Preview (Dec 18): Policy to be Unchanged and little Move in Projections?

December 8, 2025 1:18 PM UTC

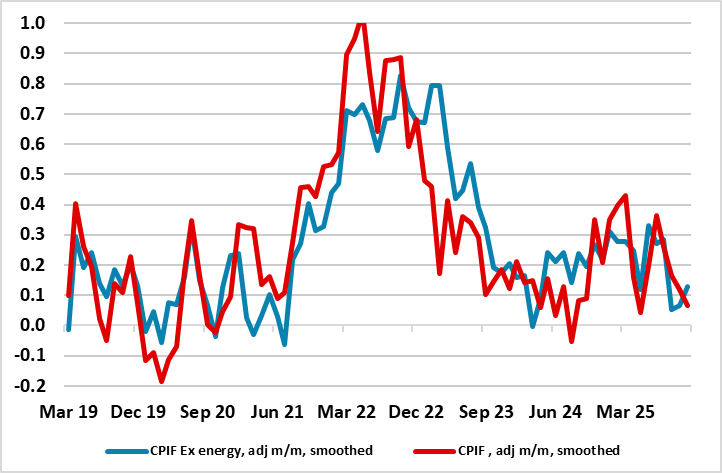

As we anticipated in our review, the Riksbank Board will be very pleased with the data flow since its last and very probably final rate cut on Sep 23 (to 1.75%). GDP saw a strong and unexpected Q3 showing of over 1% q/q while previously troublesome CPI data have softened appreciably thereby confir

December 05, 2025

Bank of Canada Preview for December 10: Stronger data reinforces case for a pause

December 5, 2025 2:31 PM UTC

The Bank of Canada looks highly likely to leave rates at 2.25% when it meets on December 10. After easing in both September and October, the BoC after its October move stated rates were now at about the right level if the economy evolved in line with its expectations. With Q3 GDP and November employ

December 04, 2025

UK GDP Preview (Dec 12): Underlying Economy Fragile and Listless

December 4, 2025 9:55 AM UTC

As we have underlined, GDP has hardly moved since March and this is un likely to change with the October GDP release. Indeed, it has fallen in two of the last three months (Figure 1), albeit where some recovery should be in store for the current quarter as the September numbers were hit (temporari

December 03, 2025

Turkiye’s Inflation Eased to 31.1% y/y in November, Hitting Below Expectations

December 3, 2025 1:40 PM UTC

Bottom line: According to Turkish Statistical Institute’s (TUIK) announcement on December 3, Turkiye’s inflation softened to 31.1% y/y in November backed by moderate unprocessed food prices. We continue to think upside-tilted inflation risks will likely limit the downward trend during the disin

December 02, 2025

UK: BoE Offers Financial Boost?

December 2, 2025 8:05 AM UTC

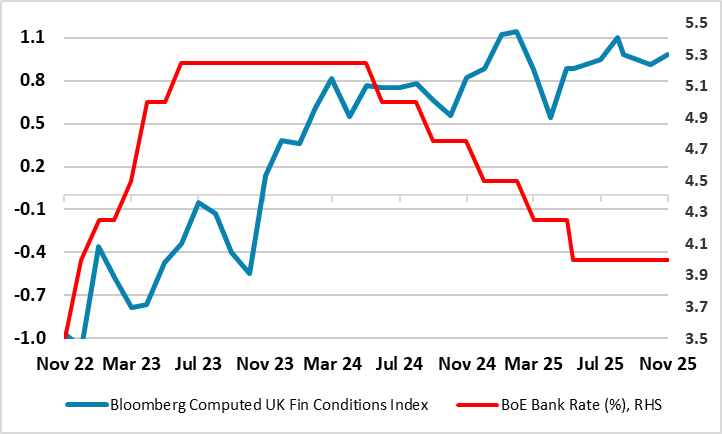

In its updated financial policy report which included fresh bank stress tests, the BoE Financial Policy Committee (FPC) is reducing bank capital requirements. This very seems to be designed to encourage bank to lend and may reflect what have been modest, if not flagging, numbers regarding actual p

