U.S. September Retail Sales lose momentum, PPI strong in goods but weak in services

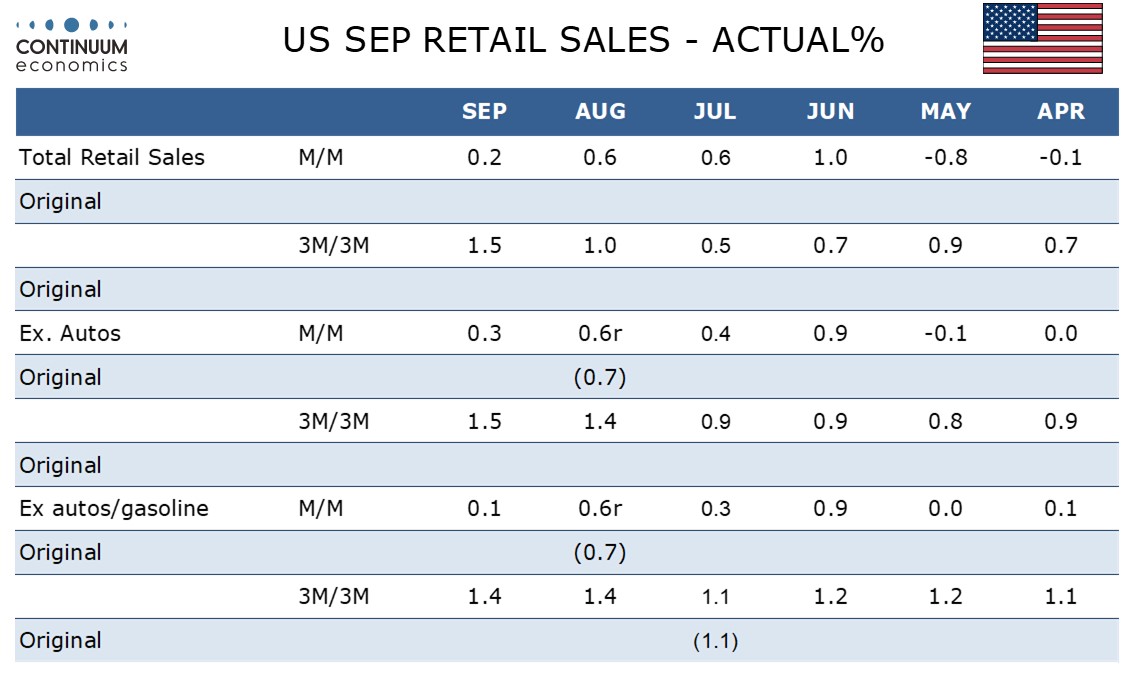

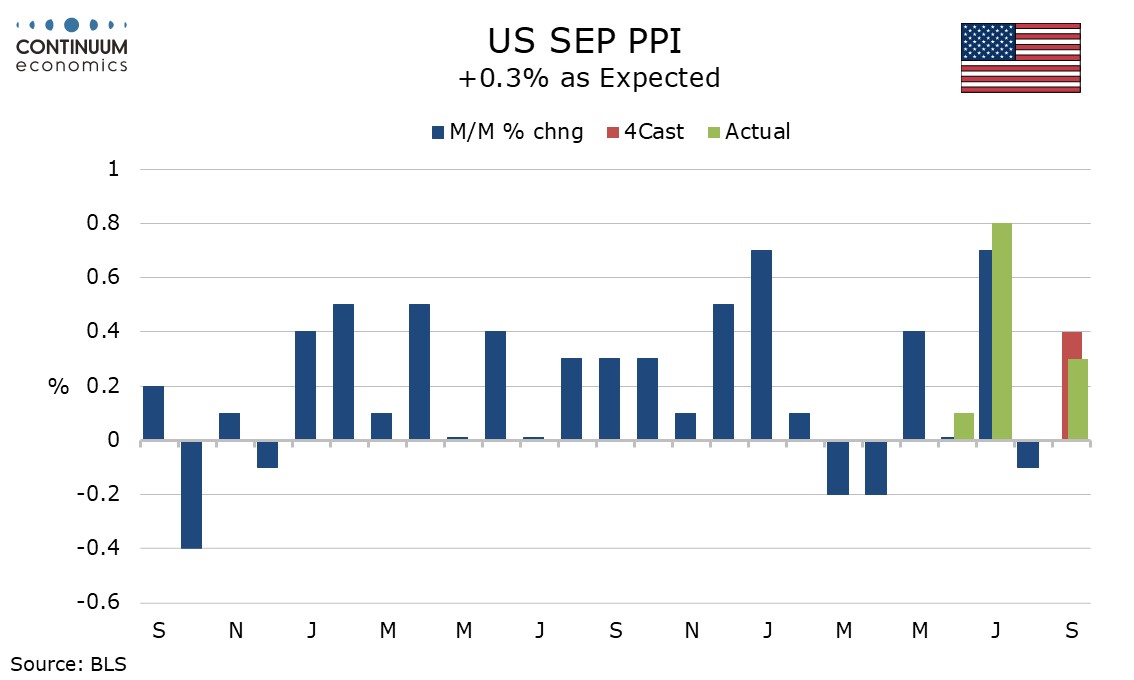

September retail sales with a rise of 0.2% are weaker than expected and likely to be negative in real terms, given September gains in CPI goods prices, suggesting momentum in consumer spending is starting to fade with employment growth. September’s PPI with a rise of 0.3% overall