December 01, 2025

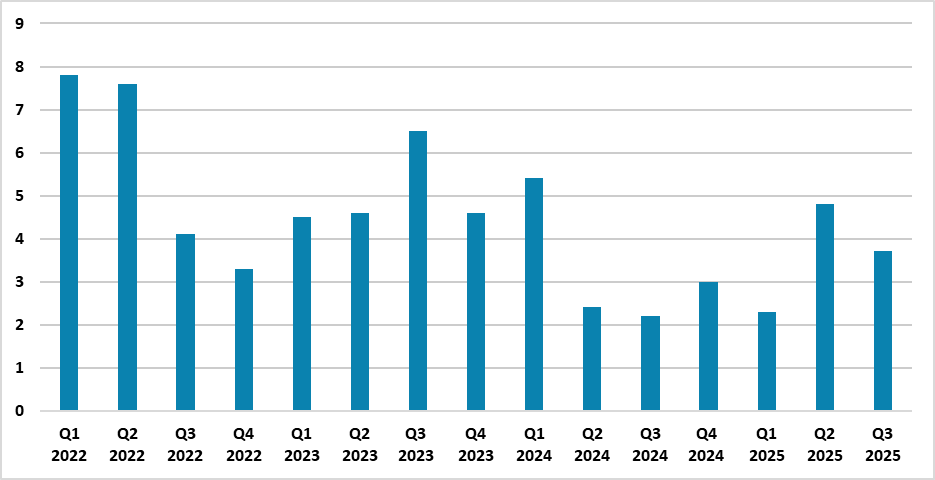

Turkish Economy Expanded by 3.7% in Q3 Backed by Robust HH Consumption and Investments

December 1, 2025 10:41 AM UTC

Bottom Line: Turkish Statistical Institute (TUIK) announced GDP growth for Q3 on December 1. Turkish economy grew by 3.7% YoY in Q3 backed by household consumption, investments, and government spending.

November 28, 2025

Canada Q3 GDP rebounds as imports plunge but domestic demand marginally negative

November 28, 2025 2:14 PM UTC

Canada’s 2.6% annualized increase in Q3 GDP is sharply higher than expected though the surprise comes largely from a sharp fall in imports. Domestic demand was almost unchanged with a 0.1% annualized decline. September GDP grew by 0.2% on the month, but the preliminary estimate for October is weak

November 27, 2025

ECB: Financial Stability Review Less Complacent than Council?

November 27, 2025 1:36 PM UTC

The ECB is clearly split about whether policy has troughed or not, this mainly a result of differences within the Council as to where inflation risks lie. Regardless, as the account of the Oct 29-30 Council meeting chimed with comments from the meeting’s press conference, it does seem to us as i

November 26, 2025

UK Budget Review: Deferring the Fiscal Pain?

November 26, 2025 2:01 PM UTC

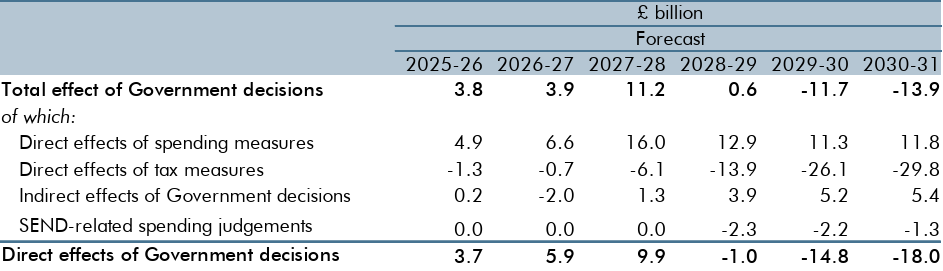

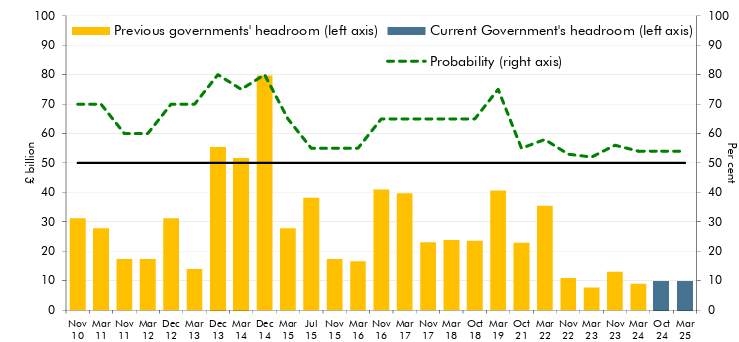

The Budget looks something of a fudge, with no fiscal tightening until 2028 suggesting policy changes very much back-loaded (Figure 1) and puzzlingly timed to take effect in what may be the lead-up to the next general election. The immediate the result is actually a modest boost to GDP growth in t

November 25, 2025

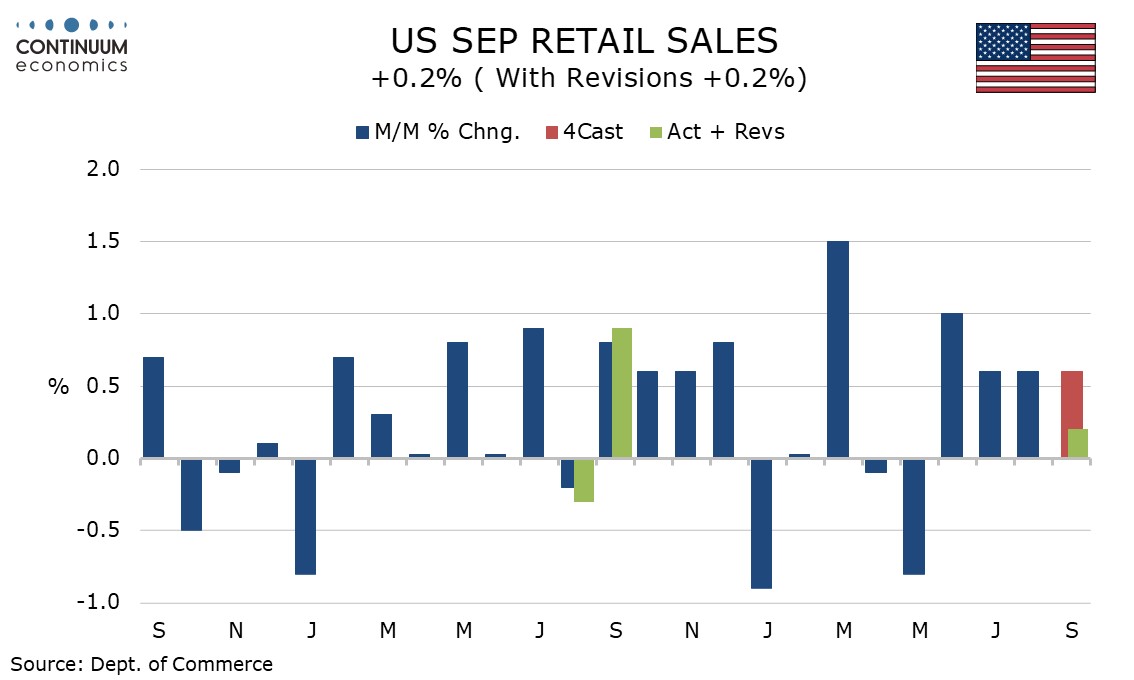

U.S. September Retail Sales lose momentum, PPI strong in goods but weak in services

November 25, 2025 2:08 PM UTC

September retail sales with a rise of 0.2% are weaker than expected and likely to be negative in real terms, given September gains in CPI goods prices, suggesting momentum in consumer spending is starting to fade with employment growth. September’s PPI with a rise of 0.3% overall met expectations

November 24, 2025

November 21, 2025

U.S. Asset Inflows After April’s Trump Tariffs

November 21, 2025 8:00 AM UTC

· Net foreign portfolio inflows have not been hurt by Trump’s April tariff drama, with the AI and tech boom attracting new equity inflows. Flows could become more volatile with a U.S. equity bear market or recession, but these are modest risk alternative scenarios rather than high r

November 20, 2025

SARB Reduced Key Rate to 6.75% Following Favorable Inflation Outlook

November 20, 2025 3:21 PM UTC

Bottom Line: South African Reserve Bank (SARB) cut the policy rate by 25 bps to 6.75% during the MPC on November 20 owing to moderate inflation, stronger ZAR, few power cuts (loadshedding) in Q3, balanced growth risks, and lower oil prices. The MPC decision was unanimous. SARB governor Kganyago ment

November 19, 2025

UK CPI Review: Down from Likely Peak?

November 19, 2025 7:50 AM UTC

It does seem as if the September CPI outcome (a third successive and lower-than-expected outcome of 3.8%) will prove to be the inflation peak. Indeed, the just released October figure fell a little less than the consensus but in line with BoE thinking, to 3.6%, helped by favourable energy base eff

November 18, 2025

UK Budget Outlook (Nov 26): The Fiscal Blame Game – Yet Again!

November 18, 2025 3:09 PM UTC

If not the most keenly awaited Budget for some years, Chancellor Reeve’s updates on Nov 26 is certainly the one that has attracted the most speculation and from all sides. What is clear is that amid several factors, a marked fiscal tightening is in store. This though now seems as if it will be

November 17, 2025

November 14, 2025

ECB – In a Good Place or Just Complacent?