met expectations but the core rate ex food and energy was subdued at 0.1%.

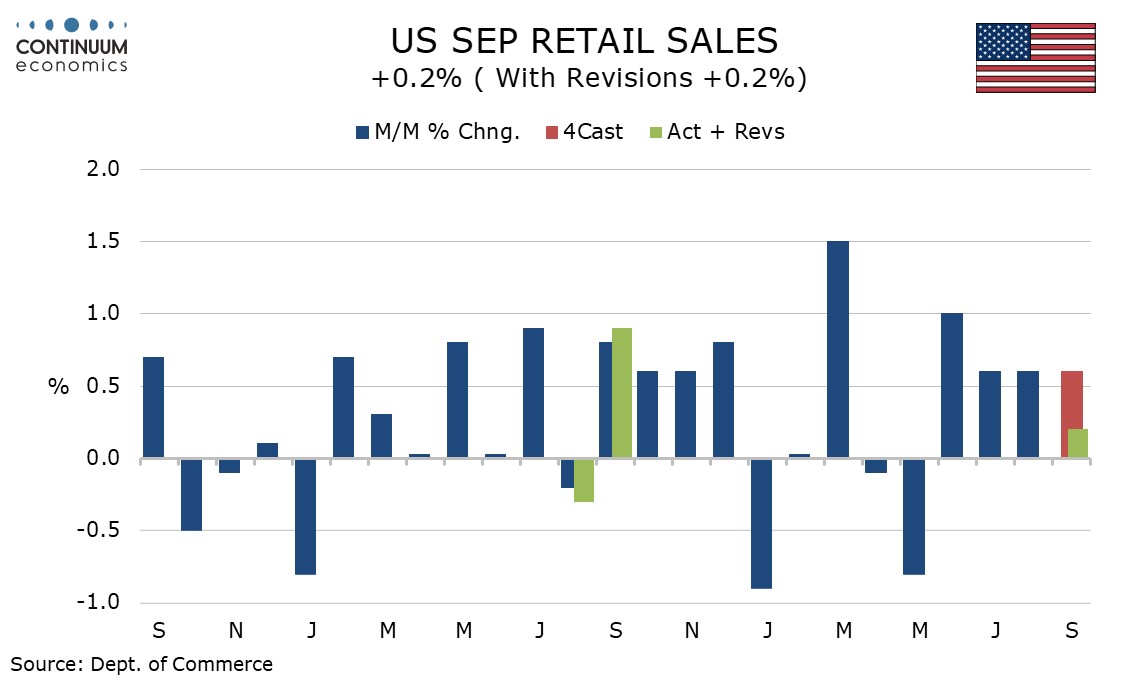

September’s CPI showed commodity prices up by 0.5% for the second straight month, so August’s 0.6% rise in retail sales was marginally ahead of prices, but September’s 0.2% rise fell short. Sales increased by 0.3% ex auto but only 0.1% ex auto and gasoline, with the control group which contributes to GDP falling by 0.1%.