November 14, 2025 11:55 AM UTC

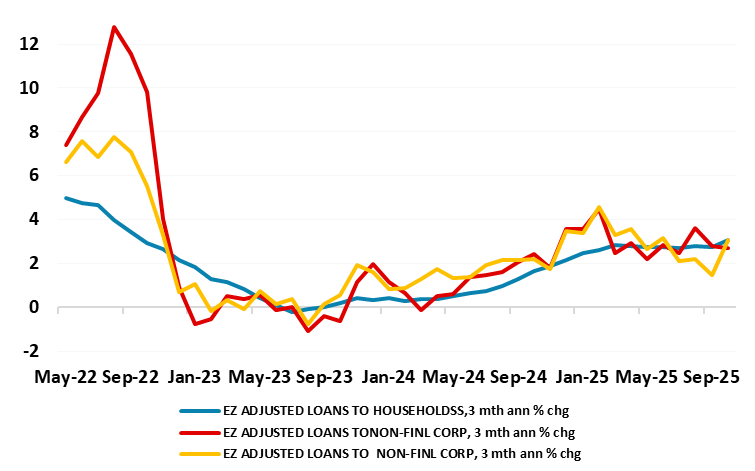

The ECB is of the view that downside growth risks have dissipated somewhat, this possibly helped by its recent actions which it suggests leave its current policy stance in a good place. However, amid a hint of what we think is a complacent upgrade about the EZ’s alleged resilience, we think, the

November 13, 2025

UK GDP Review: Underlying Economy Listless - At Best

November 13, 2025 8:10 AM UTC

As we have underlined, GDP has hardly moved since March and, again, the latest update undershot consensus thinking. Indeed, GDP has fallen in two of the last three months (Figure 1), albeit where some recovery should be in store for the current quarter as these September numbers were hit (temporar

November 12, 2025

UK Gilts: Fiscal, Politics and BOE

November 12, 2025 9:55 AM UTC

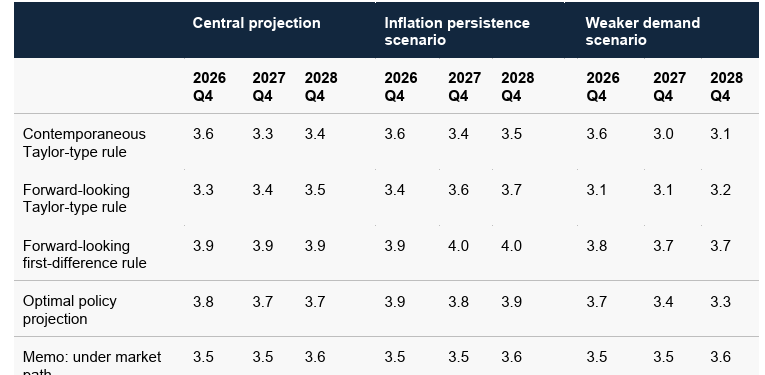

· 2yr Gilt yields have scope to fall through 2026, as we see growth and inflation slowing more than the BOE and this will likely see the MPC changing view and cutting policy rates to 3.25% in H1 2026. Though a pause could then be seen, we see one final BOE cut then being delivered to

November 11, 2025

UK Labor Market: Continued Private Sector Job Losses Weighing Even More Clearly on Wages

November 11, 2025 8:01 AM UTC

Previous signs that the labor market is haemorrhaging jobs less clearly have evaporated, with fresh and deeper falls in the more authoritative payrolls. Indeed, private sector payrolls are still falling, down almost a full ppt in y/y terms and more steeply so (Figure 1). Regardless, the latest l

November 10, 2025

UK CPI Preview (Nov 19): Falling Back Broadly From Likely Peak?

November 10, 2025 10:49 AM UTC

After the upside (and broad) June CPI surprise, CPI inflation rose further, up another 0.2 ppt to 3.8% in July and stayed there for the two following months, with the September outcome having been lower-than-expected outcome in what we (and the BoE) think will be the inflation peak. Indeed, we see

November 07, 2025

Canada October Employment - Second straight strong rise reinforces expectations for steady BoC policy

November 7, 2025 2:11 PM UTC

Canada’s October employment report provides a second straight strong increase, by 66.6k, and while the series is volatile and the two strong months follow two weak months, the data suggests underlying trend has not turned negative and that the Canadian economy may be regaining momentum. Unemployme

November 06, 2025

BoE Review: Fiscal Elephant in the Room Ignored – For Now!

November 6, 2025 1:47 PM UTC

A tight vote was always likely for the November MPC verdict, but the 5:4 split was closer than expected, but almost a repeat of the August decision when rates were cut to the current 4%. What seems clear is that the effective swing voter was Governor Bailey but who coloured his decision with a cle

November 05, 2025

Sweden Riksbank Review: Board Sticks to it Plans

November 5, 2025 9:44 AM UTC

As we anticipated in our preview, the Riksbank Board is pleased with the data flow since its last and very probably final rate cut on Sep 23 (to 1.75%). GDP indicators suggest a strong Q3 showing of over 1% q/q while previously troublesome CPI data have softened appreciably thereby confirming (bot

November 04, 2025

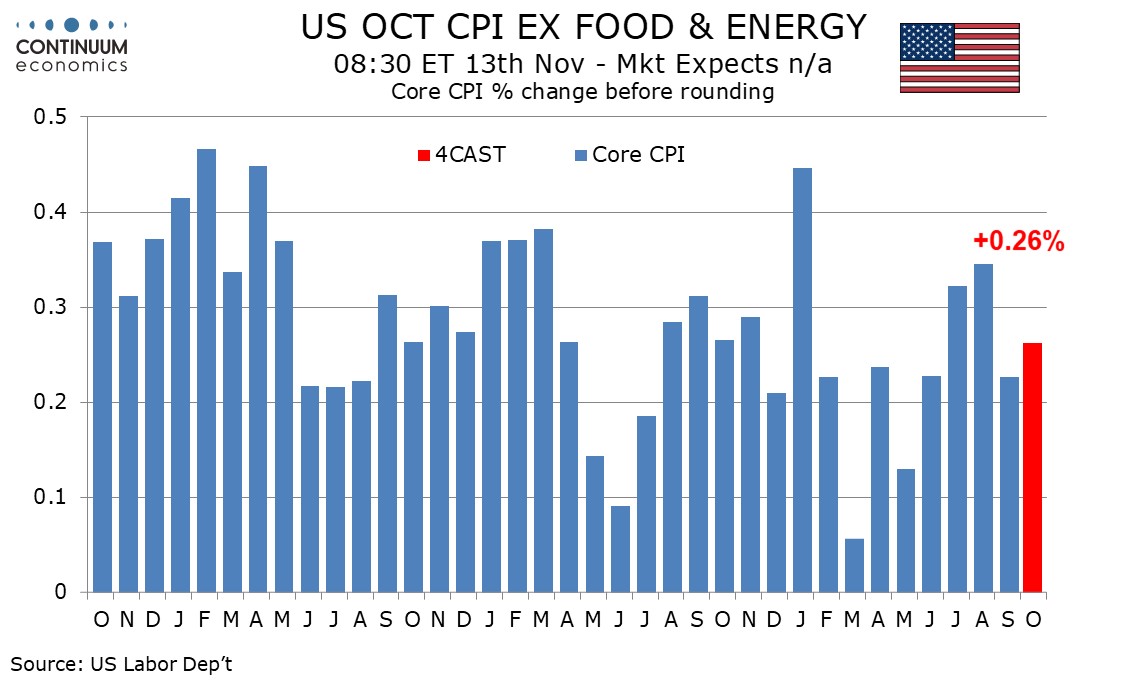

Preview: U.S. October CPI - An important number that may never be seen

November 4, 2025 3:59 PM UTC

October US CPI, while scheduled on November 13, may never be released even if the government shutdown is resolved, given lack of data collection during the month of October. However what the number would have been does matter. Our forecast is for a 0.2% increase overall, with a 0.3% rise ex food a

November 03, 2025

UK GDP Preview (Nov 13): Cyber Crime Shock but Underlying Economy Listless

November 3, 2025 4:01 PM UTC

Notably, the level of UK GDP has hardly moved since March but we think there will be distinct setback in the September numbers where the cyber-attack of JLR vehicle manufacturing may be sizeable – car reduction may have fallen some 25% m/m-plus in the month alone. As a result, we see September G