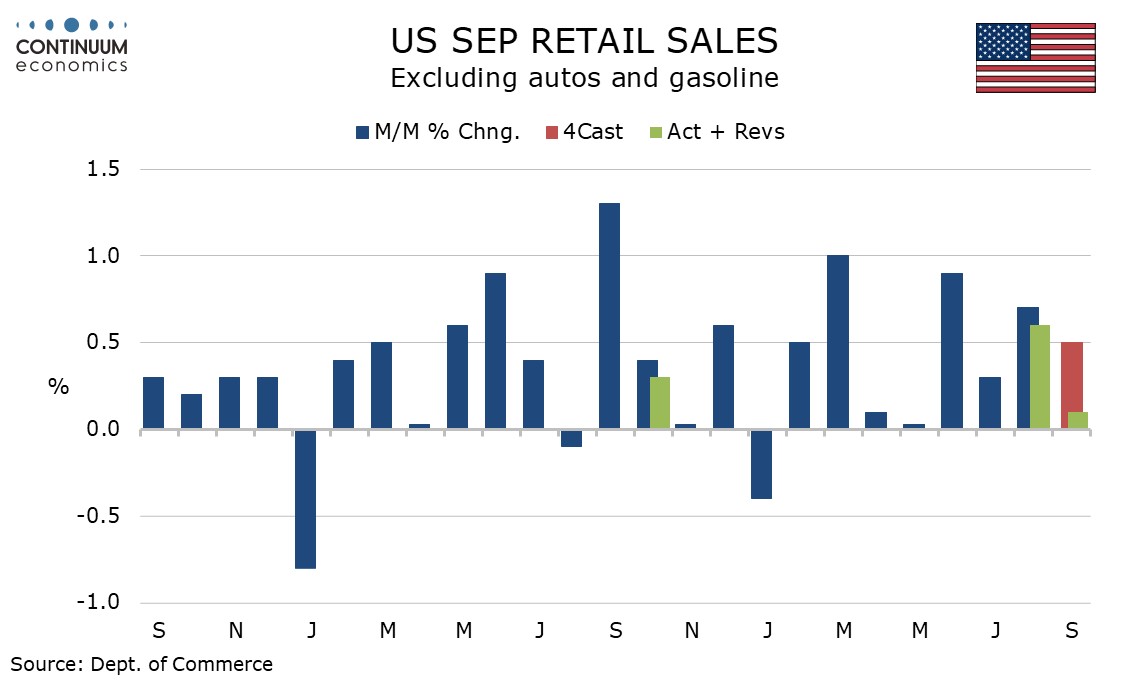

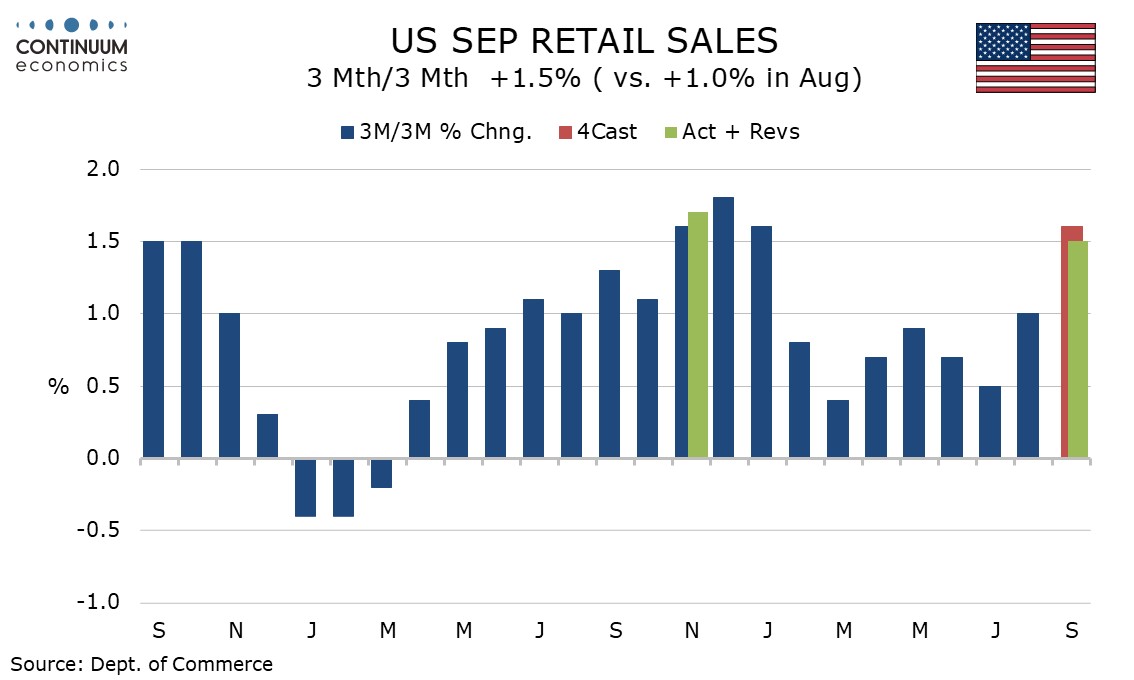

Q3 retail sales still look quite strong, up by 1.5% (not annualized) both overall and ex auto with sales ex auto and gasoline up by 1.4%. However Q3 consumer spending appears to be running ahead of disposable income while it is already known that auto sales slipped in October as a tax credit for electric vehicle purchases expired.

Strength in September came from a price-assisted 2.0% rise in gasoline, a 1.1% increase in health and personal care and a 0.7% rise in eating and drinking places which are considered as services in the personal income an spending report. Slippage however as seen in autos, electronics and clothing.

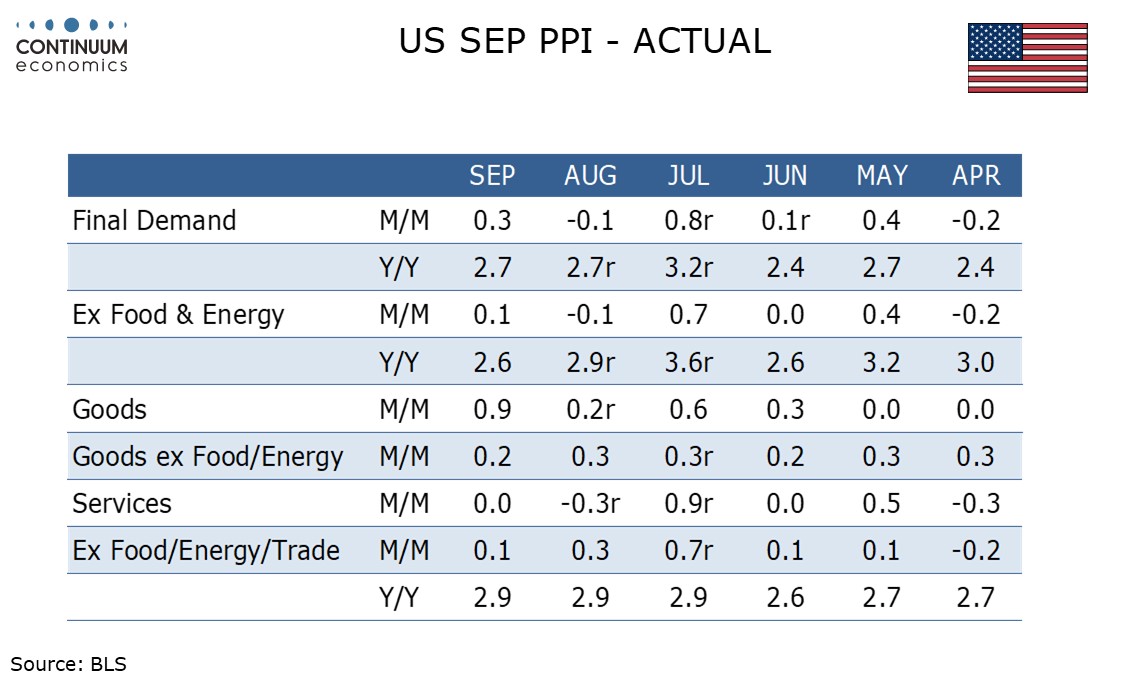

September’s PPI with a 0.3% rise matched the overall CPI but the core rate ex food and energy was softer than a 0.2% cire CPI. PPI also rose by only 0.1% ex food, energy and trade. Both food at 1.1% and energy at 3.5% saw significant gains.

Goods ex food and energy rose by 0.2% after two straight gains of 0.3%. Each quarter in 2025 to date has seen two 0.3% and one 0.2% firm core goods PPI, a significant acceleration from where trend was in 2024. However services were unchanged in September, even with continued strength in transport and warehousing at 0.8%.

Yr/yr data shows overall PPI unchanged at 2.9% and ex food, energy and trade unchanged at 2.7%, though ex food and energy PPI slowed to 2.6% from 2.9%, and is well below the 2024 trend despite the acceleration in core goods.