October 31, 2025

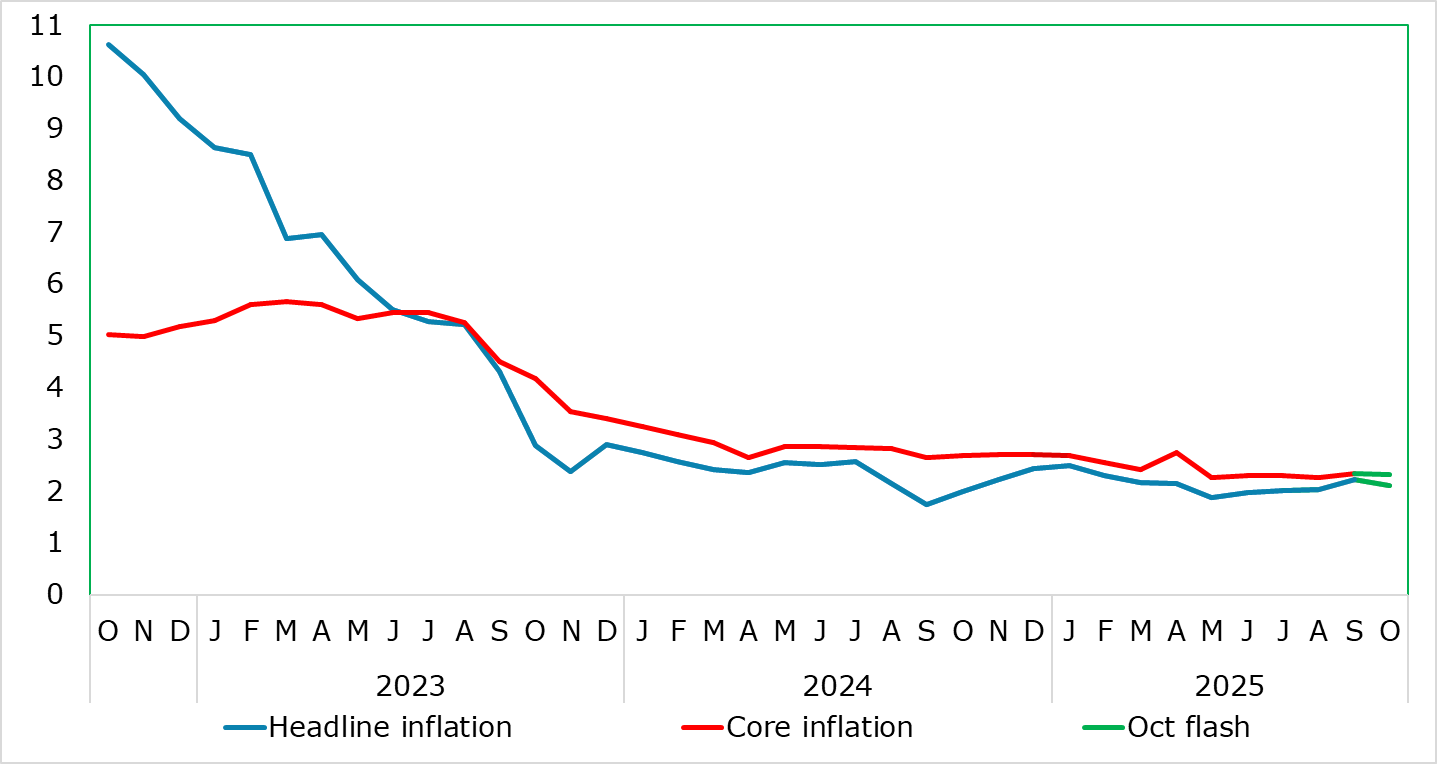

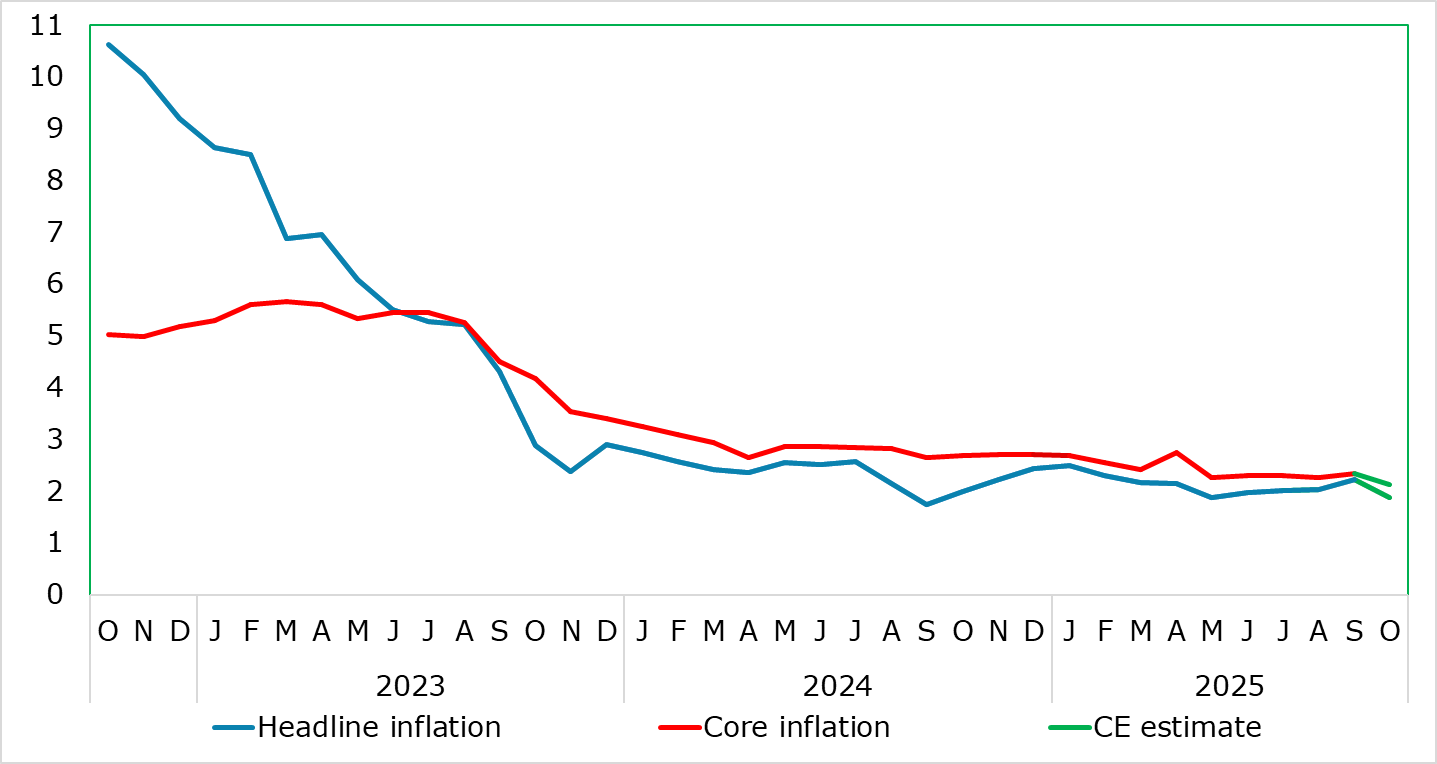

EZ HICP Review: Services Inflation Problematic?

October 31, 2025 10:39 AM UTC

With what were previously unfavourable energy-related base effects reversing, EZ inflation edged down 0.1 ppt to 2.1% in October, largely in line with consensus thinking, but with the main core rate stable at 2.4%. The latter reflected a slight pick-up in services (up 0.2 ppt to a six-mth high of

October 30, 2025

Breakthrough in Sight: India and US Move Towards Bilateral Trade Agreement

October 30, 2025 6:05 AM UTC

The India–US trade deal now seems within reach after months of deadlock, with both sides signalling convergence on major issues. For Indian exporters, particularly in textiles, marine products, and engineering goods, the removal of US tariffs would provide a timely boost amid global demand uncerta

October 29, 2025

Bank of Canada - Hawkish Ease with Current Rate Level Seen as Appropriate

October 29, 2025 3:40 PM UTC

The Bank of Canada delivered a hawkish easing, cutting rates for the second straight meeting by 25bps, to 2.25%, but stating that if inflation and activity evolve in line with its projection, the current rate is seen as about the right level to keep inflation close to 2% while helping the economy th

October 28, 2025

UK Food Inflation; Not Just a Domestic Issue, Despite Industry Claims

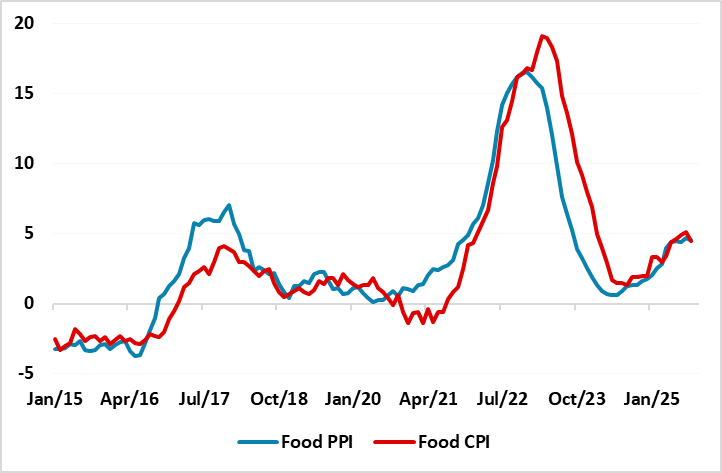

October 28, 2025 8:45 AM UTC

Food price inflation is becoming an increasing issue for both policy makers and households as well as companies that are generating and selling the produce. Particularly in the UK, rising food price inflation is helping shore up well-above target CPI inflation and thereby deterring the BoE from what

October 27, 2025

ECB Monetary Worries Emerging as Corporate Credit Dynamics Weaken More Clearly

October 27, 2025 10:36 AM UTC

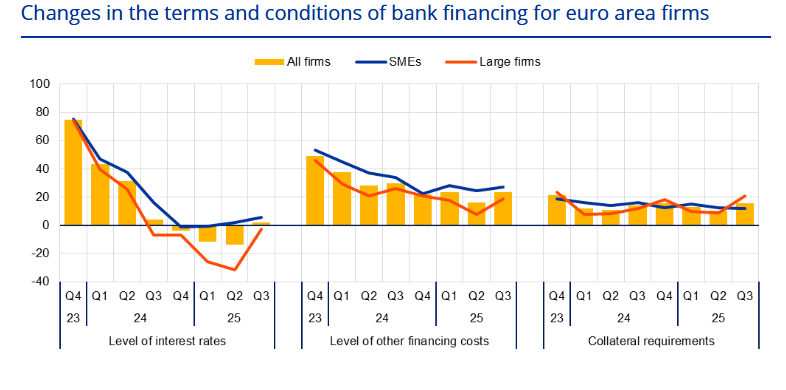

As a foretaste of the Bank Lending Survey BLS) due tomorrow, the ECB released two associated pieces of data today, both corroborating and continuing an ever worrying pattern, namely weakness in corporate credit. The data showed growth in later has fallen to its lowest in almost two years (Figure 1).

October 24, 2025

U.S. September CPI - Soft enough for an October FOMC easing but still above target

October 24, 2025 12:58 PM UTC

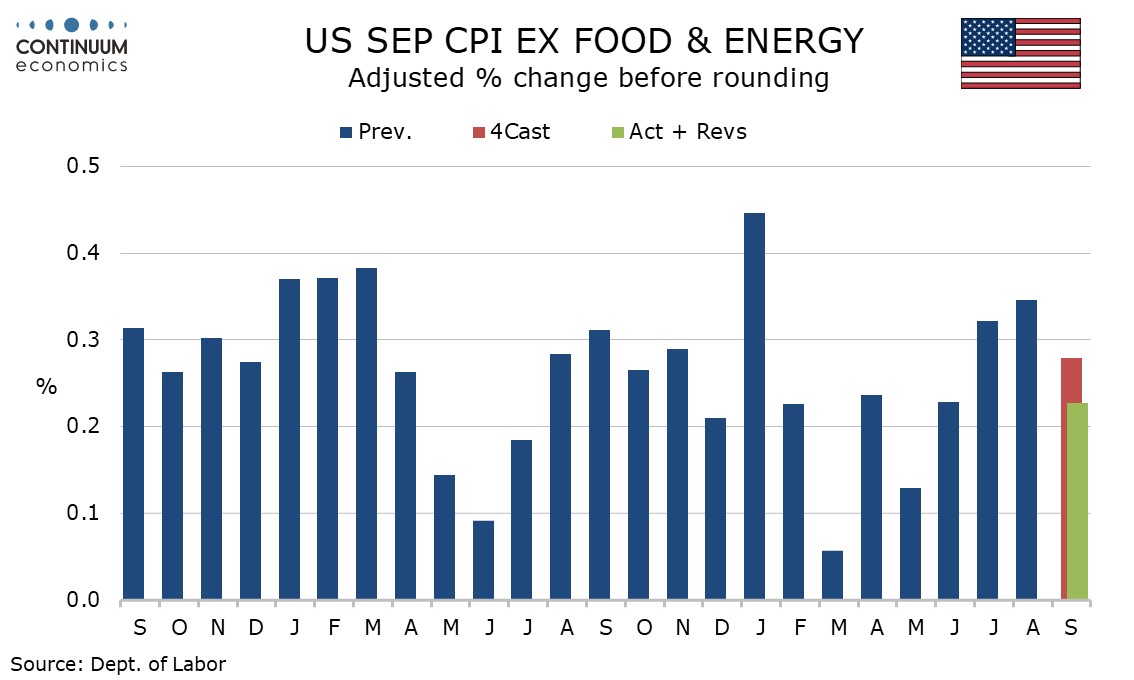

September CPI is on the low side of expectations at 0.3% overall, 0.2% ex food and energy, and should not pose an obstacle to a likely 25bps easing at the October 29 FOMC meeting. The core rate was up by 0.23% before rounding, slower than July and August gains that rise by more than 0.3% before roun

October 23, 2025

Canada August retail sales - A positive month in a choppy trend

October 23, 2025 12:49 PM UTC

Canadian retail sales with a 1.0% August increase are spot on the preliminary estimate, though the gain is more dependent on autos than consensus estimates, with ex auto sales up by a slightly less strong 0.7%. The preliminary estimate for September is for a 0.7% decline. With July having fallen by

EZ HICP Preview (Oct 31): No Halloween Horror from HICP Update

October 23, 2025 12:09 PM UTC

Mainly due to unfavourable base effects, EZ inflation has edged up in the last few months, but we think that this is temporary and that a fresh fall, possible to below the 2% target may occur in the October flash numbers – with a formal forecast of a 0.3 ppt drop to 1.9% and the core falling almos

October 22, 2025

Eurozone Flash GDP Preview (Oct 30): Resilience in the Dock?

October 22, 2025 9:11 AM UTC

As we highlighted repeatedly of late, for an economy that has seen repeated upside surprises and apparently above trend growth, now some 1.4% in the year to Q2, GDP data do not seem to have had much impact is shaping, let alone dominating, ECB policy thinking. But we think this may shift as the ECB

October 21, 2025

Bank of Canada Preview for October 29: A Pause before easing resumes in December

October 21, 2025 3:52 PM UTC

While we do not believe the Bank of Canada is done with easing, we expect the October 29 meeting to see rates left on hold at 2.50% given that most recent data have been on the firm side of expectations, though not strong enough to rule out a move. A pause in October would follow easing in September